Understanding the anatomy of payment gateway charges is crucial for businesses operating in ecommerce across Africa. With the rise of online payment systems, merchants must consider various payment options to ensure a seamless checkout experience. Popular payment methods include debit and credit cards like Visa and Mastercard, as well as mobile money solutions such as Flutterwave and Paystack. These payment gateways enable online transactions, allowing businesses to accept payments securely and efficiently. Understanding transaction fees associated with these payment solutions is essential for optimizing revenue.

In Nigeria, where online shopping is becoming increasingly popular, businesses must integrate various payment gateways like Voguepay and Skrill to facilitate making payments through wallet services or POS systems. This ensures customers have flexibility in their payment methods. Additionally, leveraging platforms like Shopify can enhance the payment process, making it easier for consumers to make and receive payments via SMS or WhatsApp. Ultimately, finding the best payment gateway for African businesses can significantly impact growth and customer satisfaction, positioning brands to thrive in the competitive e-commerce landscape.

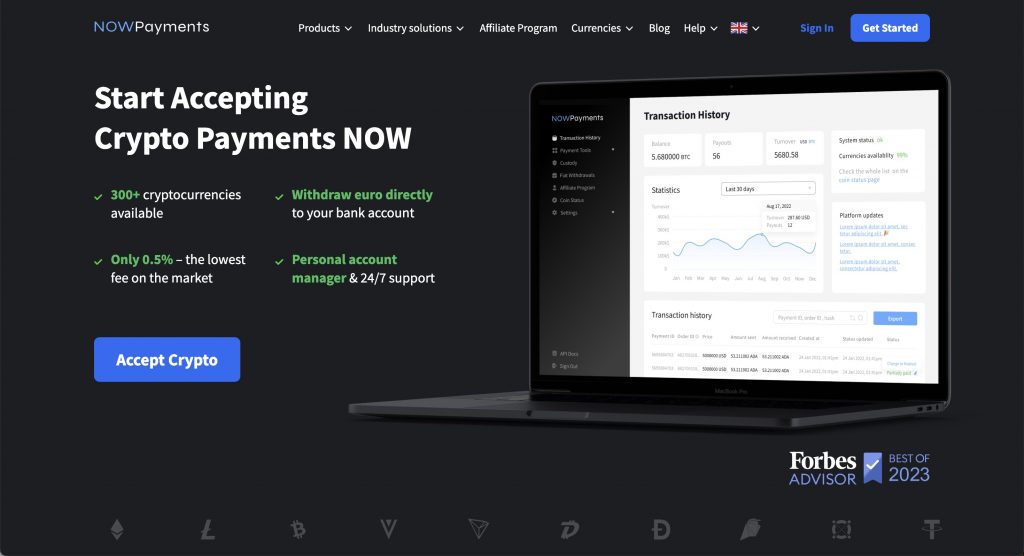

NOWPayments

NOWPayments stands out as the best payment gateway in Angola, allowing merchants to accept a variety of currency options seamlessly. Unlike other providers like voguepay’s and skrill’s, NOWPayments focuses on international transactions, making it a leading payment service for businesses within Africa’s dynamic market. Its user-friendly interface enables SMEs and larger organizations to optimize their financial operations effortlessly.

This service provider caters to businesses aiming to enhance their financial transactions by enabling them to accept payments with ease through credit and debit cards. With a diverse array of payment gateways supported, NOWPayments ensures a smooth and secure digital experience. The platform’s robust security measures further solidify its position as an attractive choice for those looking to make their business transactions more efficient. For more information, feel free to contact us today!

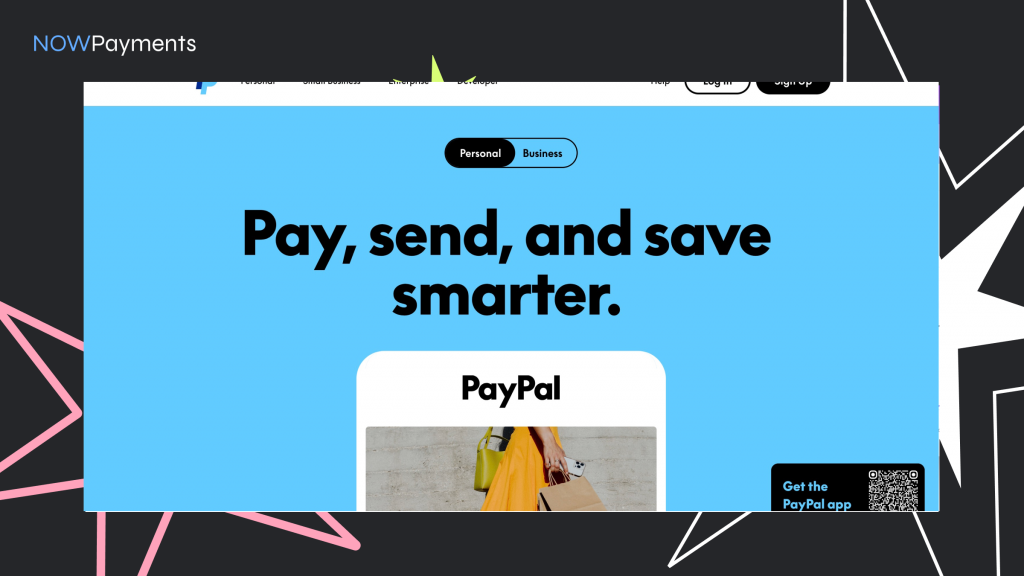

PayPal

PayPal has emerged as a revolutionary global payment solution in Angola, enabling businesses to tap into the growing trend of e-commerce service. As one of the leading payment gateways within Africa, it provides a platform that allows businesses to make transactions seamlessly through multiple channels. This strategic move is influenced by factors such as the need for cost-effective solutions and the increasing demand for online shopping.

With features like a user-friendly dashboard and front-end integration options for platforms like WordPress, Drupal, and Joomla, PayPal enhances the user experience. The platform employs advanced encryption techniques to safeguard customer data, which not only builds trust but also reduces friction in the payment process. Additionally, the ability to link with local bank accounts further empowers businesses, ensuring smoother transactions at the point-of-sale.

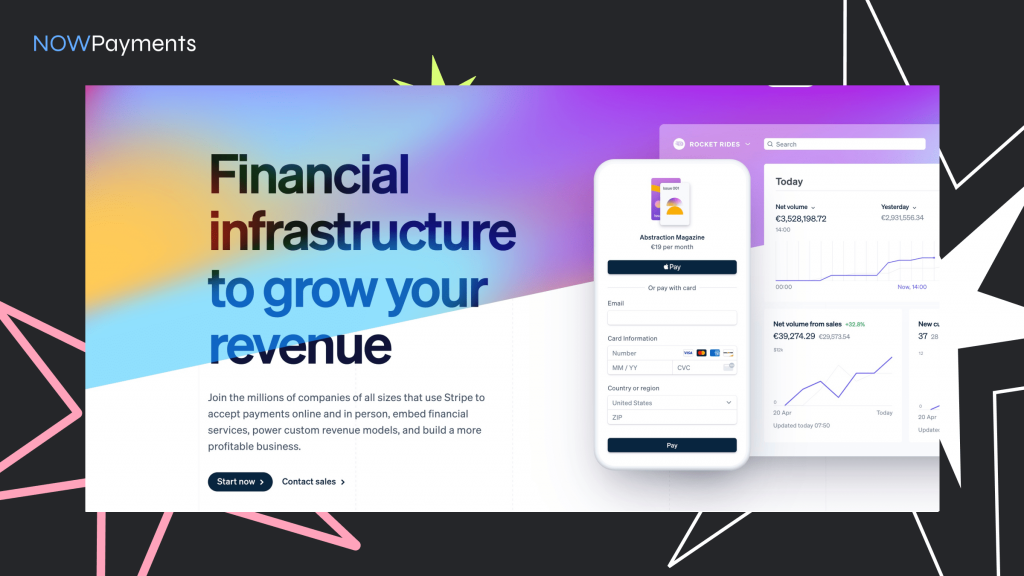

Stripe

In recent years, the adoption of digital payment solutions has significantly transformed the financial landscape in Angola, with the Stripe payment gateway emerging as a vital tool for local businesses. By offering seamless transaction processing, Stripe enables merchants to accept payments online with ease, fostering a more inclusive economy. The platform’s user-friendly interface and robust security features enhance the overall customer experience, driving higher conversion rates.

Furthermore, the optimization of payment workflows through Stripe allows businesses to tailor their services to meet the specific needs of their customers. This adaptability is crucial in a market where consumer preferences are rapidly evolving. By integrating Stripe, Angolan entrepreneurs can efficiently manage their finances and expand their reach beyond local borders.

Ultimately, the introduction of the Stripe payment gateway in Angola not only streamlines payment processes but also empowers businesses to thrive in a competitive digital economy. As more companies embrace this technology, the future of commerce in Angola looks promising.

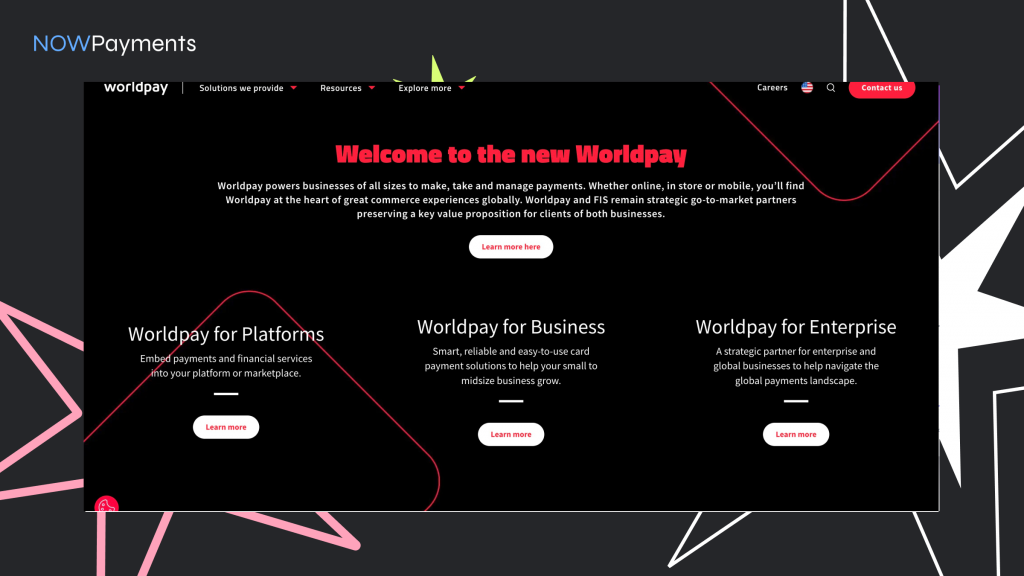

Worldpay

Worldpay is a leading payment gateway that has made significant strides in facilitating online transactions in Angola. As businesses in the country increasingly shift towards digital commerce, the need for reliable payment solutions has become paramount. With its robust infrastructure, Worldpay offers a seamless integration for merchants, allowing them to accept a variety of payment methods, including credit cards and mobile wallets.

The platform is designed to cater to the unique needs of the Angolan market, ensuring that both consumers and businesses can enjoy a secure and efficient payment experience. Worldpay also provides valuable insights and analytics to merchants, enabling them to make informed decisions and optimize their sales strategies. As e-commerce continues to grow in Angola, Worldpay stands out as a reliable partner for businesses looking to expand their online presence.

Square

Square payment gateway has emerged as a vital tool for businesses in Angola, facilitating seamless transactions in a rapidly evolving digital economy. This innovative platform allows merchants to accept payments through various methods, including credit cards, debit cards, and mobile wallets. By integrating Square, businesses can enhance their customer experience, offering a convenient and secure way to complete purchases.

The adoption of the Square payment gateway in Angola reflects the growing trend towards cashless transactions, driven by the need for efficiency and security. With its user-friendly interface and robust features, Square provides small and medium enterprises with the tools necessary to thrive in a competitive market. Additionally, the real-time analytics offered by the platform empowers businesses to make informed decisions based on customer behavior.

As Angola continues to embrace technological advancements, the integration of the Square payment gateway signifies a promising step towards modernizing the retail landscape. This shift not only benefits businesses but also contributes to the overall economic growth of the region.

Conclusion

NOWPayments stands out as the best payment gateway due to its exceptional versatility and user-friendly interface. It supports a wide array of cryptocurrencies, which caters to the diverse needs of businesses and their customers. This flexibility allows merchants to tap into the growing market of crypto enthusiasts, enhancing their customer base and boosting sales.

Moreover, NOWPayments offers seamless integration with various e-commerce platforms, ensuring that merchants can easily adopt it without technical hassles. Its commitment to low transaction fees further solidifies its appeal, allowing businesses to maximize their profits while minimizing costs.

Additionally, NOWPayments prioritizes security, utilizing advanced encryption technologies to protect transactions and customer data. This commitment to safety builds trust with users, fostering a reliable payment ecosystem.

In conclusion, the combination of flexibility, low costs, and robust security features makes NOWPayments the optimal choice for businesses looking to thrive in the digital payment landscape.