Payment gateway solutions play a crucial role in enabling e-commerce by facilitating online transactions in Myanmar. These solutions serve as a bridge between merchants and customers, allowing businesses to accept payments for goods and services seamlessly. Popular payment methods include Visa, Mastercard, and local options like KBZ Pay, which are all designed to enhance the checkout experience. By integrating payment processing directly into their Shopify store, merchants can offer a variety of payment options that cater to local and international customers, ensuring a user-friendly experience that encourages online shopping.

Moreover, the best payment gateways in Myanmar offer flexible payment solutions and competitive transaction fees compared to other platforms. Businesses can leverage payment service providers to manage money transfers and payouts, ensuring that they can send and receive money quickly and securely. With features such as fraud prevention and robust security measures to protect sensitive information, these payment platforms are essential for any successful e-commerce platform in Burma.

How does a payment gateway work?

A payment gateway is a crucial component of ecommerce that facilitates online payment transactions between buyers and sellers. When a customer makes a purchase on an online store, the payment gateway securely captures their payment details, such as credit or debit card information, and forwards them to the payment processor. This process ensures that the transaction is completed in the correct currency and in a seamless manner. Integration of the payment gateway with shopping cart software or a mobile app is essential for a smooth checkout experience.

In regions like Myanmar, available payment gateways like PayPal, Skrill, and Shopify’s supported options offer various features like no-code solutions for startups. These gateways allow users to make international payments and support cross-border transactions with lower transaction fees per transaction. By offering billing solutions and a user-friendly interface, businesses can integrate seamlessly and provide convenient payment options, ensuring a positive experience for customers.

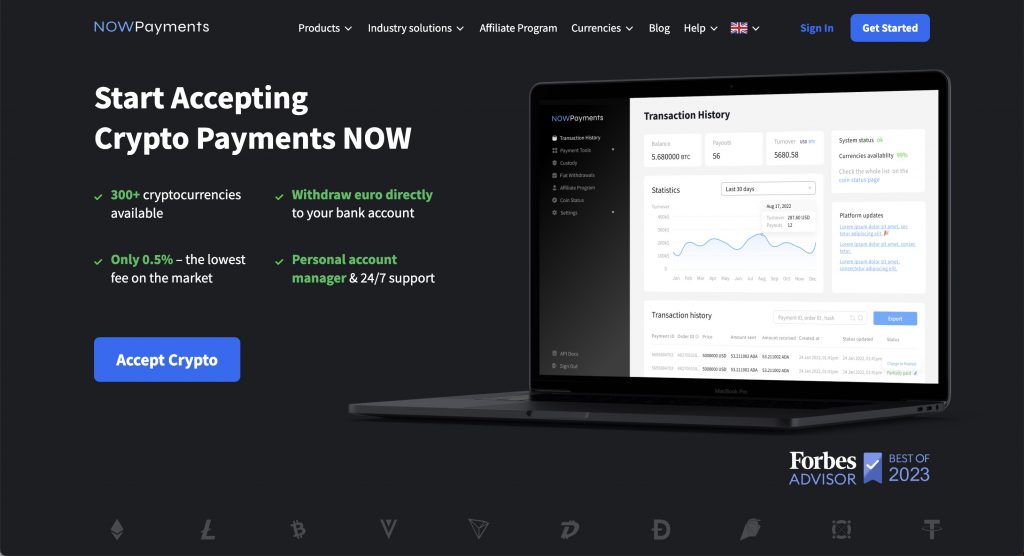

NOWPayments

In Myanmar, NOWPayments stands out as the best payment gateway, offering a comprehensive solution for e-commerce websites. The company offers payment processing that caters to local needs, providing various payment options, including credit and debit cards and mpu transactions. Designed to streamline the onboarding process, NOWPayments ensures that merchants can set up their wallet quickly and easily, enabling them to start accepting payments online in no time.

Available in Myanmar, this payment provider supports both local and international transactions, making it a top choice for businesses aiming to expand globally. With transparent pricing and lower transaction fees compared to other supported payment gateways, users can make an informed decision about their payment needs. Additionally, NOWPayments offers a hosted payment solution that includes real-time transaction tracking, ensuring that all banking services are PCI DSS compliant, providing peace of mind for both merchants and customers.

Whether you’re selling products through a popular online platform or managing point of sale systems, NOWPayments provides the flexibility required for modern commerce. With a one click integration for web and mobile applications, it revolutionizes the way businesses manage their finances, allowing them to focus on growth while easily managing money online. Furthermore, as PayPal is available within its offerings, this payment gateway caters to a diverse clientele, making it an essential tool for success in Myanmar’s evolving market.

Atome payment gateway in Myanmar

In Myanmar’s rapidly evolving digital landscape, the Atome payment gateway has emerged as a significant player among the top payment gateways. This platform specializes in facilitating local payment solutions that cater to the unique needs of consumers and businesses in the region. With its user-friendly interface and seamless integration, Atome has quickly gained traction among merchants looking to enhance their online sales experience.

As one of the available payment gateways in Myanmar, Atome provides a variety of services like buy-now-pay-later options, which allow customers to make purchases without immediate payment. This feature not only boosts conversion rates for retailers but also encourages consumer spending in a market where cash transactions have traditionally dominated. Overall, Atome is redefining the payment landscape in Myanmar, making it easier for both businesses and consumers to engage in digital commerce.

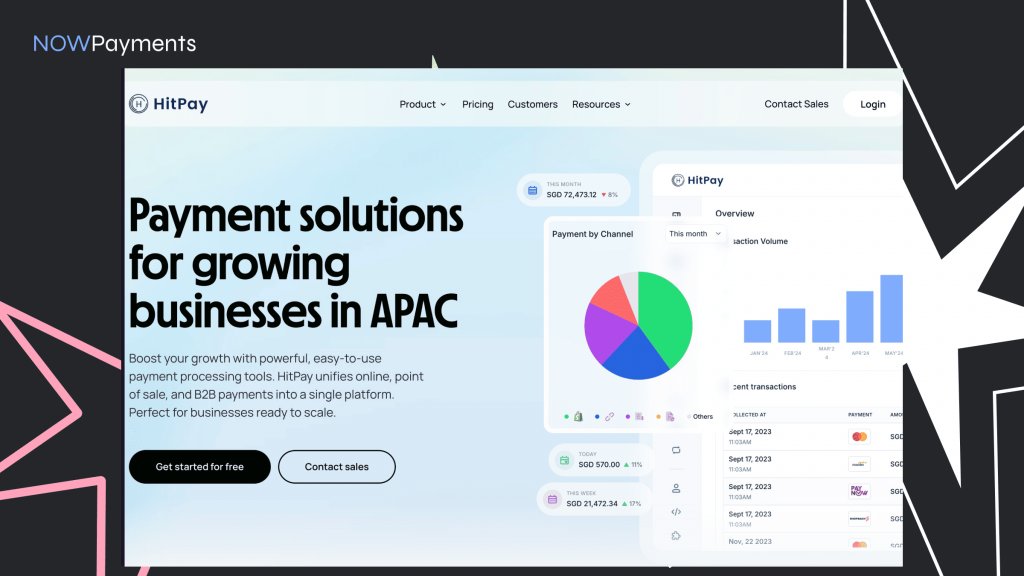

HitPay payment gateway in Myanmar

HitPay is a versatile payment gateway that has gained traction in Myanmar, catering to the evolving needs of local businesses and consumers. With its user-friendly interface, it simplifies the transaction process, allowing merchants to accept payments through various methods, including credit cards, bank transfers, and mobile wallets. This flexibility is crucial in a country where digital payments are on the rise.

By integrating HitPay, businesses can enhance their operational efficiency and customer satisfaction. The platform provides robust security measures, ensuring that sensitive data is protected during transactions. Additionally, its seamless integration with e-commerce platforms enables merchants to set up online stores quickly.

Furthermore, HitPay offers valuable analytics tools, allowing businesses in Myanmar to track sales trends and customer behavior effectively. As digital commerce continues to grow, HitPay positions itself as a key player in transforming the financial landscape of the country.

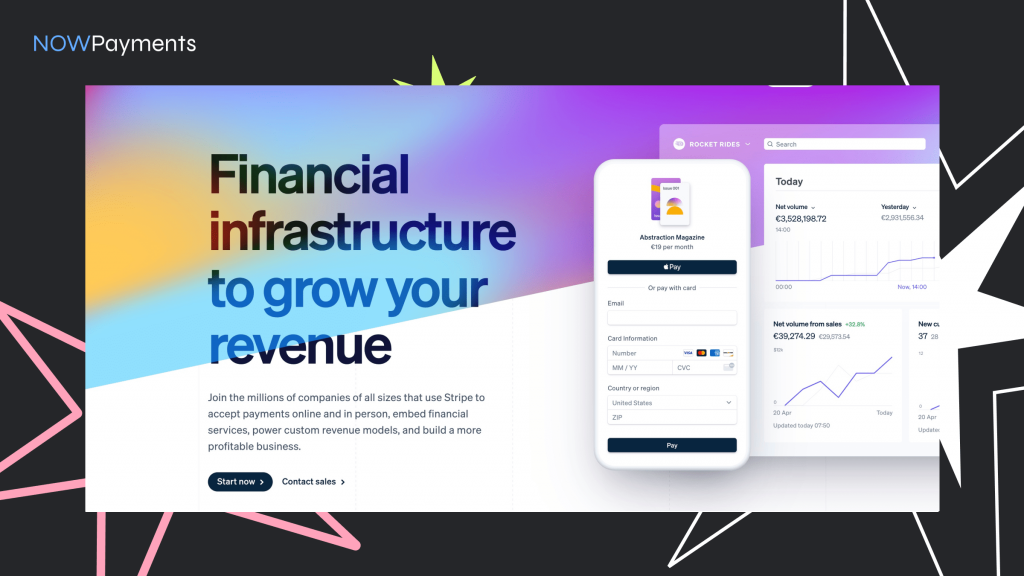

Stripe payment gateway in Myanmar

Stripe, a leading online payment processing platform, has significantly expanded its reach in the digital finance landscape, including Myanmar. With the growing number of e-commerce businesses and online services in the region, the introduction of Stripe as a payment gateway has provided a robust solution for merchants seeking to streamline transactions. This platform enables businesses to accept various forms of payments, enhancing the customer experience and boosting sales.

The integration of Stripe in Myanmar also supports local entrepreneurs by offering features such as easy setup, secure transactions, and real-time analytics. As digital payments become increasingly essential, Stripe empowers businesses to reach a broader audience, facilitating international sales and fostering economic growth. This development represents a significant step towards the modernization of Myanmar’s payment infrastructure, aligning it with global standards.

PayPal payment gateway in Myanmar

In recent years, PayPal has emerged as a significant player in the digital payment landscape of Myanmar, facilitating seamless online transactions for businesses and individuals alike. By offering a reliable payment gateway, PayPal enables users to send and receive money across borders, which is particularly beneficial for the growing e-commerce sector in the country. This ease of access has encouraged many local entrepreneurs to adopt online payment solutions, enhancing their ability to reach international customers.

The integration of PayPal into local businesses not only streamlines the payment process but also instills a sense of trust among consumers. With robust security features and user-friendly interfaces, the payment gateway addresses concerns about fraud and data breaches, which are common in the digital landscape. As Myanmar continues to embrace digital transformation, the role of PayPal is likely to grow, further revolutionizing the way financial transactions are conducted.

Conclusion

In Myanmar’s evolving e-commerce landscape, NOWPayments emerges as the leading payment gateway, offering unmatched flexibility and comprehensive solutions for businesses and consumers alike. With support for a wide range of payment methods, including credit and debit cards, cryptocurrencies, and local payment options like MPU transactions, NOWPayments ensures seamless transactions that cater to diverse customer preferences.

NOWPayments goes beyond just payment processing—it provides features like transparent pricing, lower transaction fees, and compliance with PCI DSS standards, making it a secure and cost-effective choice for businesses. Its easy onboarding process and one-click integration for web and mobile platforms allow merchants to start accepting payments quickly and focus on scaling their operations.

Unlike other payment gateways, NOWPayments combines global and local transaction capabilities, empowering businesses in Myanmar to expand their reach while maintaining a user-friendly payment experience. By offering advanced tools like real-time tracking and hosted payment solutions, NOWPayments positions itself as an essential partner for businesses seeking growth and innovation in Myanmar’s dynamic market.