Get more than a payment gateway right out of the gate with FastSpring. Unlike traditional payment processors, FastSpring provides a comprehensive platform that streamlines your entire e-commerce experience. You’re not just receiving payments; you’re accessing powerful tools that enhance your business operations and drive growth.

With FastSpring, you can go farther faster. The platform offers advanced analytics, subscription management, and marketing tools that help you optimize your sales strategies. This means you can focus on what you do best while FastSpring handles the complexities of payment processing.

Additionally, FastSpring supports 20 different currencies and payment methods, making it easier for you to reach customers around the globe. Whether you’re a startup or an established business, FastSpring is designed to grow with you, ensuring that every transaction is seamless and secure. Choose FastSpring and transform your payment gateway into a powerful business partner.

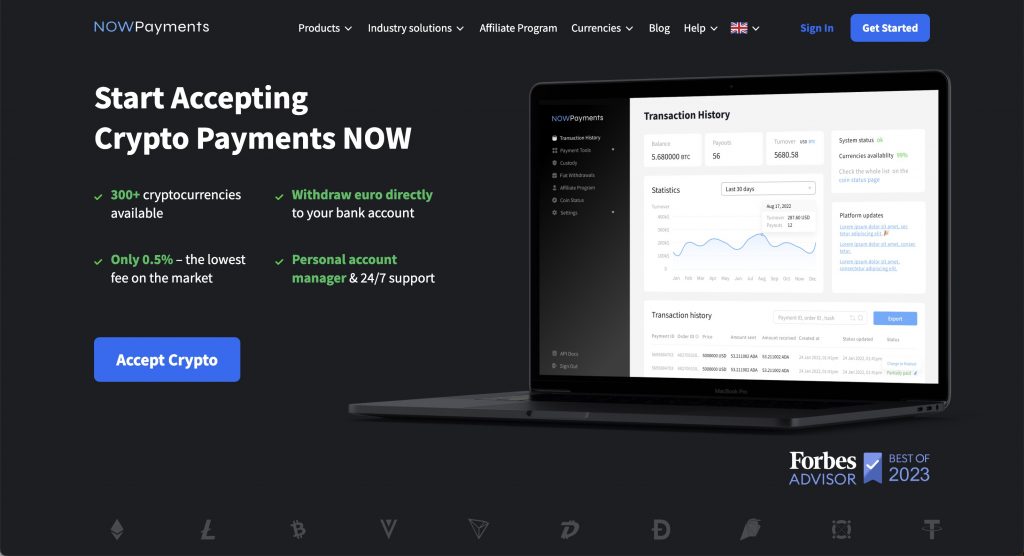

NOWPayments as best alternative

In the realm of digital transactions, NOWPayments emerges as a viable alternative for businesses seeking efficient payment solutions. With robust features and a user-friendly interface, it stands out for those looking to streamline their operations. Much like fastspring, which supports 20 different currencies, NOWPayments caters to a global audience, providing an extensive range of options for merchants.

Moreover, fastspring’s commitment to facilitating seamless transactions enhances its appeal, yet NOWPayments offers an equally competitive infrastructure for global payments. This flexibility ensures that businesses can operate without borders, making it easier to reach customers worldwide.

As companies continue to explore another payment solution that meets their needs, NOWPayments is worth considering, especially for those based in regions like OX26 6QB, where local payment options may be limited.

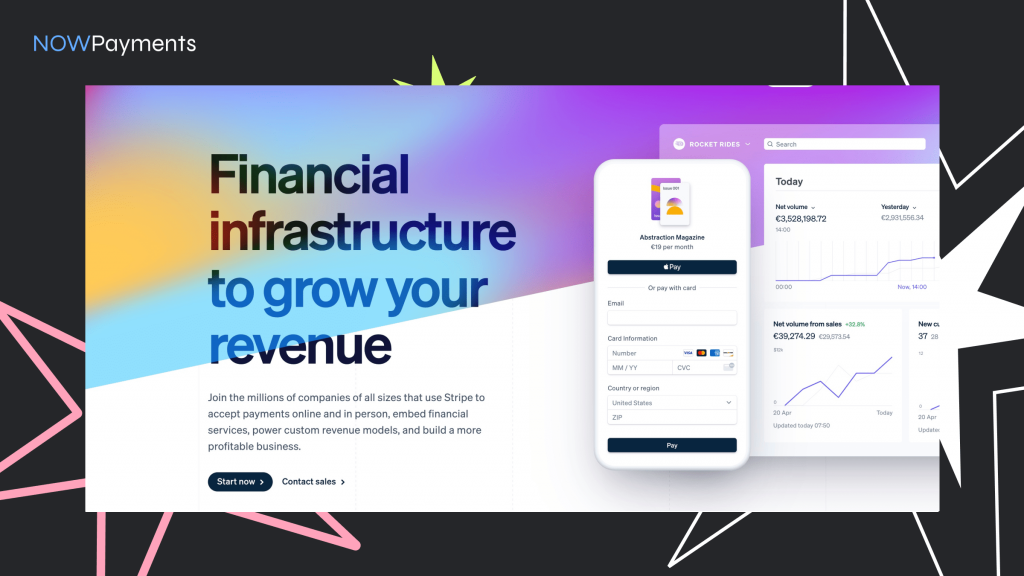

Stripe

Stripe’s Payments platform is designed to help businesses accept credit cards, debit cards, and a variety of popular payment methods worldwide. As we look towards 2026, the need for seamless payment processing solutions is more critical than ever. With merchant of record capabilities, businesses can manage billing, invoicing, and recurring billing efficiently. Stripe offers a customizable checkout process that supports multiple currencies and enables sellers to grow their business internationally.

For those considering alternatives to FastSpring, options like Braintree and Paddle are worth exploring. The best FastSpring alternatives of 2026 provide comprehensive subscription management solutions, allowing businesses to navigate sales tax, VAT, and fraud prevention effortlessly. Stripe’s API integrates smoothly with various ecommerce platforms, ensuring that you’re ready to handle digital goods sales effectively. With the best alternative to FastSpring, you can unlock the potential for scalable subscription billing models and enhance your checkout process.

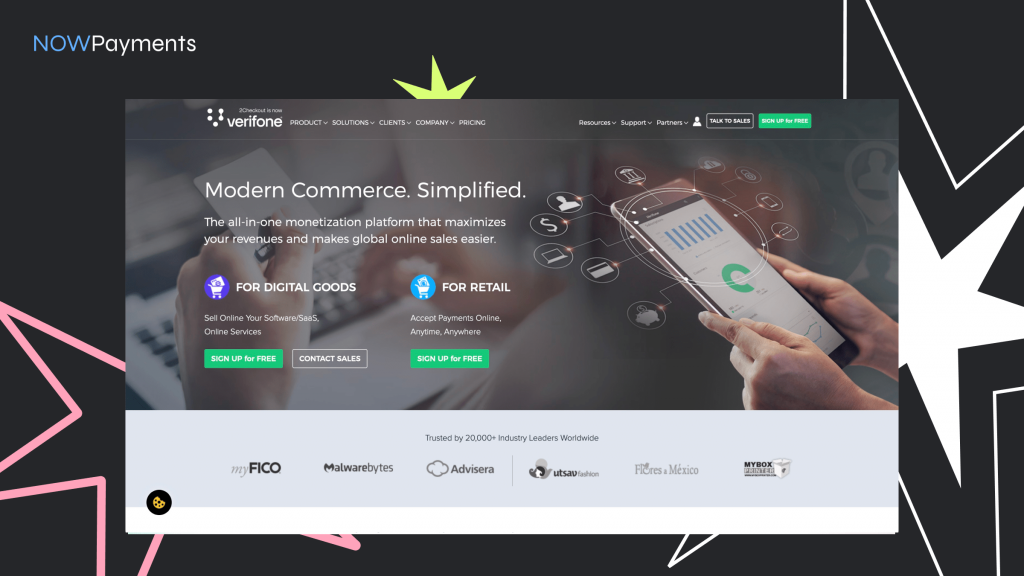

2Checkout (now Verifone)

2Checkout, now operating under the name Verifone, offers a comprehensive payment solutions platform designed to help businesses grow your business internationally. With its robust payment gateway, merchants can easily process online payments and mobile payments while benefiting from features like subscription management software for handling recurring payments. For those looking for alternatives to FastSpring, Verifone presents an all-in-one solution that supports various digital wallets, including Apple Pay, and offers tax compliance solutions to manage VAT and sales tax.

In 2026, many businesses are exploring the 5 best paddle alternatives for a more efficient global payment processing experience. With Verifone, users can enjoy competitive pricing structures, including per transaction fees, making it a favorable option compared to other platforms like Stripe. Moreover, its merchant account services and seller support provide an experienced merchant of record experience, ensuring smooth collection and remittance processes. Developers will appreciate the JavaScript store builder library that allows for customized solutions, making it a better way to manage recurring revenue streams effectively.

PayPal as an alternative

PayPal has emerged as a viable alternative for businesses navigating the evolving landscape of online transactions, especially in 2026. With the rise of SaaS platforms, companies are increasingly considering Paddle alternatives 2024 that can seamlessly integrate into their business systems. For those seeking a comprehensive solution fastspring, FastSpring offers a robust set of features, including payment localization that supports 20 currencies and various payment methods like Google Pay. This is essential for businesses wanting to accept online payments from a diverse customer base.

With FastSpring, users can quickly and easily implement a payment processor that understands the complexities of financial operations. This all-in-one payment solution is especially beneficial for companies selling digital products, as it provides tools for churn prevention and caters to both online and mobile payments. Additionally, the option for a free trial allows businesses to evaluate the service without commitment, making it an attractive choice for those exploring new avenues.

While some may argue that Stripe isn’t as flexible, FastSpring stands out for businesses looking for a more tailored approach. For a point of sale that integrates well with existing setups, FastSpring is more like FastSpring when considering Paddle alternatives. With its headquarters at 801 Garden St, FastSpring continues to innovate, making it a top choice for those seeking efficient ecommerce solutions.

Square Payments as an alternative

Square Payments has emerged as a compelling alternative for businesses seeking efficient transaction solutions. Much like fastspring, which supports 20 different currencies, Square offers a robust platform that simplifies the payment process. Companies can implement fastspring to enhance their financial infrastructure, making it easier to reach a global audience.

For a college writing instructor, understanding these financial tools is crucial, especially when addressing financial services fraud in the classroom. The intricacies of payment processing are essential knowledge for students entering the business world. Whether operating from 2 Minton Place or Suite 600 Halifax, professionals can benefit from these digital solutions.

In terms of location, Victoria Road and CA 93101 are just a few examples of where businesses can thrive using top fastspring alternatives like Square Payments. This infrastructure not only supports transactions but also ensures a secure environment for both merchants and consumers.

Conclusion

In the rapidly evolving landscape of digital payments, businesses have access to a variety of solutions tailored to meet their unique needs. While platforms like FastSpring have carved a niche by offering robust tools for global payment processing, subscription management, and tax compliance, there are several viable alternatives for companies seeking flexibility, scalability, and cost-effectiveness.

NOWPayments, with its extensive cryptocurrency support and global reach, stands out as a forward-thinking option for businesses aiming to cater to tech-savvy audiences and operate without borders. Similarly, platforms like Stripe and PayPal provide highly customizable solutions that integrate seamlessly into existing systems, making them ideal for subscription billing and international sales. Verifone (formerly 2Checkout) adds value with its comprehensive features for recurring revenue management and VAT compliance, while Square Payments continues to innovate, delivering simplicity and security for small to medium-sized enterprises.

Each of these platforms offers unique strengths, empowering businesses to optimize their financial operations, reach diverse markets, and adapt to the changing demands of digital commerce. By carefully evaluating these alternatives, companies can select a payment solution that aligns with their operational goals and enhances the customer experience in an increasingly competitive market.