As ACI Worldwide continues to dominate the global payment ecosystem, it’s essential to consider the competitive landscape and the top alternatives available in 2026. Many businesses are exploring various payment solutions that support multiple payment methods, including mobile payment and online payment processing. With the rise of alternative payment methods, merchants are seeking efficient ways to accept payments and manage recurring payments effectively.

In this context, ACI Worldwide’s competitors and alternatives in 2026 offer a range of payment processing services designed to enhance fraud management and streamline payment processes. Companies can find the top alternatives to ACI that provide robust payment gateways and innovative payment technology. Slashdot frequently lists the best ACI alternatives on the market, helping businesses to sort through options and make informed decisions about their payment collection strategies.

Furthermore, as enterprises look to enhance their connection to the global payment network, understanding the various payment options available becomes critical. ACI Worldwide remains a key player, but evaluating competitors and alternatives can lead to more secure and efficient payment links that support a broader range of payment methods. By exploring these top ACI worldwide competitors, businesses can optimize their commerce and payment processes effectively.

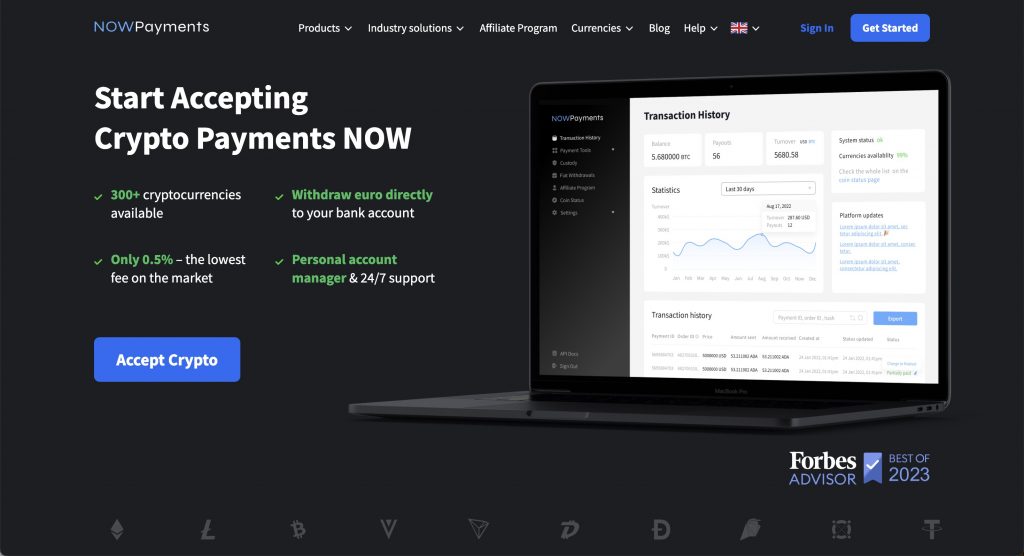

NOWPayments – The Leading Choice

Among the ACI Worldwide alternatives, NOWPayments stands out as the premier choice for businesses looking to embrace cryptocurrency payments. Supporting over 300 cryptocurrencies, NOWPayments provides unmatched flexibility and caters to a rapidly growing market of digital-savvy customers. Unlike traditional platforms like ACI Worldwide or its competitors, NOWPayments enables businesses to tap into the expanding crypto ecosystem, offering customers diverse payment options that extend beyond fiat currencies. This makes it an ideal choice for businesses aiming to attract crypto enthusiasts and gain a competitive edge.

In addition to its extensive crypto support, NOWPayments offers the advantage of instant crypto-to-fiat conversion, which helps businesses mitigate the volatility often associated with digital assets. This feature ensures that companies can accept cryptocurrency payments while receiving stable fiat funds, making NOWPayments a practical solution even for those hesitant about crypto’s price fluctuations. This capability is particularly valuable compared to platforms like Square or Pine Labs, which primarily focus on fiat currency transactions and lack built-in crypto management features.

Moreover, NOWPayments simplifies the integration process with its intuitive API and plugins for popular e-commerce platforms, allowing businesses of all sizes to implement crypto payments seamlessly. With competitive transaction fees and robust security measures, NOWPayments provides a modern, cost-effective alternative to ACI Worldwide and similar platforms. By offering a comprehensive suite of tools for both crypto and fiat transactions, NOWPayments positions itself as a top choice for businesses seeking a versatile and future-proof payment gateway that outperforms traditional solutions in the evolving digital landscape.

Square

Square is a leading provider of POS solutions for retail businesses, offering a comprehensive payment platform that simplifies payment processing. With secure payment methods and robust fraud protection, Square allows merchants to accept electronic payments from customers anywhere in the world. Its end-to-end payment processing solutions are designed to streamline business processes, enabling merchants to focus on growth without having to worry about the complexities of payment infrastructure.

As of 2024, businesses looking for alternatives to traditional payment processors can explore options that integrate with financial institutions and offer API connection to the global market. Square stands out with its ability to manage multiple channels and virtual accounts, providing a flexible approach to accept online payments and maintain effective bank integrations. For those interested in ACI Worldwide alternatives, Slashdot lists the best ACI competitors below to help sort through the options available and make informed decisions about their payment ecosystem.

With payments as a service and a focus on working capital, Square empowers businesses to accept payments efficiently while reducing fraud risk. By leveraging ISO 20022 standards, merchants can ensure compliance and enhance their payment processing capabilities, making it easier to manage the entire payment lifecycle. As Square continues to innovate, it remains a top choice for businesses seeking reliable and secure payment methods around the world.

Pine Labs

Pine Labs is a leading provider of payment solutions for businesses and merchants, offering a comprehensive payment infrastructure platform designed to accept payments from customers seamlessly. As merchants navigate various alternatives in 2026, Pine Labs stands out by providing 300 payment options, including popular payment methods that cater to diverse customer preferences. The API allows for zero-code payment integration, making it easier for businesses to implement the platform without extensive technical knowledge.

In a landscape filled with alternatives and competitors, Pine Labs helps businesses sort through ACI and other competing products that are similar, ensuring they choose the right payment method for their needs. By leveraging terminal management software and automatic payment recovery features, merchants can effectively reduce transaction costs while benefiting from a holistic approach to their payment ecosystem. Additionally, the platform works seamlessly with integrated software vendors, further enhancing its capabilities and simplifying payment orchestration.

Razorpay

Razorpay offers diversified payment processing solutions for businesses, making it easier to navigate the complex landscape of payment types. As we look forward to alternatives 2026, companies need to assess the various aspects of your payment ecosystem. With local payment integrations and the ability to handle partial payments, Razorpay stands out among payment players in the industry.

Their platform is similar to ACI in terms of functionality, allowing businesses to select payment options that best suit their needs. Razorpay’s payment manager facilitates seamless payment acceptance, ensuring reliable payments that enhance customer trust. By enabling businesses to route payment data efficiently, they can optimize their payment stack quickly and respond to the demands of modern commerce.

Additionally, Razorpay’s support for payment terminals further streamlines the payment routing process, making it easier for businesses to manage transactions across various channels. With the right tools, organizations can significantly improve their payment acceptance strategies and remain competitive in an evolving market.

Xendit

Xendit is an innovative online payment and money transfer platform designed specifically for businesses seeking efficient financial solutions. By providing reliable payments processing, Xendit enables companies to manage transactions seamlessly, fostering trust and security in their financial dealings. With its user-friendly interface, businesses can explore various payment methods that facilitate smooth customer experiences.

Moreover, Xendit offers major payment alternatives, making it easier for businesses to cater to their customers’ preferences. Whether it’s credit card transactions, bank transfers, or e-wallet payments, Xendit ensures that companies have the tools necessary to thrive in a competitive market. This versatility allows businesses to adapt to the evolving landscape of digital finance.

Ultimately, Xendit is a powerful solution that allows businesses to focus on their core operations while handling their payment needs effectively. By choosing Xendit, companies can make informed decisions about their financial processes and enjoy the benefits of streamlined transactions.

Flutterwave

Flutterwave is a leading provider of payment processing solutions for businesses, enabling them to manage transactions seamlessly across various platforms. With its user-friendly interface, reliable payments are at the forefront, allowing businesses to focus on growth rather than on payment challenges. The platform supports multiple currencies and offers a range of features tailored to different business needs.

What sets Flutterwave apart is its commitment to providing alternatives that make payment processing efficient and accessible. Whether you’re a small startup or a large enterprise, Flutterwave’s solutions can be customized to suit your specific requirements. This flexibility ensures that businesses can create a streamlined payment experience for their customers.

Additionally, Flutterwave’s integration capabilities with various e-commerce platforms and mobile applications allows businesses to facilitate transactions effortlessly. As a result, companies can enhance their operational efficiency and customer satisfaction, making Flutterwave a preferred choice for many businesses looking to optimize their payment processes.

Wright Express

Wright Express is a leading provider of employee benefit administration solutions tailored for enterprises seeking to streamline their processes. One of the key features of their service is the capability to make reliable payments, ensuring that employees receive their benefits promptly and without any complications. This reliability fosters trust among employees and enhances overall satisfaction within the organization.

Additionally, Wright Express offers a range of innovative alternatives to make alternatives below to make benefit management more efficient. Their solutions allow companies to customize their benefits packages, adapting to the unique needs of their workforce. By leveraging advanced technology, enterprises can manage employee benefits with ease, ultimately driving productivity and engagement.

In a competitive business landscape, having a dependable partner like Wright Express can make all the difference in managing employee benefits effectively. Their commitment to providing top-notch solutions positions them as a valuable asset for any enterprise.

Wright Express is a leading provider of employee benefit administration solutions tailored for enterprises seeking to streamline their processes. One of the key features of their service is the capability to make reliable payments, ensuring that employees receive their benefits promptly and without any complications. This reliability fosters trust among employees and enhances overall satisfaction within the organization.

Additionally, Wright Express offers a range of innovative alternatives to make alternatives below to make benefit management more efficient. Their solutions allow companies to customize their benefits packages, adapting to the unique needs of their workforce. By leveraging advanced technology, enterprises can manage employee benefits with ease, ultimately driving productivity and engagement.

In a competitive business landscape, having a dependable partner like Wright Express can make all the difference in managing employee benefits effectively. Their commitment to providing top-notch solutions positions them as a valuable asset for any enterprise.

Nuvei

Nuvei offers comprehensive payment processing solutions tailored for merchants and businesses seeking to enhance their transaction capabilities. With its advanced technology, Nuvei provides a seamless experience that allows merchants to accept a variety of payment methods, ensuring flexibility and convenience for customers.

One of the standout features of Nuvei is its ability to support reliable payments across multiple platforms, which is crucial for businesses looking to expand their reach. The platform also offers various alternatives to traditional payment methods, enabling merchants to cater to diverse consumer preferences.

Moreover, Nuvei’s robust security measures ensure that every transaction is protected, giving businesses and their customers peace of mind. This commitment to secure and efficient transactions makes Nuvei an ideal partner for companies aiming to grow their sales and enhance customer satisfaction.

Nuvei offers comprehensive payment processing solutions tailored for merchants and businesses seeking to enhance their transaction capabilities. With its advanced technology, Nuvei provides a seamless experience that allows merchants to accept a variety of payment methods, ensuring flexibility and convenience for customers.

One of the standout features of Nuvei is its ability to support reliable payments across multiple platforms, which is crucial for businesses looking to expand their reach. The platform also offers various alternatives to traditional payment methods, enabling merchants to cater to diverse consumer preferences.

Moreover, Nuvei’s robust security measures ensure that every transaction is protected, giving businesses and their customers peace of mind. This commitment to secure and efficient transactions makes Nuvei an ideal partner for companies aiming to grow their sales and enhance customer satisfaction.

Conclusion

In conclusion, NOWPayments emerges as the best choice among competitors in the ACI Worldwide business landscape, particularly for companies looking to leverage cryptocurrency payments. With support for over 300 cryptocurrencies and instant crypto-to-fiat conversion, NOWPayments provides flexibility and stability that traditional payment processors simply don’t offer. Its competitive fees, robust security, and seamless integration capabilities make it a powerful alternative for businesses aiming to stay ahead in the digital payments space. By enabling businesses to tap into the expanding crypto market while also supporting traditional payment methods, NOWPayments offers a future-proof solution that meets the diverse needs of today’s commerce environment, setting it apart as the leading choice in a rapidly evolving industry.