A payment gateway is a crucial component for any online store looking to accept payments online. In Colombia, a reliable payment gateway allows businesses to offer a variety of payment methods available to their customers. This includes traditional credit cards such as Mastercard, as well as bank transfer and cash payment options. By utilizing a Colombian payment gateway, merchants can facilitate online payments in Colombia securely and efficiently.

Moreover, the best payment gateways in Colombia support multiple payment methods, enabling customers to choose their preferred payment option. This payment solution not only enhances the user experience but also increases the likelihood of completing a transaction. With the rise of digital payment methods, a payment processor that supports multiple payment options is essential for e-commerce success. By integrating a payment gateway that allows for alternative payment methods, businesses can effectively accept payments from a diverse range of customers in the growing Colombian market.

Why is choosing the right payment gateway important?

Choosing the right payment gateway is crucial for merchants in Colombia as it directly impacts the payment processing experience. A reliable Colombia payment gateway enables businesses to accept payments in Colombia through a wide range of payment options, including credit and debit card payments and local payment methods. By offering various online payment methods in Colombia, merchants can cater to the preferred payment methods of their customers, allowing them to make online transactions smoothly.

Furthermore, a secure and efficient payment system ensures that online money transfers and recurring payments are processed without compromise. Popular payment gateways offer instant payment solutions and support mobile payment options, allowing customers to use their credit or debit cards or engage in international payment transactions. In 2022, the payment card industry data security standards have become increasingly important, which is why choosing a payment gateway provider that prioritizes pagos seguros en línea is essential for a positive payment experience.

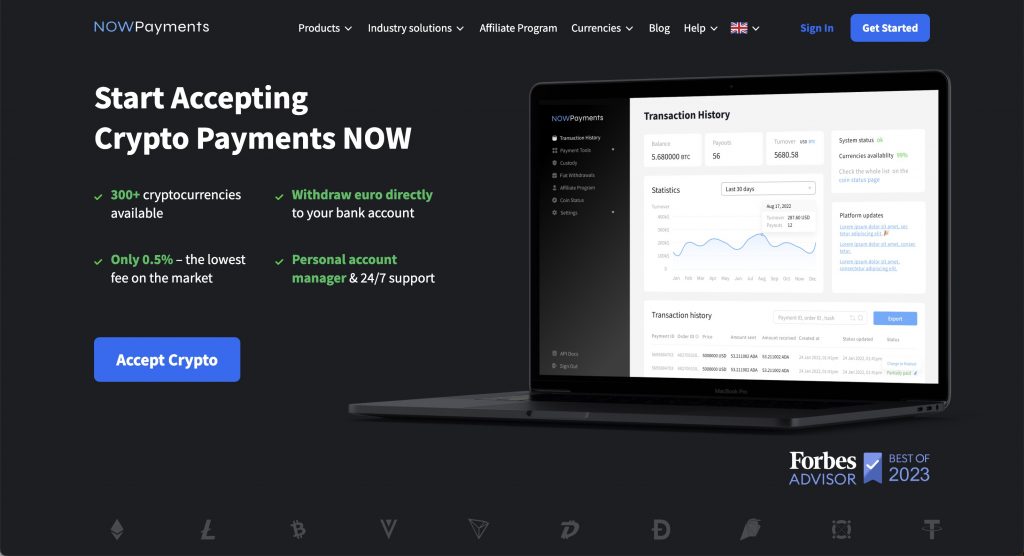

NOWPayments as the best payment gateway in Colombia

NOWPayments stands out as the best payment gateway in Colombia due to its extensive offering of various payment methods and supported payment methods. In 2022, the landscape in Colombia saw a surge in popular online payment methods, and NOWPayments has effectively adapted to this shift. Businesses in Colombia can benefit from a payment service that facilitates secure online transactions, making it easier for customers to make online payments through secure online bank transfers and other relevant payment methods.

With its payment gateway solution, NOWPayments offers multiple payment gateways that cater to the diverse needs of businesses. The process for online transactions is streamlined, allowing merchants to accept online purchases effortlessly. Furthermore, ACH Colombia and other used payment methods ensure that customers have the best options in Colombia. By accepting online payments through this leading payment gateway, businesses can enhance their operations and gain access to a global payment network, ultimately boosting their sales and customer satisfaction.

PayU

In Colombia in 2026, the rise of e-commerce significantly transformed the landscape of online shopping. Among the top contenders in the market is PayU payment gateway, a robust payment gateway developed specifically to cater to the needs of Colombian consumers and businesses. This platform provides a comprehensive solution for online transactions, ensuring that users can navigate their shopping experiences with ease.

The methods include various options such as credit cards, bank transfers, and cash payments, making it a versatile choice for anyone looking to make purchases online. Many payment gateways that offer similar services often fall short in terms of user experience, but PayU stands out by providing a seamless payment process that enhances customer satisfaction.

As online businesses continue to grow, the need for efficient payment processing becomes paramount. In Colombia, several payment options are now available, and PayU remains a chosen payment gateway for its reliability and user-friendly interface, allowing consumers to enjoy their online shopping without hassle. The adoption of this gateway reflects the increasing trend of consumers who prefer to make purchases via used online platforms, further solidifying PayU’s position in the market.

MercadoPago payment gateway in Colombia

MercadoPago is a leading payment gateway in Colombia, providing a seamless solution for online transactions. With its robust features, it allows businesses to accept payments through various methods, including credit cards, debit cards, and cash payments at local convenience stores.

One of the key advantages of MercadoPago is its user-friendly interface, which simplifies the payment process for both merchants and customers. Additionally, it offers comprehensive security measures, ensuring that sensitive information remains protected during transactions.

In Colombia, the platform has gained immense popularity among entrepreneurs and e-commerce businesses looking to expand their reach. By integrating MercadoPago, companies can enhance their payment capabilities and ultimately drive sales growth, making it an essential tool for the Colombian digital economy.

ePayco payment gateway in Colombia

ePayco is a prominent payment gateway in Colombia, offering businesses an efficient and secure method to process online transactions. With its user-friendly interface, ePayco simplifies the payment process for both merchants and customers, making it a popular choice among local businesses.

One of the key features of ePayco is its ability to support various payment methods, including credit cards, debit cards, and even cash payments through authorized points of sale across Colombia. This versatility ensures that businesses can cater to a wider audience, enhancing customer satisfaction and driving sales.

Additionally, ePayco provides robust security measures, protecting sensitive financial information and building trust with users. As the digital economy continues to grow in Colombia, payment gateways like ePayco play a crucial role in facilitating e-commerce and supporting entrepreneurial efforts in the region.

PayPal payment gateway in Colombia

In recent years, PayPal has emerged as a popular payment gateway in Colombia, facilitating online transactions for both businesses and consumers. This platform allows users to send and receive money securely, enhancing the e-commerce experience within the country. With the increasing internet penetration and smartphone usage, Colombia has seen a surge in online shopping, making PayPal an essential tool for many merchants.

Moreover, PayPal provides a user-friendly interface that supports multiple currencies, which is particularly beneficial for Colombian businesses looking to expand their reach internationally. The ability to integrate PayPal easily into various e-commerce platforms allows merchants in Colombia to offer flexible payment options to their customers, thereby increasing sales potential.

As Colombia continues to strengthen its digital economy, the role of PayPal as a trusted payment gateway is likely to grow, making it a vital component for online transactions in the region.

Conclusion: Why NOWPayments is the Best Payment Gateway in Colombia

NOWPayments stands out as the premier payment gateway in Colombia, providing businesses with a flexible, secure, and user-friendly solution to process online transactions. Unlike traditional gateways, NOWPayments offers an extensive range of payment options, including support for cryptocurrencies, credit cards, debit cards, and bank transfers, ensuring that merchants can cater to the diverse preferences of Colombian customers.

Its easy integration process and competitive transaction fees make it a cost-effective choice for businesses of all sizes. Additionally, NOWPayments prioritizes security with advanced encryption and compliance measures, giving merchants and customers peace of mind during transactions.

By enabling businesses to tap into a global network of payment options while addressing local needs, NOWPayments empowers merchants to expand their reach, increase sales, and provide a seamless customer experience. Whether for e-commerce platforms or in-person transactions, NOWPayments is the ultimate tool for driving growth and success in Colombia’s dynamic digital economy.