Implementing a good payment gateway can significantly enhance your e-commerce business, particularly as we approach 2026. A reliable payment service ensures a seamless payment processing experience for customers, offering diverse payment options like digital wallets, visa, and local payment methods. This variety caters to different consumer preferences and can lead to increased sales. Furthermore, integrating with platforms like Shopify allows for a user-friendly interface that simplifies online payments and enhances the overall payment experience for customers.

In a rapidly evolving fintech landscape, businesses must partner with top payment processing companies and payment providers that offer robust payment solutions. For instance, in Uzbekistan, payment methods in Uzbekistan are expanding, allowing for cross-border transactions and facilitating international payments. Companies like Sam Boboev are leading the way in providing innovative payment platforms and APIs that integrate seamlessly with existing systems. A deep dive into these fintech companies can reveal valuable insights into the best payment methods available today.

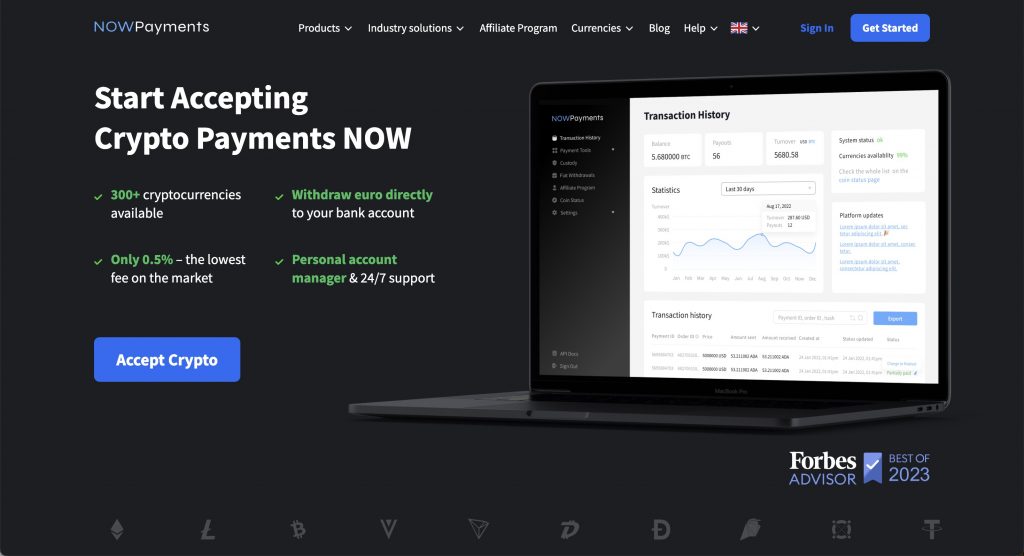

NOWPayments

NOWPayments has emerged as the best payment gateway in Uzbekistan, revolutionizing the payment system landscape. As a leading payment organization, it offers a comprehensive range of digital payment solutions tailored for both B2B and P2P transactions. Since its inception in 2022, this company in Uzbekistan has positioned itself as one of the biggest payment companies in the sector by providing a seamless user experience (UX) through its mobile application.

By utilizing a robust API, NOWPayments enables service providers to integrate mobile payments efficiently, thereby releasing capital trapped in payments. Its commitment to privacy policy and cookie policy ensures that users’ card data remains secure. With transformative digital services available in Uzbekistan, NOWPayments is setting a new standard for payments and payment systems, making it easier for consumers to purchase goods and services while outpacing traditional banks.

As the digital landscape evolves, NOWPayments continues to lead the way for licensed payment organizations, enhancing the payment experience for companies in the market and consumers alike. Its presence in the app store further solidifies its commitment to providing accessible and efficient payment solutions.

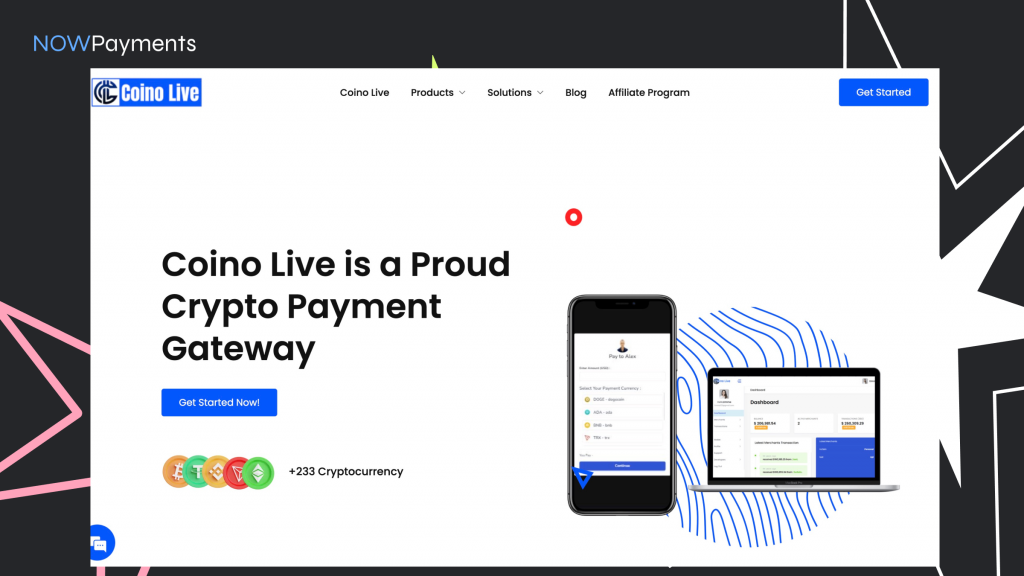

Coino Live

Coino Live is a groundbreaking payment gateway that is reshaping the sector in Uzbekistan. It allows customers to make online transactions seamlessly while offering two payment options: store payments and pay later. With the rising trend of online shopping, payments are becoming increasingly important, and platforms like Paynet and Uzcard are enhancing the number of transactions processed daily. According to KPMG, the transaction fees associated with traditional banking services are being challenged by innovative solutions like Coino Live.

As the financial systems in Uzbekistan evolve, the role of AI and cloud technologies is becoming increasingly vital. These advancements enable fast payments and enhance data security, allowing customers to confidently update your choices when transacting. The introduction of kiosks and point-of-sale systems is further integrating digital payments into daily life. Consequently, more users are turning to e-commerce platforms to explore topics related to financial freedom, while others also viewed the convenience that comes with using bank cards in this transformative landscape.

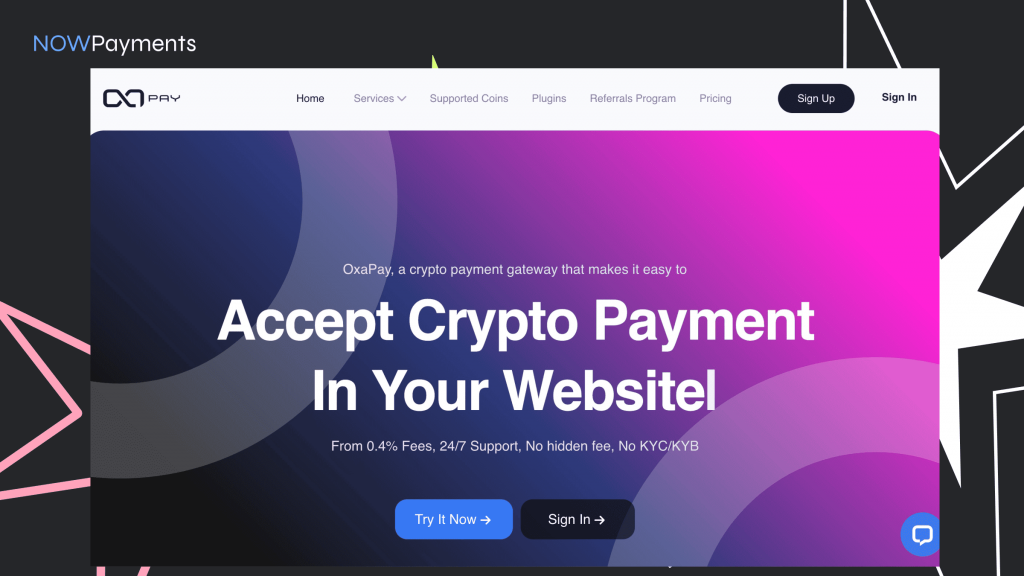

OxaPay

In Uzbekistan, the OxaPay payment gateway is revolutionizing the way customers pay for goods and services, especially within the growing e-commerce market. This user-friendly platform is designed to cater to the needs of both consumers and PSPs (Payment Service Providers), offering various financial solutions that enhance the overall payment experience. By leveraging the transformative role of AI, OxaPay ensures that transactions are not only secure but also efficient, providing compliance tools that align with international standards.

With the rise of digital payments, OxaPay has positioned itself as one of the two biggest players in the Uzbekistani market. It allows for traditional financial transactions through innovative methods like USSD, making it accessible for all users. The platform is committed to providing superior and cost-efficient services, thus driving the growth of Uzbekistan’s digital economy and facilitating a seamless shopping experience for its users.

Calypso

Calypso payment gateway is revolutionizing the way businesses in Uzbek conduct transactions. By offering seamless and secure payment solutions, it has become a preferred choice for many merchants. The platform is designed to cater to the unique needs of the local market, ensuring that users can easily navigate the payment process without any hassle.

With its innovative technology, Calypso provides solutions often tailored to enhance user experience and boost customer satisfaction. This adaptability makes it an invaluable asset for e-commerce platforms and retail businesses alike. As the digital economy in Uzbek continues to grow, the demand for reliable payment gateways has surged, and Calypso is well-positioned to meet this increasing need.

Overall, Calypso payment gateway stands out as a leading option in Uzbek for those seeking efficient and secure transaction methods.

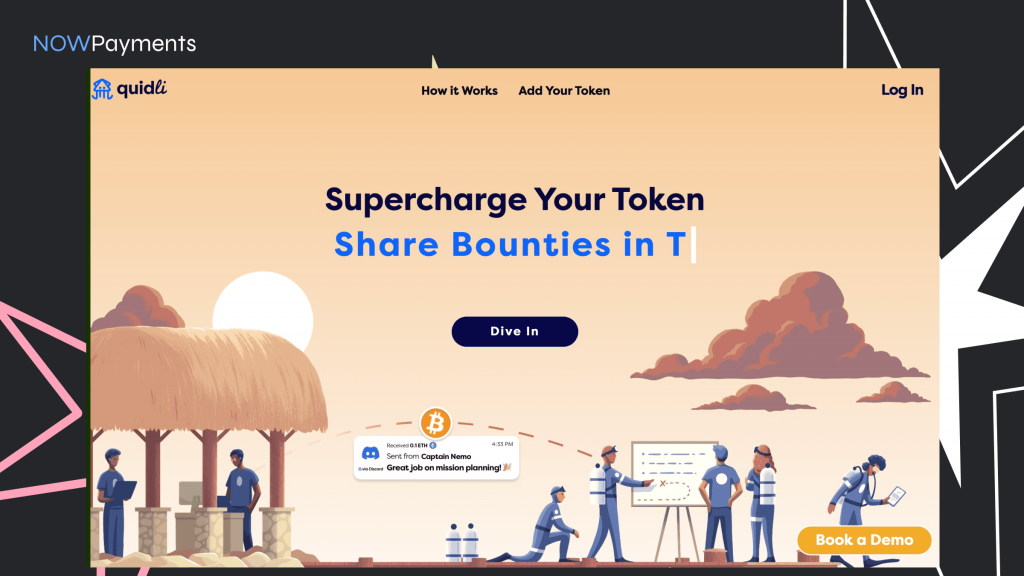

Quidli

Quidli is emerging as a pivotal payment gateway in Uzbekistan, offering services that cater to the growing demand for digital transactions. As the country embraces technological advancements, Quidli provides a seamless platform for businesses and consumers alike, facilitating secure and efficient payment solutions.

One of the standout features of Quidli is its ability to integrate with various e-commerce platforms, ensuring that merchants can easily adopt the system without disrupting their operations. This adaptability makes it a preferred choice for local businesses looking to enhance their payment processing capabilities.

Furthermore, Quidli’s commitment to customer support and user-friendly interface ensures that users can navigate the platform effortlessly. Overall, the introduction of Quidli represents a significant step towards modernizing the financial landscape in Uzbekistan, paving the way for a more inclusive digital economy.

Conclusion

In the rapidly evolving landscape of digital finance, NOWPayments stands out as the premier payment gateway in Uzbekistan. Its user-friendly interface and seamless integration capabilities allow businesses to easily accept cryptocurrency payments, catering to the growing demand for alternative payment methods.

Furthermore, NOWPayments offers a wide variety of cryptocurrencies, enabling merchants to diversify their revenue streams and attract a broader customer base. This flexibility is crucial in a market where consumers are increasingly seeking innovative payment solutions.

Additionally, NOWPayments prioritizes security and reliability, ensuring that transactions are processed swiftly and safely. With robust support and resources for businesses, it fosters a trusting relationship that empowers merchants to thrive in the competitive Uzbek market.

Overall, NOWPayments is not just a payment gateway; it is a comprehensive solution that positions businesses for success in the digital economy of Uzbekistan.