Payment gateways are essential components of the online payment ecosystem, acting as a bridge between merchants and payment service providers (PSPs). They facilitate payment processing by securely transferring customer payment information to the payment system and ensuring that transactions are completed seamlessly. In regions like Kenya and Tanzania, popular payment options include mobile money services such as m-Pesa, tigo pesa, and Vodacom, which allow businesses to accept mobile money payments and bank transfers. These mobile payment solutions cater to the growing demand for online shopping and e-commerce businesses.

As international payment gateways expand into the Tanzanian market, local e-commerce businesses can leverage online payment solutions to enhance their payment experience. Payment gateway providers, such as Flutterwave and Pesapal, offer a wide range of payment methods including credit or debit card payments, which enable merchants to accept online payments from customers using Visa and Mastercard. With the increasing popularity of mobile applications for online purchases, integrating a reliable payment gateway becomes crucial for businesses looking to thrive in the competitive e-commerce landscape of East Africa.

How Does a Payment Gateway Work for Card Transactions?

In today’s digital landscape, a payment gateway is essential for online businesses looking to accept payments seamlessly. When a customer initiates a checkout process, the payment gateway securely transmits the transaction details, including the billing address and invoice information, to the issuing bank for authorization. This process ensures that the customer has sufficient funds to complete the purchase. In regions like Tanzania, where internet penetration continues to grow, many Tanzanian businesses are looking to integrate local payment solutions like mpesa and ussd alongside traditional credit and debit card payments to cater to both local and international customers.

Payment gateway providers in Tanzania enable merchants to accept credit and debit card transactions through a merchant account, allowing you to accept payments for goods and services hassle-free. These providers often have a clear user agreement and privacy policy to ensure that customer data is handled securely. As Africa’s payment landscape evolves, businesses in Uganda and beyond are leveraging these technologies to enhance their online payments experience. With the right tools, you’ll go from a traditional business model to a thriving online presence, providing exceptional customer support and a smooth transaction experience for your customers.

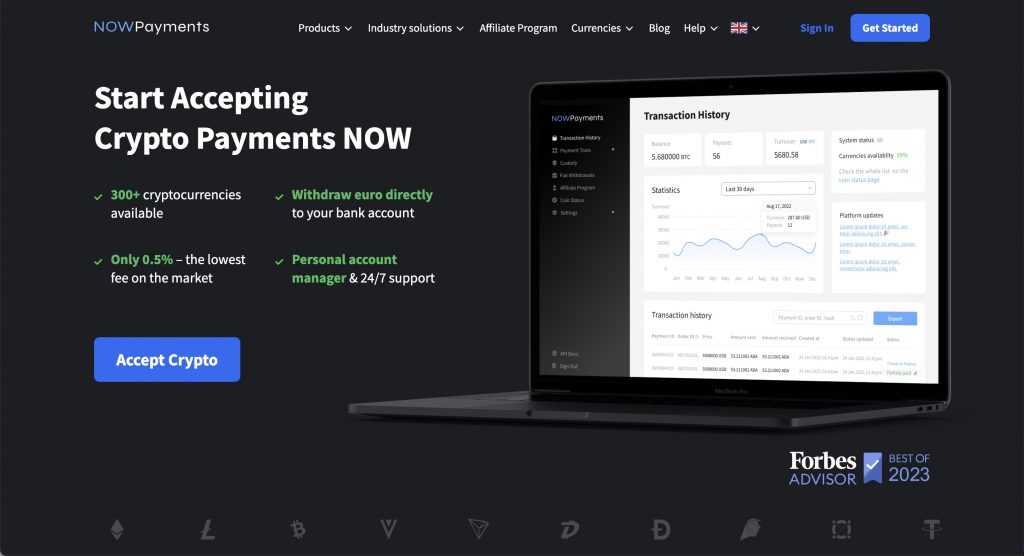

NOWPayments as the best payment gateway in Tanzania

In the evolving landscape of online payments in Tanzania, NOWPayments stands out as the best payment gateway. It offers seamless transactions for merchant’s needs, enabling them to efficiently manage payments online with a robust platform. By utilizing a unique payment link, registered businesses can effortlessly direct customers to complete their purchases, ensuring a seamless and secure experience.

With easy integration options, NOWPayments allows businesses in regions like Dar es Salaam and beyond to accept card payments and utilize various multiple channels including Skrill and local respective banks. This flexibility not only enhances the customer experience but also boosts sales, making it a preferred choice for PSP solutions in Tanzania’s dynamic marketplace. Secure transactions are a priority, ensuring that every payment is processed with the utmost safety and reliability.

Airtel Money by Airtel Tanzania

Airtel Money by Airtel Tanzania is a versatile payment gateway that offers a seamless way to conduct transactions. This platform is widely used payment solution for both individuals and businesses, enabling them to transfer funds, pay bills, and purchase goods effortlessly. With its user-friendly interface, customers can easily navigate through various options to complete their financial activities.

Moreover, Airtel Money is designed to may accept a variety of payment methods, which enhances its functionality and convenience. Users can link their bank accounts or recharge their Airtel Money wallets to facilitate faster transactions. This flexibility makes it an attractive choice for many Tanzanians looking for reliable digital payment options. As mobile money continues to gain popularity, Airtel Money remains at the forefront, ensuring that users have access to a secure and efficient payment system.

Cellulant

Cellulant is a leading digital payment gateway that facilitates seamless transactions across various platforms. With a focus on enhancing the payment experience for both businesses and consumers, Cellulant offers a robust suite of services that cater to different sectors, including e-commerce, travel, and utility payments. Its integrated solutions allow merchants to accept payments through multiple channels, including mobile money, cards, and bank transfers.

One of the standout features of the Cellulant payment gateway is its ability to support local currencies, making it easier for businesses to operate in diverse markets. Additionally, its user-friendly interface and secure transaction processes ensure that customers can make payments with confidence. By leveraging advanced technology, Cellulant aims to drive financial inclusion across Africa, enabling more people to access digital payment solutions.

With its commitment to innovation and customer satisfaction, Cellulant continues to evolve, providing businesses with the tools they need to thrive in the digital economy.

ClickPesa

ClickPesa is a versatile payment gateway designed to facilitate seamless online transactions for businesses and individuals alike. By integrating ClickPesa into their platforms, merchants can accept payments in multiple currencies, enhancing their reach to a broader customer base. The gateway supports various payment methods, including credit cards, mobile money, and bank transfers, making it a flexible choice for diverse clientele.

Security is a top priority for ClickPesa, as it employs advanced encryption and fraud detection measures to ensure safe transactions. This commitment to security builds trust and confidence among users, encouraging them to engage in online shopping without concerns about data breaches. Moreover, ClickPesa offers a user-friendly interface, making it easy for both merchants and customers to navigate the payment process.

Additionally, ClickPesa provides comprehensive support and resources for businesses looking to optimize their payment solutions. Its robust analytics tools enable merchants to track transaction performance and customer behavior, allowing for data-driven decision-making. Overall, ClickPesa stands out as a reliable payment gateway that empowers businesses to thrive in the digital economy.

Direct Pay by DPO Group

Direct Pay by DPO Group is a sophisticated payment gateway designed to facilitate seamless online transactions for businesses of all sizes. By integrating this service, merchants can accept a variety of payment methods, including credit and debit cards, mobile wallets, and bank transfers, ensuring a flexible shopping experience for their customers.

This payment gateway emphasizes security and compliance, utilizing advanced encryption techniques to protect sensitive data during transactions. DPO Group also provides a user-friendly interface that simplifies the payment process, allowing businesses to streamline their operations and enhance customer satisfaction.

Moreover, Direct Pay offers customizable solutions to suit different business needs, enabling merchants to tailor the payment experience according to their specific requirements. With robust reporting tools, businesses can easily track and analyze their transactions, leading to informed decisions and improved financial management.

Conclusion

In Tanzania’s evolving digital economy, NOWPayments stands out as the best payment gateway, offering businesses seamless, secure, and flexible solutions for managing online transactions. Unlike other providers, NOWPayments supports a wide range of payment methods, including cryptocurrencies, credit cards, and local channels like Skrill, ensuring businesses can cater to diverse customer preferences. Its ease of integration and robust security features make it a top choice for merchants seeking to optimize payment operations and enhance customer experience.

With fast transaction speeds, competitive costs, and the ability to expand globally without regulatory hurdles often associated with traditional payment methods, NOWPayments empowers businesses in Tanzania to stay ahead of competitors. Whether in Dar es Salaam or rural areas, NOWPayments bridges the gap between businesses and their customers, fostering growth and accessibility in Tanzania’s dynamic marketplace.