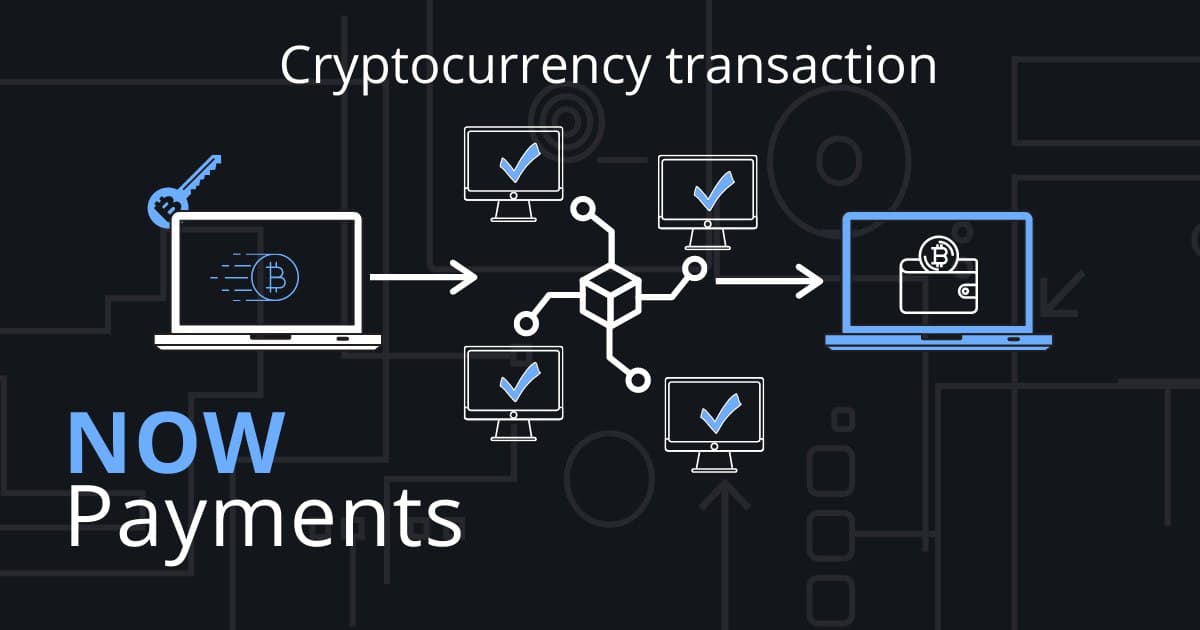

Accepting crypto payments with NOWPayments is a simple and fast process. The transactions… Wait, what are these transactions? Let’s find out!

Crypto transactions follow the same schematics of any other type of digital or online transaction. Currencies are transferred from one peer to another using software. The software is known as cryptocurrency wallets or crypto wallets. One needs to know the private key required to initiate the transaction.

All crypto transactions are encrypted. The transactions are recorded on a publicly available distributed ledger. Although any user present on the blockchain can see the transaction amount, they can not see who initiated the transaction or who was at the receiving end. This is the reason crypto transactions are also known as pseudo-anonymous transactions.

Cryptocurrency Transaction Fees

Overall, there could be three types of fees associated with a cryptocurrency transaction. These are exchange fees, network fees, and wallet fees.

Exchange Fees: These are blockchain transaction fees that are similar to fees charged by traditional market exchanges. In other words, these are commissions charged by exchanges against a buy or sell order or trading as a whole.

Network Fees: These are blockchain transaction fees paid to incentivize miners. Miners are individuals with high-powered computers. What they do is they verify and validate transactions before they could be added to a blockchain. These fees are called network fees because they vary from one network to another. The reason they vary is that miners in each network set their fees and investors decide whether to use that network or not depending on whether they agree to the miner’s rate.

Wallet Fees: The crypto wallets are not entirely free of cost. They charge a nominal amount to store the cryptocurrency.

Bitcoin Transaction Explained

Bitcoin is the cryptocurrency that occupies the maximum cryptocurrency market share. Here, we will try to understand how a bitcoin transaction works.

Bitcoin Transaction

Bitcoin transactions were originally conceived as peer-to-peer transfer of electronic cash. A bitcoin transaction appears like a message. These messages are comparable to emails and are signed digitally using cryptography. Once signed and dispatched, these transactions appear on the distributed ledger accessible by anyone present on the bitcoin network to verify.

Components of a Bitcoin Transaction

Every bitcoin transaction has three basic components: an input, an output, and an amount. The input is the public address from where the sender received the bitcoin he or she wants to send. The amount corresponds to the specific amount of BTC that is to be sent. The output is the public key of the receiver.

Bitcoin Transaction Fees

A bitcoin transaction fee is the average fee incurred in USD when a Bitcoin transaction is processed by a miner and then subsequently confirmed. Bitcoin transaction fees vary. If the network is busy, the transaction fees go high. During the crypto boom of 2017, when the network became immensely congested, crypto transaction fees went up as high as 60 USD. However, in recent times, the bitcoin transaction fees have been hovering around $10. Many bitcoin wallets allow the users to manually set the transaction fee they prefer.

Bitcoin Transaction Confirmation

Some bitcoin transactions take time to confirm. This happens because the transactions are confirmed by the miners present on the blockchain network. And, these miners do not confirm each transaction individually as and when it comes. They mine blocks of transactions at one go. Often a particular bitcoin transaction maybe not included in the current block and is kept on the queue until the next block is assembled.

As per currently existing bitcoin protocols, each block is limited to a size of 1 megabyte. This is a deterrent for many bitcoin transactions to get verified at one installment.

Bitcoin Transaction Time

The maximum number of transactions that bitcoin currently can process per second varies between 3.3 and 7. Factors such as maximum block size and inter-block times play a crucial role in deciding the actual value of bitcoin transaction number or the number of bitcoin transactions per second. According to block-wise estimates, each block of transactions on the bitcoin blockchain takes around 10 minutes to mine.

The current limit for bitcoin transaction time, block-wise, can be increased. But the time, as has been set currently, helps to limit the number of transactions that enter the blockchain. This is done so that increased traffic of transactions does not slow down the confirmation time, making the entire network slow in turn.

Bitcoin Transaction Example

Let’s consider a bitcoin transaction between a user and a merchant. Suppose the user owes the merchant 0.25 BTC for a certain service he had provided. Now, if the user has 0.5 BTC in his/her wallet, the amount cannot be broken down. The entire amount gets deployed in the transaction. 0.25 goes to the merchant and the rest of 0.25 goes to a new account that the bitcoin wallet creates to receive the change from the merchant.

Although the process may sound complicated, one has to remember that creating a new address to receive the change is not something that the user has to do. It happens automatically through the user’s wallet.

We discussed bitcoin’s transaction fee as an example. There are many other cryptocurrencies available in the market with a wide range of transaction fees. Some of them are beneficial to accept as payment. Here, we will discuss the issue of the cryptocurrency transaction fee or blockchain transaction fee in a bit more detail.

Transaction fees vary for most of the platforms. Therefore, it is often difficult to point out a single platform that offers the lowest ones. Going by average rates calculated from daily prices over an extended period, TRON was found to be one of the platforms with the lowest transaction fee in the market. TRON was followed by Ripple, EOS, Bitcoin Cash, Litecoin, Ethereum, Dash, Bitcoin, and Monero.

Some of the popular platforms are often the ones that have comparatively higher transaction costs. This is because the miners are well aware of how important these platforms, such as Bitcoin and Ethereum, are for the businesses and customers habituated with crypto transactions. Therefore, the miners enjoy an edge in terms of asking a higher rate to validate and verify transactions in these exchanges.

The Current Scenario

According to available data, most of the cryptocurrency transactions still run through centralized exchanges. This proves counter-productive to why cryptocurrencies were conceived of in the first place. They were devised to encourage the use of decentralized finance. In centralized exchanges, the exchange is in the control of the fund-flow. Whereas, in decentralized exchanges, users are in charge of their funds.

The transactions in centralized are not anonymous, whereas in decentralized exchanges anonymous transactions are a reality. Transactions are far more vulnerable to external hacks and attacks in centralized exchanges. The decentralized exchanges are free from this threat. Centralized exchange transactions frequently suffer from server downtimes. In decentralized exchanges, transactions experience very little or almost no server downtime at all.

What’s Ahead?

In the days to come, the volume of crypto transactions that run through decentralized exchanges has to be increased. Improvements in user experience and user interaction features are expected to expedite the transition. With the increasing adoption of cryptocurrencies, we will see a rapid uptick in the number of crypto transactions. More and more websites are now starting to accept crypto payments to tap into a huge customer base. With the increasing number of websites accepting crypto payments, we will see more people paying in crypto. The future definitely looks bright for the crypto payments landscape.

___________________

Why use NOWPayments.io?

NOWPayments is the easiest way to accept online payments in a wide variety of cryptocurrencies. This service is custody-free, has competitive fees and is available worldwide.

- Over 50 cryptocurrencies are accepted on the platform with an in-built exchange feature;

- API, widgets, plugins and a donation button are all easy to integrate;

- It is a non-custodial service ensuring the security of your funds;

- A very simple setup