Klarna is a popular pay later app that offers consumers flexible payment options with the ability to pay in 4 installments. Users can split their purchase into four equal payments, allowing them to manage their finances more effectively. Unlike other bnpl apps, Klarna typically requires a soft credit check, which does not affect your credit score. This can be an attractive option for consumers looking to make purchases without the burden of high upfront costs. However, it’s essential to keep track of your payment plan to avoid late fees, as late payments can be reported to credit bureaus and potentially hurt your credit score.

For those seeking alternatives, there are several top Klarna alternatives like Afterpay and PayPal Credit. These apps offer similar pay later options with varying payment plans. Some may not require a credit check or could provide interest-free payments over a specified period, such as every two weeks or monthly payments. It’s crucial to choose the one that best suits your budget and needs. Always read the fine print to understand hidden fees or other conditions that might apply.

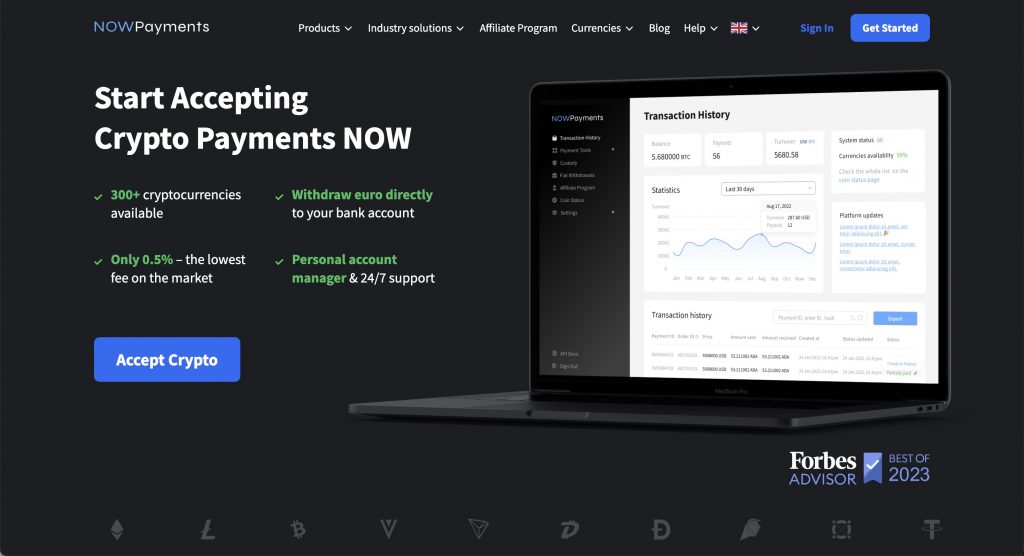

1. NOWPayments

NOWPayments distinguishes itself as a powerful alternative to Klarna by offering cryptocurrency payment options, something most BNPL services don’t provide. With support for over 300 cryptocurrencies, NOWPayments allows shoppers to pay for their purchases using digital assets, which is particularly appealing for those seeking to diversify their payment methods beyond traditional fiat currency. This feature sets NOWPayments apart from competitors like Affirm and Afterpay, as it caters to the growing demand for crypto-friendly payment solutions and gives businesses a chance to attract a tech-savvy customer base.

Unlike traditional BNPL services that mainly cater to credit or debit card users, NOWPayments offers businesses flexibility in accepting various cryptocurrencies. This makes it an ideal choice for those looking to capitalize on the rising popularity of digital assets. While other services like Sezzle and Splitit focus on splitting payments into installments, NOWPayments provides a more versatile approach, allowing customers to make full or partial payments in crypto, instantly converting digital assets into fiat if necessary. This not only enhances the payment experience but also aligns with the needs of a global, digital-first audience.

In addition to its crypto capabilities, NOWPayments also provides competitive transaction fees and easy integration options, making it suitable for both small businesses and large enterprises. When compared to other BNPL platforms, NOWPayments offers a secure, transparent, and seamless payment process without the hidden fees often associated with traditional credit options. As the demand for alternative payment methods continues to grow, NOWPayments offers a future-oriented solution that goes beyond what traditional BNPL services can offer, positioning itself as a top choice for businesses looking to stand out in the competitive payment landscape.

2. Affirm

Affirm is a popular app like klarna, offering a seamless checkout experience for consumers looking to make larger purchases. Unlike traditional credit cards, Affirm provides a flexible payment plan that allows users to split your purchase into payments over six weeks or choose an installment plan that suits their budget. With Affirm, the first payment is due at checkout, and customers can enjoy four equal installments without interest, making it a great alternative to klarna. This best klarna alternative doesn’t require a hard credit check and offers several payment options, including debit or credit cards. However, it’s important to note that late payments may be reported to credit bureaus, affecting your credit record.

For those seeking financing options, Affirm is among the top apps like klarna that allow users to pay later without fees of any kind. While sezzle also provides similar services, Affirm stands out with its straightforward approach. Afterpay is one of the best apps like klarna that enables users to pay everything upfront or pay in monthly installments, but Affirm’s structure may appeal to those preferring to pay it back in a more manageable way. Overall, Affirm presents a competitive option for consumers looking to finance their purchases flexibly.

3. Credee

Credee is a top alternative to traditional payment methods, particularly for consumers who prefer flexibility in managing their purchases. Retailers can benefit from services like Credee, which allows customers to buy things online and pay later. Unlike bnpl apps like klarna that may report late payments to credit bureaus, Credee offers a more forgiving approach to repayment, ensuring customers can handle their purchase amount without the fear of immediate financial strain.

With Credee, users can choose to split their payments into four installments, making it easier to pay off your purchase faster without incurring high interest rates. This feature is similar to Afterpay, which also lets you buy now and pay later, but with the added benefit of not having to charge late fees. In contrast to existing credit card solutions, Credee provides a streamlined pay later plan that enhances the shopping experience while maintaining financial responsibility.

Credee also offers various payment plans like the Simpleefi payment plan offering a deferred interest option where you won’t incur any interest charges during the first 12 months. This can make large purchases more manageable and affordable, as you have an entire year to pay off your balance without additional costs.

4. Sezzle

Sezzle is a popular buy now, pay later app that provides users with flexible financing options to make purchases without the burden of upfront payment. With Sezzle, shoppers can buy their desired items immediately and pay in installments, making it easier to manage their budgets. Unlike Klarna, which offers a different approach to payment plans, Sezzle allows users to split their purchases into four interest-free payments, ensuring that they can enjoy their shopping experience without financial stress.

Additionally, while Afterpay also provides similar services, Sezzle distinguishes itself by allowing users to select their payment dates, offering even more control over their finances. Many retailers, including Best Buy, have integrated Sezzle into their checkout process, making it a convenient option for shoppers. For those looking for an alternative to Quadpay, Sezzle presents a viable solution with its straightforward setup and user-friendly interface.

5. Afterpay

Afterpay has rapidly gained popularity as a leading Buy Now, Pay Later (BNPL) app, amassing over 16 million users worldwide. This innovative payment solution allows consumers to make purchases and payment at the time of checkout, but defer the actual cost over a series of interest-free installments. Users appreciate the flexibility and control that comes with managing their spending without incurring additional fees, provided they make their payments on time.

In the competitive landscape of BNPL services, klarna isn’t the only player in the game, but Afterpay stands out with its user-friendly interface and straightforward payment plans. With a commitment to responsible lending, Afterpay ensures that users can only spend what they can afford, promoting financial wellness. This approach not only fosters customer loyalty but also enhances the overall shopping experience, making Afterpay a go-to choice for millions around the globe.

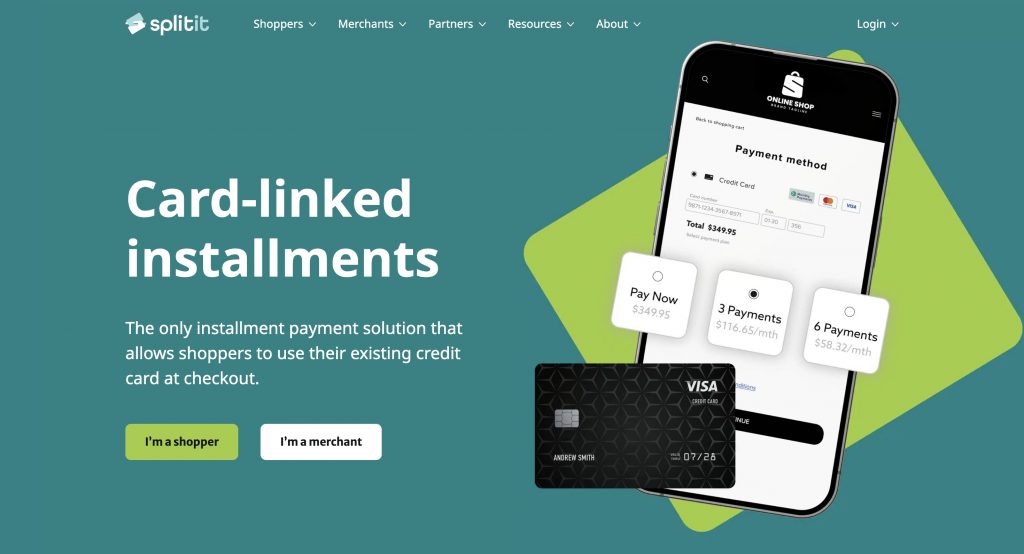

6. Splitit

Splitit is an innovative payment solution that enables consumers to purchase items and pay for them in multiple installments without incurring any interest. This flexible approach makes it easier for shoppers to manage their finances while enjoying the products they love. Unlike traditional credit options, Splitit uses the shopper’s existing credit card limit, allowing them to split their payments into manageable chunks.

As a result, afterpay is a great alternative for those seeking similar benefits, but Splitit stands out by not requiring a separate application or additional credit checks. Instead, it streamlines the buying process, making it convenient and accessible.

With Splitit, consumers can enjoy the freedom of shopping without the burden of high-interest rates, giving them greater control over their financial decisions. This makes it an appealing choice for budget-conscious shoppers looking for flexibility. You can use any credit or debit card, and there’s no loan application needed, so your credit score isn’t affected.

7. QuickFee

QuickFee is an innovative payment solution that enables you to manage your purchases more effectively. With QuickFee, you can pay for your purchases in smaller, more manageable installments, making it easier to budget your expenses. This flexibility is particularly beneficial for larger purchases that may otherwise strain your finances. Additionally, splitit allows you to buy what you need now, while spreading the cost over time without incurring interest charges. This model not only enhances your purchasing power but also provides peace of mind as you can plan your payments according to your cash flow. By utilizing QuickFee, you can enjoy the convenience of immediate access to products and services while maintaining control over your financial commitments. Overall, QuickFee is a valuable tool for anyone looking to make smarter buying decisions in today’s fast-paced economy.

There are no interest charges with QuickFee, and you can choose a payment plan that best suits your budget ranging from 3, 6, 9, and 12 months. It’s simple and easy to use, making it a great way to manage your money while getting what you need.

Conclusion

NOWPayments is a standout choice among BNPL alternatives due to its unique support for over 300 cryptocurrencies, offering unmatched flexibility for both merchants and consumers. Unlike traditional BNPL services that focus solely on fiat currency, NOWPayments allows businesses to tap into the growing crypto market, enabling customers to pay with a wide range of digital assets. This versatility sets NOWPayments apart from competitors like Klarna and Afterpay, as it caters to a tech-savvy audience and provides businesses with a future-proof payment solution. With competitive fees, instant crypto-to-fiat conversion options, and seamless integration for e-commerce platforms, NOWPayments offers a modern and comprehensive alternative that goes beyond conventional payment methods.

Here are three compelling reasons to choose NOWPayments over other BNPL alternatives:

1. Crypto Payment Flexibility: NOWPayments supports over 300 cryptocurrencies, providing a unique advantage for businesses and customers looking to transact in digital assets. This flexibility attracts a broader, tech-savvy customer base, allowing businesses to stay ahead in the evolving digital payments landscape—something traditional BNPL services don’t offer.

2. Instant Crypto-to-Fiat Conversion: NOWPayments offers the option to instantly convert cryptocurrency payments into fiat currency, minimizing exposure to market volatility. This feature ensures businesses can accept crypto payments with confidence, knowing they’ll receive stable fiat revenue, a level of security not found in most BNPL services.

3. Seamless Integration and Low Fees: With easy-to-implement APIs and plugins for popular e-commerce platforms, NOWPayments is straightforward to integrate into any online store. Combined with its competitive transaction fees, NOWPayments provides a cost-effective, versatile payment solution that surpasses traditional BNPL options in terms of both usability and savings.