A payment gateway is a crucial component of the online payment ecosystem, facilitating the payment process for businesses and consumers alike. It acts as a bridge between the customer’s chosen payment method, such as credit and debit card transactions, and the merchant’s payment processor. For small businesses operating in the UK, selecting the best payment gateway can significantly impact their operations. Popular options like Stripe and Worldpay offer robust payment solutions that cater to multiple payment options, including local payment methods and international payment capabilities. The payment processing fee associated with these services varies based on the selected payment method, making it essential for businesses to evaluate their choices carefully.

For an online store looking to streamline transactions, a reliable payment service provider is key. The payment gateway provider must offer a seamless payment page experience for customers, ensuring customer support is readily available. With the top 5 payment gateways offering diverse features, including payment links and hosted payment options, businesses can easily find the best online payment gateways to suit their needs. When choosing the right payment gateway, consider both the global payment reach and the specific requirements of your business to ensure a robust payment system that meets customer expectations.

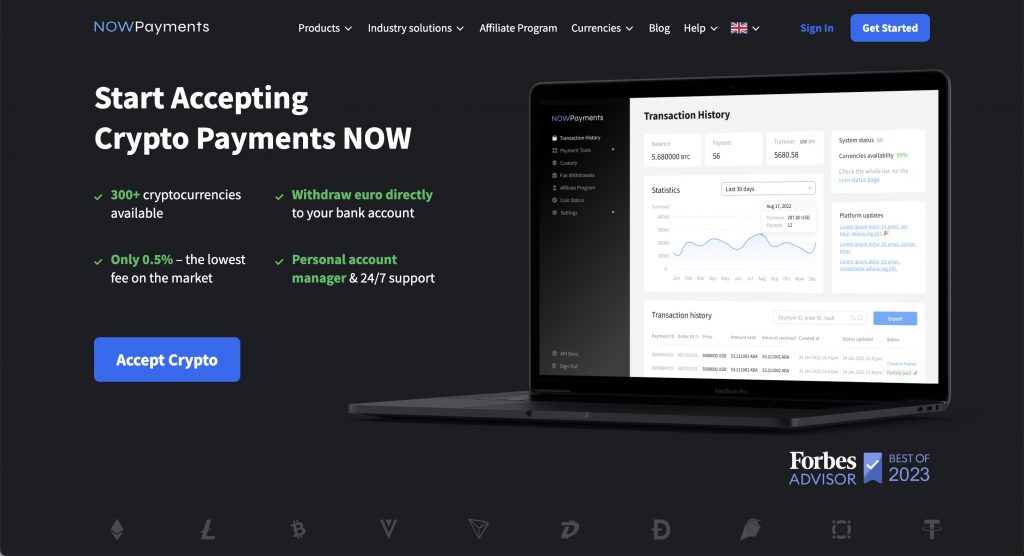

NOWPayments

NOWPayments stands out as the best payment gateway in the UK, offering businesses a seamless and reliable payment experience. As a leading payment provider, it supports a wide range of payment methods, including traditional card payment options and innovative alternative payment methods. This flexibility allows businesses in the UK to cater to diverse customer preferences by accepting multiple payment methods and enhancing their payment platform capabilities.

Choosing a payment gateway is crucial for any online business, and NOWPayments offers a hosted payment gateway solution that simplifies payment information management. The fee determined by the payment method is transparent, ensuring no hidden costs for users. With support for transactions in over 159 countries, NOWPayments is not just a reliable payment gateway but also an ideal choice for international payment gateway providers looking to expand their reach. For businesses looking to find the payment solution that meets their business needs, NOWPayments is undoubtedly among the top 8 payment gateways available today.

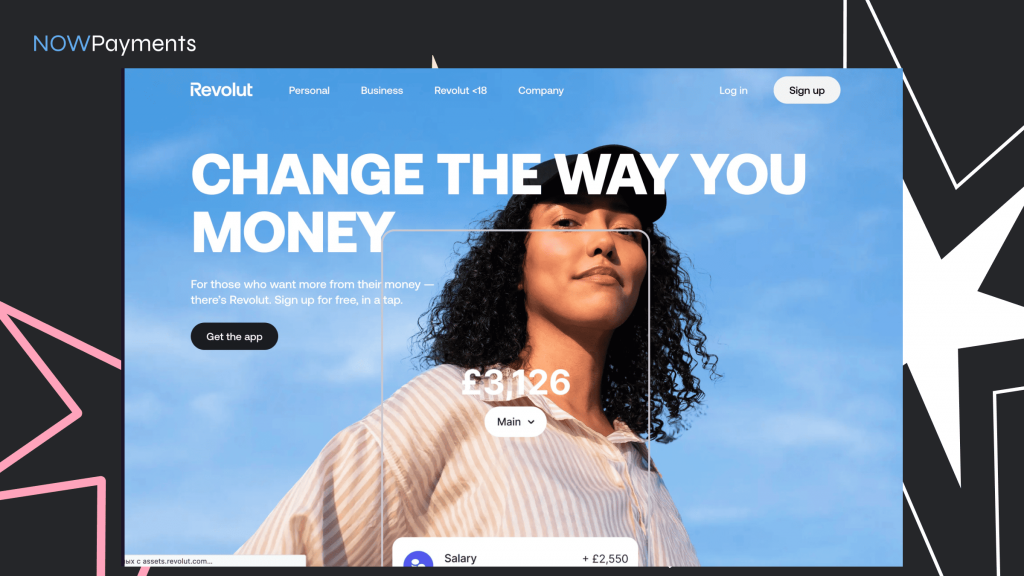

Revolut

In the UK, the Revolut payment gateway stands out as a popular payment gateway option for UK merchants. It offers a variety of payment options, including various payment methods that cater to different customer preferences. With the ability to process payment in 159 countries, Revolut ensures secure payment transactions, allowing businesses to confidently handle payment details without compromising security. This payment gateway supports both online and in-person transactions, making it versatile for various business models.

As one of the top payment gateways, Revolut enables global payment processing and accommodates over 300 payment methods. When businesses need a payment gateway, choosing the best payment gateway provider can depend on the specific type of payment they wish to accept. Whether you operate a Shopify or Shopify Plus-based online store, Revolut’s offerings can streamline your payment gateway’s functionality. Ultimately, the payment gateway that works best for your business will depend on your customers’ needs and the payment methods like cards and digital wallets you wish to support.

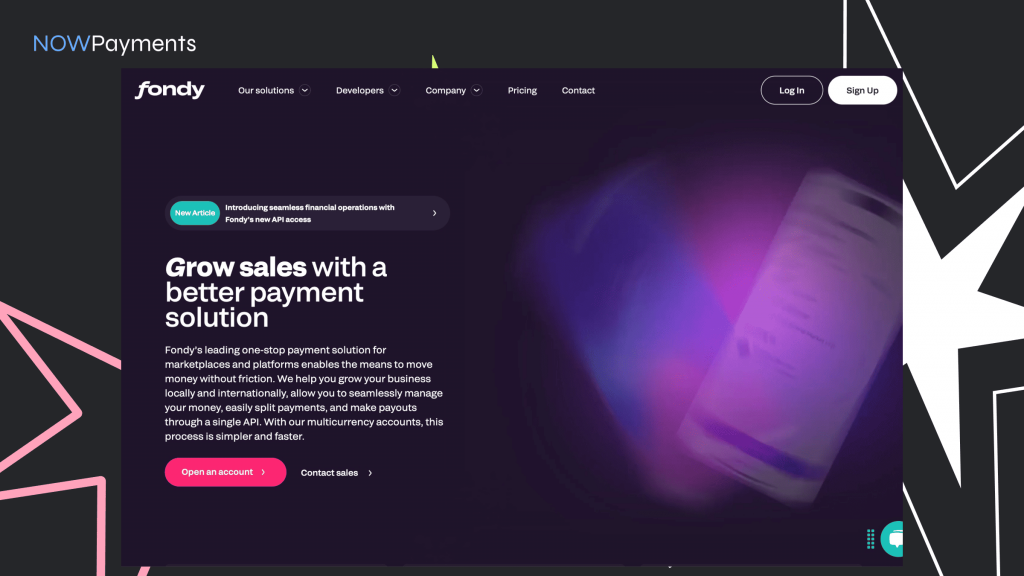

Fondy

In the competitive landscape of the UK payment market, Fondy emerges as a reliable payment gateway that caters to various business needs. This third-party payment solution offers a payment gateway that is designed for seamless transactions, supporting multiple method of payment options. Businesses can integrate this payment gateway for your business to enhance their ecommerce payment capabilities, making it one of the 8 best payment gateways available in the UK.

Fondy stands out in the payment gateway market due to its commitment to payment card industry data security, ensuring that all transactions are safe and compliant. The payment gateway works efficiently with various payment processor or acquiring bank partners, facilitating smooth transactions for users. Choosing the best UK payment option often depends on the payment method your customers prefer, and Fondy’s all-in-one payment solution is built to accommodate these diverse needs.

As businesses look for the best international payment gateways, Fondy provides a robust platform that not only simplifies the payment process but also enhances customer experience. With its comprehensive features, it’s clear why Fondy is regarded as a new payment gateway that can significantly improve how businesses manage their finances.

Planet

In the United Kingdom, Planet payment gateway is becoming increasingly popular among businesses seeking a reliable solution for processing transactions. This UK payment gateway offers payment options that cater to a diverse clientele, ensuring that customers have a seamless experience. With the rise of e-commerce, the need for effective payment gateways has never been more crucial.

One of the standout features of the Planet payment gateway is its integration with global networks, similar to how Adyen is a global payment processor. This means that merchants can accept various forms of payment effortlessly. As businesses evaluate which payment gateway is best for their needs, factors like payment gateway fees and transaction speed play a significant role in their decision-making process.

Furthermore, these payment gateways enable merchants to manage their transactions efficiently. With a payment gateway every business can trust, the path to financial growth becomes more accessible. Investing in a robust payment solution like the Planet payment gateway can significantly enhance a company’s ability to thrive in the competitive landscape of online commerce in the UK.

PayPal Braintree

In the United Kingdom, PayPal Braintree has emerged as a leading choice for businesses seeking reliable payment gateways. This versatile platform enables merchants to accept various forms of payment, including credit cards, debit cards, and digital wallets, providing customers with a seamless checkout experience.

One of the key advantages of PayPal Braintree is its user-friendly interface, which simplifies the integration process for online retailers. By utilizing this payment solution, businesses can enhance their operational efficiency and cater to a broader customer base.

Moreover, PayPal Braintree supports various currencies, making it an ideal choice for international transactions within the UK market. This flexibility allows businesses to expand their reach while ensuring that they can provide secure and efficient payment gateways for their customers.

Conclusion

In conclusion, NOWPayments stands out as the best payment gateway in the UK, offering businesses unparalleled flexibility, security, and innovation. By supporting a wide variety of payment methods, including traditional card payments and alternative solutions, NOWPayments caters to the evolving needs of UK merchants and consumers alike. Its transparent fee structure, seamless integration capabilities, and ability to process transactions globally position it as the ultimate choice for businesses looking to thrive in both local and international markets.

Whether you’re an SME or a large enterprise, NOWPayments ensures a smooth payment experience, enhances customer satisfaction, and drives operational efficiency. For businesses in the UK aiming to stay ahead in the competitive e-commerce landscape, NOWPayments delivers a reliable, future-proof payment solution that surpasses its competitors.