In 2024, there are several best ways to earn passive income using cryptocurrency. One popular way is staking your crypto, where you can earn staking rewards by locking your crypto assets in a wallet to support the network. Another method is crypto lending, which allows you to lend your cryptocurrencies on a lending platform and earn interest at competitive interest rates. Additionally, yield farming in a liquidity pool can help you generate passive income by providing liquidity for trading pairs. Mining remains a viable option, especially with cloud mining services, allowing users to earn profits without the hardware hassle. Those looking to invest can also consider bitcoin and ethereum token investments and trading on crypto exchanges for potential gains.

In addition to these passive income methods, affiliates can also earn money by joining the NOWPayments affiliate program. By promoting NOWPayments and referring new users to the platform, affiliates receive a commission for every transaction processed by their referrals. This offers an easy way to earn a steady income by leveraging NOWPayments’ growing popularity as a leading crypto payment gateway.

To make money with cryptocurrency in 2024, it’s essential to research and make informed investment decisions. By choosing a cryptocurrency with strong fundamentals, you can increase your chances of success. Consider crypto staking as a way to earn passive income from your crypto holdings. Additionally, crypto lending can provide steady passive income from crypto while minimizing risks. However, always remember the risks involved in any crypto investment. For instance, the value of the token may fluctuate, affecting your overall profit. Always make sure you’re aware of market trends and the particular cryptocurrency you’re investing in to help you make passive income effectively.

What is the fastest way to earn cryptocurrency?

When considering the fastest way to earn cryptocurrency, there are several ways to approach it. One method is lending crypto, where you can act as a liquidity provider by lending your assets to borrowers and earn interest in return. This allows you to earn a percentage of the transaction fees generated on the blockchain. Additionally, becoming a validator in a proof-of-stake network can also help you earn crypto income by confirming transactions on the blockchain. It’s important to note that mining remains a popular choice; however, it requires significant investment in mining equipment and time to join a mining pool for collaborative earnings. Depending on the cryptocurrency you want to invest in, your risk tolerance and investment goals will play a crucial role in choosing a crypto strategy that can help you earn money quickly.

Moreover, crypto trading strategies can also facilitate fast earnings, with the potential to exchange for cryptocurrency at opportune moments. As an investor, it’s vital to pick the best crypto projects that align with your investment goals. Engaging in cryptocurrency lending can serve as a source of income, allowing you to earn money with crypto while maintaining control over your crypto wallet. Ultimately, the speed at which you earn depends on your choices, the market conditions, and your ability to make smarter financial decisions.

What is the best crypto to earn?

When considering the best crypto to earn, various factors come into play, including market trends, utility, and community support. Currently, Ethereum stands out due to its robust smart contract capabilities and widespread adoption in decentralized applications. This versatility makes it a prime candidate for long-term growth and earning potential.

Additionally, newer projects like Solana and Polkadot have gained traction for their scalability and innovative features, often providing lucrative staking opportunities. By participating in these ecosystems, investors can earn rewards while contributing to the network’s growth.

Furthermore, stablecoins like USDC or Tether offer a different approach to earning through yield farming and interest-earning accounts. These options provide lower risk while still generating returns, appealing to those who prefer stability over volatility in their investment strategy.

Crypto Staking and Interest

In the world of cryptocurrency, crypto staking has emerged as a popular method for investors to not only hold their assets but also even earn additional rewards. By participating in staking, individuals lock up their existing cryptocurrencies to support the operations of a blockchain network. This process helps maintain the integrity and security of the network while providing stakers with incentives in the form of new tokens.

One of the most attractive aspects of staking is the potential to receive new cryptocurrency as a reward for their contribution. This passive income opportunity allows investors to grow their digital asset portfolio without the need for active trading. As more investors turn to staking, the landscape of crypto investment continues to evolve, offering various staking platforms and options tailored to different risk appetites and preferences.

Play-to-Earn Games

Play-to-Earn games have revolutionized the gaming industry by allowing players to earn cryptocurrency while enjoying their favorite virtual worlds. Unlike traditional gaming, where players invest time and money without tangible returns, these games provide a unique opportunity for passive income generation. Players can earn in-game assets that can be traded or sold for real-world value, creating an engaging and profitable gaming experience.

In addition to earning through gameplay, many Play-to-Earn platforms offer staking mechanisms, enabling players to generate additional income by holding their in-game tokens. This dual-income approach not only enhances player engagement but also attracts a growing community of gamers and investors alike. As the popularity of cryptocurrency continues to rise, these games are becoming increasingly appealing to those seeking alternative income streams.

Moreover, the integration of blockchain technology ensures that players have true ownership of their in-game assets. This decentralized approach fosters a trustful environment where players can trade, sell, or use their assets freely, further enhancing the potential for passive income. As Play-to-Earn games evolve, they are likely to play a significant role in the future of entertainment and finance. The most famous game is Axie Infinity

Crypto Day Trading

Crypto Day Trading has emerged as an intriguing option for those seeking passive income through cryptocurrency investments. Unlike traditional investing, day trading involves making multiple trades within a single day to capitalize on market fluctuations. This strategy requires a keen understanding of market trends, technical analysis, and a solid risk management plan.

While it may seem daunting, many traders find that with the right tools and resources, they can generate consistent returns. By utilizing automated trading bots and sophisticated algorithms, traders can execute trades even while they sleep, thus enhancing the potential for passive income. However, it’s essential to remain aware of the inherent risks involved, as the crypto market can be highly volatile.

In conclusion, crypto day trading can be a viable source of passive income for those willing to invest time in learning and adapting. With discipline and strategy, traders can navigate this dynamic market successfully.

Long-Term Investing & Holding

Long-term investing is a strategy that focuses on buying and holding assets for an extended period, typically years or even decades. This approach allows investors to benefit from the compounding effects of returns, as well as to navigate the inevitable market fluctuations without making impulsive decisions. By committing to a hold strategy, investors can potentially reduce transaction costs and avoid the pitfalls of market timing.

One of the main advantages of long-term investing is the ability to ride out short-term volatility. Historically, markets tend to recover from downturns, and those who remain invested often see substantial growth over time. Additionally, long-term investors can benefit from dividends and interest, which can further enhance the value of their portfolios.

In essence, adopting a holding strategy aligns with the principle of patient capital. Investors who are willing to wait for their investments to mature are often rewarded with greater returns, fostering a disciplined and strategic approach to wealth building.

Mining Cryptocurrency for Profit

Mining cryptocurrency for profit has become a popular venture for many individuals and companies alike. This process involves using powerful computers to solve complex mathematical problems, which in turn validates transactions on a blockchain network. Successful miners are rewarded with newly minted coins, providing a direct financial incentive to participate in this decentralized economy.

However, the profitability of crypto mining can vary significantly based on several factors. The cost of electricity, the efficiency of the mining equipment, and the current market price of the cryptocurrency all play crucial roles in determining potential earnings. Additionally, the increasing difficulty of mining as more participants join the network can further impact profitability.

To maximize returns, miners often join mining pools, which allow them to combine resources and share rewards. This collaborative approach can help mitigate risks associated with fluctuations in market prices and mining difficulty, making it an attractive option for both novice and experienced miners.

Cryptocurrency Acceptance As Payment For Goods And Services

In recent years, the acceptance of cryptocurrency as a payment method for goods and services has gained significant traction. Businesses across various sectors are increasingly recognizing the benefits of incorporating digital currencies into their payment systems. This shift is driven by factors such as lower transaction fees, faster processing times, and the appeal of attracting a tech-savvy customer base.

Moreover, major companies, including Tesla and Microsoft, have begun to accept Bitcoin and other cryptocurrencies, further legitimizing their use in everyday transactions. The decentralized nature of blockchain technology also offers enhanced security and transparency, making it an attractive option for both consumers and merchants.

However, challenges remain, including price volatility and regulatory concerns. Despite these hurdles, the trend towards embracing cryptocurrency as a legitimate payment option is likely to continue, as more consumers and businesses recognize its potential.

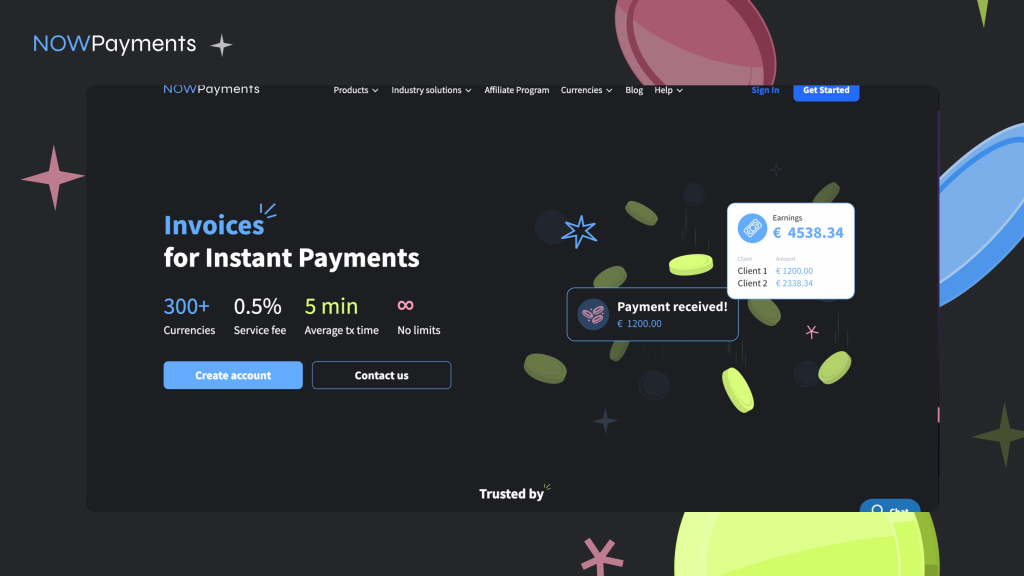

To streamline the process of accepting cryptocurrency payments, businesses can leverage NOWPayments, which stands out as the best crypto payment gateway available today. NOWPayments provides an easy-to-integrate solution for businesses of all sizes to accept a wide range of cryptocurrencies, offering both flexibility and convenience. One reason why NOWPayments is the leading choice is its competitive fee structure, allowing merchants to save more with each transaction compared to other payment gateways. Additionally, the platform supports over 300 cryptocurrencies, giving businesses the ability to accept various digital assets and cater to a diverse customer base. Lastly, NOWPayments boasts a user-friendly interface with robust security features, ensuring that both merchants and consumers can trust in the safety of their transactions. With these advantages, NOWPayments is an ideal solution for businesses looking to capitalize on the growing trend of cryptocurrency acceptance.

Cryptocurrency Lending

Cryptocurrency lending has emerged as a significant aspect of the decentralized finance (DeFi) ecosystem, allowing individuals to earn passive income on their digital assets. By lending their cryptocurrencies to borrowers, users can receive interest payments, often at rates higher than traditional banking systems. This process typically involves smart contracts, which automate the lending process, ensuring transparency and security.

Platforms facilitating cryptocurrency lending operate by connecting lenders and borrowers, often requiring collateral from the latter to mitigate risk. The collateral is usually in the form of other digital assets, safeguarding the lender’s investment. As the demand for liquidity in the crypto market grows, these lending platforms have gained popularity, offering users new avenues for capitalizing on their digital portfolios.

However, it’s essential for participants to understand the risks involved, including market volatility and potential smart contract vulnerabilities. As with any financial venture, thorough research and risk management are crucial in navigating the world of cryptocurrency lending.

How do you make money in crypto without money?

Making money in the crypto world without an initial investment might seem challenging, but there are various strategies to explore. One effective method is to participate in earn fees opportunities through decentralized finance (DeFi) platforms. By providing liquidity to these platforms, you can earn a portion of the transaction fees generated from trades. This process often requires no upfront capital, as some services allow you to use tokens earned from rewards or previous activities.

Additionally, engaging in staking can be a viable option. Many blockchain networks offer rewards for staking, which involves locking up your tokens to support network operations. In some cases, you can start staking with minimal amounts, leveraging rewards to grow your holdings.

Lastly, exploring airdrops or participating in promotional events can be an excellent way to accumulate cryptocurrency without investing money upfront. These opportunities often require you to complete certain tasks or hold specific tokens, allowing you to earn valuable assets.

How much Bitcoin should a beginner buy?

For a beginner looking to invest in Bitcoin, it’s essential to start with a manageable amount. Experts often recommend investing no more than 1% to 5% of your total investment portfolio in cryptocurrencies. This approach allows you to gain exposure to the market while minimizing risk.

Additionally, consider your individual financial situation and goals. If you’re new to investing, it may be wise to start with a small amount, such as $10 to $100, to familiarize yourself with the market dynamics. This way, you can learn about trading, wallet management, and market fluctuations without significant financial pressure.

Finally, remember that Bitcoin is highly volatile, and prices can fluctuate dramatically. It’s crucial to do your own research and ensure that any amount you invest is something you can afford to lose.

Conclusion

NOWPayments emerges as a leading solution for businesses and individuals looking to incorporate cryptocurrency into their payment processes. Its ease of integration and extensive support for over 300 different cryptocurrencies make it a versatile option, catering to diverse customer needs and expanding access to digital currencies. With a highly competitive fee structure, NOWPayments enables merchants to maximize their earnings by saving on transaction costs, a key advantage in today’s fast-paced digital economy.

Moreover, NOWPayments offers a user-friendly experience paired with robust security features, providing peace of mind for both merchants and consumers. This combination of accessibility, security, and low fees makes NOWPayments an ideal choice for businesses eager to stay at the forefront of the digital payment revolution. By leveraging NOWPayments, businesses can not only attract a tech-savvy audience but also capitalize on the growing acceptance of cryptocurrencies as a legitimate payment method, driving their operations into the future with confidence.