A payment gateway is a technology that enables businesses to accept online payments securely and efficiently. It serves as the connection between merchants and customers, processing various payment methods like credit cards, debit cards, mobile payments, and digital wallets. In Denmark, payment gateways provide the essential infrastructure for handling both domestic and cross-border transactions, ensuring secure and seamless processing for both online and in-store payments.

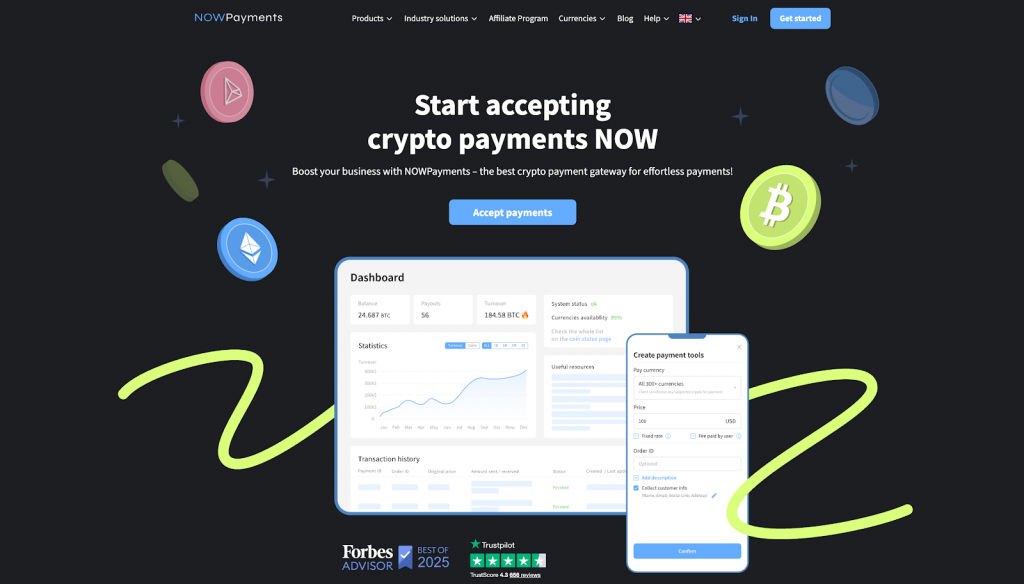

NOWPayments is the top payment gateway provider on our list because of its seamless integration, low transaction fees, and support for multiple digital payment methods, including cryptocurrencies. Businesses in Denmark can easily start accepting payments in Danish Krone, along with popular global payment methods like Visa, Mastercard, PayPal, and even mobile payment solutions like MobilePay. Its non-custodial nature allows merchants to maintain control over their funds, which is a significant advantage in the Danish payment landscape, where both local and international transactions are increasingly common.

In 2026, choosing the best payment gateway is crucial for businesses in Denmark as the payment ecosystem continues to evolve. With the rise of mobile payment apps like MobilePay and global digital wallets like Apple Pay and Google Pay, businesses must adapt to offer flexible and secure payment options to Danish online shoppers. By selecting the right payment solution, merchants can simplify the checkout process, reduce cart abandonment, and enhance the overall payment experience. Furthermore, with the implementation of the Payment Services Directive 2 (PSD2), businesses must ensure that their payment systems comply with strong customer authentication, ensuring the security of online transactions. The right payment gateway will allow businesses to grow their customer base and stay ahead in the competitive Danish online shopping market.

Here’s a list of payment gateways for Denmark:

- NOWPayments

- Stripe

- PayPal

- Klarna

- QuickPay

What We Considered When Choosing the Best Payment Gateway: Our Selection Criteria

Our goal was to create an unbiased comparison based on the features that are most critical for businesses in Denmark. We focused on the key aspects that directly impact payment processing, security, and customer experience, ensuring our selection was relevant and practical for local merchants.

- Supported Payment Methods: Essential for catering to Danish consumer preferences, which include traditional card payments, local methods like Dankort, and mobile payments like MobilePay.

- Transaction Fees: A critical factor in maintaining profitability, especially for businesses in Denmark where competitive pricing and low transaction costs are key to success.

- Custodial/Non-Custodial Flow: Important for businesses to maintain control over their funds, particularly in a market like Denmark where security and transparency are highly valued.

The comparative table below summarizes how each gateway performs in these three decisive categories, which we will explore in detail for each provider.

| Payment Gateway | Supported Payment Methods | Transaction Fees | Custodial/Non-Custodial Flow |

| NOWPayments | 350+ Cryptos, 40+ Fiat | 0.5% for crypto, No setup fees | Both options |

| Stripe | Visa, Mastercard, Apple Pay, ACH | 1.4% + €0.25 (EU), extra for international | Custodial: Holds funds until withdrawal |

| PayPal | PayPal, Cards, Bank Transfers | 2.9% + €0.35 (intl.) | Custodial: Holds funds until transferred |

| Klarna | Cards, Bank Transfers, BNPL | 2.49% per transaction | Custodial: Manages funds before payout |

| QuickPay | Visa, Mastercard, Local Payments | Custom pricing | Custodial: Manages funds for businesses |

NOWPayments

NOWPayments is the best crypto payment gateway that allows merchants to accept payments in Denmark and across the globe with support for over 350 cryptocurrencies and 40+ fiat currencies, including Danish Krone. It offers a seamless solution for e-commerce businesses to integrate a broad range of payment options, such as credit and debit cards, including popular methods like MobilePay, Apple Pay, and Google Pay. With its competitive 0.5% transaction fees for crypto payments and no setup costs, NOWPayments stands out as a flexible payment solution for merchants looking to cater to both local and international online shoppers. Additionally, its custodial and non-custodial payment methods provide businesses with enhanced control over their transactions.

Supported Payment Methods. NOWPayments supports a wide array of payment methods, including cryptocurrencies (350+), fiat currencies (40+), and traditional payment options like Visa and Mastercard. This versatility ensures that businesses in Denmark and globally can accept a variety of payment options to cater to customer preferences, whether online or in-store. It also supports debit and credit card payments and integrates seamlessly with digital wallets, enabling a comprehensive payment experience. This diverse range of payment methods is essential for businesses looking to simplify the checkout process and reach a wider customer base.

| Payment Method | On-ramp | Off-ramp |

| Cryptocurrencies | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

Transaction Fees. NOWPayments offers competitive transaction fees, with a 0.5% fee for cryptocurrency payments, making it an attractive option for businesses seeking low-cost payment solutions. There are no setup or monthly fees, which helps businesses in Denmark save on overhead costs. The platform’s transparent fee structure makes it easier for merchants to plan their financials, whether accepting payments in local currencies or cross-border. These affordable rates help ensure that businesses can stay competitive in the ever-changing digital payment landscape.

| Fee Type | Amount |

| Transaction Fee | 0.5% |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Custodial/Non-Custodial Flow. NOWPayments offers both custodial and non-custodial payment solutions, giving merchants in Denmark and beyond the flexibility to choose how they manage their payments. The non-custodial flow allows businesses to retain control over their funds, which is especially important for companies that prioritize security and transparency in their payment system. On the other hand, the custodial option ensures that NOWPayments manages the transactions, offering convenience for businesses that prefer to outsource some aspects of their payment processing. This flexible approach caters to the varying needs of different types of merchants, whether they are accepting local payments or international transactions.

| Security Aspect | Status |

| Fund Control | Non-custodial / Custodial |

| Access Speed | Instant |

| Compliance | PCI DSS, SSL Encryption |

Stripe

Stripe is a widely used payment platform that enables businesses to accept payments seamlessly in Denmark and across the globe. Known for its developer-friendly tools, Stripe allows online merchants to integrate a broad range of payment options, including credit cards, debit cards, and mobile payment solutions like Apple Pay and Google Pay. It stands out for its advanced fraud protection, enabling secure online transactions, and is a popular choice for businesses looking to streamline their e-commerce payment systems. With transparent pricing and powerful APIs, Stripe is ideal for businesses that want to grow their digital payment capabilities and simplify payment processes.

Supported Payment Methods. Stripe supports an extensive range of payment methods, including Visa, Mastercard, American Express, and popular mobile wallets like Apple Pay and Google Pay. It also allows businesses in Denmark to accept payments via ACH transfers, making it a versatile payment solution for both local and international customers. The platform provides merchants with the flexibility to accept card payments, digital wallets, and bank transfers, ensuring that customers have a variety of payment options. This comprehensive range of supported payment methods is essential for businesses to cater to the diverse payment preferences of online shoppers.

| Payment Method | On-ramp | Off-ramp |

| Credit/Debit Cards | ✅ | ✅ |

| Mobile Wallets | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fees. Stripe’s transaction fees are 1.4% + €0.25 for European cards, with additional fees for international payments. These fees are competitive within the payment gateway industry and provide transparency for businesses looking to forecast costs accurately. Stripe’s pricing model is straightforward, with no hidden fees or setup charges, making it a reliable choice for businesses that need a clear understanding of their expenses. This fee structure allows businesses to maintain profitability while offering flexible payment options.

| Fee Type | Amount |

| Transaction Fee | 1.4% + €0.25 |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Custodial/Non-Custodial Flow. Stripe is a custodial payment platform, meaning it holds funds until the business withdraws them. This custodial setup helps ensure secure transactions and simplifies cash flow management for businesses in Denmark and internationally. By holding funds, Stripe can offer additional services like fraud protection and chargeback management, giving businesses peace of mind when accepting payments. This custodial flow ensures that businesses can rely on Stripe for handling payments and transactions securely.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI DSS, 2FA |

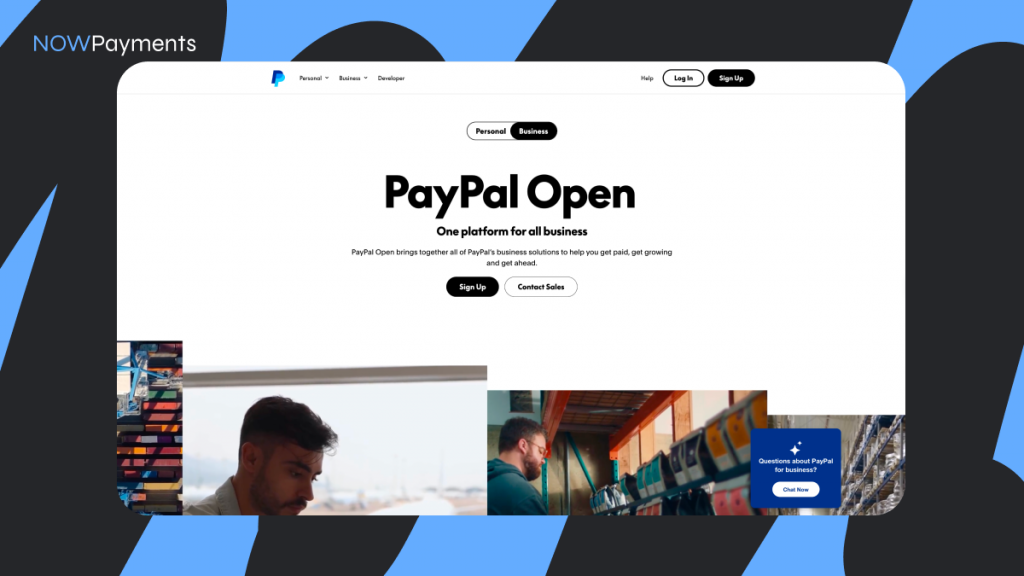

PayPal

PayPal is a global payment gateway known for its ease of use and extensive customer base, making it an excellent option for businesses looking to accept payments in Denmark and worldwide. PayPal supports a wide variety of payment methods, including credit and debit cards, PayPal balances, and bank transfers, providing customers with multiple payment options. It’s widely recognized for its strong security features and buyer protection, which enhances customer confidence and trust in transactions. PayPal’s platform is ideal for merchants who want a simple, widely accepted payment solution with global reach.

Supported Payment Methods. PayPal supports payments through its own wallet, credit cards (Visa, Mastercard), and bank transfers, making it a versatile payment method for online and in-store transactions. This range of payment options is essential for businesses in Denmark that want to offer seamless checkout experiences to their customers. PayPal also supports cross-border payments, enabling businesses to reach international markets and accept payments in multiple currencies. This flexibility in supported payment methods ensures that businesses can provide an efficient and secure payment process for their customers.

| Payment Method | On-ramp | Off-ramp |

| PayPal Wallet | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fees. PayPal charges 2.9% + €0.35 for international transactions, which is slightly higher compared to other gateways but includes additional protections for buyers. This fee structure can be higher than some alternatives, especially for international transactions, but PayPal’s buyer protection and fraud prevention services provide value for businesses and customers. The transparent pricing and ease of use make it a popular choice for businesses with cross-border customers. Additionally, there are no setup or monthly fees, which makes PayPal a cost-effective option for smaller businesses.

| Fee Type | Amount |

| Transaction Fee | 2.9% + €0.35 |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Custodial/Non-Custodial Flow. PayPal operates as a custodial payment platform, where it holds funds until they are transferred to the merchant. This system provides added security for both businesses and customers by mitigating risks associated with fraud and chargebacks. The custodial nature also simplifies the payment process for merchants, as PayPal handles much of the transaction management. This model allows businesses to focus on growth while PayPal ensures secure processing.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI DSS, 2FA |

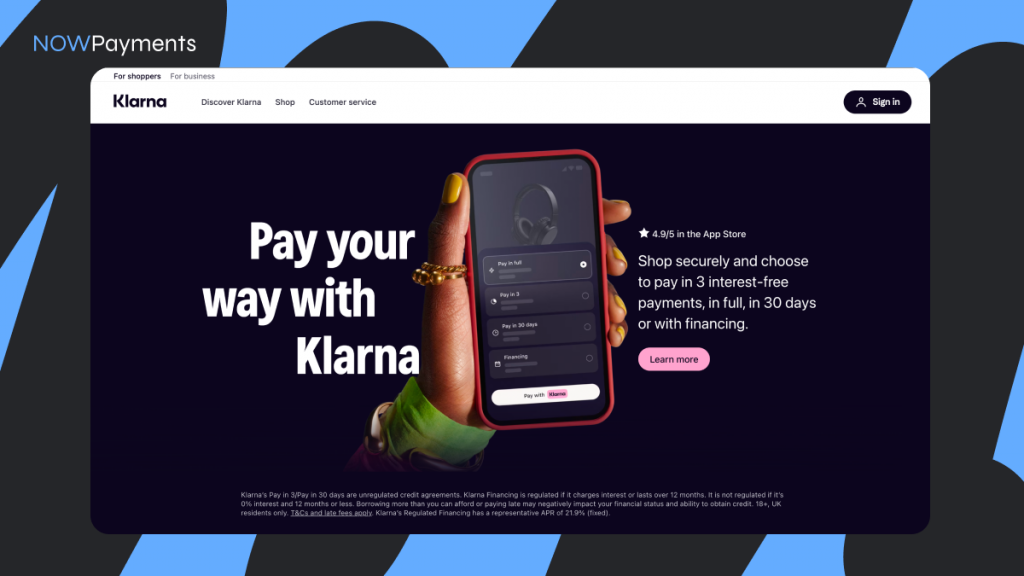

Klarna

Klarna is a flexible payment gateway that allows businesses to offer Buy Now, Pay Later (BNPL) options, making it an attractive solution for merchants looking to reduce cart abandonment and increase conversion rates. Klarna’s platform is particularly popular in Europe, and it helps businesses in Denmark and internationally provide their customers with more payment flexibility. Klarna’s ability to offer both credit card and bank transfer payments, alongside BNPL services, makes it a versatile payment solution. With its focus on improving the customer shopping experience, Klarna is ideal for businesses looking to enhance customer loyalty.

Supported Payment Methods. Klarna supports a variety of payment methods, including major credit cards, bank transfers, and its Buy Now, Pay Later option. The BNPL feature is especially valuable for businesses in Denmark, as it allows customers to pay in installments, which increases the likelihood of purchase completion. Klarna’s integration of local payment methods, like Dankort, also ensures that Danish businesses can cater to local customer preferences. This flexibility in payment methods ensures a smooth and convenient shopping experience for customers.

| Payment Method | On-ramp | Off-ramp |

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

| Buy Now, Pay Later | ✅ | ✅ |

Transaction Fees. Klarna charges a flat 2.49% transaction fee, which can vary by country and payment method. The fee structure is simple and transparent, allowing businesses to easily calculate their costs. Klarna’s fees are higher than traditional card payments but are balanced by the value it provides through its BNPL service, which can lead to increased sales and reduced cart abandonment. Klarna’s flexible payment options give businesses an edge in catering to customers looking for more flexible payment terms.

| Fee Type | Amount | Note |

| Transaction Fee | 2.49% | For transactions, varies by country |

| Monthly Fee | ❌ | None |

| Setup Fee | ❌ | None |

Custodial/Non-Custodial Flow. Klarna operates as a custodial payment platform, meaning it holds funds before they are paid out to businesses. This custodial model allows Klarna to handle the risk associated with BNPL transactions, ensuring that businesses are protected from non-payment issues. Klarna’s custodial flow simplifies the process for businesses by managing the complexities of BNPL services and providing additional fraud protection. This custodial setup makes Klarna a reliable payment solution for businesses looking to expand payment options for their customers.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI DSS, GDPR |

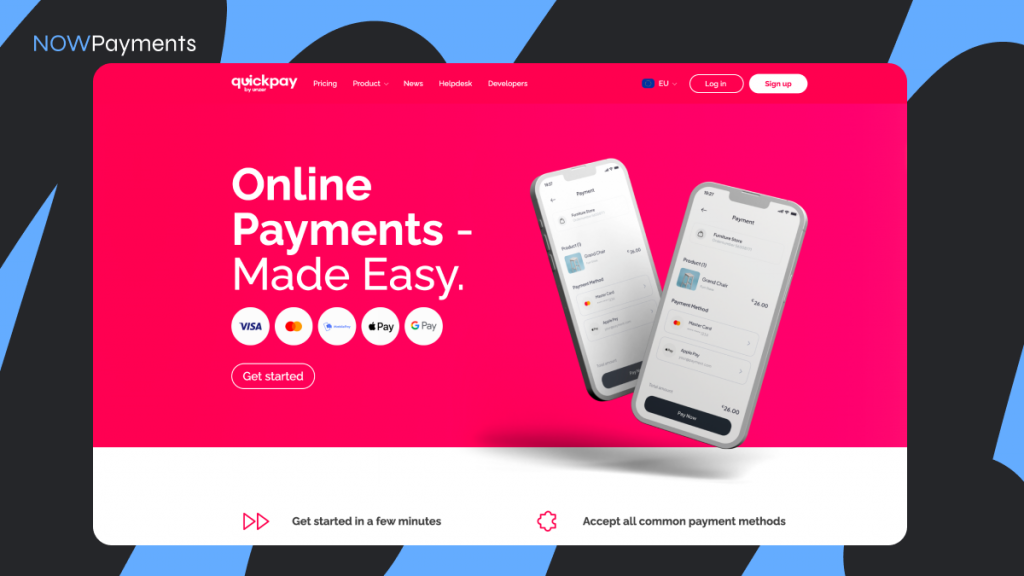

QuickPay

QuickPay is a Danish payment gateway that offers a comprehensive solution for merchants looking to accept payments online and in-store. It supports multiple payment methods, including credit and debit cards, and integrates seamlessly with local payment methods like Dankort, a popular national debit card in Denmark. QuickPay stands out for its custom pricing options, allowing businesses to tailor their payment solution to their specific needs. With its strong focus on security and compliance, QuickPay provides a reliable and scalable solution for both small and large businesses.

Supported Payment Methods. QuickPay supports a wide range of payment methods, including Visa, Mastercard, Dankort, and other local payment methods. It also allows businesses to accept mobile payments, which is essential in a market like Denmark, where mobile payment apps such as MobilePay are widely used. By supporting both international and local payment methods, QuickPay ensures businesses can cater to a diverse customer base. This broad payment method support makes QuickPay an excellent choice for businesses looking to expand their payment options.

| Payment Method | On-ramp | Off-ramp |

| Visa, Mastercard | ✅ | ✅ |

| Local Payment Methods | ✅ | ✅ |

| Mobile Payments | ✅ | ✅ |

Transaction Fees. QuickPay offers custom pricing based on business volume, making it a flexible payment platform for businesses of all sizes. There are no monthly fees, and businesses can choose the most suitable pricing plan for their needs. QuickPay’s fee structure ensures that businesses can forecast their payment processing costs accurately. This level of flexibility is ideal for businesses looking for a tailored solution.

| Fee Type | Amount |

| Transaction Fee | Custom pricing |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Custodial/Non-Custodial Flow. QuickPay operates as a custodial payment platform, managing the funds until they are transferred to the business. This custodial approach provides added security for merchants, ensuring that funds are handled safely. QuickPay also offers robust fraud detection and chargeback management services, helping businesses mitigate risks. The custodial flow simplifies the payment process, making it ideal for merchants who want a secure and hassle-free solution.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI DSS, SSL Encryption |

Conclusion

We have explored the top payment gateway solutions for Denmark, including NOWPayments, Stripe, PayPal, Klarna, and QuickPay, with a strong focus on how they fit into the Danish payment landscape. Payments in Denmark are highly digital, with consumers relying on mobile payment apps like MobilePay, local payment methods such as Dankort (the national debit card developed by Danske Bank), and contactless card payments using Visa and Mastercard. For Danish online merchants and e-commerce businesses, offering multiple payment options—including digital wallets like Apple Pay and Google Pay, credit and debit cards, and seamless checkout experiences—is essential to reduce cart abandonment, comply with PSD2 and strong customer authentication, and meet modern Danish payment preferences for both online and in-store transactions.

Among all options, NOWPayments stands out as the best payment gateway in Denmark for businesses looking to accept payments locally and globally. Its support for 350+ cryptocurrencies, 40+ fiat currencies including Danish Krone, low transaction fees, and both custodial and non-custodial flows makes it a highly flexible and future-ready payment solution. NOWPayments helps merchants simplify online transactions, support cross-border and international payments, and offer a seamless digital payment experience to customers in Denmark and beyond. For businesses aiming to grow in 2025 and beyond, adapt to the evolving payment ecosystem, and move beyond cash payments into a comprehensive, end-to-end payment platform, NOWPayments is the top payment gateway choice for forward-thinking Danish merchants.