What is a payment gateway? A payment gateway in Thailand is a critical component for businesses looking to accept payments online. This technology facilitates the payment processing of credit cards, bank transfers, and various local payment methods such as TrueMoney Wallet and Rabbit Line Pay. In bustling Bangkok, where ecommerce is thriving, merchants need a reliable payment service provider to accept online payments seamlessly, whether through PayPal, Visa, or American Express. The best payment gateways in Thailand support a range of options, enabling businesses to cater to local preferences while minimizing transaction fees associated with each payment method.

For merchants in Thailand, choosing the right payment gateway provider can significantly impact their business in Thailand. Options like 2C2P offer comprehensive payment processing solutions that allow businesses to accept multiple payment options, making it easier for customers to shop online. Depending on the chosen payment method, businesses can also discover the top local and global payment solutions. With a growing number of local payment gateways available in Thailand, companies can enhance their payments online experience while ensuring customer satisfaction.

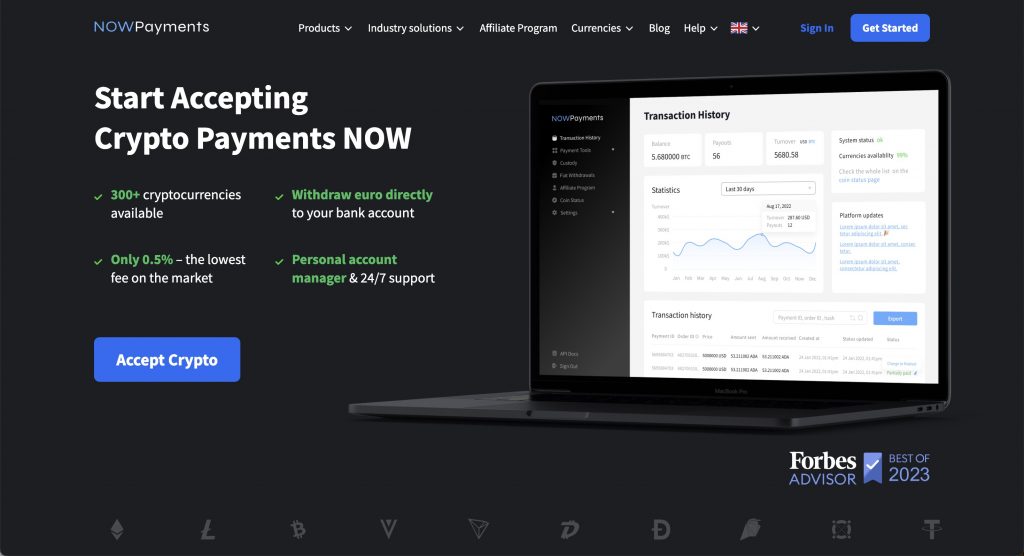

NOWPayments as the best payment gateway in Thailand

NOWPayments stands out as the best online payment gateway in Thailand, particularly for businesses looking to thrive in the vibrant Thai e-commerce market. Partnering with major financial institutions such as Bangkok Bank, this payment provider offers a robust payment system that facilitates seamless online transactions using various payment methods in Thailand. With options to accept payments in baht, NOWPayments supports credit and debit cards, Mastercard, and popular digital wallets like Alipay and K-payment. This flexibility is essential for businesses catering to diverse customer preferences, from internet banking to e-wallets and cash payments.

As a top payment gateway in Southeast Asia, NOWPayments continues to innovate to address the needs of the growing digital economy, boasting a compound annual growth rate that reflects its dominance. The company offers a variety of payment solutions in Thailand, enabling merchants to receive payments easily, depending on the payment method selected. With PromptPay and Thaiepay included in its range of payment options, it ensures that businesses can cater to various customer preferences, making it an ideal choice for those looking to optimize their online shopping experience.

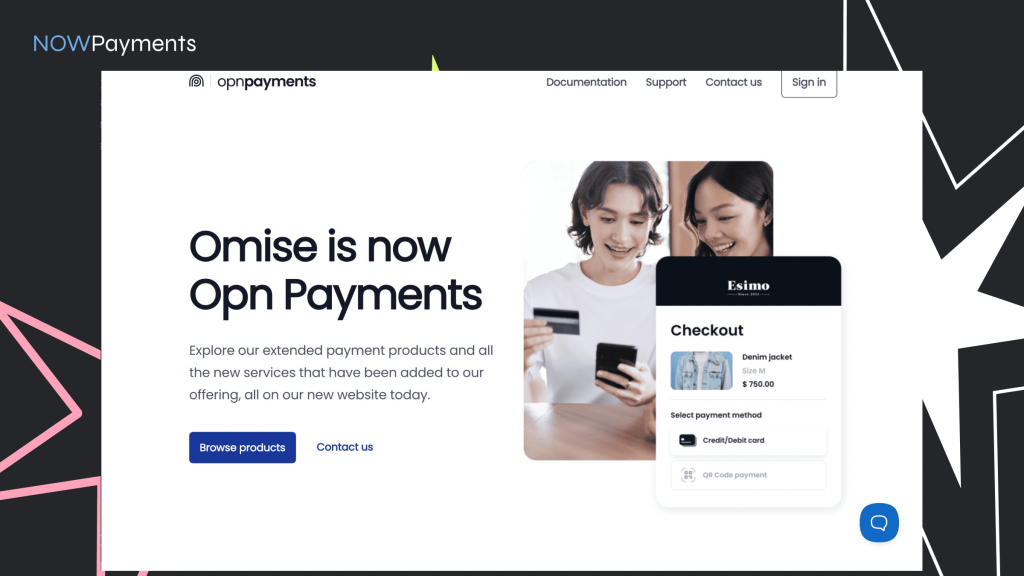

Omise payment gateway in Thailand

Omise is a prominent payment gateway in Thailand, designed to facilitate seamless online payment methods for businesses. It supports a variety of card payments, including credit card payments, enabling merchants to cater to a diverse customer base. With the rise of the Thai ecommerce market, Omise addresses the needs of merchants by offering different payment options that include international payment capabilities and alternative payment methods. This makes it a top choice among payment processors in the region.

Omise stands out by providing various payment options in Thailand, making it easier for businesses to manage transactions from bank accounts and customers to pay in THB. Depending on the type of business, Omise offers different packages to accommodate various needs. Moreover, with its strategic focus on the Asian market, particularly in Malaysia, it has emerged as a major player among different payment providers, ensuring that merchants can effectively engage with their customers while optimizing their payment processes.

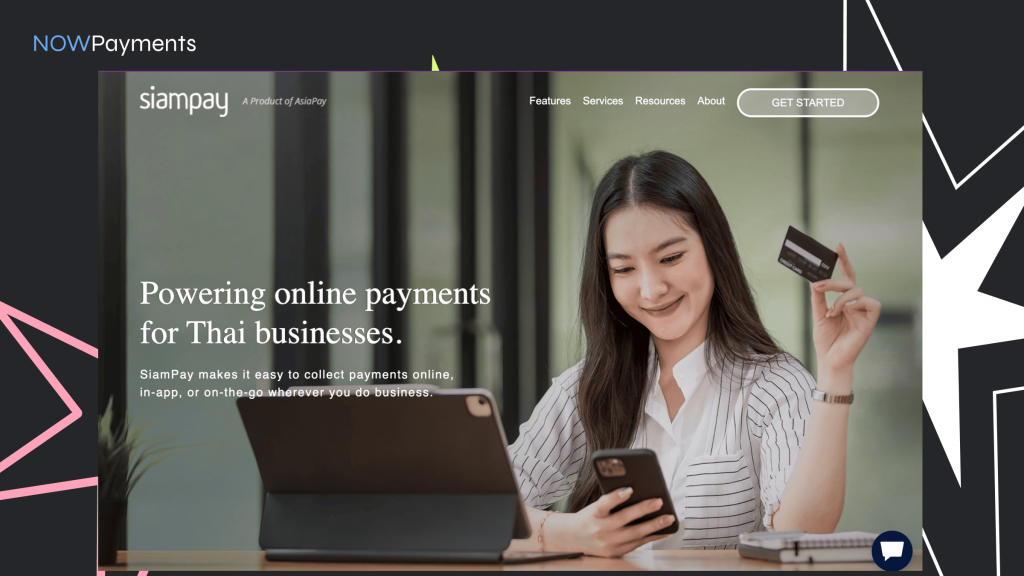

SiamPay payment gateway in Thailand

SiamPay is a leading payment gateway in Thailand, providing businesses with a reliable platform for processing payments in Thailand. This innovative gateway is designed to cater to the needs of merchants who are looking to enhance their online presence and streamline transactions. As one of the top global options, SiamPay offers a comprehensive suite of services that facilitate seamless transactions for both local and international customers.

With a robust infrastructure, SiamPay is a gateway that supports various major payment methods, ensuring that users have multiple avenues for completing transactions. This flexibility is crucial in a market where consumers increasingly prefer to shop used online. By avoiding the pitfalls of shunning the Asian market, SiamPay enables businesses to tap into the growing demand for digital payment solutions in the region.

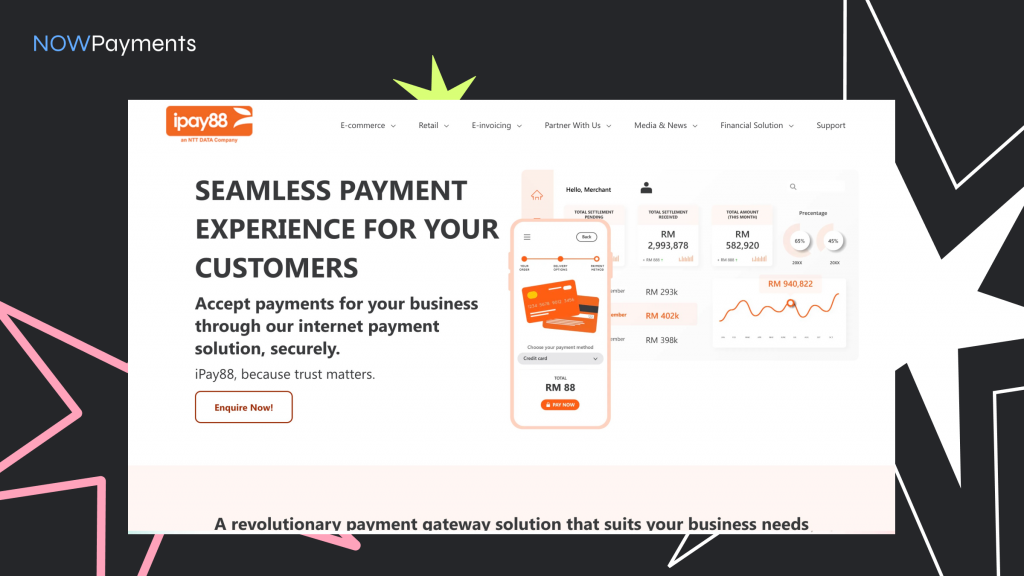

iPay88 payment gateway in Thailand

iPay88 is a leading payment gateway provider in Thailand, offering a range of payment gateway options for businesses of all sizes. This platform is designed to facilitate seamless online transactions, enabling merchants to accept payments efficiently and securely. With its user-friendly interface, iPay88 simplifies the payment process for both businesses and customers, ensuring a smooth checkout experience.

Moreover, iPay88 supports various payment methods, including credit cards, debit cards, and local e-wallets, making it adaptable to the diverse preferences of Thai consumers. By integrating this payment gateway into their systems, businesses can enhance their operational efficiency and improve customer satisfaction. The reliability and security features of iPay88 set it apart as a trusted choice for online payments in Thailand.

CodaPay payment gateway in Thailand

CodaPay is a prominent payment gateway in Thailand, facilitating seamless online transactions for businesses and consumers alike. This platform is particularly known for its ease of use, making it accessible for a wide range of users, from small merchants to large enterprises. With a strong focus on local payment methods, CodaPay supports various options, including mobile wallets and bank transfers, catering to the preferences of Thai consumers.

In addition to its user-friendly interface, CodaPay offers robust security features that ensure the safety of financial transactions. The gateway complies with local regulations and employs advanced encryption technologies, providing peace of mind for both merchants and customers. This commitment to security has helped CodaPay establish itself as a trusted payment solution in the competitive Thai e-commerce landscape.

As the digital economy continues to grow in Thailand, CodaPay is well-positioned to support this expansion by offering innovative solutions that cater to the evolving needs of businesses and consumers. Its flexibility and adaptability make it a valuable tool for those looking to enhance their online payment experience.

Conclusion

In conclusion, NOWPayments stands out as the best payment gateway in Thailand, offering a superior solution for businesses navigating the rapidly growing e-commerce market. Its ability to seamlessly integrate with various payment options, including credit cards, digital wallets like Alipay, PromptPay, and bank transfers, ensures that merchants can cater to the diverse preferences of Thai customers. By providing a secure, reliable, and flexible payment platform, NOWPayments empowers businesses to optimize their online shopping experience and boost customer satisfaction.

With its innovative approach and focus on the evolving digital economy in Southeast Asia, NOWPayments not only streamlines the payment process but also supports businesses in reaching a broader audience. For any merchant looking to thrive in Thailand’s competitive market, NOWPayments delivers unmatched versatility and efficiency, making it the preferred choice among payment gateway providers.