Is NOWPayments the right choice for your business in 2025, and how does it compare to Cregis? NOWPayments offers a user-friendly gateway for seamless crypto acceptance, while Cregis provides a sophisticated treasury management and payment infrastructure for businesses seeking deeper financial control. In this comparison, we’ll look at key factors like fees, supported currencies, settlement options, and security to help you choose the platform that best fits your business’s operational scale and financial goals.

By 2025, managing crypto assets and payments has become a critical function for businesses operating in the digital economy. The need extends beyond simple acceptance to include secure storage, efficient fund flow, and sophisticated treasury management. NOWPayments and Cregis serve different needs: one is focused on making crypto payments accessible to all, while the other delivers a comprehensive, enterprise-grade platform for managing digital assets and business finances.

This comprehensive comparison breaks down both platforms across essential metrics, answering crucial questions such as “Which platform is better for high-volume treasury management?” and “Do I need built-in business banking features?” By the end, you’ll have the insights to make the best decision for your business’s future.

Feature-by-Feature Breakdown

Products

| Products | NOWPayments | Cregis |

| API Integration Method | ✅ | ✅ |

| Crypto Invoicing | ✅ | ✅ |

| Mass Payouts | ✅ | ✅ |

| Crypto Subscription Tool | ✅ | ❌ |

| White Label Solutions | ✅ | ✅ |

NOWPayments: Offers a comprehensive range of solutions, including API integrations, crypto invoicing, mass payouts, crypto subscription tools, and customizable white-label solutions. The platform supports various payment methods such as hosted checkout pages, embedded checkout, and API-driven solutions, making it highly flexible for businesses of all sizes [1].

Cregis: Provides similar offerings, including crypto invoicing, mass payouts, and API integrations. However, it does not offer crypto subscription tools, which limits its functionality for businesses with recurring payment models [6].

Verdict: NOWPayments stands out for its broader product range, especially with crypto subscription tools and customizable white-label solutions. Cregis, while strong in crypto wallet management and SaaS subscription models, lacks crypto subscription tools, making it less suitable for businesses with recurring payment needs.

Custody & KYC

| Feature | NOWPayments | Cregis |

| Default non-custodial model | ✅ | ✅ |

| Merchant KYB required | ❌ | ❌ |

NOWPayments: NOWPayments operates on a non-custodial model by default, with custody options available for businesses that prefer them. This means businesses retain full control over their private keys and crypto assets at all times. Merchant KYB (Know Your Business) is not required for verification and withdrawals.

Cregis: Cregis follows a non-custodial model using Multi-Party Computation (MPC) technology for self-custody, ensuring businesses maintain control over their keys and assets [4]. Merchant KYB is optional for extended services, but not required for standard use.

Verdict: Both NOWPayments and Cregis offer non-custodial solutions, making them suitable for businesses that want control over their crypto assets. However, Cregis places an optional KYB for extended services, which is useful for enterprises seeking additional compliance features. NOWPayments is non-custodial by default with custody options available, providing more flexibility in how businesses manage their crypto assets, making it a better fit for large enterprises that require a balance of flexibility and compliance.

Compliance & Transparency

| Feature | NOWPayments | Cregis |

| Transaction monitoring / risk flags | ✅ | ✅ |

| Anti-fraud Measures | ✅ | ✅ |

NOWPayments: NOWPayments follows strong compliance measures, including transaction monitoring, risk flags, and anti-fraud measures to help ensure secure and compliant transactions [2].

Cregis: Cregis provides a robust compliance framework with transaction monitoring, risk flags, and anti-fraud measures in place to prevent fraudulent activities.

Verdict: Both Cregis and NOWPayments excel in legal compliance and transparency, offering businesses a well-defined framework that meets high regulatory standards.

Supported Cryptocurrencies

| Feature | NOWPayments | Cregis |

| Supported Cryptocurrencies | 300+ | 100+ [3] |

| Supported Stable Coins | 30+ | 5 |

| Supported networks | 10 | 9 |

NOWPayments: Supports 300+ cryptocurrencies, including major cryptocurrencies like Bitcoin, Ethereum, and 18 stablecoins such as USDT, USDC, DAI, BUSD, and EURC.

Cregis: Supports 100+ cryptocurrencies, including Bitcoin, Ethereum, and 5 stablecoins: USDT, USDC, DAI, BUSD, and EURC.

Verdict: NOWPayments has a clear advantage with its broader selection of cryptocurrencies and the ability to accept 18 stablecoins, offering more flexibility for businesses that need to accommodate various assets. Cregis, while strong in core coins and stablecoins, may not be sufficient for businesses looking to accept a wide array of altcoins.

Payment Methods

| Feature | NOWPayments | Cregis |

| On-chain payments | ✅ | ✅ |

| Full white-label | ✅ | ✅ |

| Manual invoices (dashboard) | ✅ | ✅ |

| API invoicing | ✅ | ✅ |

| Recurring / subscriptions | ✅ | ✅ |

NOWPayments: NOWPayments supports a wide range of payment methods, including on-chain payments, manual invoices via the dashboard, API invoicing, and recurring/subscription payments. It also offers full white-label solutions, providing businesses with a flexible and customizable platform for managing payments.

Cregis: Cregis offers the same set of features, including on-chain payments, manual invoices, API invoicing, and recurring/subscription payments. It also supports custom domains and full white-label solutions, making it just as versatile as NOWPayments in terms of customization and payment methods.

Verdict: Both NOWPayments and Cregis offer the same core features, making them equally versatile in terms of payment methods, including on-chain payments, manual invoicing, API invoicing, recurring/subscription payments, and white-label solutions. The choice between the two will depend on other factors, such as support, scalability, and compliance requirements for your business.

Processing Time

| Feature | NOWPayments | Cregis |

| Typical Confirmations & Timing | ✅ | ✅ |

NOWPayments: NOWPayments provides instant processing for certain transactions, especially for low-risk coins. Bitcoin and Litecoin, for example, can often be processed in under 3 minutes, while TON is being processed in under only 1 minute.

Cregis: Cregis also supports on-chain payments, manual invoices, API invoicing, and recurring/subscription payments. When a merchant initiates a payment request, the system generates a unique payment address, and funds are deposited into the Cregis wallet, before being swiftly transferred to the merchant’s designated wallet within 10 minutes [4].

Verdict: Both NOWPayments and Cregis offer the same core features, including on-chain payments, manual invoicing, API invoicing, recurring/subscription payments, and white-label solutions. NOWPayments stands out with its ability to transfer funds in under 3 minutes, making it ideal for businesses that need faster payment processing.

Fees & Pricing

| Feature | NOWPayments | Cregis |

| Processing fee | 0.5%-1% | 0.5% |

| Customizable network fee offers | ✅ | ❌ |

| 0% service fee for payouts | ✅ | ✅ |

NOWPayments: Charges a processing fee of 0.5%-1% per transaction, offering a flexible pricing model. Additionally, NOWPayments allows customizable network-fee offers and provides a 0% service fee for payouts, allowing businesses to adjust their fees according to their needs.

Cregis: Charges a 0.5% processing fee per transaction for businesses with standard transaction volumes. Cregis operates on a subscription model, offering scalable terms for high-volume businesses. It does not provide customizable network fee options; the deposit fee is covered by the user, while the sender pays the withdrawal fee.

Verdict: NOWPayments is ideal for businesses seeking flexible per-transaction pricing, customizable fees, and 0% service fees on payouts. Cregis suits businesses with consistent high transaction volumes that prefer a subscription-based model for predictable costs and scalability. Both platforms offer 0% service fees for payouts.

Financial Settlement & Payouts

| Feature | NOWPayments | Cregis |

| API payouts (crypto→wallet) | ✅ | ✅ |

| Dashboard CSV payouts | ✅ | ❌ |

NOWPayments: NOWPayments supports real-time crypto payouts and offers API payouts (crypto → wallet), enabling businesses to transfer crypto directly to wallets. It also provides Dashboard CSV payouts, allowing merchants to easily download transaction data for batch processing. Additionally, NOWPayments offers crypto-to-fiat payouts through external providers, allowing businesses to convert crypto to fiat and settle to bank accounts.

Cregis: Cregis settles deposits only in crypto, while payouts can be made in either fiat or crypto, providing flexibility for businesses. It supports API payouts for crypto-to-wallet transfers, but Dashboard CSV payouts are not available, which may limit the ease of processing large batches of payouts.

Verdict: NOWPayments offers a more comprehensive payout solution, with real-time crypto payouts, API payouts, and the ability to convert crypto to fiat for bank settlements, along with CSV batch processing. Cregis settles deposits only in crypto, while payouts can be in fiat or crypto, but lacks CSV payouts for batch processing, which may limit efficiency for large transactions. Overall, NOWPayments is the better choice for businesses requiring flexible payout options and easy batch processing.

Integration & Plugins

| Feature | NOWPayments | Cregis |

| REST API | ✅ | ✅ |

| Payment/Create-Intent endpoints | ✅ | ✅ |

| Plugins | ✅ | ❌ |

| Dedicated mobile/web POS (QR) | ✅ | ✅ |

NOWPayments: Offers a comprehensive range of integration options, including REST API, Payment/Create-Intent endpoints, plugins for platforms like WooCommerce, and a dedicated mobile/web POS (QR) for in-person payments.

Cregis: Focuses primarily on API-driven integrations and does not provide ready-made plugins for e-commerce platforms. While it supports REST API for custom integrations, it lacks out-of-the-box e-commerce integrations. Dedicated mobile/web POS (QR) is available, allowing businesses to accept payments via QR codes.

Verdict: NOWPayments offers a more comprehensive integration suite, making it ideal for businesses looking for easy and flexible integrations with various platforms. Cregis, on the other hand, is better suited for businesses with technical resources capable of handling custom API integrations, particularly those focused on on-chain transactions and a more developer-driven setup.

Registration & Setup Time

| Feature | NOWPayments | Cregis |

| User registration flow | Instant registrationOnly email needed | ❌Requires downloading PC/Mac client |

| Fast Setup time | ✅ | ✅ |

NOWPayments: Registration on NOWPayments is quick and straightforward, with most accounts set up in just a few minutes. The integration process is seamless, requiring only an email for registration. Additionally, NOWPayments offers both a website version and a mobile app, giving users the flexibility to choose the platform that best suits their needs.

Cregis: Cregis also offers fast setup, typically taking less than 7 days for full deployment. However, businesses are required to download the Cregis PC/Mac client for registration, which may create a minor barrier for some users, especially those unfamiliar with the setup process.

Verdict: NOWPayments offers a quick and seamless registration process, with easy setup in just minutes and the flexibility of both a website and mobile app. Cregis, while also offering a fast setup, requires users to download the PC/Mac client for registration, which may be less convenient for some. Overall, NOWPayments is ideal for businesses looking for instant registration and platform flexibility, while Cregis is better suited for businesses willing to go through an additional step for setup.

Support & Service

| Feature | NOWPayments | Cregis |

| Email/ticket | ✅ | ✅ |

| Live chat | ✅ | ❌ |

| Telegram chat | ✅ | ❌ |

| Dedicated manager | ✅ | ✅ |

| Knowledge base / help center | ✅ | ✅ |

NOWPayments: Offers 24/7 support through live chat, email/ticket, and a comprehensive knowledge base/help center. Additionally, for each partner the dedicated manager is being provided, providing personalized support for larger or more complex businesses.There is an opportunity to create a Telegram chat with the dedicated manager to stay in touch 24/7.

Cregis: Provides 24/7 support through email/ticket and offers dedicated account managers for enterprise clients, ensuring that larger businesses receive personalized support and consultation. However, live chat support is not available [6].

Verdict: Both platforms offer 24/7 support and dedicated account managers, but NOWPayments stands out by providing live chat support and offering dedicated account managers to high-volume partners, making it an excellent choice for businesses with substantial transaction volumes.

Solutions for other Businesses

NOWPayments

- E-commerce:

- Easy integration with WooCommerce.

- Automated invoicing and recurring payments.

- Custom checkout and white-label solutions.

- Real-time analytics and crypto-to-fiat payouts.

- Online Marketplaces:

- Accept 300+ cryptocurrencies, including 18 stablecoins.

- Custom payment flows via API.

- SaaS:

- Recurring payments with API invoicing.

- QR codes and embedded checkout.

- Large Enterprises:

- Dedicated account managers and real-time analytics.

- White-label solutions for branding.

Cregis

*Screenshot of the home page is sourced from Cregis’ official website.

- Enterprises:

- Instant payouts with T+0 settlement.

- Custom API integrations.

- Tech Startups:

- API-driven integrations and QR codes.

- Support from dedicated account managers.

- Niche Markets:

- Self-custody with MPC technology.

- Tailored payment flows for gaming, NFTs.

Verdict: NOWPayments is perfect for e-commerce, online marketplaces, SaaS, and large enterprises seeking flexible and scalable crypto payment solutions with robust support for high-volume transactions. Cregis is a strong choice for enterprises, tech startups, and niche markets like gaming and NFTs, requiring advanced, customizable API integrations and strong security features such as self-custody.

Pros & Cons

NOWPayments

Pros:

- Low fees (0.5%-1%), making it cost-effective for large businesses.

- White-label solutions for custom branding.

- Supports 300+ cryptocurrencies, offering extensive payment options.

- Features recurring payments and crypto subscription tools, perfect for subscription-based services.

- AML compliance and transaction monitoring ensure regulatory adherence.

- Fast payment processing and instant notifications.

- Ideal for large enterprises and global businesses needing scalability and customization.

Cons:

- More complex setup, particularly for white-label solutions.

- Requires more technical knowledge for advanced features, such as custom integration.

- Higher setup time for businesses looking for advanced features compared to simpler solutions.

Best For:

- Large enterprises and global businesses.

- E-commerce, gaming, and financial services.

- Subscription-based services and businesses needing extensive crypto support.

Cregis

Pros:

- Self-custody solution with MPC technology, offering high security for crypto assets.

- Instant payouts, ideal for businesses requiring immediate access to funds.

- Custom API integrations for highly flexible, developer-driven setups.

- Dedicated account managers for enterprise-level support.

- Tailored payment flows for niche industries like gaming, NFTs, and DeFi.

- Perfect for crypto-to-crypto transactions.

Cons:

- No native e-commerce plugins for platforms like WooCommerce, Shopify, or Magento, requiring businesses to rely on API integrations.

- Lack of fiat-to-bank payouts, meaning businesses must handle crypto-to-fiat conversions externally.

- Limited analytics and reporting tools, requiring businesses to manually track transaction data.

- PC/Mac client required for registration, which could be inconvenient for businesses that prefer a fully web-based sign-up process.

- Not suitable for businesses seeking an out-of-the-box solution—more ideal for those with technical resources for custom integrations.

Best For:

- Enterprises and tech startups needing custom API integrations and high security for managing crypto payments.

- Crypto-focused businesses like exchanges, wallet services, or DeFi projects that need self-custody solutions and instant payouts.

- Niche markets like NFT platforms, and DeFi needing tailored payment flows and fast, secure transactions.

Real User Reviews & Community Feedback

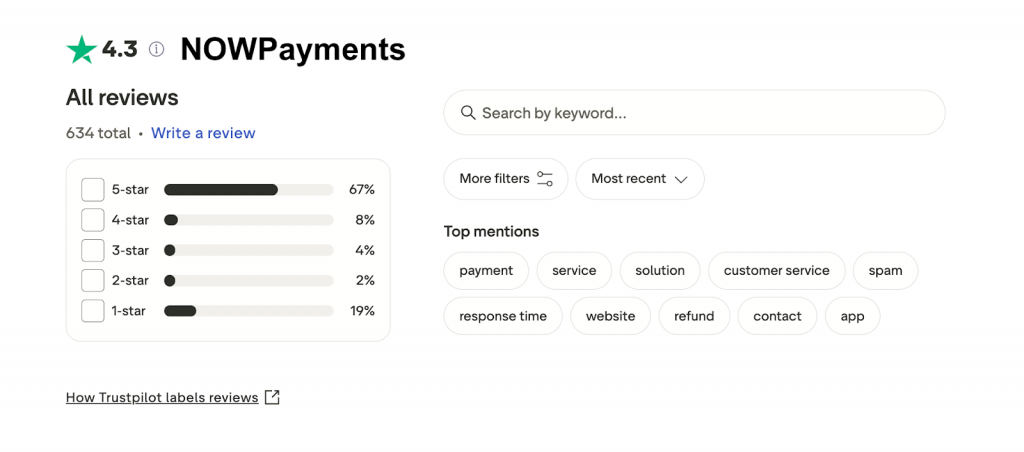

NOWPayments enjoys a generally positive reputation with users praising its speed, reliability, and helpful support with the score of 4.3/5 or 86/100. Merchants appreciate the smooth integrations and fast payment processing. However, some users mention the effort required for custom setups, though most agree it delivers on its promises. Users on Reddit appreciate the non-custodial model and transparency, but occasional delays in detecting or sending payments and slower support are noted [7]. Overall, the platform is seen as an excellent solution for businesses needing reliable crypto payment processing [8].

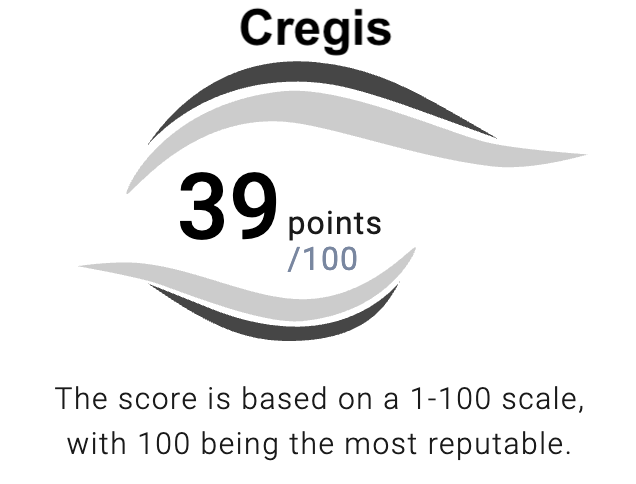

Cregis has a generally low trust score of 39/100 based on security assessments, indicating potential risks. While the platform is praised by enterprise clients for its self-custody via MPC technology, instant payouts, and robust API integrations, it lacks significant third-party reviews and has limited popularity, with low traffic and few external mentions. Some users have raised concerns about the PC/Mac client registration process and the absence of out-of-the-box e-commerce plugins, making it less accessible for smaller businesses. Overall, Cregis is considered reliable for businesses in crypto-focused industries but should be approached with caution due to its low trust score and limited online reputation [9].

General Sentiment: While both platforms are well-regarded, NOWPayments generally receives higher praise for large enterprises and e-commerce applications, offering easier integrations, faster setup, and broader usability. Cregis is better suited for technical startups that prioritize security, self-custody, and customizable payment flows.

Why Clients Choose NOWPayments Over Cregis

Clients often choose NOWPayments over Cregis because it provides comprehensive, enterprise-ready solutions tailored for larger businesses. Its white-label options allow companies to fully brand their payment systems, making it ideal for e-commerce platforms and global enterprises seeking a seamless, custom-branded payment experience. Additionally, NOWPayments supports 300+ cryptocurrencies, far exceeding Cregis’s offering, giving businesses the flexibility to accept a wide range of digital assets. For subscription-based businesses, features like crypto subscription tools and automated invoicing make NOWPayments a scalable solution for recurring payments.

Reliability and compliance are also key reasons clients prefer NOWPayments. The platform is known for fast payment processing, AML compliance, and robust transaction monitoring, ensuring that payments are both quick and secure. In contrast, Cregis, while strong in security and self-custody, has occasionally faced criticism for refund and dispute handling, which can impact trust. With NOWPayments, businesses benefit from a trusted, well-supported platform that combines speed, compliance, and scalability, making it the preferred choice for large enterprises and businesses that require a secure, feature-rich payment solution.

Final Verdict: NOWPayments or Cregis?

For large enterprises, e-commerce platforms, and businesses needing scalability and compliance → NOWPayments wins.

NOWPayments provides white-label solutions, supports 300+ cryptocurrencies, and includes advanced tools like crypto subscription features and AML compliance. Its reliable support and fast payment processing make it ideal for businesses that require robust, customizable, and compliant crypto payment solutions. This combination of features ensures a secure, seamless, and scalable payment experience for customers, making NOWPayments the preferred choice for high-volume and enterprise-level operations.

For small businesses, freelancers, and privacy-focused users → Cregis is the better option.

Cregis offers a simple setup, low fees, and a user-friendly interface, making it suitable for businesses with basic crypto payment needs. Its non-custodial model and no KYB requirement appeal to privacy-conscious users and smaller operations. While it lacks some of the advanced features of NOWPayments, Cregis provides a cost-effective and easy-to-use platform for businesses that prioritize simplicity, fast crypto payouts, and low transaction costs over enterprise-level customization and scalability.

FAQ: NOWPayments vs Cregis 2025

Is NOWPayments safe to use in 2025?

Yes, NOWPayments is considered safe to use. The platform operates with a custodial model, ensuring secure handling of funds. It employs robust security measures, including two-factor authentication (2FA), whitelisted wallets, and IP addresses to protect merchants and their transactions.

Is Cregis regulated and legit?

Yes. Cregis holds a FinCEN MSB license and complies with SOC 2 Type II standards, which ensures it meets legal and regulatory standards for financial services. It is a trusted B2B provider serving over 3,500 enterprise clients, with a strong track record of security and compliance.

Which is cheaper: NOWPayments or Cregis?

Cregis charges a 0.5% fee for each deposit, and if a business needs to accept high volumes of deposits, it will also incur a monthly subscription fee. On the other hand, NOWPayments charges a 0.5%-1% per-transaction fee, but does not require any monthly subscription. Even for businesses with high volumes, NOWPayments remains an efficient option since it avoids the additional cost of a subscription, making it a cost-effective solution for businesses of any size.

Which gateway is better for large enterprises?

NOWPayments is the better option for large enterprises, offering white-label solutions, AML compliance, and support for 300+ cryptocurrencies. It is designed for scalability and global operations, making it ideal for businesses with complex payment processing needs.

Does NOWPayments require KYC?

No. NOWPayments does not require merchant KYC/KYB for standard accounts.

Can I use Cregis without a bank account?

Yes. Cregis focuses on crypto-to-crypto payments and does not require a bank account to receive or send funds. Crypto-to-fiat payouts are not natively supported, so all transactions can remain entirely in crypto.

How We Compared NOWPayments vs. Cregis (Methodology)

This comparison was based on: