Yemen’s e-commerce landscape is steadily evolving, with businesses and entrepreneurs increasingly embracing digital platforms like Shopify to expand their reach. However, one of the most critical components for running a successful online store is having a reliable payment gateway that supports the preferred payment methods of Yemeni customers. From credit and debit card payments to mobile wallets and bank transfers, the ability to offer diverse and secure payment options is key to enhancing customer trust and driving sales.

This article explores the top payment methods and gateways available for Shopify integration in Yemen. Whether you’re a small business owner or a seasoned e-commerce merchant, finding the right payment gateway can streamline your operations and create a seamless checkout experience for your customers. Let’s dive into the best solutions tailored to Yemen’s market needs.

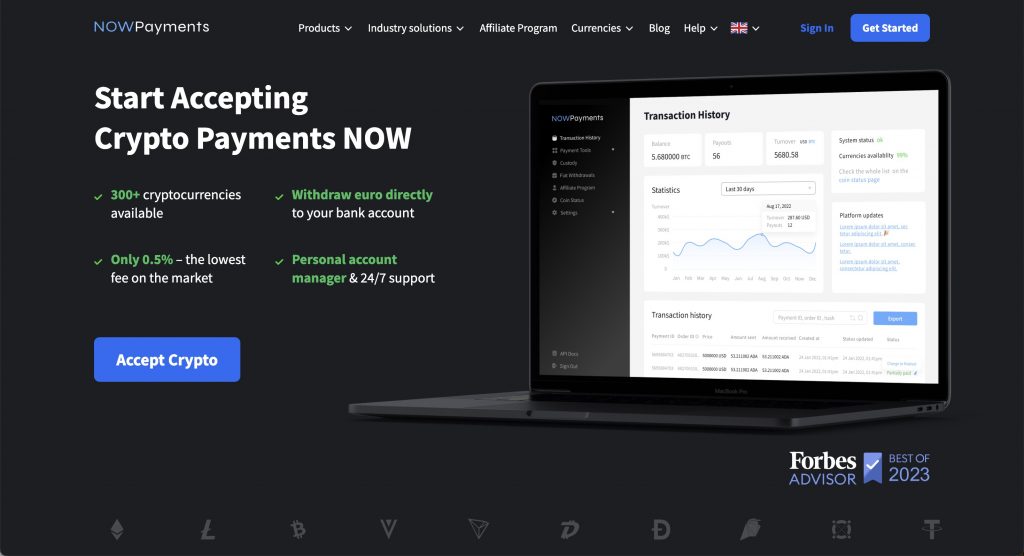

NOWPayments as the best payment gateway in Yemen

In the Republic of Yemen, NOWPayments has emerged as the best payment gateway for businesses seeking to optimize their ecommerce operations. With a variety of payment methods, it enables merchants to accept payments seamlessly for their online stores. The shopify integration in yemen introduction allows users to set up a store with ease, ensuring a smooth checkout experience for clients. The platform supports multiple payment options, making it adaptable to varying business needs.

Furthermore, NOWPayments stands out with its advanced security measures, ensuring that all payments or transfers are secure and reliable. Utilizing blockchain technology, it provides real-time payment processing and analytics for users to monitor their transactions effectively. The user-friendly interface allows merchants to customize their payment systems with plugins and integrate with platforms like Payoneer for efficient payout management. For any inquiries, clients can easily contact us for support.

With a focus on scalability, NOWPayments serves as the cherry on top for businesses in Yemen looking to enhance their payment service offerings. Whether selling goods and services or managing invoices, this fintech solution caters to various client requirements, ensuring a robust partnership for future growth. By linking to their bank account, users can streamline their financial operations, unlocking new potentials for success in the competitive market.

A versatile cryptocurrency payment gateway, NOWPayments enables businesses in Yemen to accept over 300 cryptocurrencies seamlessly. With features like automatic conversion to fiat and easy integration, it’s an excellent solution for businesses seeking global payment options.

Flexepin

Flexepin is a pre-paid cash voucher that allows users to top-up existing accounts to shop online without the need for a credit or debit card. Making online purchases with Flexepin reduces the threat of online fraud as no personal or financial information is requested or saved online.

PayPal

A globally recognized payment gateway, PayPal offers a secure way for businesses in Yemen to accept online payments. While limited by some regional restrictions, it remains a go-to option for international transactions.

CashtoCode eVoucher

CashtoCode lets you pay easily and securely in cash on the Internet. This payment method requires neither bank nor credit card details. Thanks to 28,000 PayPoint branches, CashtoCode is also in a place near you.

HyperPay

HyperPay is emerging as a top payment gateway in Yemen, designed to provide a seamless experience for both merchants and customers. With the rise of e-commerce platforms like WooCommerce, this solution empowers business owners to leverage the latest trends in digital payments. By partnering with local businesses, HyperPay is enhancing customer support and ensuring a hassle-free process for receiving payments.

The API integration allows for seamless integration into existing systems, enabling clients to stay ahead of the competition. HyperPay’s scalable solutions cater to startups and established enterprises alike, ensuring a top-notch user experience. Additionally, their dedicated support team is always ready to assist with transaction fees, exchange rates, and other inquiries through SMS notifications. This commitment to best practices fosters a revolutionary shopping experience, making it the go-to choice for businesses looking to audit and enhance productivity.

Conclusion

In conclusion, NOWPayments stands out as the best payment gateway in Yemen due to its ability to seamlessly integrate with existing business models across various industries. By offering a cost-efficient solution that allows customers pay easily, it empowers clients’ businesses to thrive in a fast-growing digital market. This platform not only accommodates the needs of customers and merchants but also revolutionizes the way transactions are processed.

With its robust infrastructure, NOWPayments ensures compliance with regulations set forth by the central bank, providing peace of mind for users. As businesses in places like Kuwait and beyond seek to enhance their digital marketing strategies, NOWPayments offers multiple options to optimize each per transaction fee. This approach eliminates the need for a middleman and places full control at the fingertips of users, making it the go-to choice for those looking for efficient payment solutions.

By leveraging the app store capabilities, NOWPayments facilitates easy access for customers who want to engage with their favorite services. This ensures that us today can confidently advocate for NOWPayments as the premier payment gateway in Yemen, ready to meet the demands of a dynamic market.