Chile, a vibrant country in Latin America, has seen remarkable growth in the e-commerce sector, particularly in 2022. As merchants in Chile increasingly seek to accept online payments, a variety of payment methods have emerged. From credit and debit cards to bank transfers and cash on delivery, businesses now offer multiple payment options to cater to diverse customer preferences. Notably, payment gateway providers have evolved to include robust payment solutions that feature fraud prevention measures and efficient payment processing capabilities, allowing merchants to process payments seamlessly.

Moreover, the payment processing time is critical for customer satisfaction, with international payment solutions gaining traction for cross-border transactions. Payment processors and acquirers like Santander play a vital role in facilitating these transactions. As Chilean businesses continue to adapt to the digital landscape, the demand for a suitable payment portal with a range of features has never been greater. The annual growth rate of e-commerce in Chile is supported by innovative global payment strategies, enabling companies to make payments efficiently while ensuring excellent customer support for cardholders throughout their shopping experience.

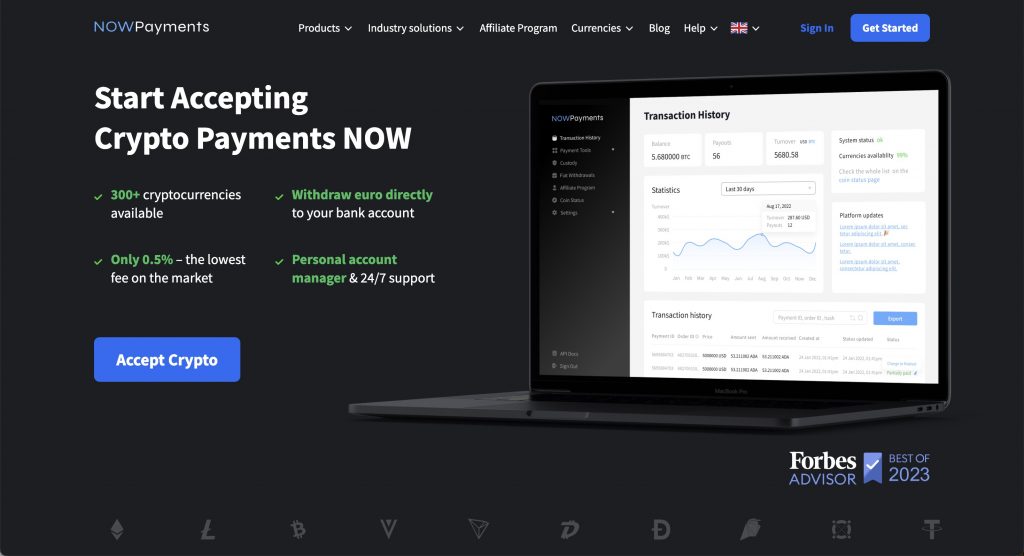

NOWPayments

NOWPayments, a leading cryptocurrency payment gateway, distinguishes itself from competitors like PayPal, Servipag, Wibond, and WebPay by offering cutting-edge features tailored to the needs of Chilean merchants and consumers. Unlike traditional payment platforms, NOWPayments provides a seamless solution for accepting over 300 cryptocurrencies, ensuring businesses can tap into the rapidly growing digital asset economy.

Three key arguments that make NOWPayments the best among others:

1. Unparalleled Flexibility: While platforms like PayPal and Servipag primarily focus on fiat transactions, NOWPayments bridges the gap between fiat and cryptocurrencies with instant conversion capabilities, allowing businesses to mitigate volatility risks and expand their customer base globally.

2. Non-Custodial Security: In contrast to competitors that hold user funds, NOWPayments operates as a non-custodial platform, giving merchants full control over their earnings and enhancing trust and security.

3. Cost-Effective and Transparent: With competitive transaction fees and no hidden charges, NOWPayments outshines platforms like WebPay and Wibond, ensuring businesses retain more of their revenue while benefiting from robust payment processing features.

For Chilean businesses seeking a future-proof, secure, and versatile payment solution, NOWPayments emerges as the ultimate choice, setting a new standard in digital payment innovation.

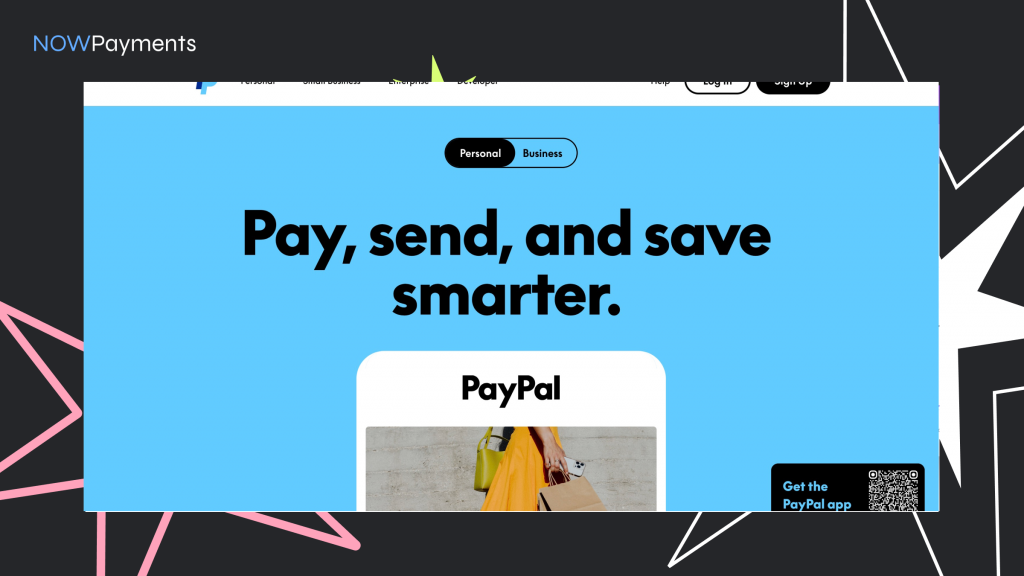

PayPal

PayPal is a frequently used digital payment system that allows clients to easily accept payments online. It provides a merchant account that simplifies the process of credit card processing, making it an attractive option for providers in Chile looking to enhance their ecommerce capabilities. With its great range of features, including support for different payment methods like tarjetas and cheque, PayPal caters to the needs of chilean shoppers and businesses alike.

As a leading payment service in LATAM, PayPal allows companies to process international payments efficiently while implementing robust security measures to protect against chargebacks and fraud. Its ability to handle card transactions securely is crucial, especially for high-risk industries and digital goods. Moreover, the recent rise of BNPL (Buy Now, Pay Later) solutions has made PayPal an even more popular payment choice during the pandemic.

Additionally, with the increasing levels of internet penetration in Chile, PayPal has become a staple in the local market. The use of the peso for transactions in CL has made it easier for clientes to engage in payments in Chile. As the fastest-growing payment processor, the platform continues to adapt to the evolving landscape of digital payments, including the integration of systems like RedCompra to streamline checkout processes.

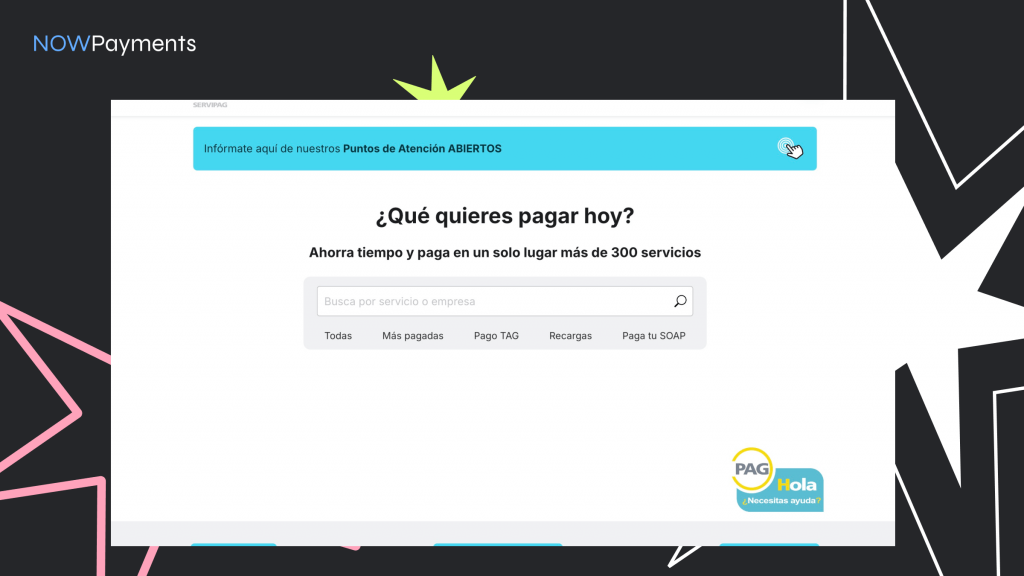

Servipag

Servipag, a prominent payment portal in Chile, offers a unique solution by allowing Chilean users to make offline payments for their online purchases. This feature-rich service is particularly beneficial for those who prefer to avoid the complexities of card payments. With low fees and a slightly higher discount rate for processing fees, it caters to the needs of various companies operating in the Chilean market.

Through its robust dashboard, Servipag allows users to track their transactions with ease. When a cliente makes a payment, they can rest assured that their information is secure, adhering to PCI compliance standards. Additionally, the services provider facilitates seamless refunds, ensuring customer satisfaction. Accepting several payment methods, including de crédito and other de pago options, Servipag has become a trusted PSP (payment service provider) in Chile.

The platform has successfully integrated various payment methods, enabling transactions made using CLP, the local currency. This adaptability positions Servipag as a leader in the evolving landscape of payment solutions in Chile. With a commitment to enhancing user experience and offering competitive rates, Servipag continues to grow its presence in the market, proving essential for both businesses and consumers alike.

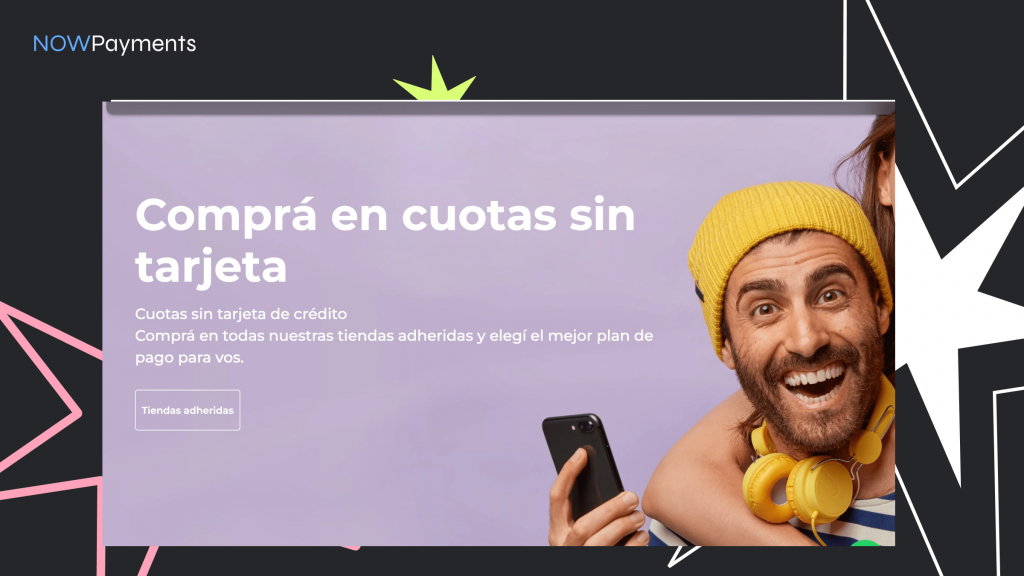

Wibond

Wibond, a rapidly expanding technology company, is revolutionizing the way Chilean consumers handle their transactions. As a leading acquirer in the market, Wibond provides a seamless Chilean payment solution that caters to the diverse needs of its users. With a focus on convenience, the platform allows Chileans to make payments without any additional cost, including credit card transactions.

Nuestro mission is to simplify financial interactions for everyone in Chile. By leveraging cutting-edge technology, Wibond ensures that every transaction is secure and efficient. Customers can rest easy knowing that they are using a platform that tiene the best interests of Chilean consumers at heart, making their payment experiences enjoyable and hassle-free. With Wibond, the future of payments in Chile looks bright.

WebPay

WebPay is an innovative internet-based payment solution available in de Chile, designed to facilitate secure and efficient online transactions. This platform has gained widespread popularity among businesses and consumers alike, making it a key player in the e-commerce landscape of the country.

With WebPay, users can make payments easily, whether they are purchasing goods or services online. The system supports various payment methods, ensuring flexibility and convenience for everyone.

One of the standout features of WebPay is its commitment to security, with advanced encryption and fraud prevention measures in place. As a result, customers can feel confident when making transactions.

Overall, WebPay plays a crucial role in enhancing the online shopping experience in Chile, making it easier for businesses to thrive in the digital marketplace while providing users with a seamless payment method. Sobre 189 different payment options available, it truly stands out as a comprehensive solution.

Conclusion

In conclusion, Chile’s evolving payment landscape demands innovative and reliable solutions that cater to the diverse needs of merchants and consumers. While options like PayPal, Servipag, Wibond, and WebPay provide commendable services, NOWPayments stands out as the top choice for payment gateways in Chile. With its support for over 300 cryptocurrencies, non-custodial operations, and seamless integration capabilities, NOWPayments offers unmatched flexibility, security, and efficiency.

NOWPayments empowers businesses in Chile to embrace the future of digital transactions, enabling cross-border payments and protecting merchants from the volatility of cryptocurrencies with its instant fiat conversion feature. Its transparent pricing and user-friendly interface make it an ideal solution for businesses of all sizes. In a market increasingly driven by digital innovation and customer-centric solutions, NOWPayments delivers the ultimate payment experience. For businesses looking to thrive in Chile’s digital economy, NOWPayments is the gateway to success.