A payment gateway is a piece of technology that lets travel agencies safely take online payments for things like booking travel, making reservations, and other travel-related activities. Customers can send money directly to the travel agency’s bank account, which makes it easy for payments to go through. This makes sure that the transaction goes well for both the customer and the travel agent. Travel companies need to be able to accept a variety of payment methods and offer flexible payment options in order to improve the payment process and meet the needs of all their customers.

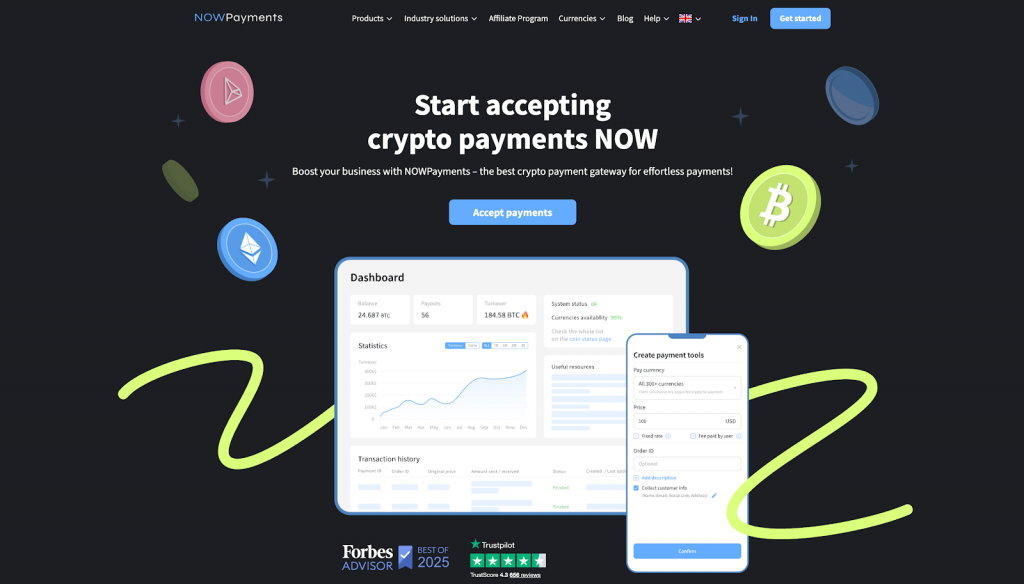

NOWPayments will be the best payment gateway for travel agencies in 2026 because it has a payment solution that works well for the travel industry. It lets agencies accept cryptocurrency payments, which is great for international bookings because it lets people pay from anywhere in the world with lower processing fees and secure payment methods. Travel companies often have customers who want to pay in different ways. NOWPayments has a number of options to help travel companies process payments more easily.

Your travel agency needs to pick the right payment gateway in 2026 so that payments go through quickly and without any problems. Travel companies need to choose payment gateways that accept a lot of different types of payments and give customers a lot of choices. This is because more people want to book trips abroad and pay with local methods. Payment gateways that let you make payments in real time, accept a variety of payment methods, and keep payments safe can help travel agencies save money on processing payments and get more people to book. Travel agents and online travel agencies can make sure they meet the needs of customers all over the world by picking the right payment gateways for travel. Some payment gateways are only for the travel business. This is very important for group travel and business travel, which are both very dangerous. Your travel agency’s gateway should be simple to add to your current systems, protect you from fraud in a big way, and make it simple to book and pay for trips. With this, your agency will be able to keep up with the fast-paced world of travel today.

Here’s a list of the Best Payment Gateways for Travel Agencies in 2026:

- NOWPayments

- Rapyd

- Flywire

- Tazapay

- PaySafe

| Payment Gateway | Supported Payment Methods | Custody & Security | Transaction Fees |

| NOWPayments | 350+ crypto + 40 fiat options | Non-custodial, optional custody, 2FA, AML/KYC | 0.5% (crypto), 1% (multi-currency) |

| Rapyd | 900+ methods (cards, wallets, bank transfers) | PCI-compliant, fraud protection | 0.20%–1.80% + scheme fees |

| Flywire | 140+ currencies (cards, bank transfers, local) | Global security, AML compliance | ~1.5%–3.5% (varies by method) |

| Tazapay | 80+ local methods (cards, UPI, PayNow) | PCI-DSS, fraud protection | 0.8%–2.5% (alt methods), 3.8% + USD 0.50 (cards) |

| PaySafe | 100+ global methods (cards, wallets) | PCI-DSS, fraud protection | Varies by method, region; competitive rates |

NOWPayments

NOWPayments is the best cryptocurrency payment gateway that allows travel agencies to accept payments in over 300 cryptocurrencies and some fiat options. NOWPayments is the best payment gateway for cryptocurrencies because it lets travel agencies take payments in more than 350 cryptocurrencies and some real-world currencies. It makes it easy and safe for both customers and businesses to make payments. It is a popular choice for companies that want to add crypto payments to their systems because it offers strong security features and low transaction fees. NOWPayments has a non-custodial solution, which means that the service does not keep the money but still makes sure it is safe.

Supported Payment Methods. A lot of different cryptocurrencies and a few fiat currencies can be used with NOWPayments. This makes it a great choice for travel agencies that deal with tech-savvy customers from all over the world. Businesses can accept payments in more than 3550 different cryptocurrencies, such as Bitcoin, Ethereum, USDT, and others. It also lets you pay with real money by turning coins into real money, which is great for businesses that want to let customers pay with both crypto and regular money. It does not directly support traditional payment methods like credit cards and bank transfers; instead, it focuses on digital currencies.

- Number of Currencies: 350+ cryptocurrencies + some fiat options

- Stablecoins: ✅ USDT, USDC, and 28 more

- Traditional Cards: ❌

- Digital Wallets: ❌

- Bank Transfer: ✅ (via fiat conversion)

Custody & Security. NOWPayments does not hold money because it is not a custodian. Instead, it helps customers and businesses pay each other directly. The payment process is safe because the service uses two-factor authentication (2FA) and follows rules for anti-money laundering (AML) and knowing your customer (KYC). It also meets global PCI DSS standards, which makes it even safer for sensitive data. NOWPayments uses security protocols that work right away to make sure that transactions are safe.

| Security Aspect | Status |

| Fund Control | Non-Custodial |

| Access Speed | Instant |

| Compliance | AML/KYC, 2FA, PCI DSS |

Transaction Fees. NOWPayments is a good choice for travel agencies because it only charges 0.5% for cryptocurrency payments. There are no monthly or setup fees, which is great for businesses that want to keep their costs low. This is a cheap way for travel companies to take payments in cryptocurrency. If you use multi-currency payment processing, the fee goes up to 1%, but that is still less than what a lot of other companies charge.

| Fee Type | Amount |

| Transaction Fee | 0.5% |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Rapyd

Rapyd is a payment gateway that works in many countries and lets you pay in more than 900 ways. This is a great option for travel agencies that work with people from all over the world. People from all over the world can easily check out because it works with both local and international payment methods. Rapyd has a full set of security features and a strong fraud protection system, so users can feel safe and have a smooth experience. If you run a travel company and want to offer a lot of different ways to pay, Rapyd is a great choice because their fees are flexible.

Supported Payment Methods. Rapyd accepts more than 900 ways to pay, such as credit and debit cards, bank transfers, and local payment systems like Alipay and WeChat Pay. Travel agencies can help people from all over the world quickly and easily with all of these payment options. The platform does not directly support cryptocurrency payments, but it does a great job of handling both regular and alternative payment methods. Customers can pay the way they want with Rapyd because they have many options.

| Payment Method | On-ramp | Off-ramp |

| Fiat | ✅ | ✅ |

| Crypto | ❌ | ❌ |

Custody & Security. Rapyd is a custodial service, which means that it keeps merchants’ money safe until it can be sent to the business’s bank account. This keeps the money safe until it is settled, which makes sure that the payment process goes smoothly. It meets PCI-DSS standards and has strong fraud protection, so it is a safe way for travel agencies to pay. With Rapyd, you can also be sure that you are following the law when you check out customers.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI-DSS, KYC/AML |

Transaction Fees. How you pay affects the fees that Rapyd charges for transactions. For normal credit card transactions, they are between 0.20% and 1.80%. There are no fees for setting up, and the prices are clear. This makes it appealing to travel agencies that want to be able to choose how they pay. The fee changes based on how the customer pays because it can handle both local and international payments.

| Fee Type | Amount |

| Transaction Fee | 0.20%–1.80% |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

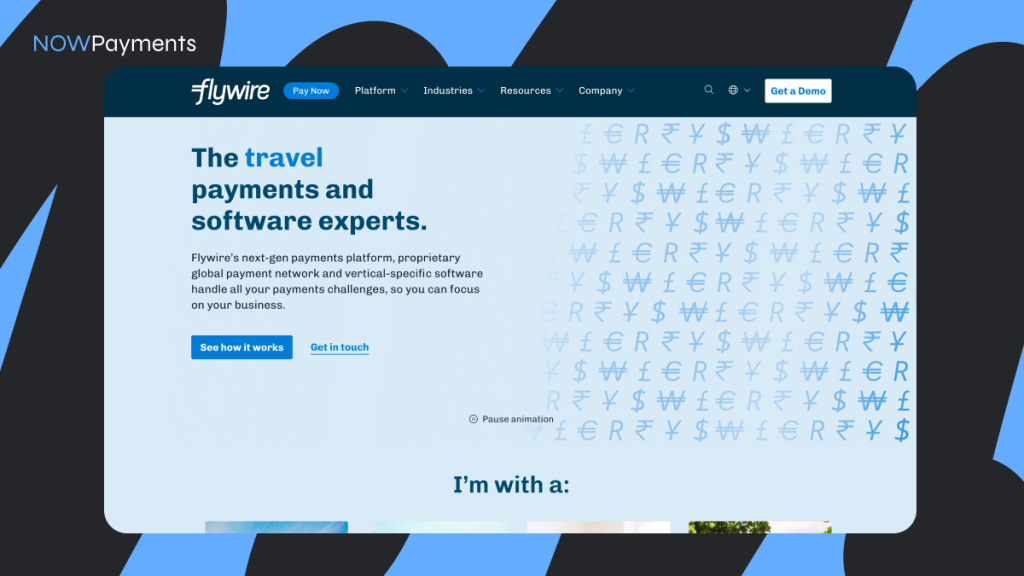

Flywire

Flywire is a payment gateway that only works for payments made outside of the US. This makes it a great choice for travel companies that do business in more than one country. It can handle more than 140 currencies, so customers can pay in their own currency. This makes it easier to pay. People know Flywire for how safe and secure it is. It is a good choice for online travel agencies because it has low fees and settles quickly.

Supported Payment Methods. You can pay with Flywire in a number of ways, such as with credit cards, digital wallets, and bank transfers. It lets customers pay in more than 140 different currencies, which is great for travel agencies that work with people from all over the world. Customers can choose how they want to pay at checkout, which makes it easy for everyone, no matter where they are. Flywire’s currency conversion makes sure that transactions go through without a hitch, even when they cross borders.

- Number of Currencies: 140+ currencies

- Stablecoins: ❌

- Traditional Cards: ✅ Visa, MasterCard

- Digital Wallets: ✅ PayPal, Alipay, WeChat Pay

- Bank Transfer: ✅ ACH, SEPA

Custody & Security. Flywire’s custodial model makes sure that money is safely stored and processed before it is sent to the merchant’s account. The platform improves the payment process by letting travel agencies get their money right away after a successful transaction. Flywire makes sure that all transactions are safe and follow international rules by using KYC/AML compliance and following PCI-DSS rules. It is a safe way for the travel industry to handle payments of large amounts because it has tools to stop fraud.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI-DSS, KYC/AML |

Transaction Fees. Depending on the payment method and the area, Flywire’s transaction fees range from 1.5% to 3.5%. People know that it has prices that are easy to understand and no extra fees. Flywire’s fees are similar to those of other travel companies, especially for big purchases like booking a trip abroad. Travel companies can use it in a lot of ways because there are no monthly or setup fees.

| Fee Type | Amount |

| Transaction Fee | 1.5%–3.5% |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Tazapay

Tazapay is a great choice for businesses that deal with customers from other countries because it has more than 80 local payment options and a simple payment gateway for travel agencies all over the world. It lets people do business safely across borders and gives them a way to pay that keeps them safe from fraud. People are talking a lot about Tazapay for online payments because it has low fees and great customer service. It also lets you take payments in more than one currency, which is good for the customer and the business.

Supported Payment Methods. Tazapay takes more than 80 local payment methods, such as bank transfers, credit cards, and debit cards. It also has options that are specific to certain areas, such as UPI, PayNow, and PromptPay. This is a great option for companies that do business with people all over the world. Tazapay does not accept cryptocurrencies as payment right now, but it does accept most other types of payment. It makes it easier for customers to pay by giving them a lot of different ways to do so.

| Payment Method | On-ramp | Off-ramp |

| Fiat | ✅ | ✅ |

| Crypto | ❌ | ❌ |

Custody & Security. Tazapay uses a custodial model, which means that it keeps merchants’ money safe until they are ready to settle. Agencies that need to make quick bookings can do so quickly and easily with instant access to funds. Tazapay keeps its users very safe by following PCI-DSS rules and KYC/AML procedures. The platform also has advanced fraud protection to keep transactions safe and lower the risk.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI-DSS, KYC/AML |

Transaction Fees. Depending on how you pay, Tazapay’s transaction fees are between 0.8% and 2.5%. It costs a little more to pay with a card: 3.8% plus $0.50. It does not cost anything to set up or use each month, so it is a good choice for travel agencies that want to save money. There are no hidden fees because both customers and merchants can see the fee structure. Tazapay is a good choice if you need to accept a lot of different local payment methods because it has low prices.

| Fee Type | Amount |

| Transaction Fee | 0.8%–2.5% |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

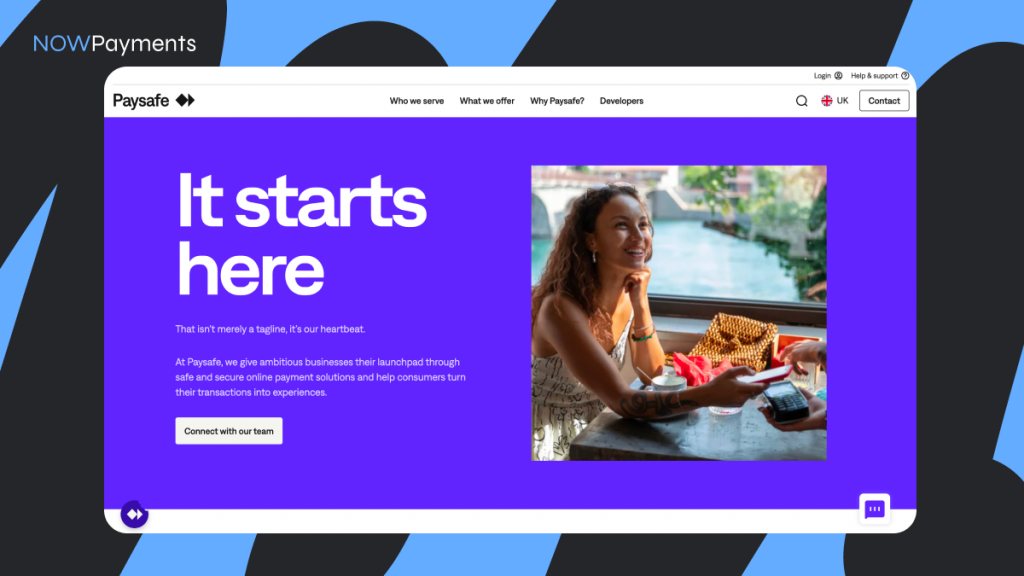

PaySafe

PaySafe is a payment gateway that lets travel companies accept payments from all over the world in a variety of ways. It works with cards, digital wallets, and bank transfers in more than 100 countries. PaySafe is known for having strong security features and tools that help keep payments safe by stopping fraud. PaySafe is a great choice for travel agencies that want to reach people all over the world because it has fees that can be changed for each transaction.

Supported Payment Methods. You can pay with PaySafe in more than 100 ways around the world, such as credit and debit cards, digital wallets like Skrill and PayPal, and bank transfers. Travel agencies that want to reach new customers will love how far the platform can go. PaySafe is great because it lets people choose how to pay, but it does not take cryptocurrency. People from other countries can pay in any way they want because it can handle many different currencies.

- Number of Currencies: 100+ methods (cards, wallets)

- Stablecoins: ❌

- Traditional Cards: ✅ Visa, MasterCard

- Digital Wallets: ✅ Skrill, Neteller, PayPal

- Bank Transfer: ✅ ACH, SEPA

Custody & Security. PaySafe is a service that holds onto money for a short time before sending it to the merchant’s account. Travel agencies can keep their cash flow healthy if they can get money right away. The platform follows PCI-DSS rules and uses KYC/AML to check that customers are who they say they are. Businesses that care about safety should use PaySafe because its fraud protection makes sure that all payments are safe.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI-DSS, KYC/AML |

Transaction Fees. PaySafe charges between 1.5% and 4.5% for each transaction, depending on how you pay, where you live, and how much you spend. When you pay with a credit card, it usually costs more, about 4.5%. It usually costs less to pay with a bank transfer or a digital wallet, about 1.5%. In different parts of the world, the fees are also different. For example, international transactions cost more because they take longer to process and need to be changed into a different currency. Also, companies that handle a lot of payments might be able to get special pricing deals that lower their fees. PaySafe is a cheap and flexible choice for travel agencies that want to keep their payment processing costs low without having to pay monthly or setup fees.

| Fee Type | Amount |

| Transaction Fee | 1.5%–4.5% |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Final thoughts

This article talked about the most common ways that travel companies can get paid. Some of the choices are NOWPayments, Rapyd, Flywire, Tazapay, and PaySafe. Each one has its own set of tools that travel agencies can use to handle payments. Nevertheless, NOWPayments is the best choice for travel agents and online travel agencies, especially those who want to give customers all over the world more ways to pay. NOWPayments supports more than 350 cryptocurrencies and lets you exchange fiat money. This gives travel businesses the freedom to meet the needs of today’s customers. It also has low transaction fees and does not need a custodian, which is great for agencies that want to save money on payment processing while still keeping payments safe.

NOWPayments is the best travel payment gateway for businesses that want to stay ahead of the game. It makes it easier for travelers to pay and gives them more options. Travel agencies can offer a lot of different ways to pay because the platform can handle different types of payments and payments in real time. This makes customers happier and increases sales. NOWPayments is the best choice for your travel agency if you want to stay ahead in an industry that changes quickly. This is true whether you are processing international bookings or looking for a payment gateway.