A payment gateway is a critical component for any online business, allowing merchants to accept various payment methods securely. It acts as a bridge between the customer and the merchant, facilitating payment processing for both local and international transactions. When businesses in Nigeria choose a payment gateway, they often consider factors such as transaction fees, payment options, and the ability to integrate with their existing payment systems. The best payment gateway providers offer a variety of payment channels, enabling merchants to accept international cards and bank transfers, thus enhancing the payment experience for their customers.

In the competitive landscape of online transactions, selecting the best payment gateway can significantly impact a business’s success. Popular payment gateways for businesses in Nigeria, like Paystack and Flutterwave, provide multiple payment options while ensuring secure payments online. These payment service providers support both digital payment solutions and international payments, making it easier for merchants to cater to a global audience. By leveraging payment links and robust payment platforms, businesses can streamline their payment processing and offer customers the flexibility to choose their preferred payment method.

Factors To Consider In Choosing An Online Payment Gateway In Nigeria

When looking to choose the best payment gateway for your business online in Nigeria, there are several crucial factors to consider. First, evaluate the multiple payment methods offered by the top payment gateways in Nigeria, as having diverse options can enhance customer satisfaction. It’s essential to select a reliable payment gateway that supports both local payment options and international payments using a payment processor. This is particularly significant if you are looking to expand your reach across Africa, including countries like Kenya.

Additionally, examine the fees associated with each payment processor to ensure they align with your budget. Some of the best payment gateways in Nigeria, such as Monnify and Squad, offer competitive rates for payments using a payment link and various functionalities that cater to different business needs. Ultimately, doing thorough research will help you choose the best payment solution that fits your online payment platform requirements.

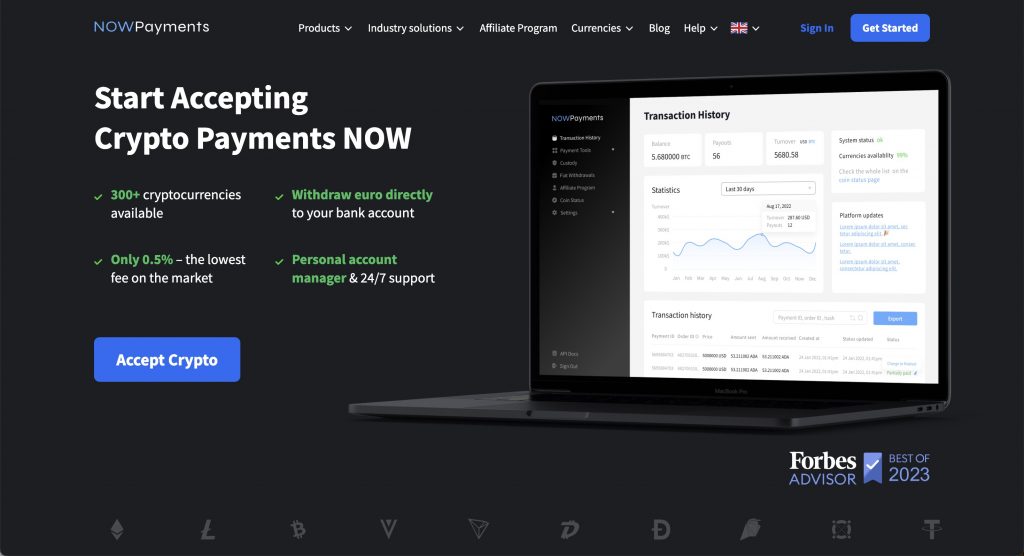

NOWPayments as the best payment gateway in Nigeria

When selecting the right payment gateway for your business in Nigeria, it’s crucial to evaluate the options available. Among the leading payment gateway providers in Nigeria, NOWPayments stands out as the best choice. This payment platform in Nigeria facilitates global payment transactions efficiently, ensuring businesses can receive payments online without any hassle. With its robust payment processing system, NOWPayments enhances the customer payment experience by offering flexible payment options and popular payment methods that cater to diverse needs.

In comparison to other gateways like Monnify and Squad, NOWPayments excels with its innovative features that allow users to receive payments online without a website. This is particularly beneficial for small businesses and freelancers looking to streamline their operations. By providing a seamless way to manage payment details and integrate third-party payment solutions, NOWPayments solidifies its presence in Nigeria’s growing digital economy.

Paystack as payment gateway in Nigeria

Paystack is a leading payment gateway that operates within Nigeria, providing businesses with an efficient solution for processing payments in Nigeria. This innovative online payment platform enables online shoppers to make transactions seamlessly, enhancing the overall customer experience. By offering various online payment methods, Paystack caters to the diverse needs of its customers in Nigeria and beyond.

In addition to Paystack, other payment gateways available in the region, such as Monnify and Squad, contribute to the growing payment infrastructure in Nigeria. These payment gateways provide innovative solutions for businesses in Africa looking to enhance their transaction capabilities. With a strong presence in Nigeria, Paystack and its competitors help facilitate currency payment processes, ensuring that businesses can operate efficiently and effectively.

Flutterwave as payment gateway in Nigeria

Flutterwave has emerged as a leading payment gateway in Nigeria, providing a robust solution for businesses that wish to accept payments online. With its user-friendly interface, Flutterwave ensures an efficient payment process, allowing merchants to manage transactions seamlessly. The platform is widely recognized for its ability to facilitate both local and international payments, making it an ideal choice for businesses looking to expand their reach.

In addition to Flutterwave, other alternatives like Monnify and Squad also serve as significant players in the Nigerian payment landscape. Monnify is a payment gateway that focuses on providing seamless payment experience for businesses, while Squad offers various features tailored to enhance transaction efficiency. Together, these platforms contribute to a vibrant ecosystem that empowers merchants in Nigeria to thrive in the online marketplace.

Interswitch as payment gateway in Nigeria

Interswitch is a leading payment gateway in Nigeria, providing seamless transaction solutions for businesses and consumers alike. The platform provides payment services that cater to various needs, including online payments, mobile transactions, and point-of-sale solutions. With its robust infrastructure, Interswitch facilitates a secure and efficient payment processing experience.

The payment gateway offers a wide range of services designed to support both merchants and customers. By utilizing advanced technology, Interswitch ensures that transactions are completed swiftly and safely, enhancing user confidence in Nigeria using digital payment methods. Interswitch’s commitment to innovation positions it as a key player in the Nigerian fintech landscape.

As businesses increasingly shift to digital platforms, Interswitch continues to evolve, adapting to the changing dynamics of commerce. Its comprehensive suite of services, including the squad is a payment gateway, makes it an essential partner for anyone looking to thrive in Nigeria including the expanding e-commerce sector.

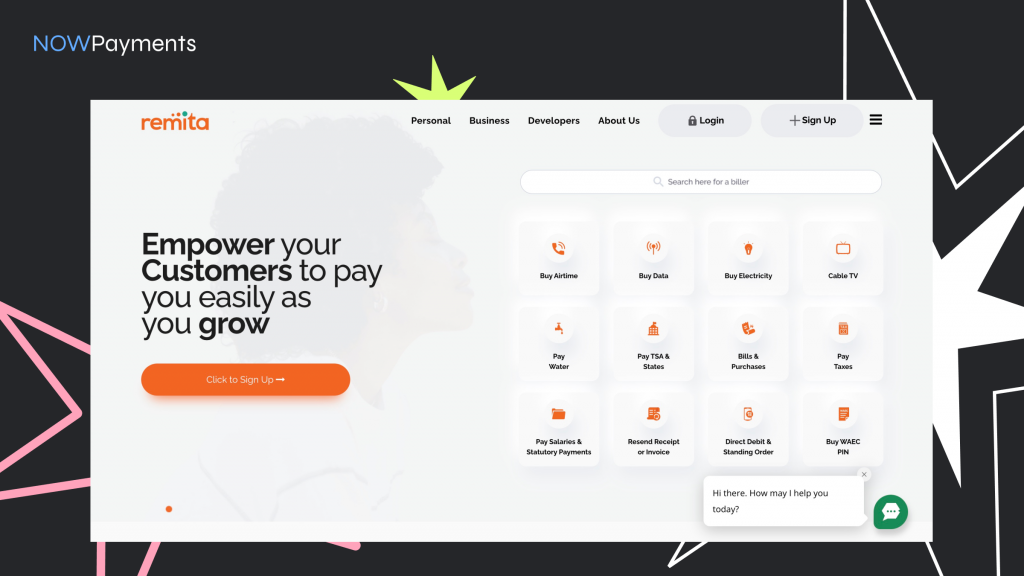

Remita as payment gateway in Nigeria

In Nigeria, Remita stands out as a reliable payment gateway that provides a payment solution catering to various sectors, including businesses, government agencies, and individuals. As the digital economy continues to grow, Remita has adapted to meet the increasing demand for seamless transactions, facilitating payments for services ranging from utility bills to school fees.

This platform not only streamlines the payment process but also enhances financial inclusion by allowing users to make transactions conveniently from their mobile devices or computers. With its user-friendly interface, Remita ensures that even those with limited technical knowledge can navigate the system with ease.

Moreover, Remita’s robust security measures protect users from fraudulent activities, instilling confidence in the payment process. As Nigeria embraces a cashless economy, Remita’s role as a key player in the payment gateway landscape cannot be overstated, significantly contributing to the growth of e-commerce in the country.

Why NOWPayments is the Best Payment Gateway in Nigeria

NOWPayments stands out as the best payment gateway in Nigeria due to its unmatched combination of flexibility, security, and innovation. Unlike traditional payment gateways, NOWPayments empowers businesses by supporting a wide range of payment methods, including cryptocurrencies, making it ideal for both local and global transactions. Its seamless integration, user-friendly interface, and advanced features like automatic coin conversion and instant payouts set it apart from competitors. By choosing NOWPayments, Nigerian businesses can future-proof their payment systems, expand their customer base, and enjoy a truly borderless and efficient payment solution tailored to meet the demands of the modern digital economy.