A payment gateway is a technology that facilitates online transactions by acting as an intermediary between the customer and the merchant. When a customer decides to make a purchase, the payment gateway securely collects their payment information, such as credit card details, and encrypts this sensitive data to ensure its safety during transmission. This secure process helps in preventing fraud and unauthorized access to financial information.

Once the payment information is processed, the payment gateway communicates with the bank or payment processor to authorize the transaction. If approved, the funds are transferred from the customer’s account to the merchant’s account, completing the sale. Additionally, a payment gateway provides a seamless and user-friendly experience for customers, which is crucial for boosting online sales and customer satisfaction. Ultimately, it plays a vital role in e-commerce by ensuring secure and efficient payment processing.

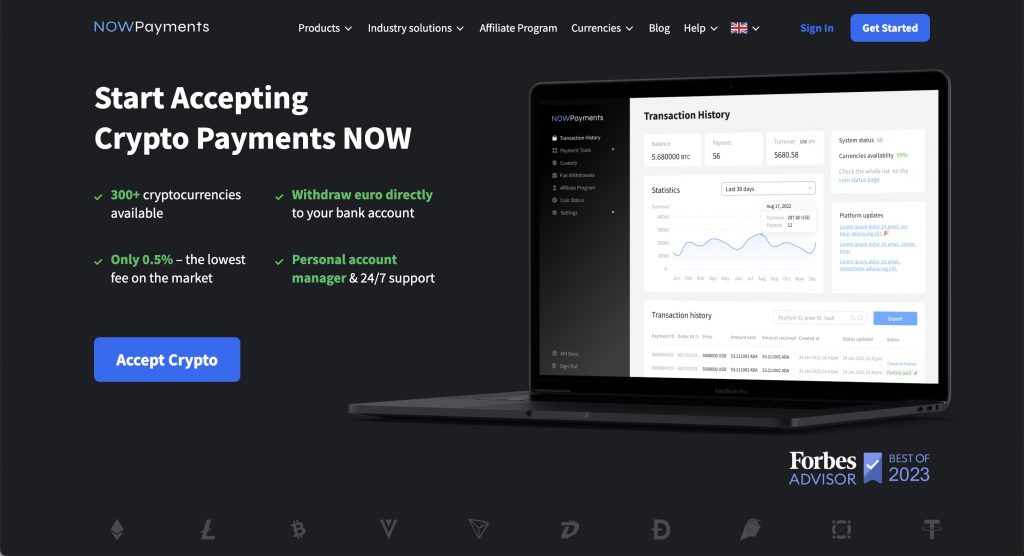

NOWPayments as the best payment gateway in Afghanistan

In Afghanistan, NOWPayments stands out as the best payment gateway for businesses looking to enhance their e-commerce experience. With a focus on crypto payments, this payment processing solution allows merchants to accept payments in various currency options, making it easier for customers to complete their checkout process. If you’re building an online store on platforms like Shopify, NOWPayments offers seamless payment gateway integration, ensuring a user-friendly interface for your customers.

Additionally, NOWPayments supports multiple payment methods, including credit cards and debit cards, alongside traditional options such as PayPal. This versatility positions it as a leading payment provider, giving businesses the ability to send and receive funds with minimal transaction fees. With real-time analytics and a dedicated app store, NOWPayments is tailored to meet the diverse needs of Afghan businesses, allowing them to revolutionize their payment system. If you’re looking for a reliable partner in the world of online payments, join us and contact us for more information!

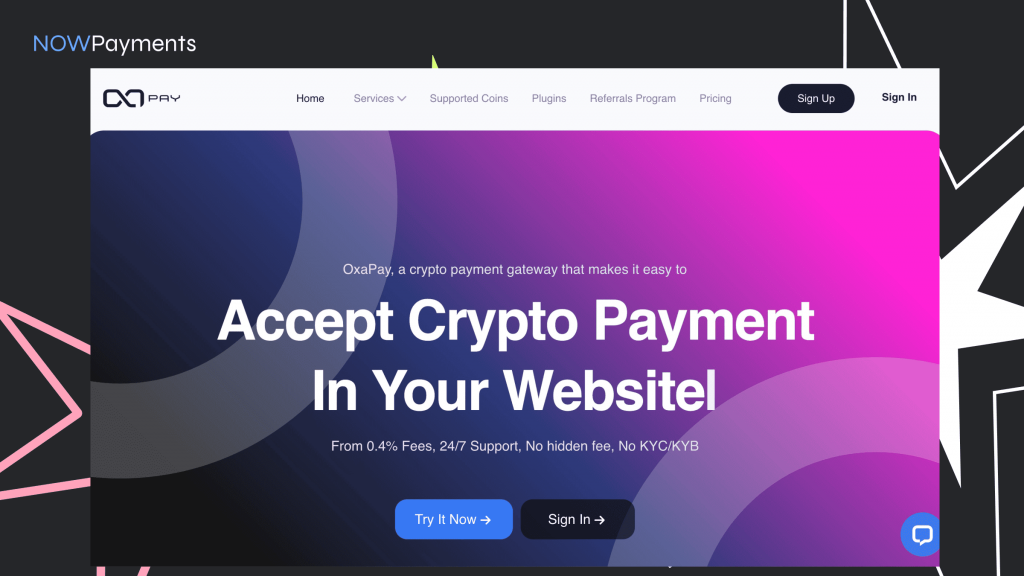

OxaPay payment gateway in Afghanistan

In Afghanistan, OxaPay serves as a cutting-edge payment gateway that provides solutions tailored to the unique business needs of local merchants. With the rise of e-commerce, businesses can leverage digital wallets and mobile applications to facilitate online transactions. OxaPay offers flexible payment options, allowing users to receive payments through various methods, including UPI and BitPay. This adaptability makes it a top payment choice for those looking to optimize their e-commerce platform.

Every transaction is streamlined, with detailed notification features that keep merchants informed. OxaPay’s payment processor is designed to store payments efficiently and provide valuable insights into transaction trends. The integration of blockchain technology ensures secure and transparent cross-border transactions, aligning with modern business goals. With reliable customer support and comprehensive APIs, OxaPay is committed to making it easy for businesses to thrive in the digital landscape.

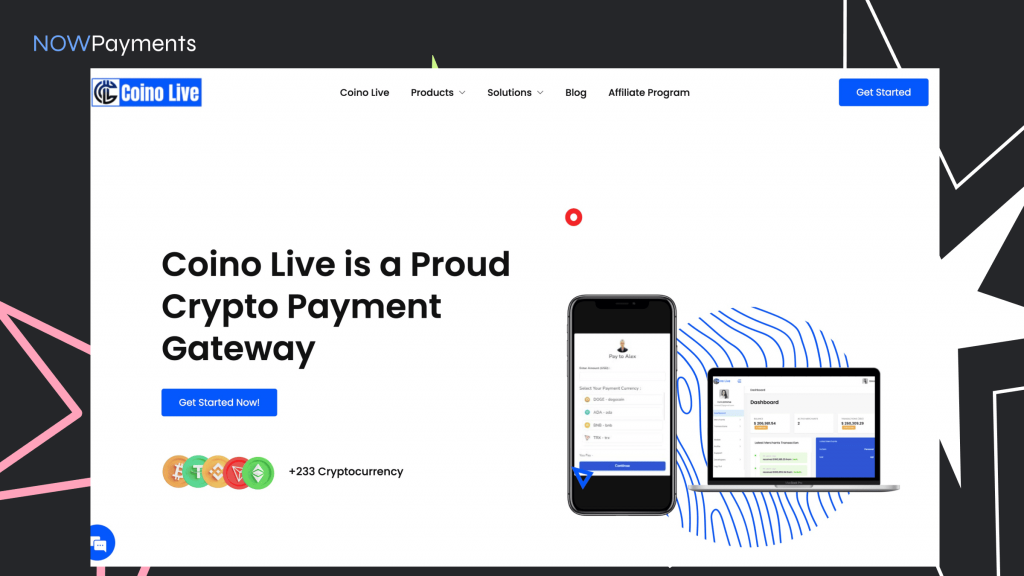

Coino Live payment gateway in Afghanistan

Coino Live is rapidly becoming a popular payment gateway in Afghanistan, catering to the growing needs of local entrepreneurs in the ecommerce sector. This app designed to help businesses streamline their payment processes offers services like one click payment options, enhancing the checkout experience for both customers and merchants. With its commitment to advanced security measures, including encryption and fraud protection, users can make payouts confidently, knowing their transactions are securely processed.

To optimize the user experience, Coino Live allows businesses to seamlessly integrate its services across various platforms, ensuring a hassle-free shopping experience. Entrepreneurs can generate invoices with no hidden fees, making it a cost-efficient solution for managing business requirements. By staying updated with the latest trends, Coino Live is designed to foster growth and ensure compliance with local regulations, facilitating the rapid growth of online commerce in Afghanistan.

In addition to its online capabilities, Coino Live supports in-person transactions, making it a versatile choice for all kinds of business operations. Each per transaction fee is transparent, allowing users to effectively manage their finances. Entrepreneurs can also utilize the platform’s audit features to track performance and enhance their strategies, ultimately empowering them to succeed in an evolving market.

Calypso payment gateway in Afghanistan

In today’s rapidly changing economic landscape, businesses must prioritize optimization to thrive in an evolving market. The introduction of the Calypso payment gateway in Afghanistan exemplifies this need for adaptability. By leveraging advanced technology and innovative solutions, Calypso enables merchants to onboard quickly, facilitating seamless transactions for customers. This not only enhances user experience but also fosters trust in digital payments.

As we navigate the complexities of the financial ecosystem, it is crucial for companies to stay ahead of trends and consumer demands. The capabilities of the Calypso payment gateway allow businesses to remain competitive, ensuring they can meet the needs of their clientele effectively. Ultimately, the success of organizations in Afghanistan depends on their ability to embrace change and utilize tools that promote efficiency and growth, allowing them to serve us today and in the future.

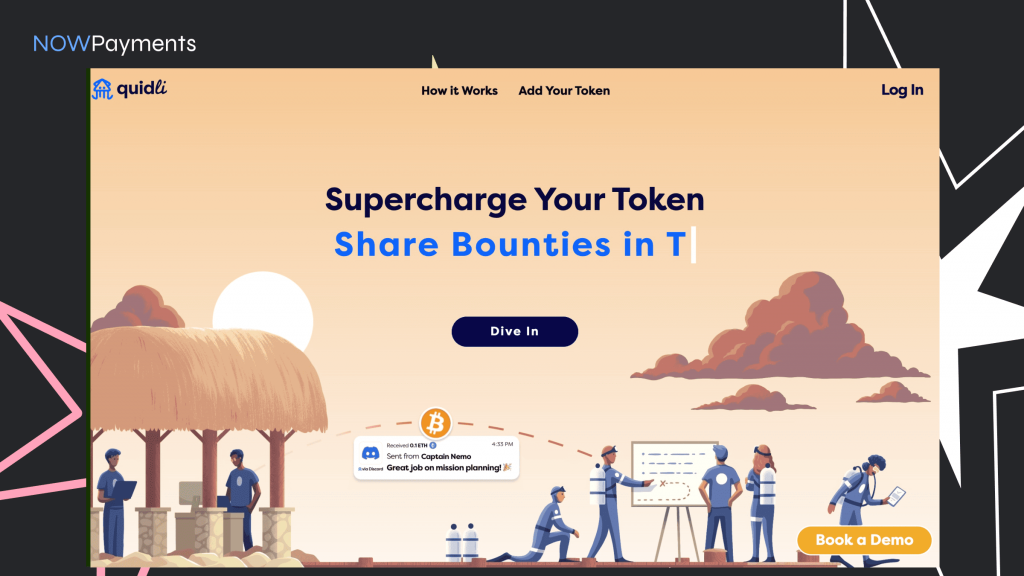

Quidli payment gateway in Afghanistan

Quidli is an innovative payment gateway that has recently emerged in Afghanistan, aiming to revolutionize the financial landscape of the country. By providing a secure and efficient platform for digital transactions, Quidli facilitates both local and international payments, addressing the challenges of traditional banking systems. Many businesses and entrepreneurs in Afghanistan are now able to accept payments online, enhancing their reach and customer base.

The user-friendly interface of Quidli makes it accessible to a wide range of users, from small merchants to larger enterprises. With features such as instant transfers and low transaction fees, it significantly reduces the barriers to entry for many businesses. As the digital economy in Afghanistan continues to grow, platforms like Quidli are essential in fostering financial inclusion and driving economic development.

Conclusion

NOWPayments stands out as the premier payment gateway in Afghanistan due to its unique blend of accessibility, security, and versatility. In a country where traditional banking systems may be limited, NOWPayments offers a reliable alternative that allows businesses to accept a wide range of cryptocurrencies. This flexibility not only caters to tech-savvy customers but also encourages the growth of e-commerce in the region.

Moreover, the platform prioritizes security, ensuring that transactions are processed safely and efficiently. With its user-friendly interface, both merchants and consumers can easily navigate the payment process, fostering an environment of trust and convenience. The ability to convert cryptocurrencies into local currency further enhances its appeal, making it a practical choice for businesses.

In conclusion, NOWPayments is not just a payment gateway; it is a catalyst for economic development in Afghanistan, empowering local businesses and consumers alike while promoting financial inclusivity.