As businesses look for better payment solutions in 2026, many are exploring alternatives to Mollie for their payment processing needs. While Mollie offers a comprehensive payment service, options like Stripe, Razorpay, and Square have emerged as top Mollie alternatives. These payment service providers support a diverse range of payment methods, making it easy for businesses to accept global payment options. For instance, Stripe is often touted as the best due to its robust payment gateway and fraud protection features.

Many of these alternatives also offer advanced features like recurring payment options and the ability to invoice clients seamlessly. With payment pages designed for a smooth payment experience, businesses can manage payment data efficiently and grow their business with confidence. Integrating these payment platforms can often streamline processes, allowing for a two-way sync payment dashboard that simplifies payment information management.

For those seeking online payment solutions, the choice between Mollie vs its competitors will ultimately depend on specific needs, such as the ability to prorate subscriptions or the availability of payment links. Each payment provider has its strengths, so evaluating which payment system aligns best with your business goals is essential.

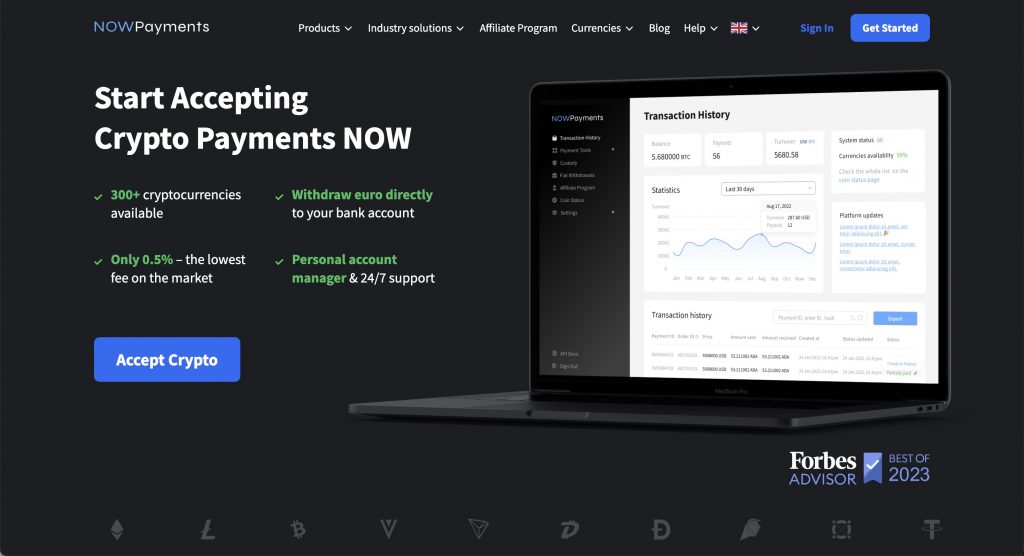

NOWPayments

NOWPayments is the best alternative to Mollie for businesses seeking greater flexibility and the ability to accept cryptocurrency payments. Unlike Mollie, which is primarily focused on traditional fiat payments, NOWPayments supports over 300 cryptocurrencies, enabling businesses to cater to a growing crypto-savvy customer base. This crypto compatibility not only broadens the range of payment options available to customers but also allows businesses to capitalize on the expanding digital currency market. By accepting payments in Bitcoin, Ethereum, and a host of other digital assets, NOWPayments provides a future-proof payment solution that traditional payment processors like Mollie cannot match.

In addition to its cryptocurrency support, NOWPayments offers seamless conversion between crypto and fiat currencies, helping businesses avoid the volatility associated with digital assets. This instant conversion feature ensures that companies receive payments in their preferred fiat currency, minimizing risk and maintaining revenue stability. Mollie, while known for its user-friendly interface and extensive fiat currency support, lacks this flexibility, which makes NOWPayments an attractive alternative for businesses looking to diversify their payment options without compromising on financial security.

Furthermore, NOWPayments provides an easy-to-use API and plugins for popular e-commerce platforms, allowing businesses to integrate crypto payments with minimal effort. With competitive transaction fees and no hidden costs, NOWPayments is a cost-effective solution that stands out from Mollie and other traditional payment processors. Businesses that choose NOWPayments can benefit from lower fees, advanced crypto capabilities, and a secure, transparent payment environment—all of which make NOWPayments a top choice for those seeking a modern and versatile alternative to Mollie.

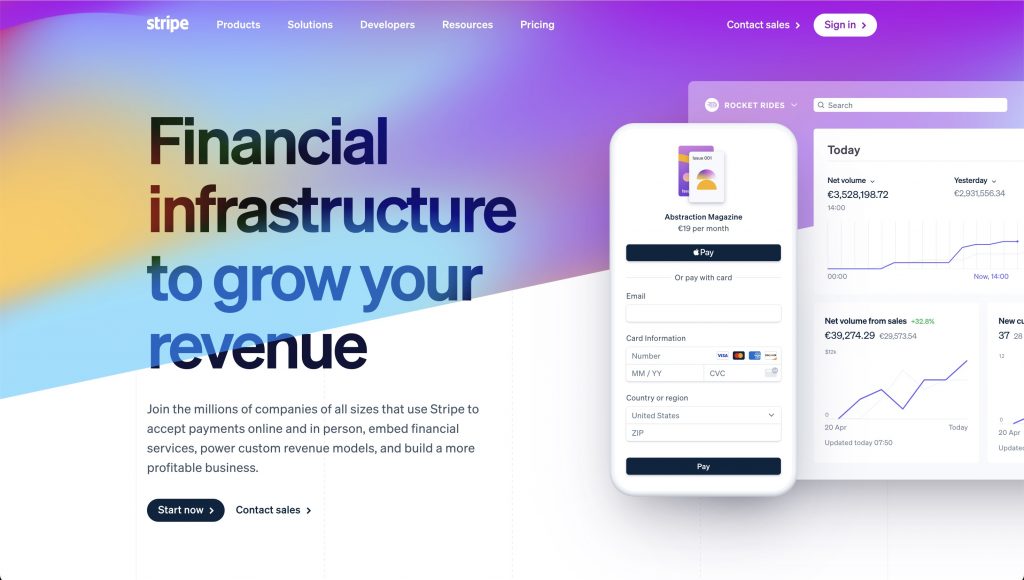

Stripe

Stripe is quickly becoming the new standard for online payments, providing a robust solution for businesses to accept payments from customers around the globe. With its global payment infrastructure, it supports popular payment methods and allows companies to leverage different payment types through a comprehensive payment suite. Whether you need to grow your business or streamline your payment processing, Stripe offers the best Mollie alternatives for 2024, making it one of the best alternatives to Mollie for managing various payment methods.

The Stripe billing feature has particularly helped businesses recover lost revenue by allowing them to prorate subscriptions effectively. With a payment gateway that offers a two-way sync payment dashboard, users can seamlessly integrate! their systems for a more efficient experience. The Mollie dashboard may have its merits, but Stripe’s ability to match products from Razorpay’s payment ecosystem sets it apart. In the end, every payment processed through Stripe is handled with utmost security, ensuring a complete payment experience for both merchants and customers alike.

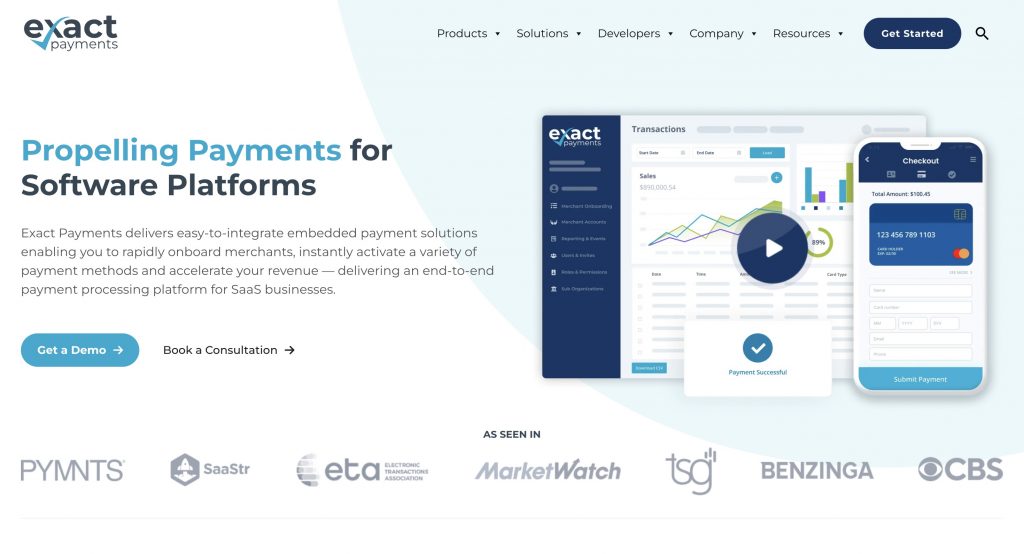

Exact Payments

Exact Payments specializes in developing and delivering easy-to-integrate and highly scalable payments technology tailored for SaaS applications. With a focus on secure payment processing, their solutions support different payment methods to cater to diverse customer preferences. By leveraging Sila’s payment platform, businesses can streamline building their payment solutions effortlessly, allowing for seamless two-way sync and a comprehensive payment dashboard for enhanced visibility.

Exact Payments also offers features to prorate subscriptions, enabling businesses to manage billing cycles effectively. By integrating with products from Razorpay’s payment suite and utilizing Stripe, often considered the best in the industry, companies can enhance their payment processing capabilities. Stripe billing has notably helped businesses recover lost revenue, while users explore the best Mollie alternatives in 2026 to find suitable solutions for their needs.

With a focus on connectivity, Exact Payments enables businesses to connect every payment effortlessly, ensuring that their integrated payment and recurring billing solutions are both efficient and reliable. As an end-to-end payment platform that provides banking-as-a-service, it empowers companies to focus on growth while managing their financial transactions with confidence.

Exact Payments specializes in developing and delivering easy-to-integrate and highly scalable payments technology tailored for SaaS applications. With a focus on secure payment processing, their solutions support different payment methods to cater to diverse customer preferences. By leveraging Sila’s payment platform, businesses can streamline building their payment solutions effortlessly, allowing for seamless two-way sync and a comprehensive payment dashboard for enhanced visibility.

Exact Payments also offers features to prorate subscriptions, enabling businesses to manage billing cycles effectively. By integrating with products from Razorpay’s payment suite and utilizing Stripe, often considered the best in the industry, companies can enhance their payment processing capabilities. Stripe billing has notably helped businesses recover lost revenue, while users explore the best Mollie alternatives in 2026 to find suitable solutions for their needs.

With a focus on connectivity, Exact Payments enables businesses to connect every payment effortlessly, ensuring that their integrated payment and recurring billing solutions are both efficient and reliable. As an end-to-end payment platform that provides banking-as-a-service, it empowers companies to focus on growth while managing their financial transactions with confidence.

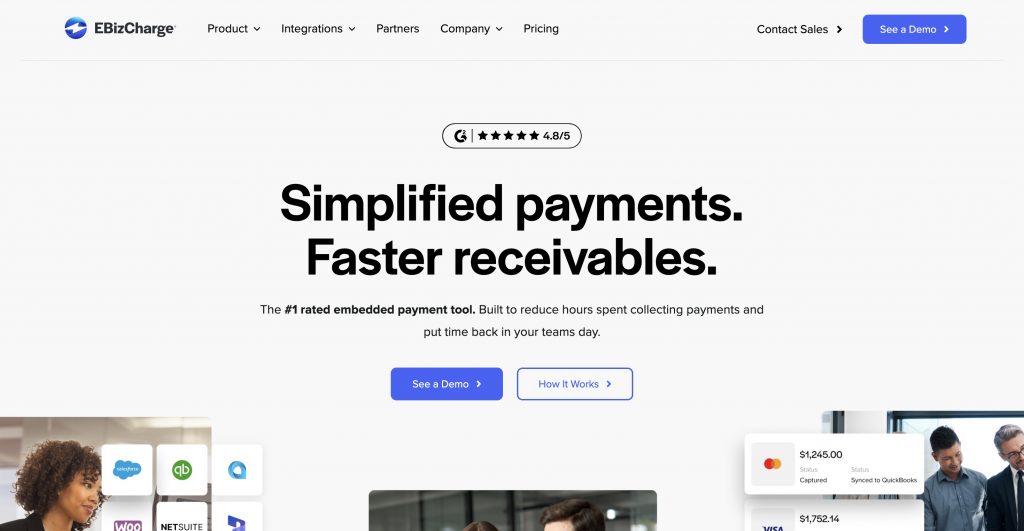

EBizCharge

EBizCharge is a leader in integrated payment processing solutions that empower businesses to facilitate seamless electronic transactions. By utilizing Sila’s payment platform, companies can streamline building their payment systems and leverage embedded payment products for financial applications. This integration enables businesses to prorate subscriptions effortlessly, enhancing customer experiences and improving revenue management.

Moreover, with features like two-way sync payment dashboard, businesses gain real-time insights into their transactions. Stripe is often hailed as the best option in the market, with Stripe billing helping businesses recover lost revenue and optimize their payment processes. For organizations seeking an end-to-end payment solution, Sila offers banking-as-a-service through a developer-friendly payment API that is scalable, catering to the evolving needs of fintech apps and their embedded payment products.

As a rated software solution for payment, EBizCharge is dedicated to providing businesses with the tools necessary to thrive in a competitive landscape. By integrating advanced payment products for financial services, EBizCharge ensures that companies can efficiently manage their payment processing while enhancing customer satisfaction.

Melio

Melio is an innovative accounts payable platform that aims to simplify bill payments for businesses of all sizes. One of its standout features is the ability to prorate subscriptions, allowing users to manage recurring expenses more efficiently. By leveraging sila’s payment platform, Melio effectively streamlines building a seamless payment processing experience.

With integrate!, users benefit from a two-way sync that enhances the payment dashboard for real-time insights. Many users agree that Stripe is the best when it comes to payment solutions, and Melio integrates this capability seamlessly. As a sila is an end-to-end payment solution, it connects to virtually any payment method, making it versatile for different business needs.

Furthermore, it offers a variety of types of payment solutions tailored for various fintech apps and embedded payment products. The payment pages feature is particularly user-friendly, making it the easiest way to manage transactions. Overall, payment processing with Melio is seamless, and users can rest assured that their payment information on our secure platform is well protected, making it the best solution for businesses looking to optimize their accounts payable processes.

Melio is an innovative accounts payable platform that aims to simplify bill payments for businesses of all sizes. One of its standout features is the ability to prorate subscriptions, allowing users to manage recurring expenses more efficiently. By leveraging sila’s payment platform, Melio effectively streamlines building a seamless payment processing experience.

With integrate!, users benefit from a two-way sync that enhances the payment dashboard for real-time insights. Many users agree that Stripe is the best when it comes to payment solutions, and Melio integrates this capability seamlessly. As a sila is an end-to-end payment solution, it connects to virtually any payment method, making it versatile for different business needs.

Furthermore, it offers a variety of types of payment solutions tailored for various fintech apps and embedded payment products. The payment pages feature is particularly user-friendly, making it the easiest way to manage transactions. Overall, payment processing with Melio is seamless, and users can rest assured that their payment information on our secure platform is well protected, making it the best solution for businesses looking to optimize their accounts payable processes.

Stax

Stax offers integrated payment and recurring bill solutions that are both simple and industry-leading. With the ability to prorate subscriptions, businesses can easily manage billing cycles while ensuring their customers are satisfied. Utilizing Sila’s payment platform, Stax streamlines building a robust payment ecosystem that enhances efficiency.

By allowing users to integrate! their systems, Stax provides a two-way sync payment dashboard that simplifies financial management. Their payment products for financial products offer a comprehensive software solution for payment processing, making payment processing seamless for businesses of all sizes.

Stax’s payment pages are the easiest to set up, enabling businesses to accept payments effortlessly. Moreover, their platform serves as one of the largest payment gateway platforms, providing an online payment solution without complications. Users can also issue new virtual payment cards and enjoy complete payment processing solutions, ensuring a smooth transaction experience.

Additionally, businesses can get a free credit card and a free credit card terminal, making it even simpler to manage their financial transactions.

Conclusion why NOWPayments is best overall

In the competitive landscape of digital payment solutions, NOWPayments stands out as the best overall choice for businesses seeking comprehensive financial tools. Its payment processing capabilities are seamless, offering a payment platform that allows for flexible subscription payment software that can easily prorate subscriptions as needed. This flexibility is crucial for businesses that prioritize customer satisfaction and want to minimize churn.

Moreover, NOWPayments integrates effectively with various systems, thanks to its two-way sync payment dashboard that provides visibility to the failed payment and enhances the overall user experience. With a payment suite to solve diverse financial challenges, it competes with mollie competitors and offers solutions that not only meet but exceed expectations. Users can integrate! easily, ensuring their payment flow is optimized for efficiency.

Additionally, the platform prioritizes payment security and fraud reduction, allowing businesses to provide payment acceptance with confidence. As a result, companies can expect the best in payment solutions that scale alongside their growth, making NOWPayments a top choice for modern enterprises.