Payment gateways are essential tools in the world of e-commerce, facilitating online transactions between merchants and customers. They serve as a bridge, securely transferring data between the customer’s payment method and the merchant account. In Morocco, various payment options are available, including card payments through Visa and Mastercard, along with local debit card options. A payment gateway provider plays a crucial role in the payment process, offering a payment processing service that ensures smooth and secure transactions.

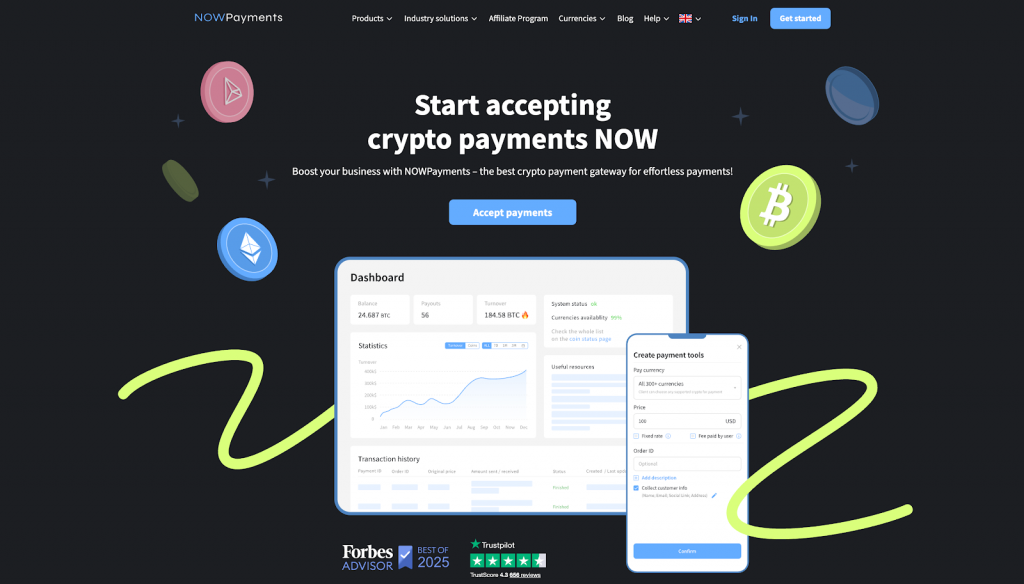

The best crypto payment gateway in our rating is NOWPayments because it combines fast, secure transactions with easy integration and competitive fees, making it an excellent choice for businesses looking for a reliable payment gateway Morocco merchants can trust. NOWPayments supports a wide range of cryptocurrencies and provides automatic conversion to local currency (MAD) or other fiat currencies, reducing volatility risk and simplifying accounting for Moroccan e-commerce stores, marketplaces, and service providers. Its developer-friendly API and pre-built plugins for popular platforms let you integrate crypto payments quickly without complex development work, while features like instant settlements, multi-currency invoicing, and robust security measures ensure smooth operations and protection for both merchants and customers.

If your business uses platforms like Shopify, it is very important to find a good payment gateway that works in Morocco. These payment options in Morocco are designed to meet the needs of the people there, but they also work with international payment gateways to reach more people. PayPal and other well-known payment service providers offer reliable customer service and a variety of payment options to make the digital payment experience better.Merchants can improve their sales strategies by knowing how much it costs to change money and how much it costs to make a transaction with different payment methods. Your business’s ability to handle payments can be greatly affected by the payment gateway you choose. That is why you should pick one of Morocco’s best payment gateway companies. Businesses can better meet their customers’ needs and process payments more quickly with the right solution.

Here’s a list of the best payment gateways for businesses in Morocco:

- NOWPayments

- Payzone

- Cmi

- PayPal

- PayDunya

| Payment Gateway | Payment Method Support | Integration Tools | Transaction Speed |

|---|---|---|---|

| NOWPayments | 300+ cryptos, 40+ fiat currencies | API, WooCommerce, Plugin POS, Payment links, Payment button and widget, Mass Payouts | Instant payment processing, 5 min for fund settlement |

| Payzone | Visa/Mastercard, mobile wallets, bank transfers | Payment links, Shopify | Real‑time processing, settlement same day |

| CMI | Visa/Mastercard, local interbank cards (MAD) | API, e‑commerce modules (Shopify) | Instant authorization, settlement same day |

| PayPal | Visa, Mastercard, American Express, PayPal balance | REST APIs, SDKs, payment buttons, invoicing | Instant authorization, settlement within 1 day |

| PayDunya | Cards, mobile money (Orange, MTN, Free) | REST API, payment buttons/links, WooCommerce Plugin | Instant payment processing, settlement depends on method |

NOWPayments

NOWPayments is the best cryptocurrency payment gateway that allows businesses to accept crypto payments easily while enabling them to convert these into fiat currencies. Merchants can choose from a lot of different ways to pay because it works with a lot of different coins and tokens. It stands out because its tools are easy to use and it processes transactions quickly. This is why a lot of online stores use it to pay for things. It is simple to use and works well. NOWPayments also makes sure that businesses get their money quickly, which is great for stores that need money right away.

Payment Method Support. NOWPayments works with over 40 fiat currencies and over 300 cryptocurrencies. This includes 28 other stablecoins, like USDT and USDC, that are well-known. This gives companies more options for how to pay, whether they use digital or traditional methods. It works with a lot of digital assets, like tokens from Ethereum, Bitcoin, and a lot of other cryptocurrencies. Businesses can also let customers pay in their own currency, which brings in more business.

- Number of Currencies: 40+ fiat, 300+ cryptocurrencies

- Stablecoins: ✅ USDT, USDC, and 28 more

- Traditional Cards: ❌

- Digital Wallets: ❌

- Bank Transfer: ❌

Integration tools. There are many ways to connect to NOWPayments. For instance, WooCommerce and other platforms have full REST APIs and e-commerce plugins that are simple to set up. This makes it simple for businesses to add cryptocurrency payments to their current stores without needing a lot of technical knowledge. They also have tools for payments, such as donation buttons, invoices, and subscription management, to make their services more useful. Customers can pay for things they buy in person with the platform’s point-of-sale (POS) system.

| Tool / Integration | Available | Setup |

|---|---|---|

| REST API | ✅ | For developers |

| E-commerce Plugins | ✅ | Easy (WooCommerce) |

| Payment Links | ✅ | Instant |

| POS System | ✅ | Simple |

| Mass Payouts | ✅ | Efficient |

Transaction speed. According to NOWPayments, transactions are very fast. Coins like Tron take only 45 seconds, while other coins can take up to 5 minutes. The platform does not hold onto money, so it goes straight to the merchants. Payments are usually settled in five minutes. Businesses that want to make sure their customers have a good time when they check out need this fast processing time. Because they are always open, merchants can take payments at any time without having to wait.

| Speed Metric | Timeframe |

|---|---|

| Payment Confirmation | 45 sec (Tron), up to 5 min for other coins |

| Settlement to Account | 5 minutes |

| Instant Payout | ✅ |

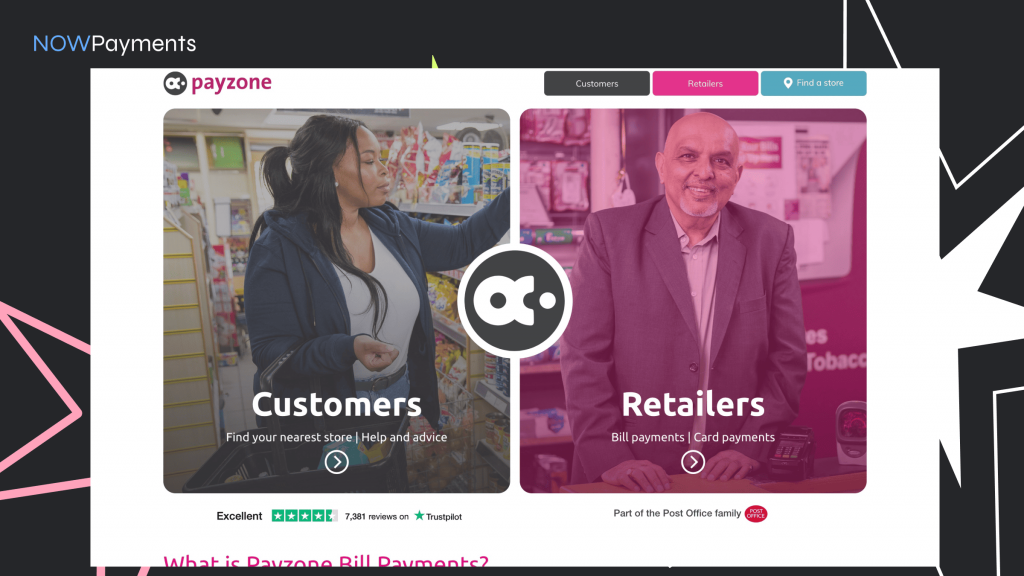

Payzone

Payzone is a payment gateway in Morocco that was designed to work well for businesses in that country. It lets you safely take a lot of different types of payments, like credit and debit cards, mobile wallets, and bank transfers. Payzone’s integration options work with both online stores and payment systems that customers can use in person. This makes it easy for businesses to sell things through more than one channel. It processes payments in real time, which makes sure that merchants get paid right away.

Payment Method Support. Payzone accepts a wide range of payment methods that are popular in Morocco, such as Visa and Mastercard cards and mobile wallets like Orange Money and MTN Mobile Money. It also lets people send money to each other through banks, which means that businesses in the area can accept payments in any way they want. Because there are so many options, businesses do not have to worry about how their customers want to pay. Moroccan businesses like Payzone because it focuses on payment methods that are common in the country.

- Number of Currencies: MAD (local) + USD, EUR

- Stablecoins: ❌

- Traditional Cards: ✅ Visa, Mastercard

- Digital Wallets: ✅ Orange Money, MTN Mobile Money

- Bank Transfer: ✅

Integration tools. Payzone offers a lot of integration tools, like payment links and custom payment forms, that make it easy for businesses to accept payments on their websites. People who use Shopify can use plugins that make it easier to pay. Payzone’s dashboard also lets merchants keep track of their payments and do business quickly and easily. Because of this flexibility, businesses can easily start accepting payments with little to no setup.

| Tool / Integration | Available | Setup |

|---|---|---|

| REST API | ✅ | For developers |

| E-commerce Plugins | ✅ | Easy (Shopify, others) |

| Payment Links | ✅ | Instant |

| POS System | ✅ | Simple |

Transaction speed. Payzone makes sure that payments go through right away, which lets merchants know right away that they have been paid. The money might take a little longer to show up in the merchant accounts, though. This usually happens on the first day the business is open. This quick confirmation of the transaction lets merchants know right away when a payment has been made. Payzone is always open, so businesses can accept payments whenever they want.

| Speed Metric | Timeframe |

|---|---|

| Payment Confirmation | Real-time |

| Settlement to Account | Same day |

| Instant Payout | ❌ |

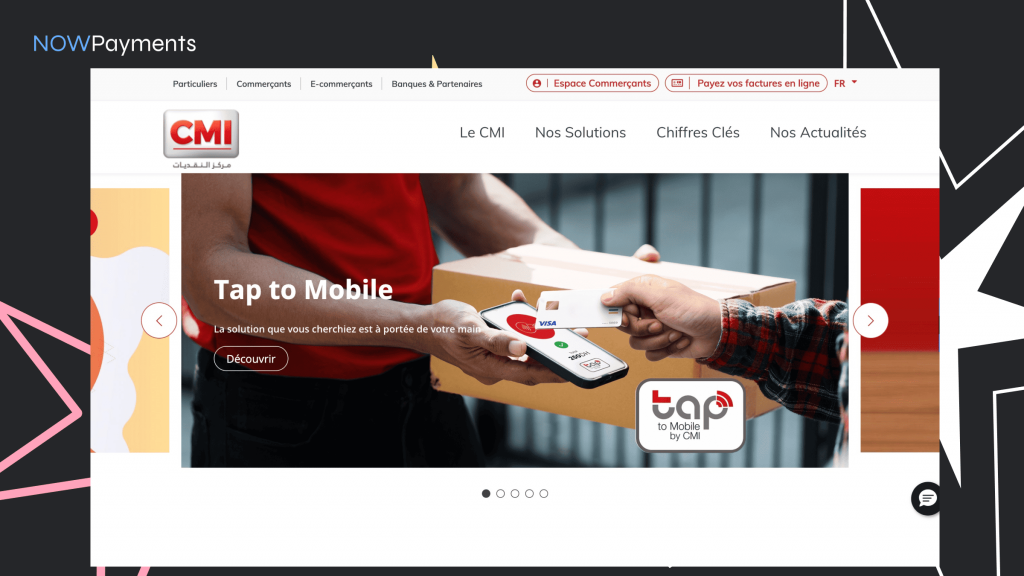

Cmi (Centre Monétique Interbancaire)

Cmi (Centre Monétique Interbancaire) is a major payment gateway in Morocco that makes it simple and safe for businesses to accept credit cards. It is backed by major Moroccan banks, which makes it reliable and trustworthy for transactions in Morocco and around the world. It works with both Visa and Mastercard, so businesses can easily accept payments from customers all over the world. CMI partners with the biggest online stores to make it simple for businesses to accept payments online.

Payment Method Support. CMI accepts all Visa and Mastercard payments, as well as local interbank cards in Morocco. All transactions are done in Moroccan Dirham (MAD). Morocco cares a lot about its own people, so businesses can make it easy for their customers to pay. But it does not work with digital payments like mobile wallets, crypto payments, or other types of digital payments. There are not many ways to pay, but traditional card payments are very reliable.

- Number of Currencies: MAD (local)

- Stablecoins: ❌

- Traditional Cards: ✅ Visa, Mastercard

- Digital Wallets: ❌

- Bank Transfer: ❌

Integration tools. CMI’s simple API lets you connect to e-commerce sites and platforms. Businesses can also add CMI payment modules to platforms like Shopify to make sure the checkout process goes smoothly. However, CMI does not have as many advanced integration options as other international gateways. It stays simple and useful for Moroccan businesses because it only looks at local problems.

| Tool / Integration | Available |

|---|---|

| REST API | ✅ |

| E-commerce Plugins | ✅ |

| Payment Links | ❌ |

| POS System | ❌ |

Transaction speed. CMI speeds things up by letting customers pay with a card right away. But it could take a few days for the money to show up in the merchant’s account, depending on how the banking system works. Businesses that need their money right away may have trouble with this delay. CMI is open for business, and during that time, things are taken care of right away.

| Speed Metric | Timeframe |

|---|---|

| Payment Confirmation | Instant |

| Settlement to Account | 1-3 days |

| Instant Payout | ❌ |

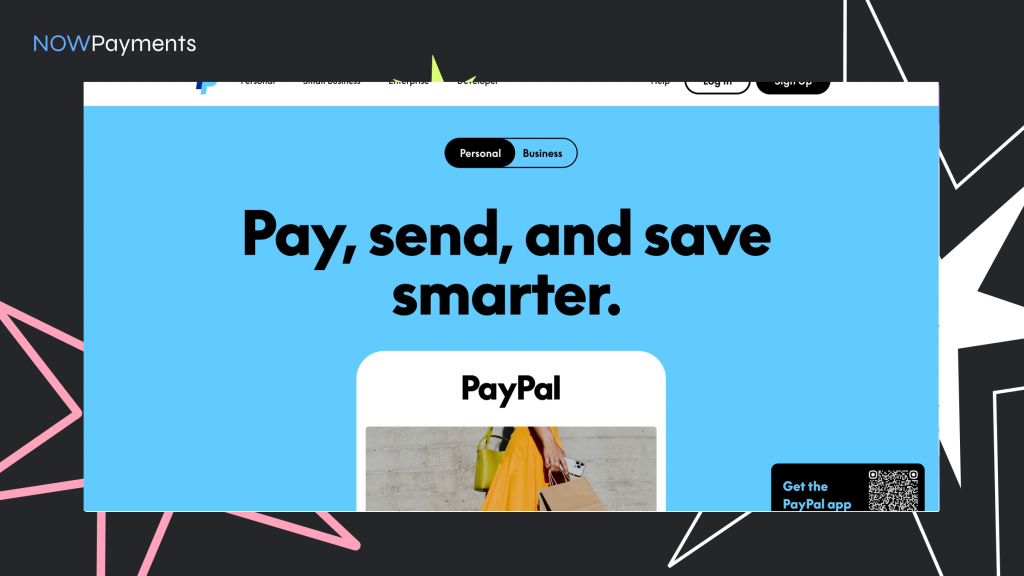

PayPal

PayPal is a popular payment gateway that lets businesses of all sizes easily accept payments. People all over the world trust it because it can accept payments in many different currencies. PayPal is a popular choice for businesses that want to make safe online payments because it is easy to use, has great integration tools, and keeps buyers safe. PayPal works with most online stores, and it processes payments quickly for people in the US and around the world.

Payment Method Support. You can pay with your own PayPal balance or with major credit and debit cards like Visa, Mastercard, and American Express. It can process payments in over 25 currencies, which means that businesses can get money from customers all over the world. It does not work with cryptocurrencies, but it does work very well with digital payments in general. PayPal is a good option for payments between countries because it accepts many different types of payment.

- Number of Currencies: 25+

- Stablecoins: ❌

- Traditional Cards: ✅ Visa, Mastercard, American Express

- Digital Wallets: ✅ PayPal balance

- Bank Transfer: ❌

Integration tools. PayPal makes it easy for online stores to use its service by giving them full REST APIs, SDKs, and payment buttons. It also has billing tools that make it easy for businesses to send bills straight to customers. People can easily get started with PayPal because it works well with sites like Shopify. It is easy to set up because the integration tools are easy to find.

| Tool / Integration | Available |

|---|---|

| REST API | ✅ |

| E-commerce Plugins | ✅ |

| Payment Links | ✅ |

| POS System | ❌ |

Transaction speed. PayPal is a fast way to finish transactions because you can approve payments right away. Most of the time, the money is ready in a few minutes. But some transactions could take a few business days, especially if the amount is big or the payment is coming from another country. PayPal will not let you get your money right away, but you can take it out of your bank account in one to three business days. PayPal is always an option for businesses to get paid.

| Speed Metric | Timeframe |

|---|---|

| Payment Confirmation | Instant |

| Settlement to Account | 1-3 days |

| Instant Payout | ❌ |

PayDunya payment gateway in Morocco

PayDunya is a versatile payment gateway designed to serve businesses in Morocco and across West Africa. It lets businesses take payments from credit and debit cards, as well as from popular mobile wallets like MTN Mobile Money and Orange Money. PayDunya’s main goal is to help businesses in areas with few banks by making it easy to use and giving them good local support. PayDunya is a great choice for businesses that want to reach customers in a lot of places because it has a lot of payment options and tools that are simple for developers to use.

Payment Method Support. PayDunya accepts credit and debit cards, as well as local mobile money services like Orange Money, MTN Mobile Money, and Free Money. PayDunya is a great choice for markets with few banks because it works with both cards and mobile wallets. But it does not work with cryptocurrencies or bank transfers, which could make it harder for some businesses to use. You can be sure that local mobile money solutions will meet the needs of people in Morocco and West Africa if you focus on them.

- Number of Currencies: MAD, XOF (West African CFA)

- Stablecoins: ❌

- Traditional Cards: ✅ Visa, Mastercard

- Digital Wallets: ✅ Orange Money, MTN Mobile Money

- Bank Transfer: ❌

Integration tools. PayDunya makes it easy for businesses to take payments by offering REST APIs, payment links, and plugins for well-known platforms like WooCommerce. The tools for integration are easy to use and help merchants set up payments quickly. PayDunya’s focus on simplicity makes it easy for businesses that do not have a lot of technical resources to use its payment gateway. It also has extra features, like buttons for payments and tools for making invoices, that let you customize it even more.

| Tool / Integration | Available |

|---|---|

| REST API | ✅ |

| E-commerce Plugins | ✅ |

| Payment Links | ✅ |

| POS System | ❌ |

Transaction speed. After a customer confirms a payment, PayDunya processes it right away. The payment method, on the other hand, has an effect on how quickly the money is settled. Payments made with mobile money usually go through faster than payments made with credit or debit cards. PayDunya is open all day, every day, so businesses can get paid whenever they want. Most of the time, settling a fund happens quickly. But it might take longer depending on how banks work where you live.

| Speed Metric | Timeframe |

|---|---|

| Payment Confirmation | Instant |

| Settlement to Account | Depends on method |

| Instant Payout | ❌ |

Conclusion

We talked about the most important payment gateways in Morocco such as PayPal, PayDunya, NOWPayments, Payzone, and CMI. Each gateway has a variety of payment options, such as credit cards, mobile wallets, and cryptocurrencies, to meet the needs of Moroccan businesses. But if you think about the future of e-commerce and how more and more people are using cryptocurrency, NOWPayments is the best option for Moroccan businesses that want to add crypto payments quickly and easily.

NOWPayments offers significant advantages, including support for 40+ fiat currencies and 300+ cryptocurrencies, which provides unparalleled flexibility for businesses seeking to expand their global reach. The platform’s easy integration tools, such as APIs, e-commerce plugins, and POS systems, ensure that businesses can set up crypto payments quickly and efficiently. Additionally, its fast transaction speed—with payment confirmations in as little as 45 seconds—coupled with instant payouts and a 5-minute settlement time, makes NOWPayments a standout solution for businesses that need reliable and swift payment processing.