As cryptocurrency adoption continues to grow, choosing the right payment gateway is essential for businesses in 2025. NOWPayments offers a user-friendly solution for businesses looking to integrate crypto payments easily, while Binance Pay provides a comprehensive platform for businesses needing advanced treasury management and robust financial infrastructure. In this comparison, we’ll analyze key factors like fees, supported currencies, settlement options, and security to help you determine which platform aligns with your business’s goals and operational needs.

By 2025, businesses operating in the digital economy require more than just crypto payment acceptance—they need secure storage, efficient fund management, and advanced treasury capabilities. NOWPayments focuses on making crypto payments accessible with low fees and flexible currency support, ideal for small to medium-sized businesses. In contrast, Binance Pay delivers an enterprise-level solution for businesses that need comprehensive management of both digital assets and traditional finances, with integrated tools for high-volume transactions and business banking features.

This comparison breaks down both platforms by examining their fees, currencies, settlement methods, and security features, answering essential questions like “Which platform is best for handling high-volume payments?” and “Do I need advanced financial tools like fiat-to-crypto conversions?” By the end of this guide, you’ll have the insights needed to choose the best platform for your business’s needs in 2025.

Feature-by-Feature Breakdown

Products

| Products | NOWPayments | Binance Pay |

| API Integration Method | ✅ | ✅ |

| Crypto Invoicing | ✅ | ✅ |

| Mass Payouts | ✅ | ✅ |

| Crypto Subscription Tool | ✅ | ❌ |

| White Label Solutions | ✅ | ✅ |

NOWPayments: Offers a comprehensive suite of crypto payment tools designed for flexibility and ease of use. It supports API integration, crypto invoicing, mass payouts, and — critically — recurring subscription payments via its dedicated recurring billing API. Merchants can also customize the checkout experience with widgets, buttons, and payment links, enabling seamless integration into websites and e-commerce platforms. Importantly, NOWPayments provides a free white-label solution, allowing businesses to fully brand the payment page with their logo, colors, and domain — with no enterprise contract required.

Binance Pay: Delivers enterprise-grade infrastructure built on the trust and security of the world’s largest crypto exchange. It offers robust API integration, crypto invoicing, and mass payouts — but does not support recurring subscriptions at all. While it does offer a full white-label solution, this is only available under an enterprise agreement, requiring legal review, minimum volume thresholds, and direct sales engagement — making it inaccessible to small or mid-sized merchants.

Verdict: For businesses needing recurring billing, instant white-labeling, and frictionless integration — NOWPayments is the clear choice.For businesses already within the Binance ecosystem seeking institutional compliance, lower payout fees at scale, and full custom branding under contract — Binance Pay delivers superior enterprise capabilities.

Custody & KYC

| Feature | NOWPayments | Binance Pay |

| Default non-custodial model | ✅ | ❌ |

| Difficult KYB Process | ❌ | ✅ |

NOWPayments: NOWPayments operates on a non-custodial model with custody options available, giving businesses full control over their private keys and crypto assets. The verification process is simple and straightforward, with no Merchant KYB or KYC required for registration or withdrawals, making it quick and easy for businesses to get started.

Binance Pay: Binance Pay follows a self-custodial model. Merchant KYC is required due to Binance Pay compliance.

Verdict: NOWPayments offers a simpler and more streamlined verification process, with no Merchant KYC or KYB required, making it faster and easier for businesses to get started while retaining full control over their assets. Binance Pay, on the other hand, follows a self-custodial model and requires merchant KYC for compliance, which can be more time-consuming. Overall, NOWPayments is the better choice for businesses seeking faster setup and less stringent verification.

Compliance & Transparency

| Feature | NOWPayments | Binance Pay |

| Transaction monitoring / risk flags | ✅ | ✅ |

| Anti-fraud Measures | ✅ | ✅ |

NOWPayments: NOWPayments follows AML (Anti-Money Laundering) regulations, ensuring compliance with global financial standards.

Binance Pay: Binance Pay is fully FATF (Financial Action Task Force) compliant and publishes Proof of Reserves regularly. It follows strict global anti-money laundering (AML) standards, ensuring a higher level of transparency and trust.

Verdict: Binance Pay stands out with its transparent compliance practices, including Proof of Reserves and FATF compliance. NOWPayments follows AML regulations but does not provide the same level of transparency as Binance Pay.

Supported Cryptocurrencies

| Feature | NOWPayments | Binance Pay |

| Supported Cryptocurrencies | 300+ [1] | 100+ [3] |

| Supported Stable Coins | 30+ | 5 |

| Major Supported Networks | 10 | 8 |

NOWPayments: Supports over 300 cryptocurrencies across a wide range of networks, including major assets like BTC, ETH, USDT, BNB, SOL, XRP, and ADA. It also integrates with 10 major blockchain networks—BTC, ETH, BSC, TRX, SOL, MATIC, XRP, ADA, AVAX, and LTC—providing merchants with a broad and flexible range of options to accept payments globally.

Binance Pay: Supports around 100 cryptocurrencies, focusing on high-liquidity coins and popular stablecoins like BTC, ETH, USDT, and BUSD. It operates across 8 major networks—BTC, ETH, TRX, SOL, XRP, ADA, AVAX, and LTC—covering the most widely used and trusted blockchains.

Verdict: NOWPayments offers a broader selection of cryptocurrencies and blockchain networks, making it ideal for businesses that want to accept a wide variety of digital assets. Binance Pay, while more limited in scope, focuses on popular and stable coins, which can be sufficient for businesses targeting mainstream crypto users.

Payment Methods

| Feature | NOWPayments | Binance Pay |

| On-chain payments | ✅ | ✅ |

| Full white-label | ✅ | ❌ |

| Manual invoices (dashboard) | ✅ | ✅ |

| API invoicing | ✅ | ✅ |

| Recurring / subscriptions | ✅ | ✅ |

NOWPayments: Offers a full white-label solution, allowing businesses to create a fully branded payment experience. It also supports on-chain payments, manual invoices, API invoicing, and recurring subscriptions, making it a comprehensive solution for businesses looking for extensive customization and payment tools.

Binance Pay: Also supports on-chain payments, manual invoices, API invoicing, and recurring subscriptions, but lacks a full white-label solution, limiting the ability for businesses to fully customize the checkout experience.

Verdict: NOWPayments is the better choice for businesses that need full branding control with white-label solutions and flexibility in payment customization, while Binance Pay is suitable for businesses that don’t require heavy branding and focus more on basic payment processing features.

Processing Time

| Feature | NOWPayments | Binance Pay |

| Typical Confirmations & Timing | ✅ | ✅ |

NOWPayments: NOWPayments ensures fast processing times, with most transactions confirmed under three minutes. For networks like TRON, the confirmation time is even faster, typically under one minute. This makes it an excellent choice for businesses prioritizing speed.

Binance Pay: Binance Pay’s transaction confirmation times are typically swift, taking seconds to minutes depending on the blockchain. For example, BTC transactions can take 10–30 minutes for full confirmation, while faster coins like TRON and ETH may take just seconds.

Verdict: NOWPayments offers quicker confirmation times, especially for networks like TRON, making it a better option for businesses that require rapid processing. Binance Pay offers efficient processing but may have slightly longer confirmation times for some assets.

Fees & Pricing

| Feature | NOWPayments | Binance Pay |

| Processing fee | 0.5%-1% | ~1% MDR (Merchant Discount Rate) |

| Customizable network-fee offers | ✅ | ✅ |

| 0% service fee for payouts | ✅ | ❌ |

NOWPayments: NOWPayments charges a 0.5% to 1% processing fee, which is considered one of the lowest in the market. This makes it an attractive option for businesses focused on cost savings.

Binance Pay: Binance Pay’s fees are around 1% Merchant Discount Rate (MDR), which can be higher than NOWPayments’ 0.5% to 1% fee, although this may vary depending on the volume and account type.

Verdict: For small to large-sized businesses, NOWPayments provides a more budget-friendly solution, while Binance Pay could be ideal for enterprises that prioritize other features such as integration with the Binance ecosystem.

Financial Settlement & Payouts

| Feature | NOWPayments | Binance Pay |

| API payouts (crypto→wallet) | ✅ | ✅ |

| Dashboard CSV payouts | ✅ | ❌ |

NOWPayments: NOWPayments settles payments in cryptocurrency and provides crypto-to-fiat payouts, allowing merchants to convert their crypto earnings into fiat currency through third-party providers.

Binance Pay: Binance Pay settles exclusively in cryptocurrency, with no option for direct fiat-to-bank payouts. Merchants must convert their crypto into fiat via the Binance exchange if they want to withdraw in fiat.

Verdict: NOWPayments provides more flexibility with crypto-to-fiat payouts, making it a more adaptable option for businesses that need fiat settlement. Binance Pay, however, is restricted to crypto-only settlements.

Integration & Plugins

| Feature | NOWPayments | Binance Pay |

| REST API | ✅ | ✅ |

| Payment/Create-Intent endpoints | ✅ | ✅ |

| Plugins | ✅ | ✅ |

| Dedicated mobile/web POS (QR) | ✅ | ✅ |

NOWPayments: NOWPayments offers integrations for plugins like WooCommerce and various e-commerce platforms. It also supports API-based integrations for custom solutions, allowing businesses to integrate the payment system into their existing platforms easily.

Binance Pay: Binance Pay supports various integrations, including plugins for platforms like Shopify, WooCommerce, and Magento, and it also offers API-driven solutions. However, it has fewer options for framework-specific libraries.

Verdict: NOWPayments is slightly ahead in terms of available integrations, especially for smaller platforms and custom setups. Binance Pay is also well-integrated but may be more suitable for those already in the Binance ecosystem.

Registration & Setup Time

| Feature | NOWPayments | Binance Pay |

| User registration flow | Instant registrationOnly email needed | emailKYC |

| Fast Setup time | ✅ | ❌ |

NOWPayments: Offers instant registration with just an email required, allowing businesses to start accepting payments almost immediately.

Binance Pay: Requires business verification (KYC), which may take a few days before merchants can start accepting payments.

Verdict: NOWPayments provides a faster registration process, ideal for businesses looking to get started quickly with minimal hassle, while Binance Pay requires more time due to the business verification process.

Reporting & Analytics

| Feature | NOWPayments | Binance Pay |

| Dashboard analytics | ✅ | ✅ |

| Exports (CSV/XLS/API) | ✅ | ✅ |

NOWPayments: NOWPayments offers real-time reporting and analytics, with export capabilities to CSV, PDF, and XLS for further analysis. Merchants can track transactions, revenue, and other key metrics.

Binance Pay: Binance Pay also provides robust reporting and analytics via its dashboard, with real-time data and export capabilities. Merchants can view success rates, top coins, payout histories, and more.

Verdict: Both platforms offer strong analytics tools, but Binance Pay might have a slight edge in the variety of reports available for larger enterprises. NOWPayments provides everything needed for smaller to medium-sized businesses.

Support & Service

| Feature | NOWPayments | Binance Pay |

| Email/ticket | ✅ | ✅ |

| Live chat | ✅ | ❌ |

| Dedicated manager | ✅ | ✅(only for enterprise clients) |

| Knowledge base / help center | ✅ | ✅ |

NOWPayments: NOWPayments provides 24/7 support through live chat, email, and a comprehensive knowledge base. Their support team is responsive, and the knowledge base helps solve common issues. Additionally, partners get Telegram chat support with a dedicated manager for more personalized assistance.

Binance Pay: Binance Pay offers 24/7 email/ticket support only for merchants, and enterprise clients receive a dedicated manager. While they do not offer live chat for general users, their help center is well-equipped with resources.

Verdict: NOWPayments offers more accessible 24/7 live chat support and Telegram chat with a dedicated manager for partners, while Binance Pay provides a higher level of service for enterprise clients with dedicated account managers.

Solutions for other Businesses

NOWPayments

- Large Enterprises: NOWPayments offers flexible payment methods, including API integration and widgets for seamless crypto payment processing, ideal for large enterprises needing scalable solutions.

- E-Commerce: Integrate crypto payments via API or plugins like WooCommerce, Shopify, etc., with customizable widgets and buttons for a smooth checkout experience.

- Freelancers & Service Providers: Accept mass payouts and crypto payments globally with low fees (0.5%-1%).

- Non-Profit Organizations: Easily set up crypto donation systems with low transaction fees.

- Tech Startups: Accept multiple cryptocurrencies, with crypto-to-fiat payouts through third-party providers and quick integration.

Binance Pay

*Screenshot of the home page is sourced from Binanace Pay’s official website.

- E-Commerce: Offer crypto payments with QR codes and customized checkout for a seamless experience, especially for Binance users.

- Subscription-Based Services: Automate recurring payments with stablecoins for predictable billing.

- Freelancers & Service Providers: Receive payments instantly in high-liquidity assets with low transaction fees.

- Gaming & Digital Goods: Enable in-game purchases and virtual goods payments using multiple cryptocurrencies.

- Tech Startups: Integrate crypto payments easily through API and leverage stablecoins for reduced volatility risk.

Verdict: NOWPayments is best for large enterprises looking for flexible payment methods, low fees, and scalable solutions, making it ideal for global businesses, e-commerce platforms, and nonprofits. Binance Pay is perfect for businesses already in the Binance ecosystem, offering white-label solutions, stablecoin payments, and seamless integration for subscription-based services and enterprises.

Pros & Cons

NOWPayments

Pros:

- Flexible Payment Methods: Supports API integration, plugins for e-commerce platforms, and customizable widgets and buttons.

- Non-Custodial & Custodial Options: Offers non-custodial payment solutions with custodial options available for businesses that prefer to delegate control of funds.

- Wide Cryptocurrency Support: Supports 300+ cryptocurrencies and major blockchain networks like BTC, ETH, BNB, TRON, and more.

- Low Transaction Fees: 0.5% to 1% processing fees, which are cost-effective for businesses.

- Crypto-to-Fiat Payouts: Provides crypto-to-fiat payouts via third-party providers, offering flexibility for businesses that need fiat settlements.

- Fast Processing: Transactions typically confirmed in under 3 minutes, with TRON under 1 minute.

- Dedicated Support: Offers Telegram chat support for partners with a dedicated manager for more personalized assistance.

- Recurring Payments for Subscription-Based Businesses: Ability to handle recurring payments for subscription services.

Cons:

- No Sandbox

Best For:

- Large Enterprises looking for a flexible and scalable crypto payment solution.

- Global E-Commerce businesses needing low fees and multiple cryptocurrency options.

- Freelancers & Service Providers wanting to accept crypto payments easily and offer mass payouts.

- Non-Profit Organizations seeking a simple crypto donation setup.

Binance Pay

Pros:

- White-Label Solutions: Offers full white-label solutions with customizable branding for enterprise clients.

- High-Liquidity Asset Support: Supports major cryptocurrencies like BTC, ETH, BUSD, USDT, and more, ensuring easy payments with liquid assets.

Seamless Binance Integration: Best for businesses already within the Binance ecosystem, offering a smooth experience for Binance users. - Stablecoin Payments: Allows businesses to settle transactions using stablecoins like BUSD, ensuring predictable pricing and minimizing volatility.

- Recurring Payments: Supports recurring payments for subscription-based services.

- Low Fees: Competitive 1% MDR (Merchant Discount Rate), though slightly higher than NOWPayments.

Cons:

- Limited Cryptocurrency Support: Supports fewer coins (~100) compared to NOWPayments.

- Fiat Settlement Restrictions: Does not offer direct fiat-to-bank payouts; merchants need to convert crypto to fiat via Binance exchange.

- Less Flexible Integration Options: Limited flexibility in integrations for businesses outside the Binance ecosystem, and fewer framework-specific libraries.

Best For:

- Large Enterprises and businesses already integrated with Binance, especially those requiring white-label solutions and stablecoin payments.

- Subscription-Based Services needing recurring payments and predictable billing.

- Gaming & Digital Goods industries offering crypto payments for in-game purchases or virtual goods.

Real User Reviews & Community Feedback

NOWPayments enjoys a generally positive reputation with users praising its speed, reliability, and helpful support. Merchants appreciate the smooth integrations and fast payment processing. However, some users mention the effort required for custom setups, though most agree it delivers on its promises. Users on Reddit appreciate the non-custodial model and transparency, but occasional delays in detecting or sending payments and slower support are noted. Overall, the platform is seen as an excellent solution for businesses needing reliable crypto payment processing [4].

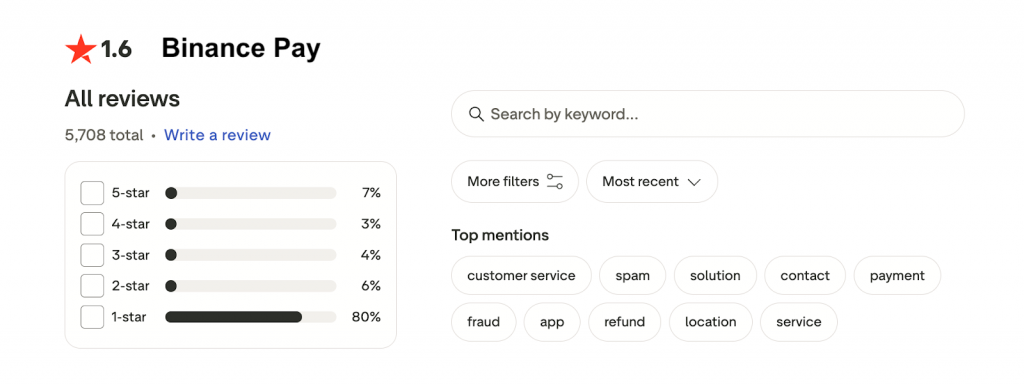

Binance Pay has received a mix of feedback, with some users praising its ease of integration and seamless experience for Binance users. Merchants appreciate the ability to process payments in major cryptocurrencies and stablecoins, making it a convenient solution for businesses in the Binance ecosystem. However, many users have expressed frustration with slow customer support, often reporting long wait times for responses and resolution. Additionally, account freezes and delayed withdrawals have been recurring issues, with users noting that funds can be inaccessible for weeks without clear explanations. Despite these setbacks, some users have had positive experiences, particularly those who are already familiar with the Binance platform. Overall, Binance Pay is seen as a solid option for businesses integrated with Binance, but potential users should be aware of the customer service challenges and account restrictions that may arise [5].

General Sentiment: NOWPayments is widely praised for its speed, reliability, and ease of integration, making it an excellent choice for businesses seeking efficient crypto payment processing, though occasional delays and slower support are noted. Binance Pay offers seamless integration for Binance users but is hindered by customer service issues, account freezes, and delayed withdrawals, making it better suited for businesses already within the Binance ecosystem.

Why Clients Choose NOWPayments Over Binance Pay

Businesses across industries choose NOWPayments over Binance Pay for its cost-effective solutions and profit-driven advantages. In e-commerce, freelancing, and digital goods, NOWPayments’ low transaction fees (0.5% to 1%) and fast processing times (under 3 minutes, with TRON under 1 minute) help businesses boost revenue by reducing overhead and payment delays. With the ability to accept over 300 cryptocurrencies, businesses can attract a wider audience, including crypto-savvy consumers. Additionally, NOWPayments offers custodial options for businesses that prefer managed funds, alongside its non-custodial model for greater flexibility.

Industries like gaming, subscription services, and SaaS platforms also benefit from NOWPayments’ recurring payment features and seamless integrations with platforms like WooCommerce. The ability to handle payments efficiently and securely, combined with the option for custodial management, allows businesses to scale while maintaining full control over funds. NOWPayments is an ideal choice for businesses seeking low fees, fast payments, and operational flexibility in the crypto payment space.

Final Verdict: NOWPayments or Binance Pay?

For large enterprises, e-commerce platforms, and businesses needing scalability and compliance → NOWPayments wins.

NOWPayments offers white-label solutions, supports 300+ cryptocurrencies, and includes advanced tools like crypto subscription features and AML compliance. Its combination of reliable support, fast payment processing, and non-custodial and custodial options make it a top choice for businesses that require a robust, customizable, and compliant crypto payment solution. This makes NOWPayments ideal for high-volume and enterprise-level operations, offering a secure and scalable payment experience for both businesses and customers.

For businesses within the Binance ecosystem, small to medium-sized enterprises, and those focused on recurring payments and stablecoins → Binance Pay wins.

Binance Pay offers seamless integration with the Binance platform, white-label solutions, and the ability to process payments in major cryptocurrencies and stablecoins like BUSD. Its focus on simple recurring billing makes it an attractive choice for businesses looking for ease of use and predictable pricing. Despite customer service challenges and account restrictions, Binance Pay is ideal for companies already embedded in the Binance ecosystem seeking a reliable, user-friendly payment solution.

FAQ: NOWPayments vs Binance Pay 2025

Is NOWPayments safe to use in 2025?

Yes, NOWPayments is considered safe to use. The platform operates with a custodial model, ensuring secure handling of funds. It employs robust security measures, including two-factor authentication (2FA), whitelisted wallets, and IP addresses to protect merchants and their transactions.

Is Binance Pay regulated and legit?

Yes, Binance Pay is a legitimate platform operating under the Binance ecosystem, which is globally recognized. However, its regulation varies by region, and while it follows AML standards, users should check local regulations as Binance has faced scrutiny in several countries.

Which is cheaper: NOWPayments or Binance Pay?

NOWPayments is generally cheaper than Binance Pay, with transaction fees ranging from 0.5% to 1%, depending on the volume. In comparison, Binance Pay charges around 1% Merchant Discount Rate (MDR), which can be higher than NOWPayments’ fees.

Which gateway is better for large enterprises?

For large enterprises, NOWPayments is generally the better choice. It offers white-label solutions, supports 300+ cryptocurrencies, and includes advanced features like crypto subscription tool and AML compliance, making it a robust and scalable option.

Does NOWPayments require KYC?

No. NOWPayments does not require merchant KYC/KYB for standard accounts.

Can I use Binance Pay without a bank account?

Yes, you can use Binance Pay without a bank account, as it primarily operates with cryptocurrencies. You can receive and make payments in digital assets like BTC, ETH, and BUSD, without the need for a bank account. However, if you wish to convert your crypto into fiat currency or withdraw funds to a traditional bank account, a bank account would be necessary for fiat withdrawals.

How We Compared NOWPayments vs. Binance Pay (Methodology)

This comparison was based on:

- NOWPayments Official Site

- Binance Pay Account Setup

- Binance Supported Coins

- Crypto Processing Time on Binance Pay

- Binance Pay Official Site

- Binance Pay Support

- Reddit Discussions

- Trustpilot Reviews

- NOWPayments support – KYC AML Procedure.

Binance Pay Blog – Identity Verification Process