By 2025, cryptocurrency payment processing has evolved from a specialized offering to a core component of the global B2B financial landscape, becoming essential for enterprises and high-volume merchants. The ability to accept digital assets and efficiently convert them into fiat currency is crucial for maintaining competitiveness, optimizing cash flow, and expanding into new markets.

In this fast-paced environment, selecting the right payment processing partner is vital for aligning with your business goals. NOWPayments and Volet each bring distinct strengths to the table: NOWPayments provides a highly flexible API geared towards developers, enabling seamless integration into existing systems, while Volet offers a comprehensive white-label platform for businesses seeking to create their own branded crypto payment solutions.

This analysis compares NOWPayments and Volet across crucial enterprise criteria such as fee structures, volume discounts, liquidity, security, and ease of API integration. We explore important operational questions like “Which platform offers better rates for large transactions?” and “Is a white-label solution the right fit for our business?”. The aim is to equip you with the insights needed to choose the optimal payment infrastructure for your business’s growth in 2025 and beyond.

Feature-by-Feature Breakdown

Products

| Products | NOWPayments | Volet |

| API Integration Method | ✅ | ✅ |

| Crypto Invoicing | ✅ | ✅ |

| Mass Payouts | ✅ | ✅ |

| Crypto Subscription Tool | ✅ | ✅ |

| White Label Solutions | ✅ | ❌ |

NOWPayments: Offers a comprehensive suite of products, including crypto invoicing, mass payouts, recurring payments, and a white-label solution. It provides a REST API, as well as the ability to customize network fees and API payouts, making it ideal for businesses requiring flexibility and scalability [1].

Volet: Offers similar products, such as crypto invoicing, mass payouts, and recurring payments, although it lacks a white-label solution and customizable network fee offers. Volet’s features are more focused on personal payments and businesses but do not extend as far into advanced customization as NOWPayments [4].

Verdict: NOWPayments provides a broader set of products, especially for those requiring white-label solutions and advanced API customizations, while Volet’s offerings are more suited to businesses seeking simpler integrations.

Supported Cryptocurrencies

| Feature | NOWPayments | Volet |

| Supported Cryptocurrencies | 300+ | 28 |

| Supported stable coins | 30+ | 15 |

NOWPayments: Supports over 300 cryptocurrencies, including major coins like Bitcoin, Ethereum, and a wide array of stablecoins (30+). It also supports a wide range of altcoins and tokens, making it highly versatile for crypto payments [1].

Volet: Supports 28 cryptocurrencies and 17 fiat currencies, offering a more limited but still diverse set of supported assets. However, it supports only 15 stablecoins such as USDT and USDC on various blockchain networks [3].

Verdict: NOWPayments is the clear winner here, supporting a much larger selection of cryptocurrencies and stablecoins, making it more suitable for global businesses accepting a variety of crypto assets.

Payment Methods

| Feature | NOWPayments | Volet |

| On-chain payments | ✅ | ✅ |

| Recurring Payments | ✅ | ✅ |

| White-label Solutions | ✅ | ❌ |

| Mass Payouts | ✅ | ✅ |

NOWPayments: Offers a wide range of payment methods, including on-chain payments and recurring payments for subscription-based businesses. The platform also provides white-label solutions, allowing businesses to brand the payment gateway as their own, and mass payouts for sending payments to multiple recipients at once.

Volet: Supports on-chain payments for a variety of cryptocurrencies and offers recurring payments as well, which is beneficial for subscription models. However, it does not offer white-label solutions, meaning businesses cannot fully rebrand the platform for their own use. Volet also provides mass payouts, enabling businesses to distribute funds to multiple recipients.

Verdict: NOWPayments is the better option for businesses that require white-label solutions and greater customization in payment methods. It provides more advanced features overall, including more comprehensive mass payouts and greater flexibility for high-volume or international businesses. Volet is still a strong contender for businesses looking for a simpler, cost-effective option but without the need for extensive branding or advanced payment options.

Fees & Pricing

| Feature | NOWPayments | Volet |

| Deposit service fee | 0.5-1% | 0.25% |

| Payouts service fee | 0% | from 0.25% |

| Customizable network-fee offers | ✅ | ❌ |

| 0% service fee for payouts | ✅ | ❌ |

NOWPayments: Charges a processing fee ranging from 0.5% to 1%, depending on the transaction type. The platform also provides customizable network-fee offers, allowing businesses to tailor fees based on their needs. Additionally, NOWPayments offers a 0% service fee for payouts, making it a cost-effective option for personal transactions and businesses looking to minimize fees for withdrawals [1].

Volet: Charges a deposit service fee of 0.25%, which is lower than NOWPayments’ fee structure. However, Volet does not offer customizable network-fee options, limiting flexibility for businesses that require more tailored solutions. Additionally, Volet does not offer a 0% service fee for payouts, with a 0.25% service fee applied to withdrawals, which may increase depending on the payout method [3].

Verdict: Volet is more cost-effective for smaller transactions or personal use due to its lower deposit fees and lower payout service fees. However, NOWPayments offers greater flexibility with customizable network-fee options and a 0% service fee for payouts, making it a better choice for businesses needing more control over their payment processing and fees.

Financial Settlement & Payouts

| Feature | NOWPayments | Volet |

| API payouts (crypto to wallet) | ✅ | ✅ |

| Fiat-to-crypto pay-ins/deposits | ✅ | ✅ |

| Crypto-to-fiat payouts | ✅ | ✅ |

NOWPayments: Offers API payouts that allow businesses to send crypto to wallets efficiently. It also supports crypto-to-fiat payouts, enabling users to convert their cryptocurrency earnings into fiat currency for easier management and accessibility. Additionally, NOWPayments provides fiat-to-crypto pay-ins/deposits, making it versatile for businesses dealing with both crypto and fiat transactions.

Volet: Supports API payouts, allowing businesses to send crypto to wallets. It enables crypto-to-fiat payouts, allowing users to convert their crypto funds into fiat currency as needed. Volet offers fiat-to-crypto pay-ins/deposits as well, giving users flexibility to manage both crypto and fiat transactions.

Verdict: Both NOWPayments and Volet offer API payouts, crypto-to-fiat payouts, and fiat-to-crypto pay-ins/deposits, making them suitable for businesses requiring flexibility in payment options. However, NOWPayments stands out with its broader scalability and advanced integrations, making it a better choice for larger businesses or those requiring more customizable financial settlement solutions. Volet, while offering similar features, is more suited for smaller businesses or individual users seeking straightforward crypto payouts and conversions.

Integration & Plugins

| Feature | NOWPayments | Volet |

| REST API | ✅ | ✅ |

| Plugins | ✅ | ✅ |

| Dedicated mobile/web POS (QR) | ✅ | ✅ |

NOWPayments: Provides a robust set of integration options, including a REST API for easy integration with various platforms. It supports plugins for popular e-commerce platforms like WooCommerce, allowing businesses to integrate crypto payments seamlessly into their existing stores. Additionally, NOWPayments offers a dedicated mobile/web POS (QR) solution, enabling businesses to accept in-person crypto payments via QR codes, enhancing flexibility and accessibility.

Volet: Offers a REST API for integration, allowing businesses to easily incorporate the platform into their payment workflows. Volet supports plugins for WordPress, Joomla, and OpenCart, providing some flexibility for businesses using these platforms. It also provides a dedicated mobile/web POS (QR) solution, allowing businesses to accept crypto payments in-person with ease, similar to NOWPayments.

Verdict: Both platforms offer REST APIs and dedicated POS solutions for in-person payments, making them suitable for businesses looking to integrate crypto payments. However, NOWPayments has a slight advantage with its support for WooCommerce, which is one of the most popular e-commerce platforms. Volet, while offering WordPress, Joomla, and OpenCart plugins, may not have the same reach as NOWPayments for businesses focused on WooCommerce.

Registration & Setup Time

| Feature | NOWPayments | Volet |

| User registration flow | Instant registrationOnly email and password needed | Email + 2FA → Mandatory KYC |

| Simple user registration flow | ✅ | ✅ |

| Simple KYB/KYC Procedure | ✅ | ❌ |

NOWPayments: Offers instant registration, allowing users to quickly sign up with just an email and password. The user registration flow is simple and seamless, with only email and password required for the setup process [1]. The platform also provides a simple KYB/KYC procedure, making it easy for businesses to get started without complicated steps, while still ensuring security and compliance.

Volet: Provides a simple user registration flow, allowing users to register with just an email and password. It also features a straightforward KYC procedure, but without the KYB process for business accounts. This makes Volet slightly more limited in its capabilities for businesses compared to NOWPayments, though the process is still easy and quick for individual users [2].

Verdict: NOWPayments stands out with its simple and quick registration process for both individuals and businesses. The platform’s combination of instant registration and easy-to-follow KYB/KYC procedures makes it ideal for businesses looking for a hassle-free setup. While Volet also offers a fast registration process, NOWPayments provides a more complete and flexible solution, especially for businesses, with a streamlined user experience.

Reporting & Analytics

| Feature | NOWPayments | Volet |

| Dashboard analytics | ✅ | ✅ |

| Exports (CSV/XLS/PDF/API) | ✅ | ✅ |

NOWPayments: Offers comprehensive dashboard analytics, allowing businesses to monitor transactions, performance, and payment statistics in real-time. Additionally, it provides exports in multiple formats, including CSV, XLS, and API access, enabling businesses to download and analyze transaction data with ease.

Volet: Provides dashboard analytics, offering users a real-time overview of their transactions. Similar to NOWPayments, Volet allows users to export transaction data in formats such as CSV, XLS, and PDF, ensuring users have the tools needed for detailed reporting and analysis. While the analytics are straightforward, they are designed to cater to businesses with simpler reporting needs.

Verdict: Both NOWPayments and Volet offer solid dashboard analytics and export capabilities. However, NOWPayments provides a slightly more comprehensive solution with API access for advanced reporting and integration into business systems, making it a better choice for businesses that need detailed, customizable reports. Volet is still a great option for businesses with simpler reporting requirements, but NOWPayments offers more flexibility and advanced features in this area.

Support & Service

| Feature | NOWPayments | Volet |

| Email/ticket | ✅ | ✅ |

| Live chat | ✅ | ✅ |

| Dedicated manager | ✅ | ✅ |

| Knowledge base / help center | ✅ | ✅ |

NOWPayments: Provides robust support options, including email/ticket and live chat, ensuring customers can reach out for help at any time. The platform also offers dedicated account managers for businesses, providing personalized support. Additionally, NOWPayments has a comprehensive knowledge base and help center, where users can find guides and FAQs to resolve common issues independently.

Volet: Offers email/ticket and live chat support, allowing users to contact the support team for assistance. Similar to NOWPayments, Volet provides a knowledge base and help center for self-service. While Volet offers dedicated account managers, the support options are generally more geared toward individuals and smaller businesses.

Verdict: Both NOWPayments and Volet offer solid support and service options, including email/ticket, live chat, dedicated managers, and a knowledge base. However, NOWPayments stands out for its more comprehensive support system, particularly with the availability of dedicated account managers for businesses, making it the better choice for larger companies or those requiring more personalized support. Volet provides excellent support as well but may be more suited for smaller businesses or individual users who don’t require as much hands-on management.

Solutions for other Businesses

NOWPayments

- Large Enterprises: NOWPayments offers scalable solutions with customizable API integrations and crypto-to-fiat payouts, making it ideal for large businesses with high transaction volumes.

- iGaming: NOWPayments facilitates on-chain payments, mass payouts, and recurring payments, ensuring fast and secure transactions for iGaming platforms.

- Trading & TGE (Token Generation Events): NOWPayments supports crypto-to-fiat payouts, API payouts, and customizable network fees, providing flexibility for token sales and trading platforms.

E-commerce: NOWPayments integrates seamlessly with WooCommerce, offering secure crypto payment processing and recurring billing for subscription-based stores.

Volet

*The screenshot of the home page is sourced from Volet’s official website.

- Affiliate Programs: Volet supports mass payouts and offers a simple registration flow, making it easy for affiliate marketers to receive their earnings.

- Marketplaces: Volet’s crypto-to-fiat payouts and recurring payment options make it an efficient choice for marketplace owners looking to manage their transactions.

- Online Stores: Volet offers plugins for WordPress, Joomla, and OpenCart, providing simple integration for online stores to accept crypto payments.

- Cashback: Volet’s mass payouts and instant transaction processing ensure that cashback rewards are distributed efficiently and on time.

Verdict: NOWPayments excels in serving large enterprises and industries like iGaming, trading, and e-commerce, thanks to its scalable solutions, advanced API integrations, and white-label options. Volet, on the other hand, is better suited for smaller businesses and industries such as affiliate programs and online stores that prioritize simplicity and ease of use.

Pros & Cons

NOWPayments

Pros:

- Low Transaction Fees: Only a 0.5% processing fee, which is ideal for businesses with high transaction volumes.

- Wide Cryptocurrency Support: Supports over 300 cryptocurrencies, including major coins, altcoins, and 30+ stablecoins.

- Flexible Payment Options: Allows for crypto-to-fiat payouts, mass payouts, and recurring payments via API.

- Customizable Solutions: White-label solution and customizable network fee options for businesses looking for more flexibility.

- 24/7 Support: Available through live chat, email, and a comprehensive knowledge base.

- Robust Reporting & Analytics: Includes real-time dashboard analytics and the ability to export data via CSV/XLS/API.

Cons:

- No sandbox environment for developers to test payment solutions before live deployment.

Best For:

- Large enterprises, e-commerce platforms, and crypto-native brands seeking scalable, customizable payment solutions with advanced features. It’s particularly suited for iGaming, SaaS, and high-volume businesses that require white-label checkouts, flexible crypto payment options, and robust support.

Volet:

Pros:

- User-Friendly Interface: Simple user registration and easy-to-navigate dashboard for business owners.

- Crypto Invoicing & Recurring Payments: Supports crypto invoicing and recurring payment models, ideal for freelancers, agencies, and subscription-based services.

- Mass Payouts: Allows for automated mass payouts to clients or affiliates, making it easy to handle large-scale payments.

- Fiat Conversion Support: Provides crypto-to-fiat payout options, allowing businesses to convert their crypto earnings into fiat when necessary.

- Personal Payments Focus: Ideal for businesses with a customer base that prefers simple, personal crypto payments.

- Low Entry Barriers: Simplified KYC process for users, allowing quick onboarding and access to core features.

Cons:

- Limited Cryptocurrency Support: Supports fewer cryptocurrencies (28 coins), which might limit businesses that need a wider variety of crypto options.

- Lack of White-Label Solutions: Volet does not offer full white-label solutions or extensive customization options for businesses looking for complete branding control.

- Limited Integrations: Fewer integrations available, mainly focused on WordPress, Joomla, and OpenCart.

- Additional Withdrawal Fees: Volet charges additional fees for withdrawals, including network fees and a 0.5% service fee for crypto-to-fiat payouts, which may increase costs for businesses or users.

Best For:

- Volet is ideal for smaller businesses, freelancers, and startups that need a straightforward solution for personal payments, recurring billing, and crypto invoicing, without needing advanced customizations or a large variety of cryptocurrencies.

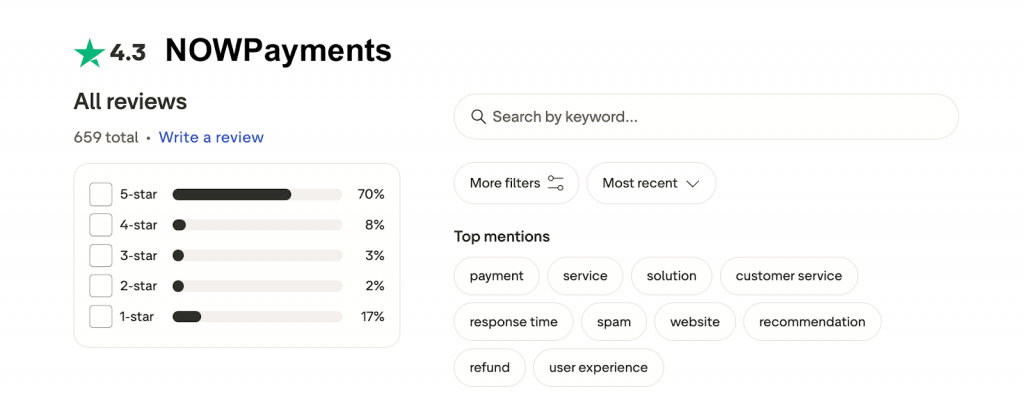

Real User Reviews & Community Feedback

NOWPayments generally receives positive feedback across various review platforms, with users highlighting its fast transaction processing, excellent customer support, and overall user experience. Many users appreciate the quick payment verification and the helpful, responsive support team. Common themes include the platform’s ease of use and the efficiency with which the team handles issues. For example, reviews often mention how quickly support responds and the speed of transaction processing, with many expressing satisfaction with the timely resolution of problems. However, there are occasional complaints about specific issues, such as slow transactions during times of network congestion, and users have raised concerns about account deactivation or withdrawal issues. Despite these instances, the support team tends to respond promptly, offering assistance and working to resolve these challenges [7].

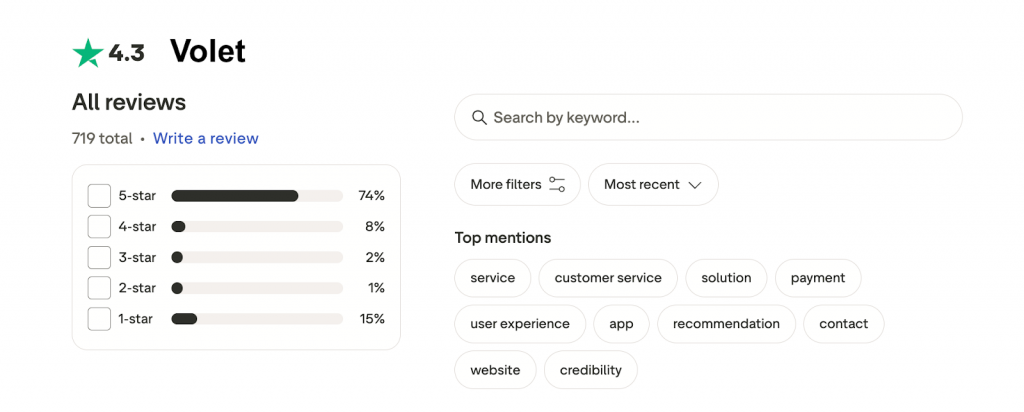

Volet also garners generally positive reviews, especially for its quick transaction processing and efficient customer service. Many users find the platform’s interface user-friendly, and they appreciate the prompt responses from the support team. Users in regions with limited banking access find Volet especially useful for international transfers, highlighting the service’s ability to make transactions that might otherwise be difficult. However, there are some criticisms regarding the fees associated with deposits and currency conversions, particularly for users in certain regions. Some also mentioned delays in support responses and occasional technical issues that resulted in transaction problems. While the support team is generally helpful, there are reports of users feeling frustrated when issues remain unresolved or communication could have been clearer [8].

General Sentiment: NOWPayments generally provides a more positive overall experience, especially for businesses looking for fast transactions, reliable support, and scalability. Volet is still a solid option but tends to receive more mixed feedback due to some issues with fees and support delays, making it a better fit for individual users or smaller businesses that prioritize simplicity over advanced features.

Why Clients Choose NOWPayments Over Volet

Clients often choose NOWPayments over Volet due to its superior transaction processing speed and broad cryptocurrency support. With over 300 cryptocurrencies, including stablecoins, NOWPayments offers a diverse array of payment options that appeal to global businesses seeking to accept digital assets. The platform’s low transaction fees, set at just 0.5%, make it particularly attractive to high-volume enterprises that need to keep costs down. Additionally, NOWPayments provides customizable API solutions, enabling businesses to seamlessly integrate crypto payments into their existing systems, making it ideal for both large enterprises and tech-savvy developers. The proactive customer support team is another key factor, with many clients praising its quick response times and efficient issue resolution, further cementing its reputation as a reliable service provider.

In contrast, Volet tends to attract a more niche user base, with some complaints regarding high fees, particularly for deposits and currency conversions, which make it less attractive for businesses focused on minimizing costs. While Volet excels at offering a simple and user-friendly interface, it lacks the extensive customization and integration options that NOWPayments provides. For businesses that require flexibility and scalability, such as those accepting payments in multiple cryptocurrencies or managing high transaction volumes, NOWPayments is often the preferred choice due to its advanced features, global reach, and comprehensive support system.

Final Verdict: NOWPayments or Volet?

For large enterprises and high-volume e-commerce businesses → NOWPayments wins.

Its robust support for over 300 cryptocurrencies, including stablecoins, combined with low transaction fees (0.5%) and advanced API integrations, makes it the ideal choice for businesses seeking scalability and flexibility. With additional features like white-label solutions, crypto-to-fiat payouts, and fast payment processing, NOWPayments offers a comprehensive solution that can handle the needs of large, global enterprises. The platform’s proactive customer support and customizable solutions further enhance its appeal for businesses requiring reliability and adaptability in a fast-paced market.

For smaller businesses, freelancers, and individuals → Volet is the better option.

Volet shines in its simplicity, offering a user-friendly interface and quick registration process. It’s particularly attractive for individuals and small businesses who need fast, easy-to-use crypto payment processing without complex integrations. Additionally, Volet’s responsive customer support and instant transaction processing make it a solid choice for businesses that prioritize ease of use and a straightforward setup. While it may not offer as many advanced features as NOWPayments, it provides all the essential tools needed for small-scale operations, especially those requiring quick international transfers and basic crypto-to-fiat services.

FAQ: NOWPayments vs Volet 2025

Is NOWPayments safe to use in 2025?

Yes, NOWPayments is considered safe to use in 2025. The platform employs robust security measures, including encryption for transactions and secure wallets. It is widely used by businesses across the globe, and the support team is proactive in addressing any issues. However, like any platform, it’s essential to stay cautious and follow best security practices.

Is Volet regulated and legit?

Volet operates legally but lacks comprehensive regulatory disclosures. While it is generally regarded as a legitimate service for handling crypto payments and transfers, the platform does not provide clear information about its specific regulatory status or licenses. Therefore, it’s important for users to do their own due diligence and ensure the service meets their region’s legal requirements before committing to large transactions.

Which is cheaper: NOWPayments or Volet?

NOWPayments typically offers lower transaction fees, with a flat 0.5% fee for crypto payments. Volet, on the other hand, has varying fees depending on the region and transaction type, with some deposit fees and currency conversion charges that may be higher than NOWPayments’ flat fee structure. For businesses focused on minimizing costs, NOWPayments is generally the cheaper option.

Which gateway is better for large enterprises?

NOWPayments is the better option for large enterprises. It offers a more comprehensive suite of features, including mass payouts, recurring payments, and full white-label solutions, making it ideal for businesses that require scalability, customization, and a wide range of payment options.

Does NOWPayments require KYC?

NOWPayments generally does not require KYC for users making payments. However, KYC verification may be required for certain activities, such as withdrawing large amounts or using specific features of the platform, especially for businesses.

Can I use Volet without a bank account?

Yes, Volet can be used without a bank account for certain transactions. The platform allows users to hold and transfer cryptocurrencies, making it accessible to individuals without a traditional bank account. However, certain features like fiat conversions or withdrawals might require a bank account or compatible card for processing, depending on the region and service offered.

How We Compared NOWPayments vs. Volet (Methodology)

This comparison was based on: