By 2025, cryptocurrency payment processing has become a critical element in the global B2B financial landscape, transforming from a niche offering to a core feature for enterprises and high-volume merchants. The ability to accept digital assets and seamlessly convert them into fiat currency is now essential for staying competitive, optimizing cash flow, and tapping into new markets.

In this dynamic environment, choosing the right partner is key to aligning with your business objectives. NOWPayments and MixPay each bring their own strengths: one provides a highly flexible, developer-focused API for seamless integration, while the other delivers a comprehensive white-label platform for businesses wanting to launch their own branded payment solutions.

This in-depth analysis compares NOWPayments and MixPay across critical enterprise criteria such as fee structures, volume discounts, liquidity, security, and API integration ease. We address key operational considerations like “Which platform offers better rates for large transactions?” and “Is a white-label solution the right choice for our business?” Our goal is to provide the insights necessary to select the best payment infrastructure for your enterprise’s growth in 2025 and beyond.

Feature-by-Feature Breakdown

Products

| Products | NOWPayments | MixPay |

| API Integration Method | ✅ | ✅ |

| Crypto Invoicing | ✅ | ✅ |

| Mass Payouts | ✅ | ❌ |

| Crypto Subscription Tool | ✅ | ❌ |

| White Label Solutions | ✅ | ✅ |

NOWPayments: Offers a wide range of products, including an API integration method, crypto invoicing, mass payouts, a subscription tool for recurring payments, and white-label solutions [1].

MixPay: Provides a more streamlined set of products, focusing on a payment API and one-time payment links via the API. However, it does not offer features like mass payouts or subscription tools, which could limit its use for businesses that require those functionalities [4].

Verdict: NOWPayments has a broader product suite, making it a better fit for businesses needing full customization and scalability in payment systems. MixPay’s offerings may appeal more to small-scale businesses or projects with simpler needs.

Supported Cryptocurrencies

| Feature | NOWPayments | MixPay |

| Supported Cryptocurrencies | 300+ | 60 |

| Supported stable coins | 30+ | 17 |

NOWPayments: Supports over 300 cryptocurrencies, including major assets like Bitcoin, Ethereum, and stablecoins such as USDT, USDC, DAI, BUSD, and 26 others. This extensive selection makes NOWPayments a versatile choice for businesses wanting to accept a wide variety of crypto payments [1].

MixPay: Supports fewer assets—around 60 cryptocurrencies—though it still includes popular coins such as Bitcoin and Ethereum and offers support across multiple blockchains [3].

Verdict: NOWPayments wins in this category with its broad selection of over 300 cryptocurrencies, which provides more flexibility for businesses accepting crypto payments. MixPay is more limited in scope but still covers the major assets.

Payment Methods

| Feature | NOWPayments | MixPay |

| On-chain payments | ✅ | ✅ |

| Recurring Payments | ✅ | ❌ |

| White-label Solutions | ✅ | ✅ |

| Mass Payouts | ✅ | ❌ |

NOWPayments: Enables both on-chain payments and crypto-to-fiat conversions. Its payment methods are diverse, and it includes mass payouts and subscription-based recurring payments, which cater to businesses looking for long-term payment solutions.

MixPay: Primarily supports on-chain payments across several blockchains. It does not support direct crypto-to-fiat conversions or recurring payments, which limits its options for businesses that need such functionalities.

Verdict: NOWPayments offers more comprehensive payment methods, especially for businesses requiring recurring payments or fiat settlement, while MixPay is more focused on simple, one-time crypto transactions.

Fees & Pricing

| Feature | NOWPayments | MixPay |

| Processing fee | 0.5-1% | 0% + subscription needed |

| Customizable network-fee offers | ✅ | ❌ |

| 0% service fee for payouts | ✅ | ✅ |

NOWPayments: Charges a 0.5-1% processing fee and allows customizable network-fee offers for larger merchants, such as merchant-absorbed or blended fees. Additionally, it has a 0% service fee for payouts, with users typically covering the gas fees.

MixPay: Does not explicitly mention a service fee for transactions within its network. However, external chain transactions may incur minor network fees (around 0.0001 tokens). While individual users can access basic services for free, team and enterprise users must subscribe to gain access to extended services within the Mixin network. This subscription model ensures cost-effective solutions for businesses with higher transaction volumes [10].

Verdict: NOWPayments is the better option for businesses, as it offers transparent pricing with a 0.5% processing fee per transaction, and no subscription is required for any type of client. In contrast, MixPay operates on a subscription-based model for team and enterprise users, requiring annual payments ranging from $100 to $10,000 depending on the service tier. This makes NOWPayments more accessible for businesses of all sizes, without the additional financial commitment needed for MixPay’s extended services within its network.

Financial Settlement & Payouts

| Feature | NOWPayments | MixPay |

| API payouts (crypto to wallet) | ✅ | ❌ |

| Crypto-to-fiat payouts | ✅ | ❌ |

NOWPayments: Offers a variety of payout options, including crypto-to-fiat conversions. Users are responsible for network fees when withdrawing. Payouts are fast and straightforward with zero service fees.

MixPay: Does not provide direct fiat payouts and focuses on crypto-to-crypto transactions. It does not charge a service fee for payouts but still requires network fees for transactions [9].

Verdict: NOWPayments provides a better solution for businesses looking for crypto-to-fiat settlement, while MixPay is more suited for businesses sticking with crypto-only payouts.

Integration & Plugins

| Feature | NOWPayments | MixPay |

| REST API | ✅ | ✅ |

| Plugins | ✅ | ✅ |

| Dedicated mobile/web POS (QR) | ✅ | ✅ |

NOWPayments: NOWPayments provides a limited set of integrations, mainly focusing on WooCommerce. It offers a straightforward setup for those using WooCommerce for their e-commerce platforms [1].

MixPay: MixPay supports integrations with Shopify, WooCommerce, and WordPress, giving it a more flexible set of plugin options for various platforms [4].

Verdict: MixPay offers broader integration options across different platforms, while NOWPayments is more limited with WooCommerce but may be perfect for businesses that use it.

Registration & Setup Time

| Feature | NOWPayments | MixPay |

| User registration flow | Instant registrationOnly email and password needed | Merchants: email → login code → business form → whitelisting (~48h). Payers: no registration |

| Simple user registration flow | ✅ | ❌ |

NOWPayments: NOWPayments offers a quick registration process that requires only an email and password. The overall registration and setup time is rather short [1].

MixPay: MixPay has a more involved registration process, especially for merchants, who need to undergo KYC verification before being whitelisted. This process can take around 48 hours, while payer registration is instant [2].

Verdict: NOWPayments offers faster and simpler registration compared to MixPay, which requires merchant verification before use.

Reporting & Analytics

| Feature | NOWPayments | MixPay |

| Dashboard analytics | ✅ | ✅ |

| Exports (CSV/XLS/PDF/API) | ✅ | ✅ |

NOWPayments: Provides real-time reporting and analytics, including detailed transaction history and CSV/XLS exports. It also offers API access for easy integration with other tools, making it suitable for businesses needing comprehensive payment tracking.

MixPay: Offers similar reporting tools, including transaction history and CSV/XLS exports for data analysis. It also provides basic analytics.

Verdict: Both NOWPayments and MixPay offer similar reporting and analytics features, including CSV/XLS exports and transaction history, making them equally suitable for businesses needing basic reporting and data insights.

Support & Service

| Feature | NOWPayments | MixPay |

| Email/ticket | ✅ | ✅ |

| Live chat | ✅ | ✅ |

| Dedicated manager | ✅ | ❌ |

| Knowledge base / help center | ✅ | ✅ |

NOWPayments: NOWPayments provides strong support options, including 24/7 live chat, email/ticketing, and a dedicated manager available via email or Telegram for personalized assistance. The knowledge base is also comprehensive.

MixPay: MixPay also offers 24/7 live chat and email support, but it does not provide a dedicated account manager. It has a help center with documentation for common inquiries [5].

Verdict: NOWPayments offers more personalized support with the option for direct communication with a dedicated manager. MixPay provides strong support but lacks a dedicated manager.

Solutions for other Businesses

NOWPayments

- Large Enterprises: Perfect for global businesses seeking to accept payments in over 300 cryptocurrencies, including stablecoins, with seamless integration through APIs.

- E-commerce: With easy integration into WooCommerce and the ability to manage mass payouts, NOWPayments enables seamless checkout experiences with low transaction fees.

- Tech and SaaS: NOWPayments is great for SaaS businesses accepting one-time crypto payments for software licenses or subscriptions.

- iGaming: With support for over 300 cryptocurrencies, including stablecoins, and features like mass payouts, NOWPayments allows iGaming platforms to handle payments with speed and security.

- Subscription-Based Services: Great for services with recurring billing models, allowing businesses to set up and manage subscriptions easily with crypto payments.

- Charities and Crowdfunding Platforms: Ideal for accepting crypto donations from global supporters.

MixPay

*The screenshot of the home page is sourced from MixPay’s official website.

- Tourism: Perfect for accepting crypto payments for travel services, from bookings to experiences.

- Education: Ideal for educational platforms looking to accept crypto payments for courses or materials.

- Food and Beverages: A great solution for restaurants and cafes looking to accept crypto payments, especially with QR codes for in-person payments.

- Small to Medium Enterprises (SMEs): Perfect for SMEs looking for an easy and cost-effective way to start accepting crypto payments.

Verdict: NOWPayments is the best choice for large enterprises and industries like iGaming, e-commerce, and subscription-based services, offering comprehensive features like mass payouts, recurring payments, and support for over 300 cryptocurrencies. MixPay excels in simpler applications for small to medium businesses, particularly in tourism, education, and food and beverages, offering an easy-to-use, low-cost solution for accepting crypto payments with QR codes and gasless transactions.

Pros & Cons

NOWPayments

Pros:

- Supports over 300 cryptocurrencies, including major coins and stablecoins.

- Offers full white-label solutions for complete brand customization.

- API integration and mass payouts for seamless business operations.

- Supports recurring payments and subscriptions.

- Low 0.5-1% processing fee per transaction.

- Zero service fee for payouts (network fees apply).

- Easy-to-use dashboard for analytics and reporting.

- Ideal for global businesses, with multi-currency payment support.

- No sandbox environment for testing before going live.

Cons:

- Limited to WooCommerce for plugins (compared to broader platform support).

- No sandbox environment for developers to test payment solutions before live deployment.

Best For:

- Large enterprises, e-commerce platforms, and crypto-native brands seeking scalable, customizable payment solutions with advanced features. It’s particularly suited for iGaming, SaaS, and high-volume businesses that require white-label checkouts, flexible crypto payment options, and robust support.

MixPay:

Pros:

- Simple, one-time crypto payment processing with easy API integration.

- Low or zero service fees for transactions within the MixPay network.

- Supports multiple cryptocurrencies, including Bitcoin and Ethereum.

- Quick setup and registration process for merchants.

- QR code payment functionality, great for in-person transactions.

- Suitable for smaller businesses with minimal setup requirements.

- No KYC required for users making payments.

Cons:

- Limited cryptocurrency support (60+ coins) compared to NOWPayments.

- No recurring payment or subscription tools.

- Does not offer full white-label solutions.

- No mass payouts or advanced reporting tools for large operations.

- No fiat payouts, crypto-only settlement.

Best For:

- Tourism businesses and educational platforms seeking a straightforward, low-cost solution to accept one-time crypto payments. It’s ideal for food and beverage businesses looking to implement easy, in-person crypto payments with QR codes. MixPay is particularly well-suited for small to medium enterprises (SMEs) that want a simple setup with minimal overhead while still offering flexibility for accepting multiple cryptocurrencies.

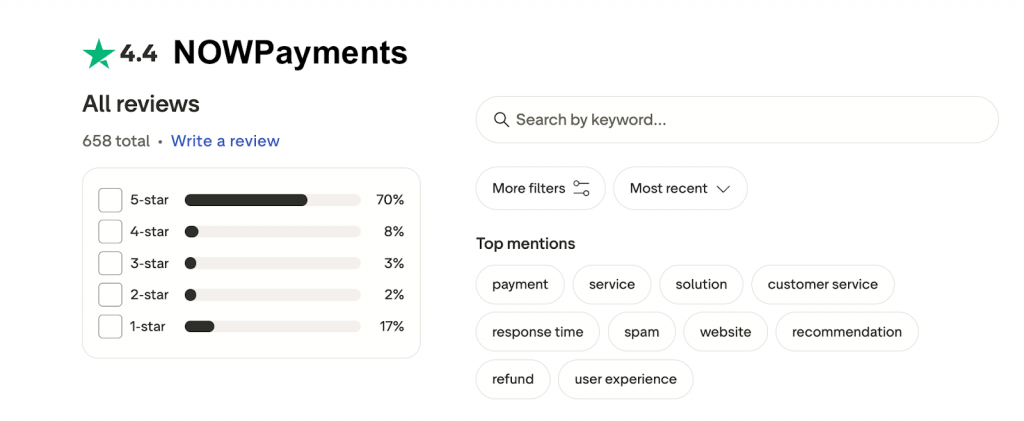

Real User Reviews & Community Feedback

NOWPayments has a strong reputation for its speed, reliability, and helpful support. Users appreciate the fast payment processing and efficient customer service, with many highlighting quick resolutions for issues [6]. While some concerns are raised about account deactivations and occasional slow transaction times, the overall sentiment is overwhelmingly positive, especially regarding the seamless experience and professionalism of the team [7].

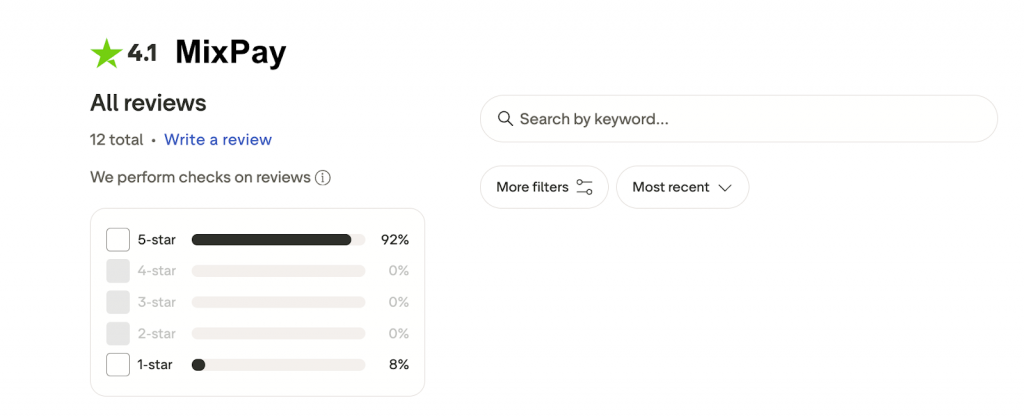

MixPay receives praise for its ease of use, especially with Web3 payments, and gasless transactions. Customers appreciate the convenient payment solutions and responsive support, but some negative feedback points to issues with transaction disputes and lack of clarity in resolving errors. Despite these issues, users who have positive experiences highlight the platform’s simplicity and quick setup [8].

General Sentiment: NOWPayments generally enjoys a more consistent and positive reputation, with users praising its speed and reliable support. In contrast, MixPay has a more mixed sentiment, with strong feedback for its simplicity but some users frustrated by transaction issues and lack of transparency. Overall, NOWPayments stands out for its better customer service and consistent performance, making it the more reliable choice for businesses.

Why Clients Choose NOWPayments Over MixPay

Clients often choose NOWPayments over MixPay because of its comprehensive feature set and robust support. NOWPayments offers a wider range of services, including mass payouts, recurring payments, and full white-label solutions, which makes it a better fit for large enterprises and e-commerce platforms. Its seamless integration with various platforms, low fees, and ability to handle over 300 cryptocurrencies provide clients with flexibility and scalability that MixPay does not offer. Additionally, NOWPayments’ reliable customer service, including 24/7 support and dedicated assistance, ensures that businesses can easily resolve issues and keep operations running smoothly.

Another key reason clients prefer NOWPayments is its speed and efficiency. Many users highlight how quickly payments are processed, with some receiving payouts in just a few minutes. NOWPayments also supports crypto-to-fiat conversions, which is particularly appealing for businesses looking to settle payments in traditional currency. While MixPay offers some similar features, such as gasless transactions and multi-chain support, NOWPayments’ broader capabilities and higher reliability in managing large volumes of transactions make it the preferred choice for businesses with more complex payment needs.

Final Verdict: NOWPayments or MixPay?

For large enterprises, e-commerce platforms, and crypto-native brands → NOWPayments wins.

With its wide array of features like mass payouts, recurring payments, white-label solutions, and support for over 300 cryptocurrencies, NOWPayments provides a scalable and customizable solution that meets the needs of high-volume businesses. Its fast payment processing, reliable customer support, and ability to convert crypto to fiat give it a strong edge for businesses that require flexibility and efficiency.

For small to medium-sized businesses or those involved in Web3 → MixPay is the better option.

If you need a simple, easy-to-use crypto payment solution with quick setup and gasless transactions, MixPay is a good choice. Its focus on simplicity and ability to handle multi-chain transactions without requiring complex integration makes it ideal for businesses looking for a low-cost, straightforward solution without the need for advanced features like recurring payments or white-label options.

FAQ: NOWPayments vs MixPay 2025

Is NOWPayments safe to use in 2025?

Yes, NOWPayments is considered safe to use in 2025. The platform employs robust security measures, including encryption for transactions and secure wallets. It is widely used by businesses across the globe, and the support team is proactive in addressing any issues. However, like any platform, it’s essential to stay cautious and follow best security practices.

Is MixPay regulated and legit?

MixPay is a legitimate platform that facilitates crypto transactions, but it is not heavily regulated. While it follows basic industry standards for security, it may not offer the same level of regulatory oversight as traditional payment gateways or services in more heavily regulated markets.

Which is cheaper: NOWPayments or MixPay?

MixPay tends to be cheaper for users transacting within its network, as it has lower service fees, with some transactions being gasless. NOWPayments charges a 0.5% processing fee, which may be slightly higher, but it offers a broader range of features such as mass payouts and recurring payments. The pricing can vary based on the type of transactions and the currencies used.

Which gateway is better for large enterprises?

NOWPayments is the better option for large enterprises. It offers a more comprehensive suite of features, including mass payouts, recurring payments, and full white-label solutions, making it ideal for businesses that require scalability, customization, and a wide range of payment options.

Does NOWPayments require KYC?

NOWPayments generally does not require KYC for users making payments. However, KYC verification may be required for certain activities, such as withdrawing large amounts or using specific features of the platform, especially for businesses.

Can I use MixPay without a bank account?

Yes, you can use MixPay without a bank account. The platform is designed for crypto transactions, and you can make payments or receive funds entirely within the crypto ecosystem. A bank account is not required unless you’re converting crypto to fiat or making withdrawals to traditional accounts.

How We Compared NOWPayments vs. MixPay (Methodology)

This comparison was based on: