When selecting a payment gateway in Germany, businesses must consider the wide range of payment methods popular among German customers. The best payment gateways in Germany should support multiple online payment methods, including credit cards, debit cards, and digital wallets like Apple Pay and Google Pay. Additionally, local payment methods such as direct debit and bank transfers are also popular in Germany, making it essential for a payment service provider to accommodate these options. By offering a variety of payment methods, businesses can effectively accept payments and enhance the online shopping experience for their customers.

Another crucial aspect is the security of online payments. A reliable payment solution must ensure secure payment processing to protect sensitive payment information. Moreover, the payment platform should facilitate recurring payments and be capable of handling global payment transactions to support e-commerce payment needs. Evaluating the top payment methods and the best payment gateway options available will help businesses in Germany make informed decisions when selecting a payment provider that meets their requirements and enhances customer satisfaction.

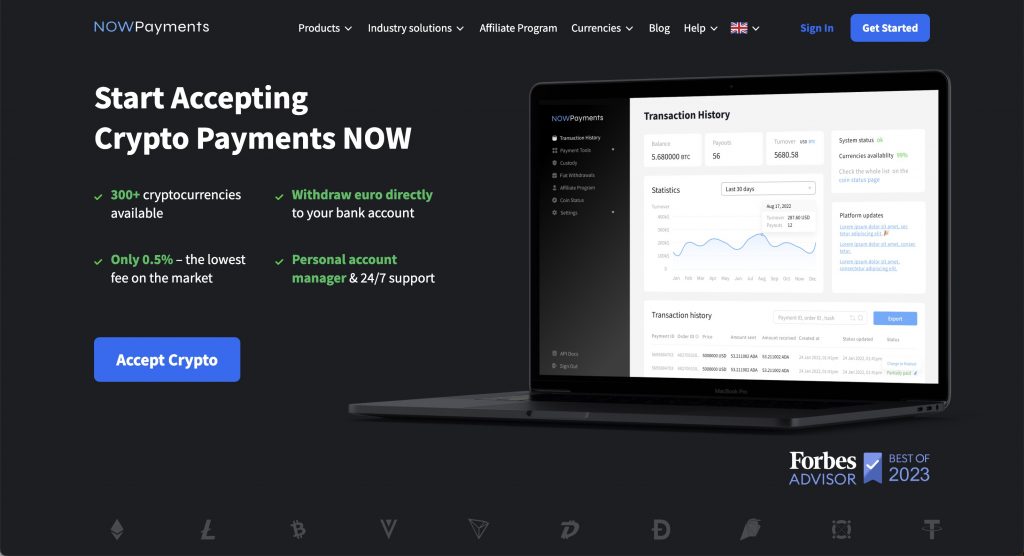

NOWPayments as the best payment gateway in Germany

NOWPayments stands out as the best payment gateway in Germany, offering a wide array of payment options tailored for both online merchants and businesses that operate online and in-person. This payment system supports multiple payment methods, making it easy for german consumers to make payments using their preferred payment method in Germany. With the growing popularity of mobile payment solutions, NOWPayments integrates seamlessly with popular online payment methods like amazon pay and credit card payments, providing a seamless payment experience for users.

By catering to the needs of german e-commerce, NOWPayments allows online stores to accept digital payment methods that resonate with local customers. It enables processing payments efficiently, ensuring that payments from Germany are handled smoothly. Furthermore, with support for transfer payment, businesses can easily manage payments in Germany while offering a variety of different payment solutions. Choosing the right payment gateway like NOWPayments ensures that merchants can maximize their sales potential by appealing to diverse customer preferences.

Stripe payment gateway in Germany

Stripe has emerged as a popular payment method in Germany, appealing to businesses looking to streamline their online payment processing. As one of the top payment gateways, Stripe enables merchants to accept payments from customers through various online payment methods in Germany. This versatile payment gateway allows for the integration of multiple payment gateways and supports international payment methods, making it ideal for businesses targeting both local and global audiences.

In a landscape where traditional payment methods are still relevant, new payment methods are gaining traction. Stripe’s payment technology provides a seamless experience for users who want to pay online using different payment methods. The platform offers payment links and is compatible with various payment apps, ensuring that customers can manage their transactions effortlessly. With Stripe, businesses can offer end-to-end payment solutions that cater to the evolving needs of consumers in Germany.

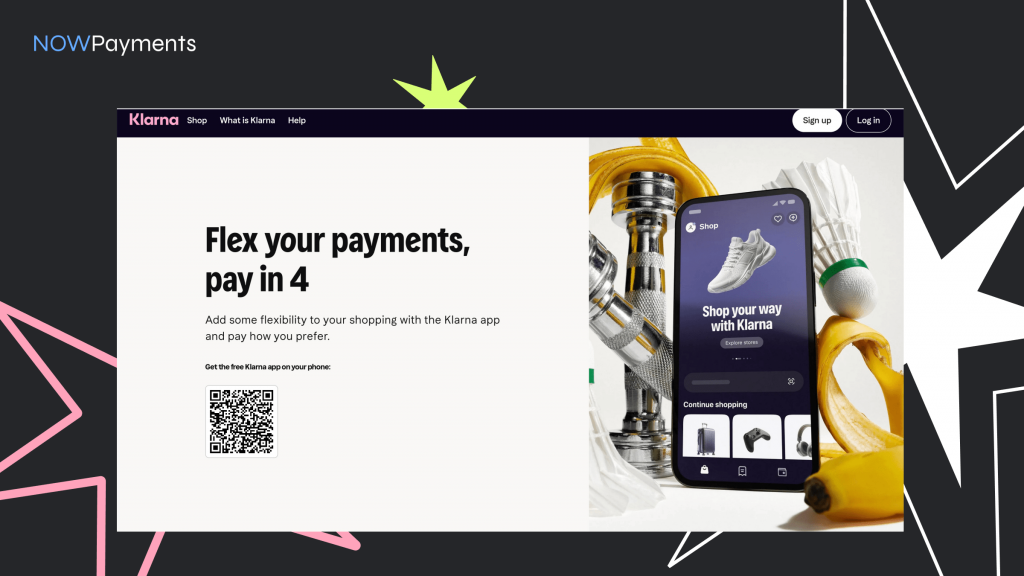

Klarna payment gateway in Germany

Klarna is a renowned payment company that has emerged as one of the leading payment gateways in Germany. With its ability to integrate payment solutions seamlessly, Klarna offers multiple payment options that cater to various consumer preferences. This flexibility makes it a popular payment method for online purchases, allowing users to make payments online efficiently.

One of the standout features of Klarna is its ability to provide one payment solution that simplifies the checkout process. In a market where paypal is the most popular choice, Klarna competes effectively by offering numerous local payment options that appeal to German customers. This adaptability highlights the platform’s commitment to enhancing the shopping experience for purchases in Germany, making it a go-to choice for many consumers.

Furthermore, Klarna supports various types of payment, ensuring that customers can select the method that best suits their needs. As a result, it has firmly established itself among the top contenders in the German payment landscape, paving the way for a more convenient and user-friendly online shopping experience.

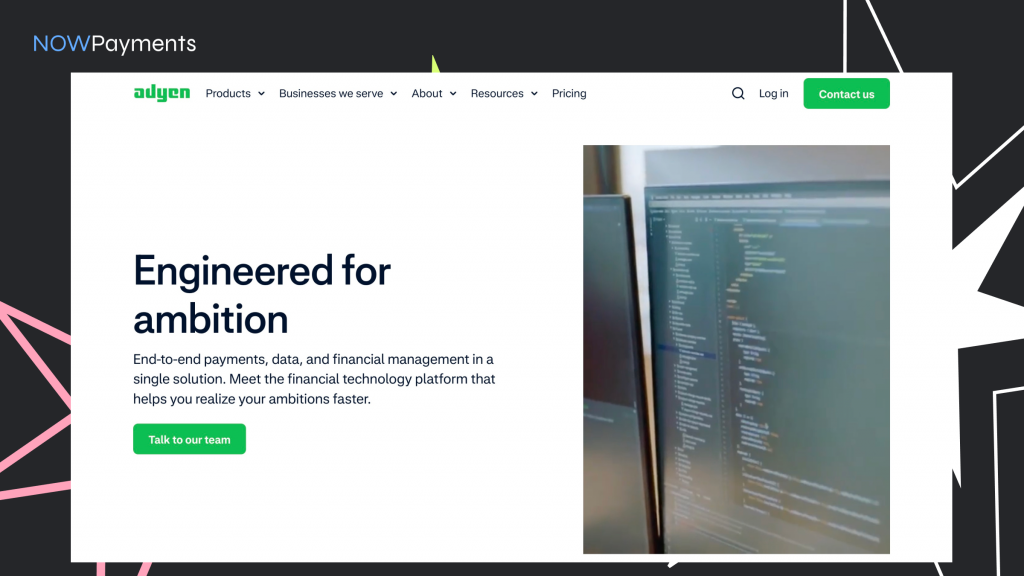

Adyen payment gateway in Germany

Adyen is a leading payment gateway provider in Germany, known for its seamless integration and robust features that cater to businesses of all sizes. With a focus on enhancing the customer experience, Adyen supports various payment methods, including credit cards, digital wallets, and local options, making it easier for merchants to reach a broader audience.

One of the standout features of Adyen is its ability to facilitate transactions directly through online bank options, allowing customers to make payments securely and efficiently. This not only boosts customer satisfaction but also reduces cart abandonment rates, a common issue faced by e-commerce platforms.

Additionally, Adyen’s advanced fraud prevention tools and real-time analytics empower businesses to optimize their payment strategies. As more consumers in Germany turn to digital payment solutions, Adyen’s innovative approach positions it as a vital player in the evolving landscape of online transactions.

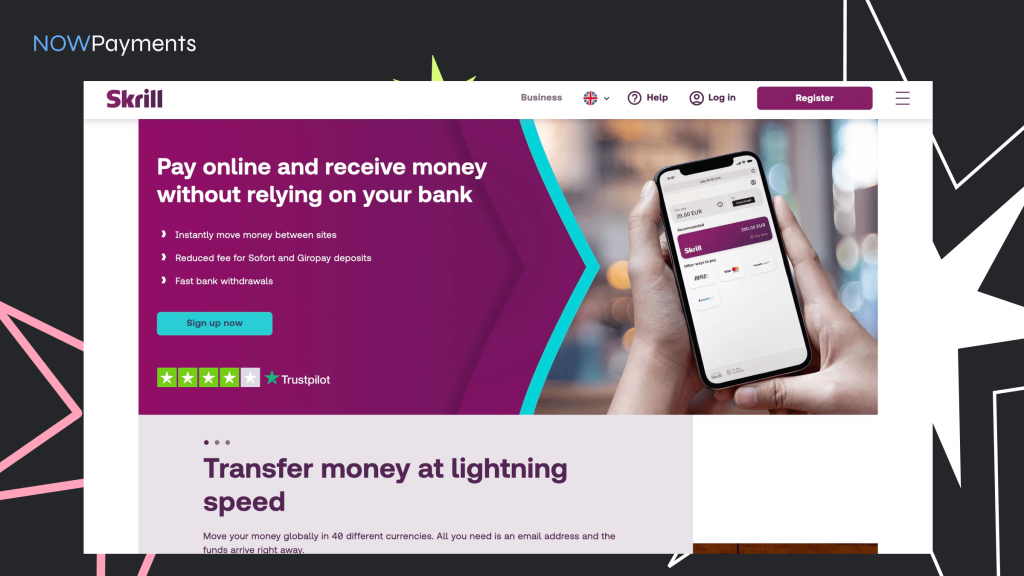

Skrill payment gateway in Germany

Skrill has emerged as a popular payment gateway in Germany, offering a versatile solution for both consumers and businesses. With its user-friendly interface, Skrill allows users to send and receive money instantly, making it an ideal choice for online transactions. The platform supports multiple currencies, which is particularly beneficial for businesses engaging in international commerce.

One of the key features of Skrill is its emphasis on security. The gateway employs advanced encryption technology to protect sensitive financial information, ensuring users can transact with confidence. Furthermore, Skrill provides a prepaid card option, enabling users to access their funds easily and make purchases at millions of locations worldwide.

In addition to its convenience and security, Skrill also offers competitive fees, making it an attractive choice for merchants looking to minimize transaction costs. As e-commerce continues to grow, Skrill’s presence in Germany is likely to expand, catering to the increasing demand for efficient digital payment solutions.

Conclusion

NOWPayments stands out as the best payment gateway in Germany due to its unmatched versatility, security, and seamless integration with local and international payment methods. By supporting a wide array of payment options, including credit cards, digital wallets, and cryptocurrencies, NOWPayments empowers businesses to cater to the diverse preferences of German consumers. This adaptability ensures that merchants can deliver a smooth and convenient payment experience, enhancing customer satisfaction and loyalty.

In a competitive market with strong players like Stripe, Klarna, and Adyen, NOWPayments differentiates itself through its focus on providing innovative solutions tailored to the unique needs of e-commerce and in-person businesses in Germany. Its robust API and user-friendly platform enable easy implementation, while advanced security measures guarantee safe transactions. By choosing NOWPayments, businesses can optimize their payment processes, expand their reach, and thrive in Germany’s rapidly evolving digital economy.