Payment gateways are essential payment solutions that enable merchants to accept payments online. They facilitate various payment methods, including credit and debit card transactions, digital wallets, and local payment methods, allowing businesses to cater to a diverse clientele. In the French market, for example, customers in France often prefer using cartes bancaires alongside major cards like Visa. An ideal payment gateway should integrate smoothly with existing e-commerce platforms while ensuring compliance with PCI DSS standards to protect sensitive information during the payment process.

When selecting a payment gateway provider, businesses in France must consider factors such as transaction fees, the ability to handle multiple payment options, and support for both credit and debit transactions. While every payment gateway may offer different features, the top payment gateways often provide a wide range of payment methods that include alternative payment methods for international bank transactions. This flexibility is crucial for optimizing the landscape of payment and enhancing customer experience during online transactions.

Factors to Consider for Best Payment Gateways in France

When considering the best payment gateways in France, it is essential to evaluate several factors that cater to both local and international customers. A reliable payment processor should support a range of common payment methods such as credit card and debit options to accommodate French customers. Look for a payment gateway that offers robust security measures to protect payment information and ensure a smooth transaction experience.

Furthermore, online payment solutions should provide customizable options to suit your business needs. When you choose a payment gateway, consider whether it can handle card payments efficiently and if it supports global payment transactions for your online presence in France. Some gateways may have limitations, as a payment gateway may not offer specific features necessary for your operations.

Ultimately, to choose the best online payment gateway, assess the comprehensive payment service that aligns with your business strategy, ensuring it can manage payments from customers in France as well as single payment transactions. This holistic approach will help you streamline your payment processes and enhance customer satisfaction.

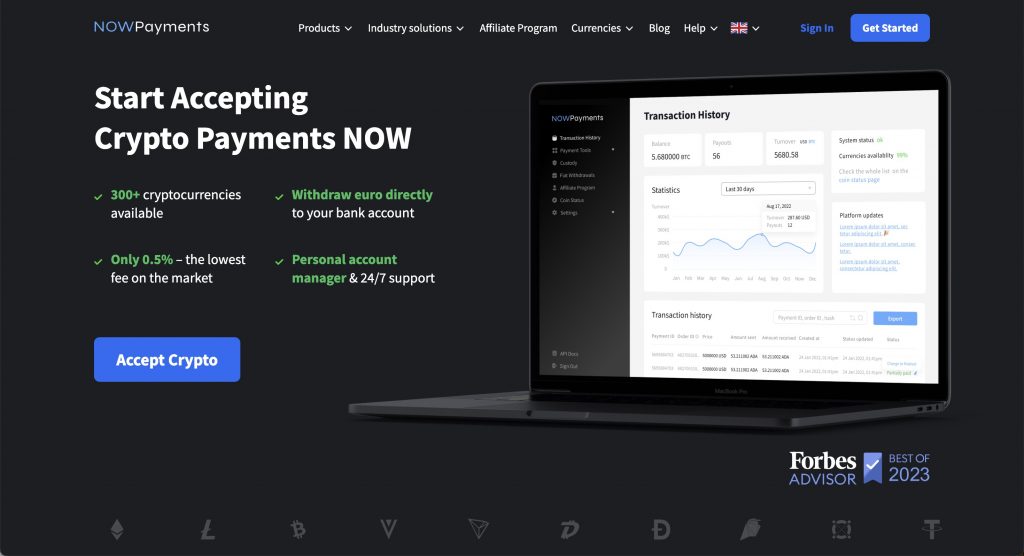

NOWPayments as the best payment gateway in France

When it comes to selecting the best payment gateway in France, NOWPayments stands out due to its diverse payment methods and customizable options. Operating in France, this payment gateway allows businesses to accept both debit and credit card transactions seamlessly. With the rise of mobile-only payment solutions, NOWPayments ensures that your payment gateway is not only versatile but also suited to the preferences of French consumers.

In a landscape where traditional credit card payments in France are complemented by innovative payment technologies, NOWPayments offers a robust solution for businesses. While some gateways may not offer integrations with international bank accounts, NOWPayments supports the international bank account number (IBAN) for smoother transactions. Its integration options ensure that businesses can connect with various platforms easily, making it a top choice for those looking to enhance their operations in France.

PayPal payment gateway in France

PayPal is a widely recognized payment gateway that allows businesses in France to facilitate online purchases. With the rise of e-commerce, ensuring your payment gateway is efficient and secure is crucial for attracting customers. This platform supports various credit card in France options, including the type of credit card commonly used by French consumers. In addition, French credit cards come equipped with features that cater to local payment preferences.

As online shopping has increased in France, the demand for a reliable gateway should have a good reputation has also grown. PayPal not only handles traditional payments from French customers, but also integrates digital wallets as the second option for seamless transactions. Alongside popular payment methods like Klarna and other local options, PayPal offers France-specific options to accommodate the diverse needs of consumers.

Moreover, with the support of the international bank system, PayPal stands as the second most popular European payment solution in the region. Whether you have a physical or online presence, implementing PayPal can significantly enhance your ability to process different payment types, ensuring a smooth shopping experience for your customers using any digital device.

Stripe payment gateway in France

Stripe is a leading payment gateway in France, offering businesses a robust platform for processing purchases online. With its seamless integration, merchants can accept payments through various methods, including klarna and local options, which cater to the preferences of local consumers. This flexibility allows businesses to enhance customer satisfaction and drive sales.

In addition to supporting france-specific options, Stripe also handles international transactions, making it an ideal choice for companies looking to expand their reach. Depending on your business, you may find that you need the swift or bic codes for efficient cross-border payments. This capability is crucial for businesses that aim to tap into the global market.

Furthermore, Stripe allows customers to use digital wallets, a feature that has become increasingly popular in the digital age. By providing common digital payment solutions, Stripe ensures that both local and international customers enjoy a smooth purchasing experience.

Adyen payment gateway in France

Adyen payment gateway has become a popular choice in France, offering a seamless experience for both merchants and customers. The platform integrates various payment methods, making it suitable for businesses of all sizes. With its robust technology, Adyen supports transactions with multiple currencies, as well as international bank transfers, ensuring that businesses can cater to a diverse clientele.

In addition to facilitating cross-border payments, Adyen provides France-specific options that enhance the local shopping experience. These features are designed to meet the unique preferences of French consumers, allowing merchants to connect better with their audience. Furthermore, many customers need the swift processing of their transactions, and Adyen’s efficient system ensures quick and secure payments, helping businesses maintain customer satisfaction.

PayPlug payment gateway in France

PayPlug is a leading payment gateway in France, designed to streamline online transactions for businesses of all sizes. With its user-friendly interface and robust functionality, it provides a seamless checkout experience for customers, making it a preferred choice for merchants.

In addition to supporting local payment methods, PayPlug offers integration with international bank services, ensuring that businesses can cater to a global clientele. This feature allows merchants to accept payments from various countries, enhancing their market reach.

Moreover, PayPlug also provides France-specific options such as local payment methods and compliance with French regulations, making it an ideal solution for businesses operating within the country. This tailored approach not only boosts customer trust but also improves conversion rates.

Conclusion

In France’s dynamic digital payment landscape, NOWPayments emerges as the best payment gateway for businesses seeking a reliable, versatile, and secure solution. Supporting over 300 cryptocurrencies alongside traditional payment methods like credit and debit cards, NOWPayments provides unparalleled flexibility, ensuring merchants can cater to diverse customer preferences. Its seamless integration, low fees, and robust security measures make it ideal for businesses aiming to optimize their operations and scale globally. With tailored options for the French market and the ability to handle international transactions effortlessly, NOWPayments is the gateway of choice for forward-thinking businesses.