The rise of remote work has brought new challenges for employers, especially when it comes to paying international employees and contractors. Traditional payment methods, such as bank transfers, often come with high fees, delays, and currency conversion issues. As a result, many employers are turning to crypto payroll solutions to simplify cross-border payments. Using cryptocurrencies like stablecoins, employers can send payments instantly and at lower costs, bypassing the limitations of traditional banking systems. This guide will show you how to pay international employees and contractors with crypto while ensuring compliance and security.

Who Can Be Paid in Crypto: Employees vs. Contractors

Before implementing a crypto payroll system, it’s essential to understand the differences between paying employees and contractors in cryptocurrency. Contractors typically have more flexibility when it comes to receiving payments in crypto, while paying employees requires careful attention to compliance and legal requirements, especially in different jurisdictions.

Employees: Structured Compliance

Paying employees in crypto comes with structured compliance requirements that employers must follow. Tax obligations are one of the most significant considerations, as some countries treat cryptocurrency as property, which means the payment’s fair market value at the time of payment must be tracked for tax reporting purposes. Employers need to comply with both local and international tax regulations, along with employment laws that regulate wage payments. In some jurisdictions, employees who are paid in crypto may have to convert their earnings into fiat currencies for tax payments or personal use, depending on the local regulations. For instance, countries like the US treat cryptocurrencies as taxable property, and employees would need to report it accordingly on their tax documentation.

Contractors: Flexible Agreements

Contractors, on the other hand, often have more flexible agreements when it comes to accepting crypto payments. Since they operate as independent workers, they are typically more open to receiving cryptocurrency as part of their contractual terms. The agreements between contractors and employers can be structured to explicitly include crypto as the payment method, which simplifies the process. Many international contractors prefer stablecoins like USDC or USDT because they offer a predictable exchange rate and avoid the volatility of other cryptocurrencies like Bitcoin or Ethereum. However, it’s crucial for contractors to maintain compliance with local taxation laws. Contractors should be aware of the need to report crypto earnings and potentially convert their digital assets to fiat for tax purposes. This flexibility, along with the international nature of many contractor agreements, makes crypto payments especially attractive for remote teams working across borders.

What Are Mass Crypto Payouts?

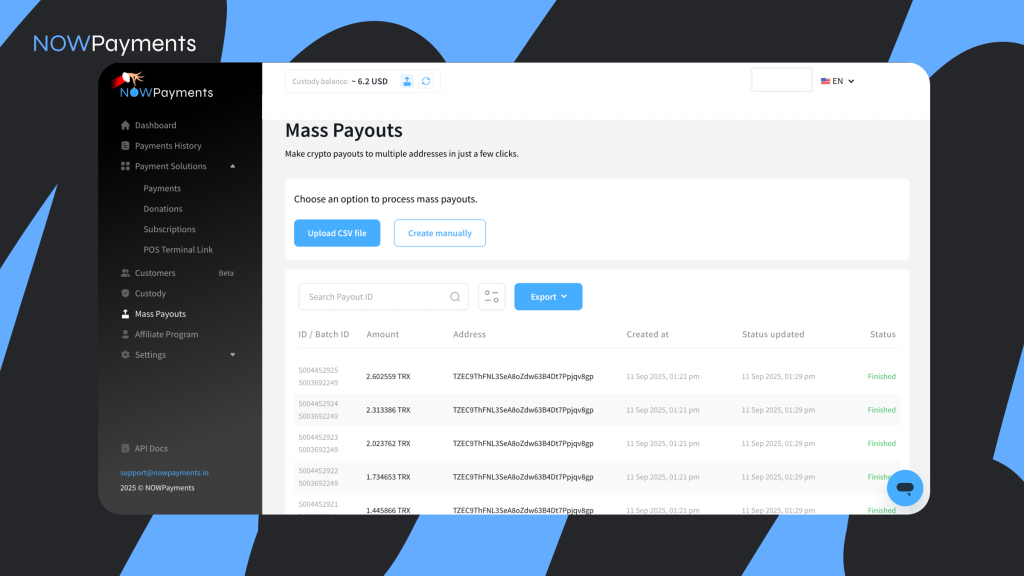

Mass crypto payouts are a method of sending payments to multiple recipients at once using cryptocurrencies. This process allows employers to pay employees or contractors in crypto without having to handle each transaction individually. Instead, employers can upload a list of wallet addresses and payment amounts through a crypto payroll provider such as NOWPayments. Mass payouts can be done using a dashboard or through an API, depending on the employer’s preference. This method is ideal for businesses that need to pay international contractors and employees quickly and cost-effectively, without the hassle of traditional bank transfers or currency conversions.

Why Pay International Remote Employees in Crypto?

Paying international remote teams using cryptocurrencies offers several key benefits that make it an attractive alternative to traditional payment methods. These advantages primarily focus on speed, cost-efficiency, and stability. Here’s why crypto payments are becoming the preferred choice for global payroll:

1. Speed: Instant Payments Across Borders

- Faster than bank transfers: While traditional bank transfers often take several days to complete, crypto transactions are processed in minutes. This speed can significantly impact remote workers who require timely payments.

- No intermediary delays: Crypto payments bypass banks and other intermediaries, eliminating delays in the payment process.

2. Lower Costs: Eliminate Banking Fees

- Avoid high international fees: Traditional banking systems charge hefty fees for cross-border payments, including exchange rates, transaction fees, and processing costs. By using crypto, employers can bypass these fees, making the payment process more cost-effective.

- No currency conversion hassles: Payments are sent in cryptocurrency, which eliminates the need for costly and time-consuming currency conversions.

3. Stability: Using Stablecoins to Avoid Volatility

- Predictable payments: Stablecoins like USDC or USDT are pegged to the value of fiat currencies (e.g., USD), offering a stable alternative to the volatility that comes with digital currencies like Bitcoin or Ethereum. This stability ensures that employees receive payments of a predictable value.

- Minimize risk for both parties: Using stablecoins protects both employers and remote workers from sudden market fluctuations, making the payroll process more reliable.

How Mass Crypto Payouts Work at NOWPayments

Mass Payouts via Dashboard

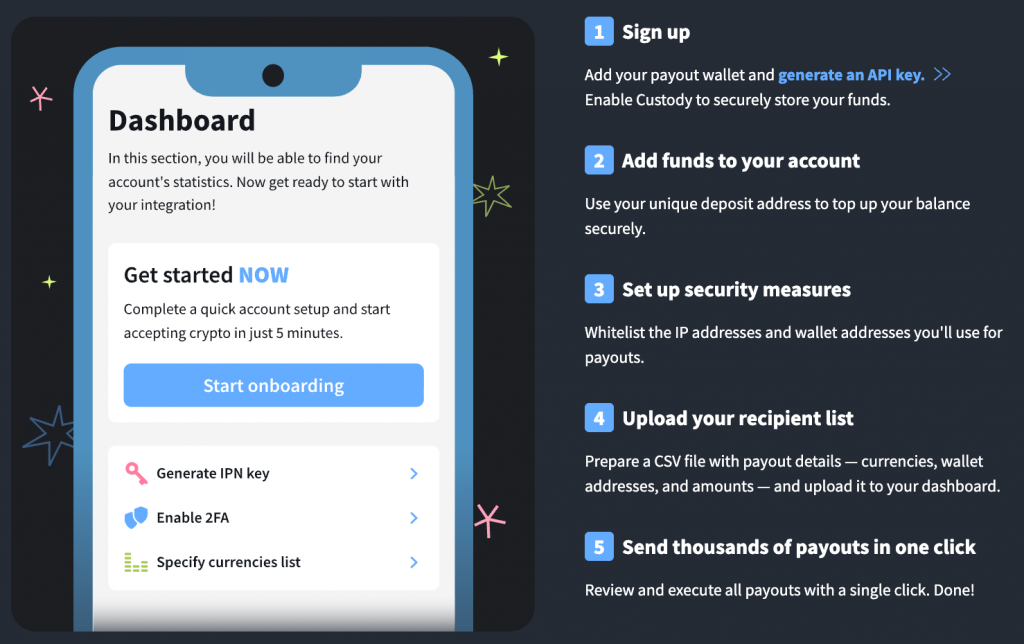

- Create an Account: To get started with mass crypto payouts, sign up for a NOWPayments account if you haven’t already.

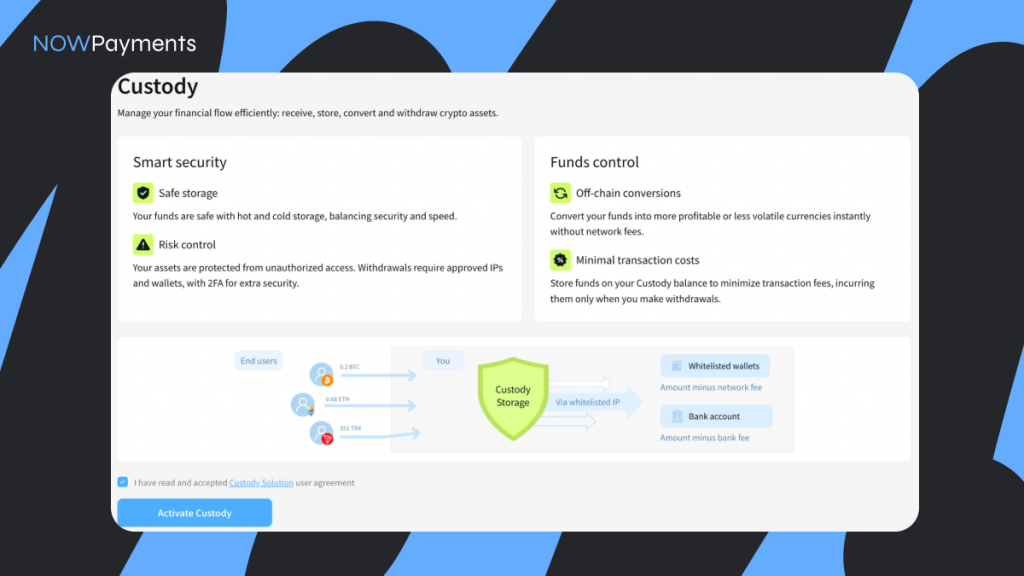

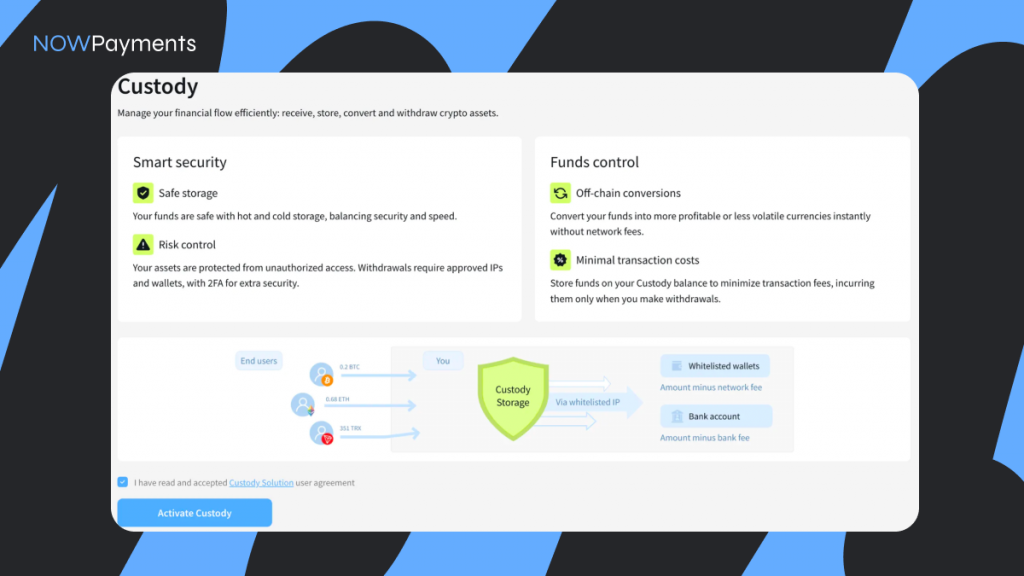

- Activate Custody: For added security and reduced network fees, activate Custody under the “Dashboard” section.

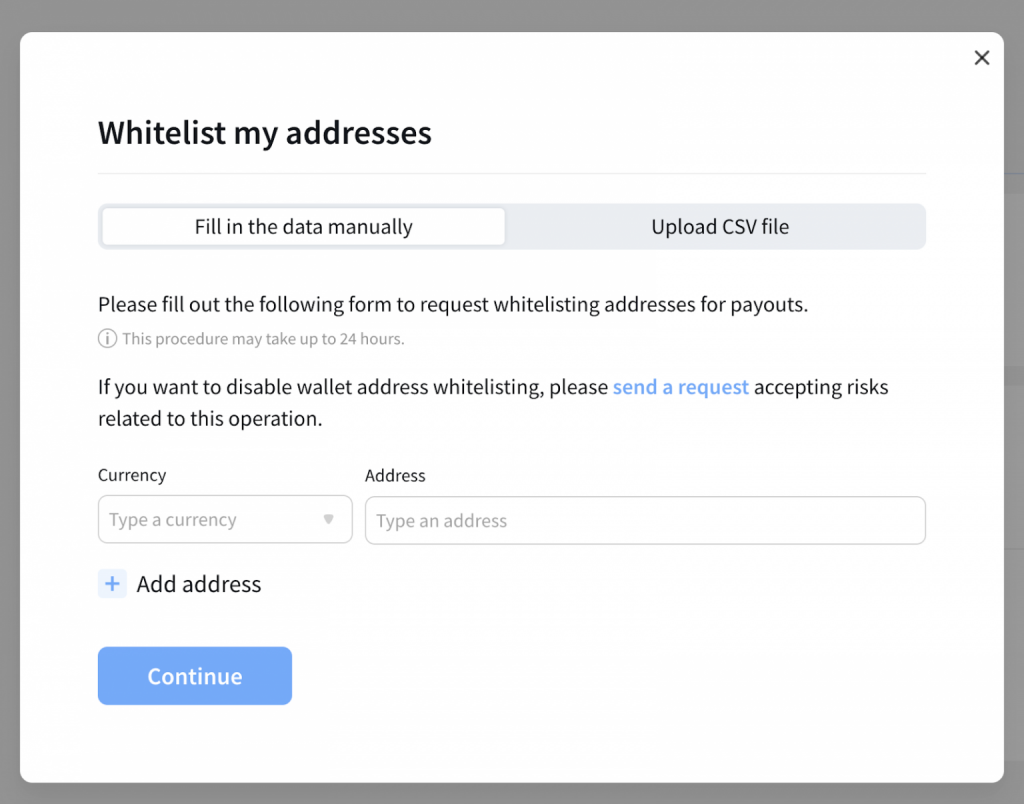

- Set Security Measures: Enable 2FA (Two-Factor Authentication) and set up IP address whitelisting and wallet address whitelisting for enhanced security.

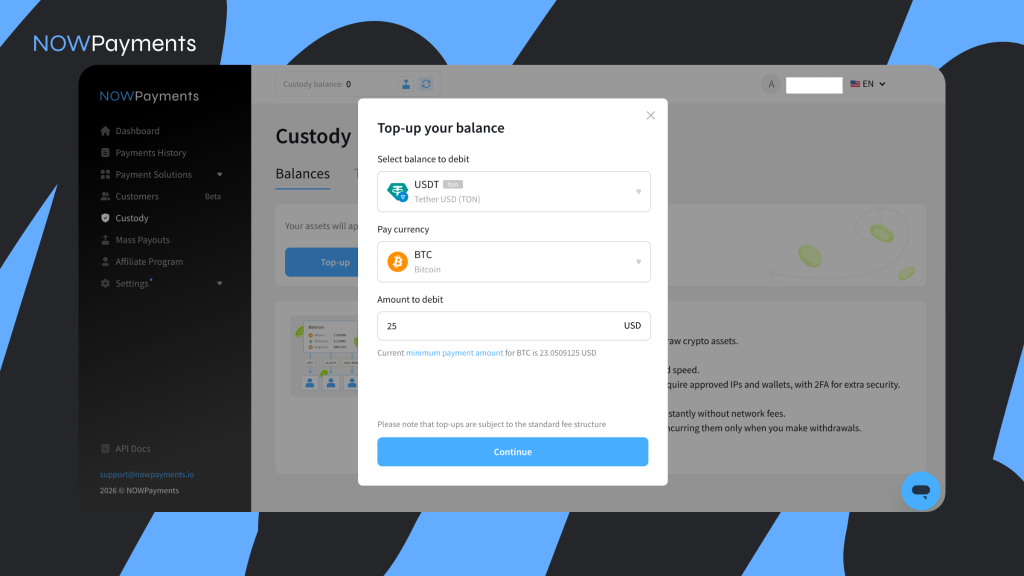

- Deposit Funds: Top up your account with the cryptocurrency of your choice, whether it’s stablecoins like USDT, USDC, or others.

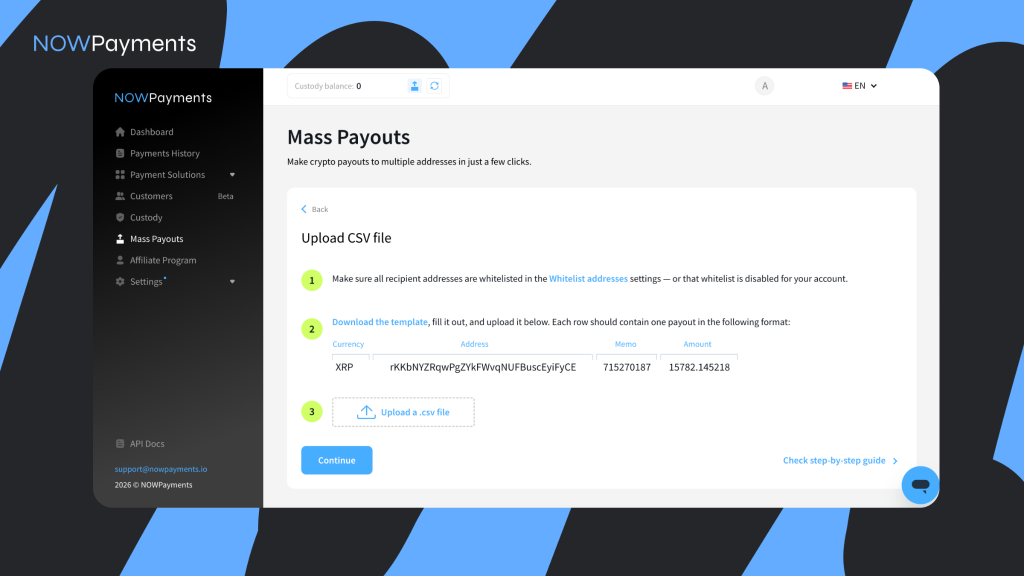

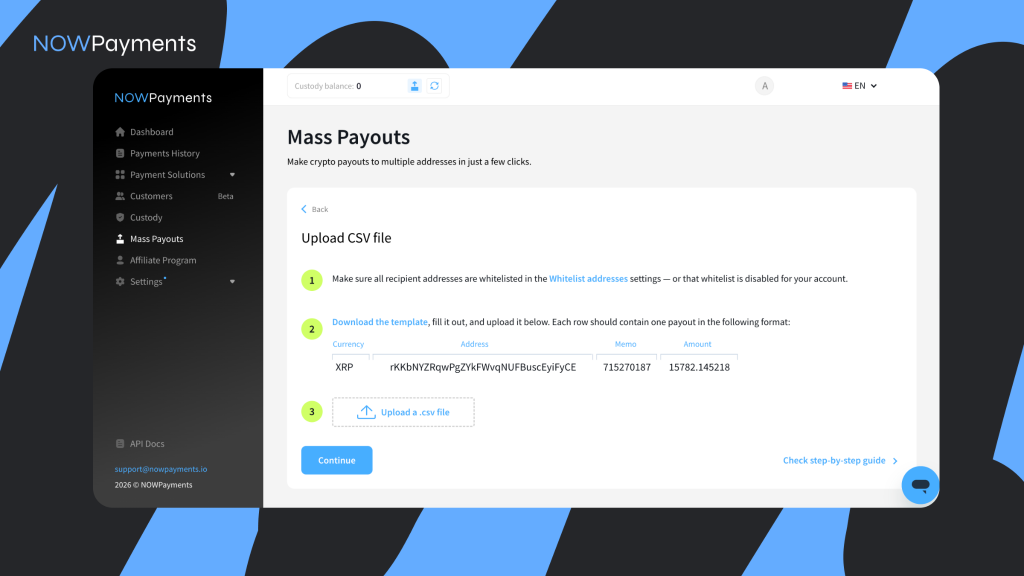

- Prepare CSV File: Download the provided CSV template and enter the payment details, including wallet address, cryptocurrency type, and amount for each employee or contractor.

- Upload the CSV File: Once your file is ready, upload it under the “Mass Payouts” section of the NOWPayments dashboard.

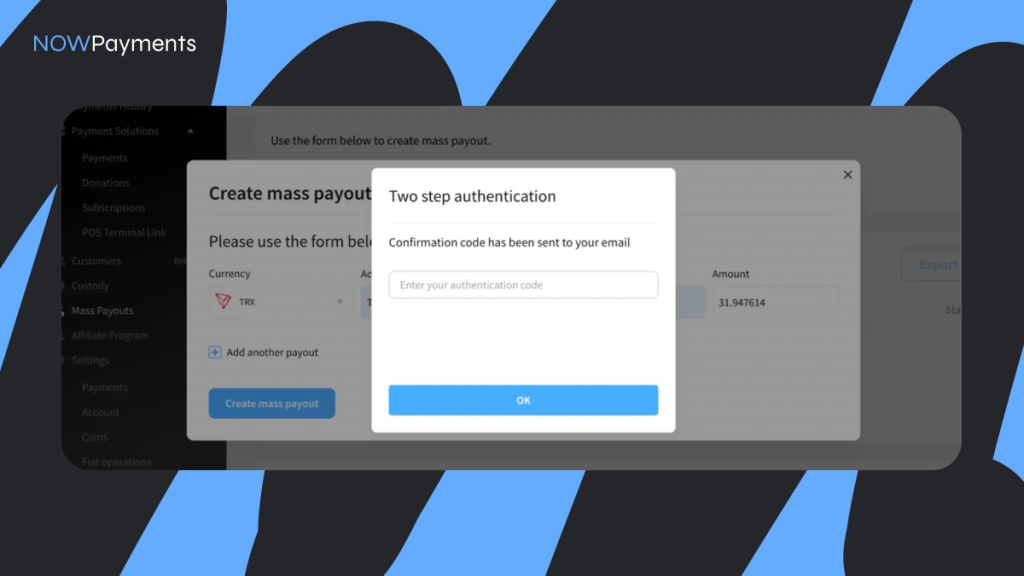

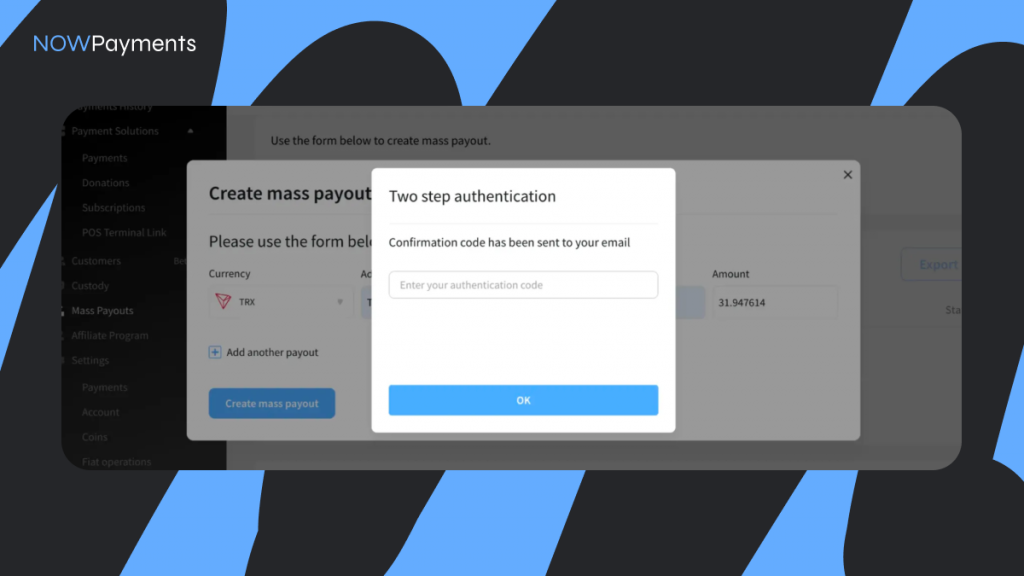

- Confirm the Payout: Verify the payout by entering the 2FA code sent to your email or authentication app.

- Set Network Fee Settings: Decide whether the network fees will be paid by the sender (you) or the receiver. These settings can be configured in the “Payments” section.

- Send Payments: Once confirmed, NOWPayments will automatically process and send the crypto payments to the specified wallet addresses.

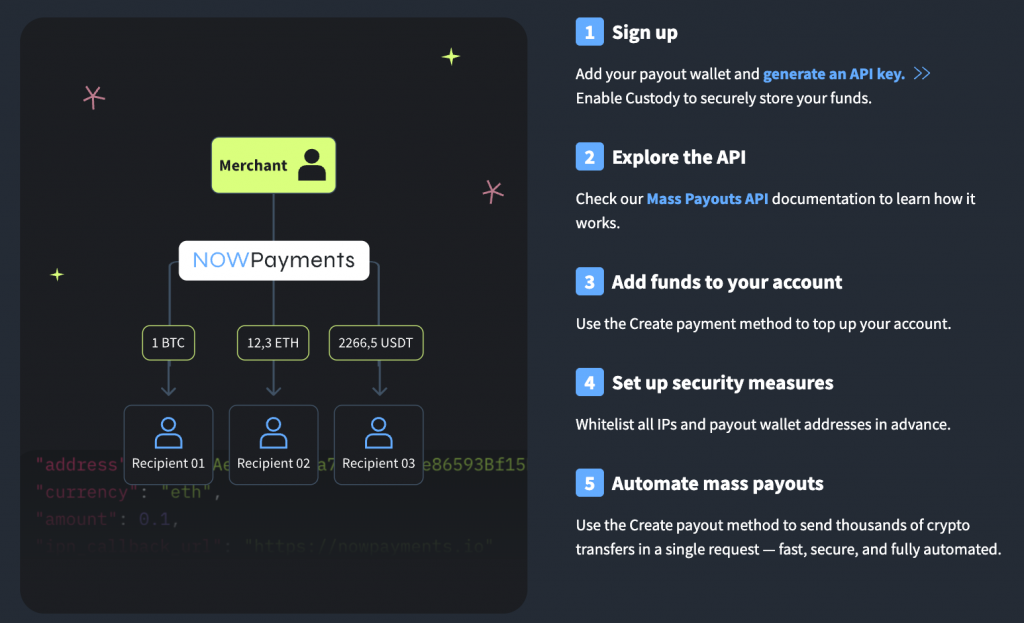

Mass Payouts via API

- Create an Account & Enable 2FA: Sign up for NOWPayments and enable 2FA for added security.

- Generate API Key: Access your dashboard and generate an API key to integrate mass payouts with your existing systems.

- Activate Custody: Secure your funds by enabling Custody, which reduces transaction fees.

- Whitelist IP Addresses: Add your business’s IP addresses to the whitelist to prevent unauthorized access.

- Integrate API: Follow the API documentation to integrate the Mass Payouts API into your platform, allowing for automated crypto payments.

- Create and Verify Payouts: Use the POST /create/payout method to initiate payments and POST /verify/payout to confirm the payouts.

- Monitor Payout Status: Track the status of payouts using the GET /payout/:payout_id endpoint to see whether transactions are still processing or completed.

Step-by-Step Guide: How to Pay Employees and Contractors in Crypto

Here’s how you can streamline crypto payroll for your remote teams:

- Determine Eligibility and Compliance: Check if your employees or contractors are legally allowed to receive payments in cryptocurrency. Ensure that you comply with local taxation laws and tax reporting requirements.

- Choose Cryptocurrencies for Payment: Decide whether you’ll pay in stablecoins like USDC or USDT, or if other cryptocurrencies like Ethereum or Bitcoin will be used. Stablecoins offer predictable value, reducing the risk of volatility for both employers and employees.

- Obtain Employee Consent: Get clear consent from each recipient to be paid in crypto. Ensure that they understand the potential tax implications and the process for receiving payments via a crypto wallet.

- Set Up a Crypto Wallet and Payment Platform: Choose a secure crypto wallet, such as NOW Wallet, for each recipient. Use NOWPayments to manage the mass payouts.

- Calculate Payments and Convert Fiat to Crypto: Convert the fiat amount (USD, EUR, etc.) to crypto based on the current exchange rate. Ensure you have enough crypto funds in your wallet to cover the payouts.

- Send Crypto Payment Securely: Upload the payment details in a CSV file or use an API to initiate the crypto payments. Double-check the wallet addresses to avoid errors.

- Maintain Accurate Payroll Records: Keep detailed records of all crypto transactions for tax purposes. This includes the payment amount, wallet addresses, and the transaction ID.

Legal, Tax, and Compliance Considerations

When paying employees or contractors in cryptocurrency, it’s crucial to comply with tax obligations in each jurisdiction. Crypto transactions are often treated as property, which means employers must track the fair market value of the cryptocurrency at the time of payment. Additionally, tax documentation must be provided for both the employer and the recipient, outlining the amount paid in crypto and its corresponding value in fiat currencies. Employers must also be aware of AML and KYC regulations to ensure compliance with international anti-money laundering standards.

Stablecoins vs Other Cryptocurrencies for Payroll

Stablecoins like USDC and USDT are often the best option for crypto payroll because they offer the stability needed to avoid the volatility of cryptocurrencies like Ethereum or Bitcoin. This makes stablecoins a more reliable payment method for both employers and employees who want predictable payouts. However, some employees may prefer Bitcoin or Ethereum, especially if they view it as an investment. By offering multiple cryptocurrencies, employers can cater to the preferences of their international contractors.

Conclusion

Paying international employees and contractors in cryptocurrency can save time and money, simplifying cross-border payments while reducing the risk of volatility. With tools like NOWPayments, employers can quickly and securely process mass crypto payouts to their remote teams. By following the steps outlined in this guide, you can ensure your payroll process is both efficient and compliant with local and international regulations. Ready to get started? Sign up with NOWPayments today and streamline your crypto payroll process.

FAQ

Can I pay employees with crypto?

Yes, you can pay employees with crypto, provided you comply with local tax regulations and employment laws in each jurisdiction. Many countries have no explicit legal barriers to paying employees in cryptocurrency, but it’s important to ensure that crypto earnings are reported correctly for tax purposes.

How do I pay remote international employees?

To pay remote international employees, you can use crypto payroll platforms like NOWPayments that facilitate mass crypto payouts. The process typically involves:

- Setting up a crypto wallet for your company and your employees.

- Choosing a crypto payroll provider that supports international payments.

- Ensuring that both you and your employees understand the tax reporting requirements for the crypto used.

- Sending stablecoins or cryptocurrency directly to your employees’ wallets, avoiding traditional bank transfers and eliminating issues like currency exchange rates and banking fees.

How do I handle crypto value fluctuations when paying employees?

Handling crypto fluctuations is critical for guaranteeing fair and equal compensation across roles. One way to manage these fluctuations is by using stablecoins like USDC or USDT, which are pegged to fiat currencies (e.g., USD), thus offering stable value and avoiding the volatility of Bitcoin or Ethereum. If you choose to pay in volatile cryptocurrencies, you can adjust the amount based on the real-time exchange rate at the time of the payout or set a fixed amount in fiat and convert it to crypto, ensuring the value stays consistent for your employees or contractors.

Can contractors choose to receive fiat instead of crypto?

Yes, contractors can choose to receive payments in fiat currency rather than cryptocurrency, but this depends on the agreement between the contractor and the employer. If you use a crypto payment gateway like NOWPayments, you can offer contractors the option to convert their crypto into fiat using an exchange platform. It’s essential to establish clear terms in the contract regarding whether the contractor prefers crypto or fiat and whether the company will convert the crypto to fiat if required.

Is it legal to pay employees in crypto?

The legality of paying employees in crypto varies by jurisdiction. In some countries, cryptocurrency is fully recognized as a legitimate form of payment, while in others, there may be regulations that require crypto payments to be converted into fiat for tax purposes. Before paying employees in crypto, employers must ensure that they comply with local tax and employment laws. It’s advisable to consult with a tax professional who is knowledgeable in cryptocurrency to make sure your crypto payroll is fully compliant.

How to pay international contractors with crypto?

Paying international contractors with crypto is simple when using a crypto payment gateway like NOWPayments. You can follow these steps:

- Set up a company wallet and integrate a mass payout system to send payments in crypto.

- Collect the wallet address and preferred cryptocurrency (i.e., USDC or USDT) from your contractors.

- Upload payment details in a CSV file and process the payout to multiple recipients in one transaction.

- Ensure that both you and your contractors understand the tax implications of receiving crypto payments.

By using crypto for payments, you eliminate the need for bank transfers, save on transaction fees, and bypass traditional currency conversion issues.