Payments in Kenya have evolved significantly, with various payment gateways in Kenya for 2026 providing businesses with the tools to accept online payments. A popular payment service provider is M-Pesa, leveraging mobile money to facilitate mobile payments seamlessly. This payment platform allows businesses to accept payments from a wide range of payment options, including card payments and international payments, making it easier for merchants to cater to their customers’ needs.

Moreover, businesses can utilize e-commerce platforms equipped with a payment gateway that allows multiple payment options to streamline the payment process. These payment solutions ensure a smooth experience for both sellers and buyers, facilitating quick online transactions. With options for bulk payment and cross-border payments, enterprises can efficiently receive payments and make payments, enhancing their operational efficiency in the competitive landscape of businesses in Kenya.

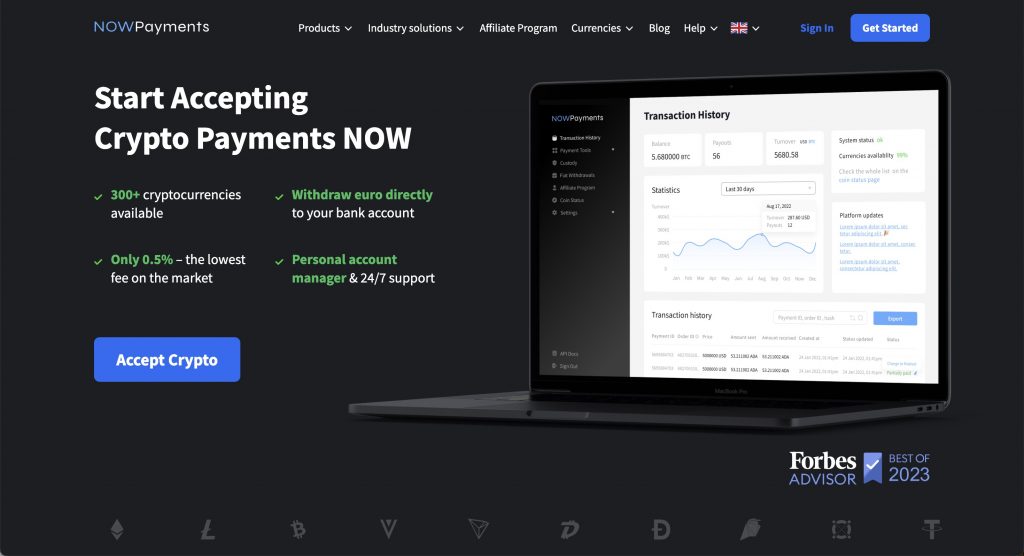

NOWPayments as the best payment gateway in Kenya

NOWPayments stands out as the best payment gateway in Kenya, providing a seamless payment system for businesses and consumers alike. With its ability to facilitate payments online, NOWPayments supports a diverse range of payment methods, making it a preferred choice among businesses looking to enhance their online payments in Kenya. This kenyan payment gateway is recognized by the Central Bank of Kenya, ensuring that it adheres to all regulatory requirements.

NOWPayments allows businesses to collect online payments from customers through a variety of payment options, including bill payments and payment links. Its integration with popular online payment platforms in Kenya, such as platforms like Shopify, enables merchants to cater to a wider audience. By offering multiple payment methods, NOWPayments ensures that customers have a convenient payment method that suits their needs, ultimately enhancing the overall digital payment experience.

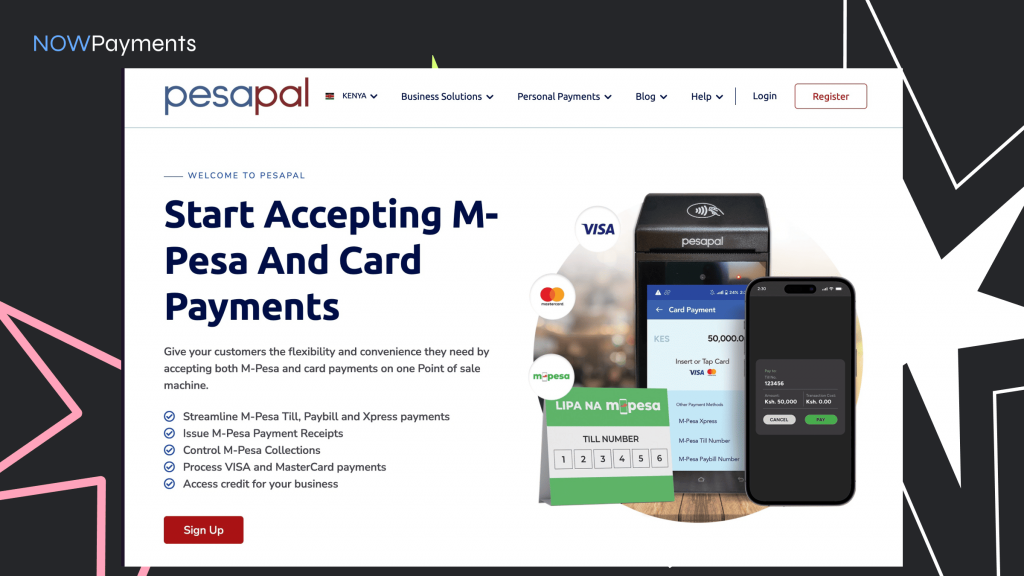

PesaPal

In Kenya, PesaPal stands out as a popular payment gateway that allows businesses to accept payments from customers seamlessly. This payment gateway offers a variety of payment methods, making it easier for merchants to cater to diverse customer preferences. With options including mobile money, credit cards, and bank transfers, businesses can choose their preferred payment method that suits their target audience.

When choosing a payment gateway in Kenya, it’s essential to consider security, as security is a top priority for both businesses and their customers. PesaPal ensures reliable and secure payment processing, which enhances trust and encourages more transactions. As one of the leading payment gateway providers in Kenya, it delivers online payment solutions that allow merchants to receive payments online efficiently, making it a top choice for those looking to enhance their online payment services.

Furthermore, PesaPal’s user-friendly interface and integration capabilities set it apart from other online payment gateways. This makes it an ideal option for businesses seeking to provide secure and reliable payment experiences to their customers. By utilizing various payment methods, businesses can ensure they cater to the needs of their clients effectively, promoting customer satisfaction and loyalty.

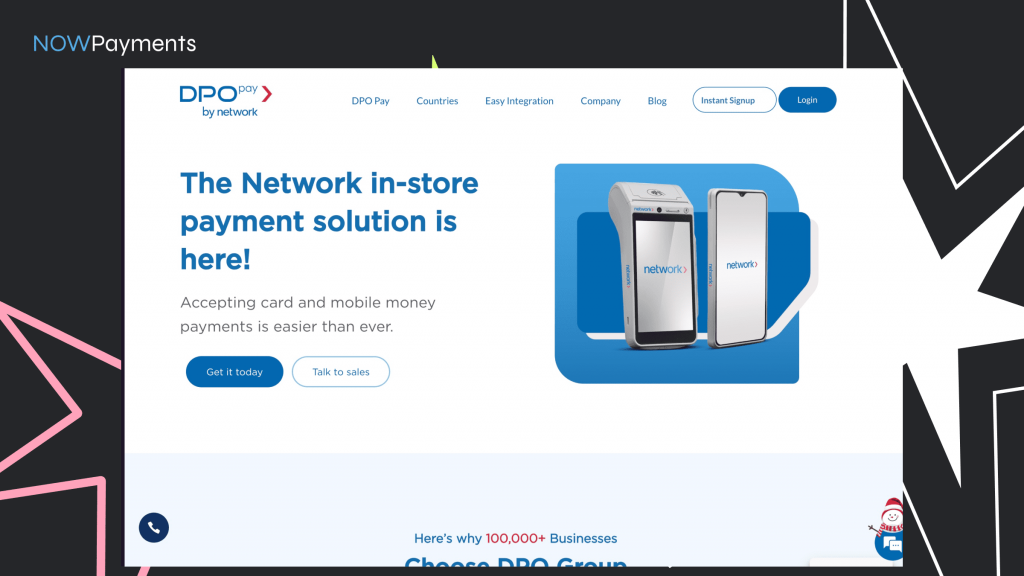

DPO Group

DPO Group is a popular payment gateway in Kenya that provides a robust payment platform that offers various solutions for businesses looking to start accepting online payments. This Kenya payment gateway supports multiple payment methods, enabling merchants to provide payment options to customers that include local and international cards, mobile money, and bank transfers. As a secure payment gateway, DPO Group ensures that all payment information is encrypted and handled with the highest level of security, fostering trust between businesses and their clients.

With its efficient online payment processing, DPO Group enhances the efficiency of online transactions, allowing businesses to seamlessly integrate with popular platforms like Shopify, WooCommerce, and more. The payment gateway integration is straightforward, enabling merchants to easily set up their systems for smooth payment experiences. By offering popular payment methods and ensuring reliable service, DPO Group stands out as a leading gateway in Kenya that allows businesses to thrive in the digital economy.

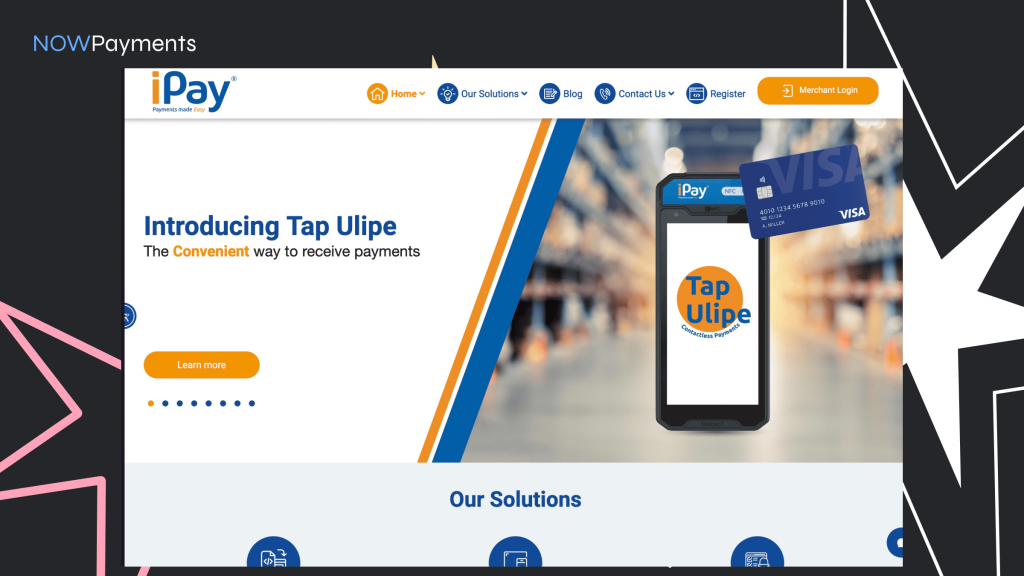

ipay Africa

ipay Africa is a prominent payment gateway in Kenya that offers a variety of payment methods like mobile money, credit cards, and bank transfers. This versatility enables businesses to cater to diverse customer preferences, making it easier for them to receive customer payments efficiently. With its user-friendly interface, ipay Africa simplifies the process of make online payments for both merchants and customers.

The platform boasts comprehensive payment features that enhance the overall transaction experience. Its seamless integration with popular platforms like Shopify and WooCommerce allows businesses to leverage existing e-commerce solutions, making it one of the leading gateways for online transactions in the region. Furthermore, ipay Africa supports both online and offline payment solutions in Kenya, ensuring that merchants can operate smoothly regardless of their business model.

Flutterwave

Flutterwave has emerged as a crucial player in the payment landscape of Kenya, revolutionizing the way businesses and consumers transact. This innovative payment gateway facilitates many payment options, allowing merchants to accept local and international transactions seamlessly. With its user-friendly interface and robust security features, Flutterwave has gained trust among Kenyan businesses, from small startups to large enterprises.

The industry in Kenya has seen significant growth due to the increasing adoption of digital payment solutions. Flutterwave’s ability to integrate with various platforms and support multiple currencies makes it a preferred choice for merchants looking to expand their reach. As a result, many businesses are now leveraging this gateway to enhance their customer experience and streamline their operations.

Ultimately, Flutterwave is not just a payment processor; it is transforming the payment ecosystem in Kenya, driving financial inclusion and facilitating economic growth across the region.

Conclusion

NOWPayments is the best payment gateway in Kenya, offering unmatched versatility and efficiency for businesses of all sizes. By supporting a wide range of payment methods, including cryptocurrencies, mobile money, credit cards, and bank transfers, NOWPayments ensures businesses can cater to diverse customer preferences. Its seamless integration with platforms like Shopify and WooCommerce simplifies adoption, while its adherence to regulatory standards under the Central Bank of Kenya enhances reliability and trust. With transparent fees, robust security, and global reach, NOWPayments empowers Kenyan businesses to streamline their operations, expand their customer base, and thrive in an increasingly digital economy.