When navigating payments in Iran, it’s essential to understand the variety of payment options available. Traditional methods like cash remain popular, but electronic payment solutions are growing rapidly, especially in urban areas like Tehran. Debit cards and credit cards are common for card payments, although sanctions imposed on Iran have limited the use of international visa and mastercard services. Many companies in Iran are now turning to mobile wallets and digital payment systems to facilitate online purchases. These payment service providers offer a range of secure payment and payment processing solutions, including bank transfers and alternative payment methods like cryptocurrencies.

For those visiting Iran, it’s crucial to familiarize yourself with local payment systems. Many businesses have adapted to secure payment processing through merchant accounts that accept various payment methods. This includes local payment options for seamless transactions within the country. Startups and established firms alike are leveraging payment platforms that support prepay models and card processing to enhance customer experience. Understanding these payment solutions will ensure you can receive payments efficiently and enjoy the growing e-commerce landscape in Iran.

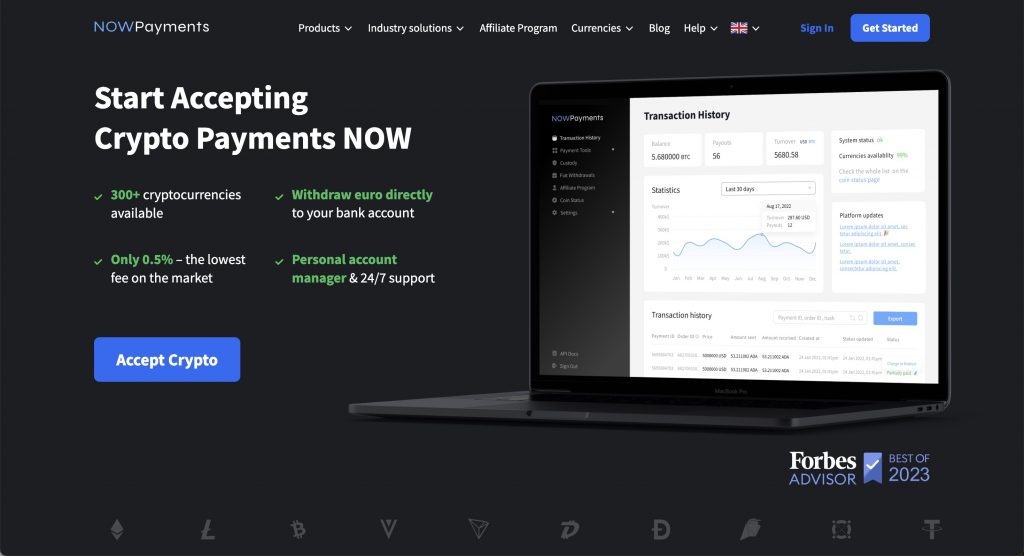

NOWPayments as the best payment gateway in Iran

NOWPayments stands out as the top payment gateway for businesses in Iran, enabling them to accept payments seamlessly. As online payments have become essential for any online store, NOWPayments offers a reliable and secure payment solution that caters to the diverse needs of iranians.

For iranian businesses looking to expand their reach, NOWPayments provides a robust payment processor that is compatible with various financial institutions in Iran. This means they can easily accept online payments and offer the right payment options for their customers. By leveraging this gateway, iran can help local enterprises thrive in a competitive marketplace, ensuring that they can provide payment solutions that meet the expectations of their clientele.

In addition to facilitating online payment solutions, NOWPayments supports businesses to accept both credit and debit cards, enhancing the overall customer experience. With its focus on reliability, NOWPayments has quickly become the preferred payment choice for many, proving invaluable for any business in Iran that wishes to stay ahead in the evolving digital landscape.

PayPal payment gateway in Iran

In Iran, the availability of a reliable payment gateway like PayPal has been significantly impacted by economic sanctions. As a result, individuals and businesses in Iran face challenges in processing payments, especially for international transactions. Many users turn to alternatives like Skrill or UPI to facilitate online transactions. However, these options often come with high processing fees and limited functionality compared to platforms like PayPal.

For users to store their funds and securely process online payments, account opening with international gateways remains a complex issue. Choosing the right platform is crucial for those looking to start accepting payments within Iran. Frequent frequently asked questions arise regarding the privacy policy of these services and how they comply with local regulations. Ultimately, the barriers created by traditional banking systems and economic sanctions continue to hinder the growth of digital payment solutions in Iran, leaving many seeking viable alternatives.

Amazon Pay payment gateway in Iran

Amazon Pay is a versatile payment gateway that has garnered attention in various regions, including Iran. This platform allows users to make seamless transactions through both debit and credit cards, facilitating payments for goods and services. However, the implementation of Amazon Pay in Iran faces challenges, especially due to sanctions that limit international financial transactions.

Despite these hurdles, there is a growing interest in utilizing Amazon Pay as a means for online shopping. With the possibility of integrating pos systems within local businesses, consumers in Iran are eager to explore options that allow them to navigate the complexities of the current financial landscape. As the demand for secure and efficient payment methods increases, Iran aims to create an environment that is officially regulated and accessible for all users.

Authorize.Net payment gateway in Iran

The use of payment gateways in Iran has evolved significantly, with Authorize.Net emerging as a potential solution for businesses looking to facilitate online transactions. As Iranian merchants seek to expand their reach, integrating a reliable payment gateway allows them to streamline payment processes and enhance customer experiences.

For Iranian businesses, it is crucial to choose a payment gateway that aligns with local regulations and supports various payment methods. Authorize.Net can be an effective option for those who want to ensure secure transactions while serving their customers. In order for Iran to get the most out of such platforms, it is essential to navigate the legal and technological landscape effectively.

With the increasing global demand for online services, the integration of Authorize.Net could provide Iranian businesses with the tools necessary to thrive in a competitive market. This integration would not only foster economic growth but also help Iran to get the necessary exposure to international markets.

Braintree payment gateway in Iran

Braintree is a widely recognized payment gateway that offers a seamless solution for businesses looking to process transactions in various regions, including Iran. As the digital landscape continues to evolve, merchants in Iran are increasingly seeking reliable platforms for online payments. Braintree provides comprehensive support for multiple currencies, allowing businesses to cater to a diverse customer base.

However, operating in Iran presents unique challenges due to international sanctions and regulatory considerations. Despite these hurdles, Braintree’s user-friendly interface and robust security features make it an attractive option for Iranian merchants. Many businesses in the country are eager to leverage online payment solutions to enhance customer experience and streamline operations.

As more Iranian entrepreneurs venture into the digital marketplace, the demand for efficient payment gateways like Braintree is likely to grow. This could potentially lead to increased economic opportunities in the region, driving innovation in the online payment space.

Conclusion

NOWPayments stands out as the best payment gateway in Iran due to its unmatched versatility, security, and ability to cater to local and international payment needs. In a region where economic sanctions and regulatory challenges limit the use of traditional platforms like PayPal or Amazon Pay, NOWPayments provides a seamless alternative for businesses and consumers. Its support for cryptocurrencies alongside traditional payment methods such as debit and credit cards offers flexibility that is crucial for navigating Iran’s evolving digital economy.

With features like secure transactions, easy API integration, and cost-effective solutions, NOWPayments not only enhances the customer experience but also positions itself as a key player in the growing e-commerce landscape in Iran.

For businesses in Iran aiming to thrive in the digital age, NOWPayments delivers the ideal blend of innovation, reliability, and adaptability, making it the clear choice among payment gateways.