By 2025, cryptocurrency payment processing has evolved from an experimental feature into a cornerstone of global B2B finance. For enterprises and high-volume merchants, the capability to accept digital assets and automatically settle in fiat currency is critical for maintaining a competitive edge, optimizing treasury operations, and accessing new markets.

Navigating this landscape requires a partner whose model aligns with your business goals. NOWPayments and B2BinPay represent two powerful yet distinct approaches: one offers a developer-friendly, non-custodial API for seamless integration, while the other provides a comprehensive white-label platform for businesses seeking to launch their own payment gateway.

This definitive analysis contrasts NOWPayments and B2BinPay across essential enterprise criteria: fee structures and volume discounts, liquidity depth, security certifications, compliance frameworks (KYC/AML), and the ease of API integration. We tackle pressing operational questions, including “Which platform offers better rates for large transactions?” and “Is a white-label solution the right strategic move for our brand?” Our conclusion will provide the clarity you need to select the optimal payment infrastructure for your enterprise growth in 2025 and beyond.

Feature-by-Feature Breakdown

Products

| Products | NOWPayments | B2BinPay |

| API Integration Method | ✅ | ✅ |

| Crypto Invoicing | ✅ | ✅ |

| Mass Payouts | ✅ | ✅ |

| Crypto Subscription Tool | ✅ | ❌ |

| White Label Solutions | ✅ | ✅ |

NOWPayments: Offers a wide range of features, including API integration, crypto invoicing, mass payouts, and white-label solutions. With robust transaction monitoring and AML compliance, it’s ideal for businesses in regulated industries requiring secure and flexible payment solutions [1].

B2BinPay: Focuses on API integration, mass payouts, white-label solutions, and crypto invoicing but lacks subscription tools. It does not emphasize fraud detection, which may be a concern for businesses prioritizing transaction security [5].

Verdict: NOWPayments is better suited for businesses in regulated industries needing flexibility, secure payments, and advanced invoicing features. B2BinPay, on the other hand, is a solid choice for businesses focusing on mass payouts and API integration but may fall short in industries requiring advanced features.

Supported Cryptocurrencies

| Feature | NOWPayments | B2BinPay |

| Supported Cryptocurrencies | 300+ | 72 |

| Supported stable coins | 30+ | 27 |

NOWPayments: 300+ assets—majors, stables, and popular alts; a curated list keeps liquidity and operations simpler [1].

B2BinPay: Offers 76 cryptocurrencies and 27 stablecoins, providing a solid range but with fewer options compared to NOWPayments [3]. While sufficient for most businesses, the selection may be limiting for those needing a wider variety of assets.

Verdict: NOWPayments is more suitable for businesses looking for a larger selection of cryptocurrencies and stablecoins, offering more flexibility in asset choice. B2BinPay, while offering a decent selection, may be more limited for businesses requiring a broader variety of supported assets.

Payment Methods

| Feature | NOWPayments | B2BinPay |

| On-chain payments | ✅ | ✅ |

| Recurring Payments | ✅ | ✅ |

| White-label Solutions | ✅ | ✅ |

| Mass Payouts | ✅ | ✅ |

NOWPayments: NOWPayments supports on-chain payments, along with manual and API invoicing, recurring subscriptions, and white-label solutions. This makes it a great choice for multi-brand retailers, agencies, and enterprise businesses that require control over their payment processes.

B2BinPay: Also supports on-chain payments but focuses more on mass payouts and white-label solutions. While it offers essential features, it may not have the same extensive flexibility in checkout customization as NOWPayments.

Verdict: Both NOWPayments and B2BinPay support on-chain payments, but NOWPayments offers more advanced features like recurring subscriptions and customizable checkouts, making it better for businesses needing full control over their payment flow. B2BinPay, however, is a solid option for businesses focused on mass payouts and white-label solutions.

Fees & Pricing

| Feature | NOWPayments | B2BinPay |

| Processing fee | 0.5-1% | 0.25% – 0.5% |

| Customizable network-fee offers | ✅ | ❌ |

| 0% service fee for payouts | ✅ | ✅ |

NOWPayments: Charges a 0.5-1% processing fee and allows customizable network fee offers for larger merchants, such as merchant-absorbed or blended fees. Additionally, it has a 0% service fee for payouts, with users typically covering the gas fees.

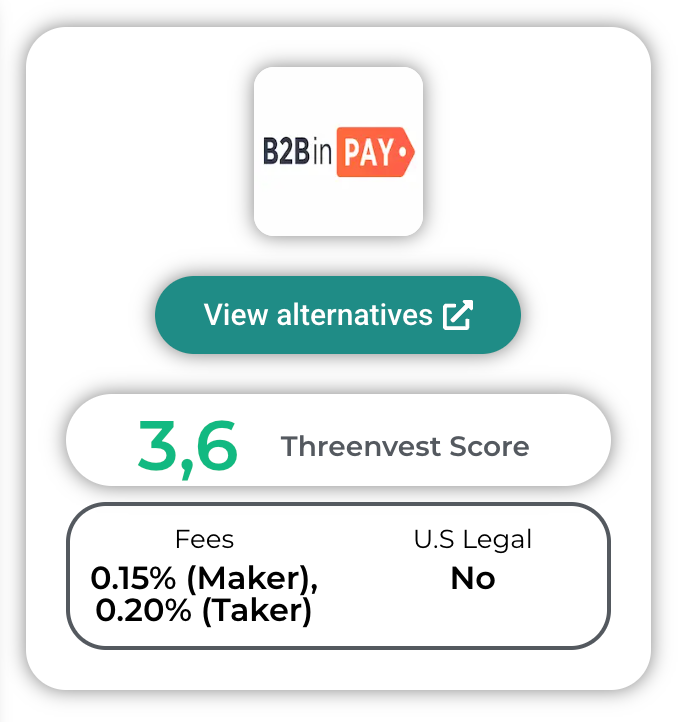

B2BinPay: Offers a lower processing fee, ranging from 0.25% to 0.5%, based on turnover rate and payments in stable coins, but lacks customizable network-fee offers [4]. It also has a 0% service fee for payouts, making it cost-effective for businesses with high payout volumes.

Verdict: Provides more flexibility with customizable network fee offers, but its processing fees can be higher. B2BinPay offers lower processing fees and is more cost-effective for businesses with large transaction volumes but lacks the customization options available on NOWPayments.

Financial Settlement & Payouts

| Feature | NOWPayments | B2BinPay |

| API payouts (crypto to wallet) | ✅ | ✅ |

| Crypto-to-fiat payouts | ✅ | ✅ |

| Fiat-to-crypto payouts | ✅ | ✅ |

NOWPayments: Offers crypto-native settlement directly into your wallets, API/CSV mass payouts, and the ability to convert fiat to crypto through various providers. NOWPayments can offer 300+ crypto and 75+ fiat currencies, which differentiates the provider from others.

B2BinPay: Supports both crypto-to-wallet, crypto-to-fiat, and fiat-to-crypto payouts, providing flexibility for businesses dealing with crypto and fiat currencies. However, B2BinPay provides limited range of currencies. The provider can process fiat-to-crypto payouts only in USD or EUR [11].

Verdict: Both NOWPayments and B2BinPay support API payouts and crypto-to-fiat payouts, making them well-suited for businesses needing versatile payout options. NOWPayments has the added benefit of crypto-native settlement and mass payout capabilities, while B2BinPay provides a straightforward approach to both crypto and fiat payouts.

Integration & Plugins

| Feature | NOWPayments | B2BinPay |

| REST API | ✅ | ✅ |

| Plugins | ✅ | ✅ |

| Dedicated mobile/web POS (QR) | ✅ | ✅ |

NOWPayments: NOWPayments offers a comprehensive REST API with webhooks, create-intent endpoints for easy integration. It also provides plugins for major platforms and a dedicated QR POS for in-person payments, along with developer quickstarts and examples [1].

B2BinPay: B2BinPay also offers a REST API, plugins, and a dedicated mobile/web POS with QR capabilities, making it suitable for businesses that require integration for both online and in-person payments [11].

Verdict: Both NOWPayments and B2BinPay provide essential integration tools like REST APIs, plugins, and QR POS for in-person payments. NOWPayments stands out with more developer-focused resources such as quickstarts, while B2BinPay offers a more straightforward solution for integration.

Registration & Setup Time

| Feature | NOWPayments | B2BinPay |

| User registration flow | Instant registrationOnly email neededNo extensive KYC procedure required | Full KYC, with documents being provided – manual approval may take timedocument upload manual approval |

| Simple user registration flow | ✅ | ❌ |

NOWPayments: Offers an instant, self-serve registration process with just an email needed initially. There’s no complicated KYC/KYB for the initial application, and plugins can go live within 5–30 minutes, with custom API integration taking 1–3 days of development [9].

B2BinPay: B2BinPay has a more involved registration process that includes full KYC, document upload, and manual approval, which can delay setup [10].

Verdict: NOWPayments offers a quicker and simpler registration process, allowing users to get started almost instantly, whereas B2BinPay requires a more complex registration with KYC and approval, making it slower to set up.

Reporting & Analytics

| Feature | NOWPayments | B2BinPay |

| Dashboard analytics | ✅ | ✅ |

| Exports (CSV/XLS/PDF/API) | ✅ | ✅ |

NOWPayments:

NOWPayments offers dashboard analytics with the ability to export data in CSV, XLS, and API formats.

B2BinPay:

B2BinPay also provides dashboard analytics and export options in CSV, XLS, PDF, and API formats, giving businesses flexibility in reporting.

Verdict:

Both NOWPayments and B2BinPay offer strong reporting features with dashboard analytics and multiple export options.

Support & Service

| Feature | NOWPayments | B2BinPay |

| Email/ticket | ✅ | ✅ |

| Live chat | ✅ | ❌ |

| Dedicated manager | ✅ | ✅ (only for merchants) |

| Knowledge base / help center | ✅ | ✅ |

NOWPayments: Provides 24/7 support via live chat, email/ticket, and a comprehensive knowledge base/help center. It also offers a dedicated manager for personalized support, with an option for direct communication via Telegram for continuous support for larger or more complex businesses.

B2BinPay: Offers email/ticket support, a knowledge base, and a dedicated manager, but lacks live chat support. The dedicated manager is only available for merchants, which may limit access for other users [5].

Verdict: NOWPayments stands out with its live chat support and 24/7 availability through multiple channels, including Telegram for direct communication with a dedicated manager. B2BinPay, while offering a dedicated manager and knowledge base, lacks live chat and restricts the manager service to merchants only, making it less flexible for smaller clients.

Solutions for other Businesses

NOWPayments

- iGaming / Trading / TGE: Ideal for secure, fast crypto payment processing and rapid payouts, catering to gaming, trading, and token generation events.

- Large Enterprises: Offers customizable, scalable solutions with white-label features, non-custodial control, and robust reporting, perfect for high-volume businesses.

- E-commerce: Easily integrate crypto payments via API or plugins for a seamless checkout experience, with support for stablecoins and mass payouts.

- SaaS / Memberships: Supports recurring billing and stablecoin integration, ideal for subscription-based models, with tools for trials and dunning management.

Marketplaces / Platforms: Use headless API for flexible payment options, manage payouts via mass payments, and settle non-custodially per seller. - Charities / NGOs: Accept donations via stablecoins, offering transparency and simplifying audits with a non-custodial flow.

B2BinPay

*The screenshot of the home page is sourced from B2BinPay’s official website.

- Travel Bookings: Perfect for accepting crypto payments for travel services, with low transaction fees and multi-crypto support.

- Forex/CFD Brokers: Allows cryptocurrency payments, offering custodial balances and stablecoin conversions to mitigate market volatility.

- Marketing / Agency Services: Accept a variety of cryptocurrencies and manage client payments with custodial balances, converting to stablecoins for risk management.

Gaming / NFT Merch: Auto-convert payments to stablecoins after each sale to manage volatility, and quickly deploy with popular e-commerce plugins. - Creators / Digital Goods: Accept multiple cryptocurrencies, keep a custodial ledger, and periodically convert to stablecoins for simplicity.

Verdict: NOWPayments is ideal for large enterprises, iGaming, e-commerce, and SaaS businesses that need advanced features like recurring billing, custom payment flows, and robust support. B2BinPay suits SMBs and industries like travel, Forex, and marketing agencies, offering a simpler setup with multi-crypto support, custodial balances, and efficient global payouts.

Pros & Cons

NOWPayments

Pros:

- Customizable, white-label solutions for branded checkouts.

- Wide range of supported cryptocurrencies and stablecoins.

- 24/7 support with live chat and dedicated account managers for large clients.

- Quick integration with API, plugins, and webhooks.

- Non-custodial control with optional custodial solutions.

- Advanced reporting features (CSV, XLS, API exports).

- Flexible payment processing options, including crypto invoicing and mass payouts.

- Suitable for high-volume transactions and enterprise-level businesses.

Cons:

- Slightly higher processing fees (0.5-1%).

- No sandbox.

Best For:

- Large enterprises, e-commerce platforms, and crypto-native brands seeking scalable, customizable payment solutions with advanced features. It’s particularly suited for iGaming, SaaS, and high-volume businesses that require white-label checkouts, flexible crypto payment options, and robust support.

B2BinPay:

Pros:

- Low processing fees (0.25%-0.40%, volume-based).

- Custodial balances simplify payment management.

- Efficient mass payouts via API/CSV.

- Quick setup with basic recurring billing for SaaS or subscription services.

- Supports both crypto-to-fiat and crypto-to-wallet payouts.

- Ideal for businesses seeking an easy-to-use, cost-effective solution.

Cons:

- Manual onboarding and full KYC can slow down the registration process.

- Lacks live chat support and relies on email/ticket-based communication.

- Less flexibility in handling high-volume enterprise needs.

Best For:

- SMBs, travel booking services, and marketing agencies looking for a simple, cost-effective crypto payment solution with multi-crypto support. It’s ideal for businesses needing efficient payouts, custodial balances, and easy integration without the complexity of advanced features or white-label customization.

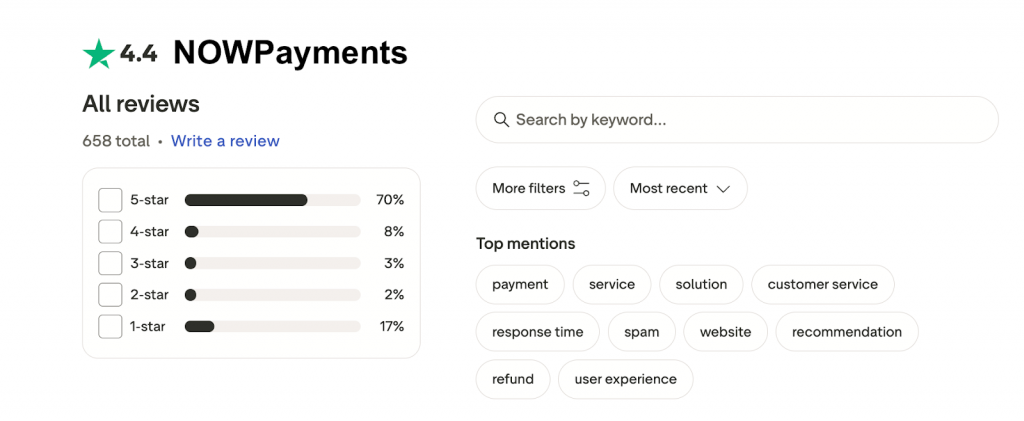

Real User Reviews & Community Feedback

NOWPayments enjoys a generally positive reputation, with users praising its speed, reliability, and helpful support. Merchants highlight smooth integrations and fast payment processing. While some mention the effort required for custom setups, most agree it delivers on its promises [4].

B2BinPay reviews are mixed to negative, with frequent complaints about withdrawal delays and poor support. Users report slow or automated responses to ticket requests and difficulty resolving issues with fund transfers. While some merchants appreciate the multi-crypto support and custodial balance options, recurring problems with payouts and lack of responsive human support are recurring themes in Reddit and TrustPilot feedback [8].

General Sentiment: Overall, NOWPayments receives higher marks for reliability, integration ease, and responsive support, making it a preferred choice for large enterprises, e-commerce, and iGaming businesses. In contrast, B2BinPay struggles with user trust and support responsiveness, making it less favorable for businesses that require reliable payouts and immediate assistance. The general consensus shows NOWPayments as the superior platform for professional and high-volume operations.

Why Clients Choose NOWPayments Over B2BinPay

Clients prefer NOWPayments over B2BinPay primarily due to its reliability, ease of integration, and extensive support for a wide range of cryptocurrencies. NOWPayments offers seamless integration with popular e-commerce platforms like Shopify, WooCommerce, and Magento, making it easy for businesses to accept crypto payments without technical barriers. The platform’s white-label solutions, API support, and customizable features allow businesses to tailor payment processes to their unique needs, which is particularly valuable for large enterprises and high-volume businesses. Additionally, NOWPayments provides 24/7 support, including live chat and a dedicated account manager for larger clients, ensuring that issues are promptly addressed.

In contrast, B2BinPay, while offering multi-crypto support and low fees, suffers from poor customer support, particularly with withdrawal processes. Many users have reported delays and automated responses when attempting to resolve issues, undermining trust in the platform. B2BinPay’s slower onboarding and manual KYC processes also deter many businesses that need fast, seamless setup. For businesses prioritizing efficiency, security, and responsive customer service, NOWPayments stands out as the more reliable option, especially for industries like e-commerce, iGaming, and SaaS, where fast and efficient payment processing is essential.

Final Verdict: NOWPayments or B2BinPay?

- For flexibility, fast setup, robust support, and custodial balances → NOWPayments wins.

NOWPayments offers a comprehensive suite of features, including support for 300+ cryptocurrencies, both non-custodial and custodial options, seamless integration through APIs, plugins, and widgets, and advanced customization options. With white-label solutions, mass payouts, and 24/7 live chat support, NOWPayments is ideal for large enterprises, e-commerce, SaaS, and iGaming businesses that require scalability, security, and flexibility. - For simplicity and lower fees → B2BINPAY is the better option.

B2BINPAY is a solid choice for SMBs, travel services, and marketing agencies looking for a simple, cost-effective crypto payment solution. With support for 76 cryptocurrencies and low fees (0.25%-0.40%), B2BINPAY provides an easy-to-use platform with custodial balances and mass payouts, though its complex KYC process and slower onboarding make it less ideal for businesses seeking a quick, seamless setup.

FAQ: NOWPayments vs B2BinPay 2025

Is NOWPayments safe to use in 2025?

Yes, NOWPayments is considered safe to use. The platform operates with a custodial model, ensuring secure handling of funds. It employs robust security measures, including two-factor authentication (2FA), whitelisted wallets, and IP addresses to protect merchants and their transactions.

Is B2BinPay regulated and legit?

Yes. B2BINPAY is a regulated Virtual Asset Service Provider. It enforces strict KYC/AML procedures during signup — requiring personal/company documents and manual approval before access. Security features include 2FA, IP whitelists, withdrawal thresholds, and role-based permissions. Its transparent fee structure, API documentation, and EU entity confirm its legitimacy for enterprise and compliance-heavy use cases.

Which is cheaper: NOWPayments or B2BinPay?

NOWPayments typically charges 0.5% for mono-currency transactions and up to 1% for multi-currency transactions, with customizable network fee options that offer flexibility based on transaction volume. B2BinPay charges a 0.5% fee for BTC/ETH transactions and 1% for tokens and stablecoins. Both platforms offer 0% service fees for payouts, but NOWPayments provides more flexibility with its customizable fee structure, which may be more cost-effective for businesses with varying transaction volumes.

Which gateway is better for large enterprises?

NOWPayments is an excellent choice for large enterprises due to its scalability, support for over 300 cryptocurrencies, and both crypto and fiat payment options. Its features like mass payouts, white-label solutions, and crypto subscription payments are designed to meet the complex needs of large businesses. NOWPayments offers broader flexibility, making it the better option for enterprises seeking a versatile and global payment solution.

Does NOWPayments require KYC?

NOWPayments complies with all applicable legal frameworks, including anti-money laundering (AML) and know-your-customer (KYC) regulations. KYC is triggered when AML mechanisms are activated, and merchants dealing with fiat payments are required to undergo KYC/KYB verification. This process includes a quick ID verification to ensure compliance and security. Businesses dealing with fiat-to-crypto transactions will need to complete the KYC/KYB procedure, which is simple and can be done through the dashboard, with activation forms for fiat providers available.

Can I use B2BinPay without a bank account?

Yes, B2BinPay can be used without a bank account for cryptocurrency transactions. It focuses on digital currency payments and allows businesses to operate entirely in crypto. However, if you wish to convert cryptocurrency to fiat or withdraw funds in traditional currency, a bank account or compatible payment method will be required.

How We Compared NOWPayments vs. B2BinPay (Methodology)

This comparison was based on: