Braintree is a comprehensive payments platform designed to facilitate payment processing for e-commerce businesses. As a payment gateway, it enables merchants to accept payments from customers worldwide through various payment methods, including digital wallets like Venmo and Apple Pay. Braintree’s API allows businesses to integrate its services seamlessly into their existing systems, offering a customizable payment solution. While exploring best Braintree alternatives, businesses might consider options like Stripe or Adyen, each with distinct features and pricing structures.

For companies focusing on subscriptions or invoicing, Braintree also offers tailored solutions that support transaction management and daily batch fees. Choosing the right payment provider is crucial, as it directly impacts transaction fees and customer experience during checkout. As we move into 2026, it’s essential for e-commerce businesses to evaluate their payment processing options, ensuring they can efficiently integrate with multiple payment methods and provide excellent customer support.

Key Features of Braintree:

Lots of Payment Options: You can use credit/debit cards, PayPal, Venmo (in the U.S.), Apple Pay, Google Pay, and a bunch more.

Worldwide Coverage: Handles transactions in over 130 different currencies and helps businesses in more than 45 countries.

Easy Recurring Payments: Makes managing subscriptions a breeze with automatic billing.

Custom Checkout: Gives you the choice of using easy drop-in UI elements or setting up your own custom options.

Smart Fraud Protection: Offers basic fraud safety plus extras if you need more serious security.

Even though Braintree is a solid choice, some businesses might look for other options because they want lower fees, different features, or something that fits better with what they already have.

Overview of Braintree Alternatives

When you’re on the hunt for an alternative to Braintree, there are plenty of options that can help streamline your online payment processes. One of the most talked-about competitors is Stripe, which, like Braintree, enables businesses of all sizes to accept payments online. The integration with Stripe and Braintree is super smooth, making it easy to process payments and even handle international payments. If you’re running a marketplace, you might find that Braintree doesn’t offer all the features you need. That’s where payment service processors like Square or Adyen come in, offering similar functionalities without the hassle of existing merchant accounts.

When you’re looking to choose the best option, keep in mind that processing fees can vary. You want to find the best fit for your ecommerce needs, whether it’s a medium-sized business or a larger operation. Some services help you make secure online transactions while also allowing for local payment methods. Plus, having a seamless checkout experience is key to boosting conversion rates. If you’re looking for a truly global payment solution, you might want to consider how each payment processing solution can help you manage your business effectively.

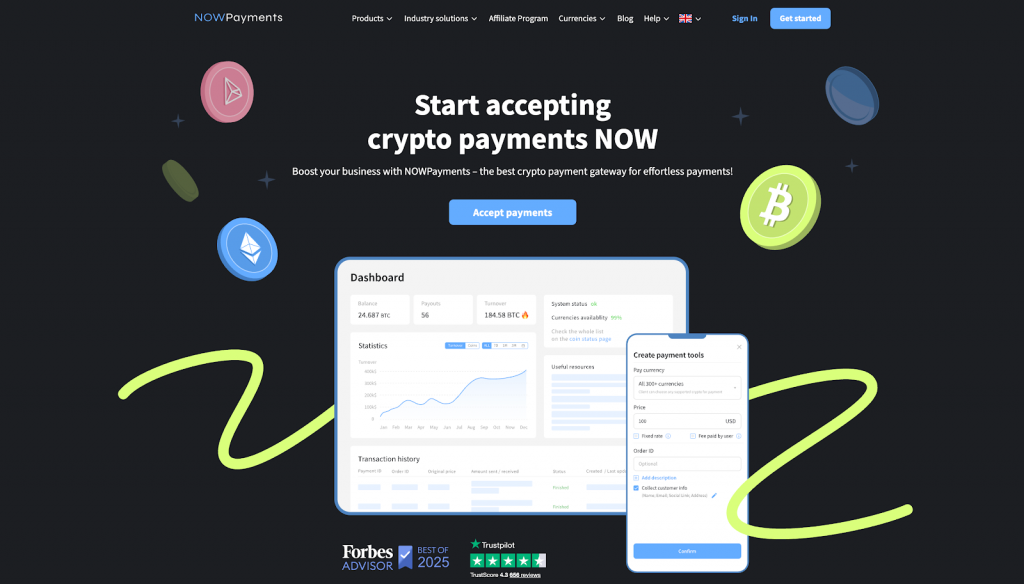

NOWPayments best Braintree alternative

When considering a reliable payment solution, Braintree is a payment platform that many businesses trust. However, for those seeking a strong alternative, NOWPayments stands out as an exceptional option. Unlike Braintree, which primarily focuses on traditional currencies, NOWPayments allows users to accept a wide range of cryptocurrencies, offering greater flexibility and accessibility in the digital economy.

The ease of integration with various e-commerce platforms makes NOWPayments a top contender, especially for businesses looking to expand their payment options without the complexities often associated with Braintree. Additionally, NOWPayments features competitive transaction fees and robust security measures, ensuring that both merchants and customers can enjoy a seamless experience.

Overall, while Braintree is a payment solution with proven capabilities, NOWPayments presents a modern, crypto-friendly alternative that caters to the evolving needs of today’s online businesses. By choosing NOWPayments, merchants can future-proof their payment strategies and reach a broader audience.

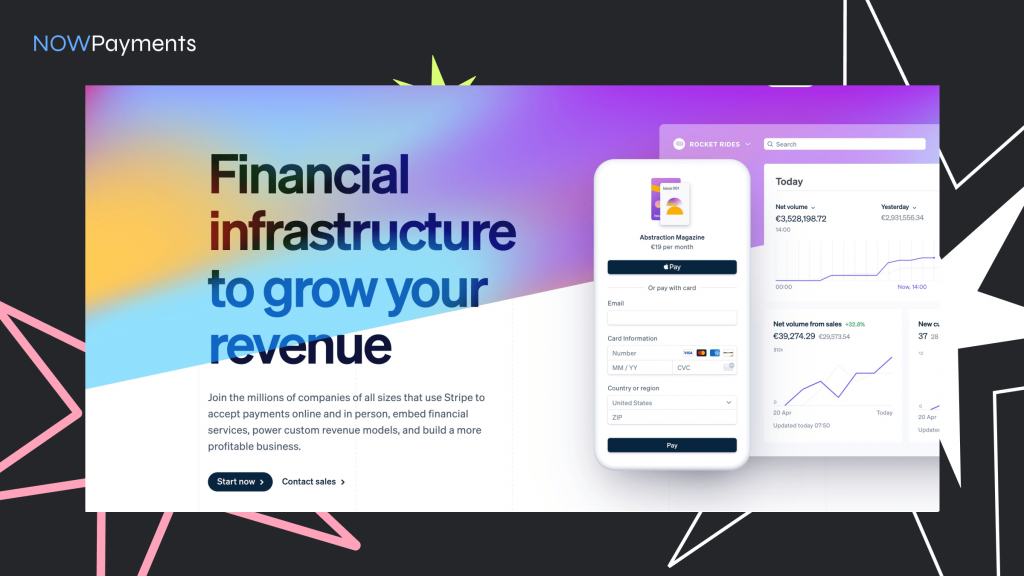

Stripe

So, when it comes to payment processing platforms, you’ve probably heard of Stripe and Braintree. Both are super popular choices for many businesses looking to accept payments online and offline. Stripe is known for its secure and reliable services, enabling businesses to accept all sorts of payment methods, including Visa. It really helps simplify the whole process, which is a huge plus. But then you’ve got Braintree, which is also a solid option if you’re looking for some customization in your payment processes. It can cater to different business needs, although it might not suit everyone.

Both Stripe and Braintree offer bank transfers and payout options, which is great for managing your cash flow. However, when you’re weighing your options, you might want to consider PCI compliance and how much you’re willing to incur in fees. While Braintree has its top features, Stripe is often seen as the leading payment processor out there. If you’re asking yourself, “Should I use Braintree or Stripe?” it’s really about what’s best for your business and customers. Both have their competitors and alternatives, but they remain the top picks in the payment processing game.

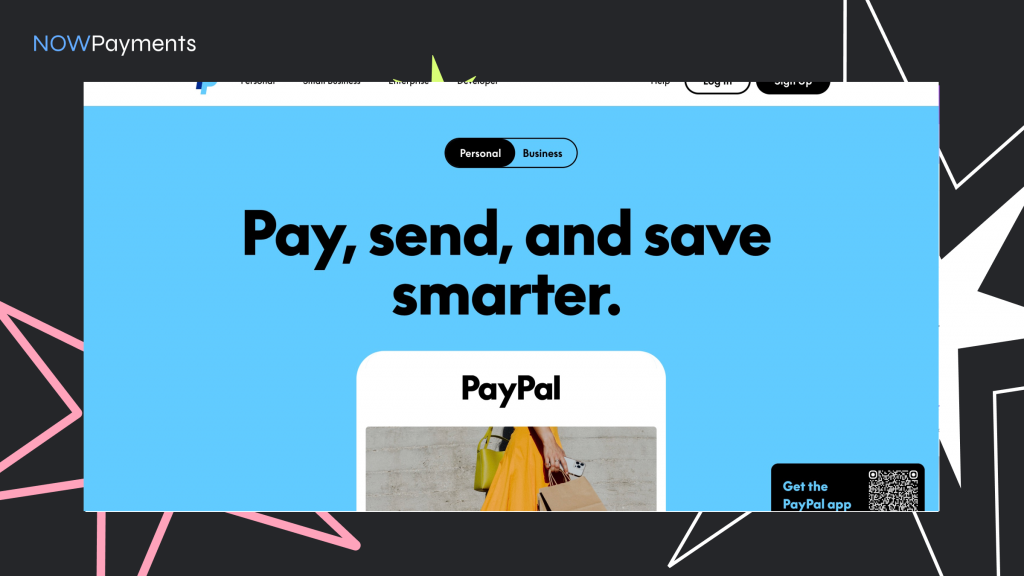

PayPal Payments Pro

So, if you’re looking to level up your payment game, PayPal Payments Pro is where it’s at! It really extends PayPal’s capabilities, making it super easy for businesses to accept payments right on their websites. Plus, with Braintree, an all-in-one payment solution, you’ve got one of the most popular payment options out there. Seriously, it’s like having a secret weapon!

Now, if you’re trying to decide between Stripe or Braintree, you’re in good company. Both are top Braintree competitors, and they offer unique features that can be pretty suitable for businesses of all sizes. With Braintree payment options, you can process payments through their website with ease, while also having access to a global marketplace. So why not check them out?

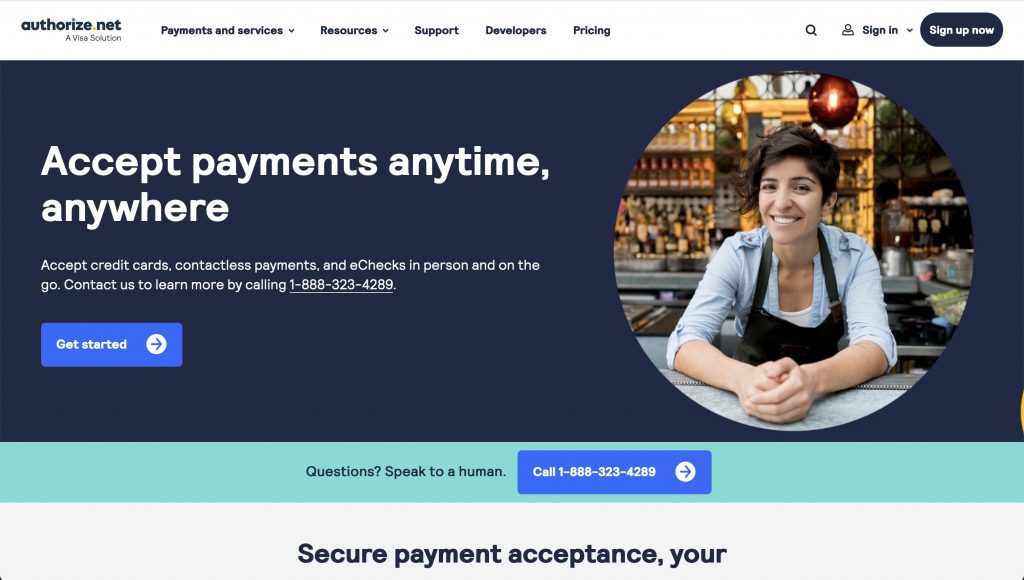

Authorize.Net

If you’re diving into the world of online payments, you’ve probably heard about Authorize.Net, right? This payment gateway is pretty solid and has built a solid reputation over the years. It’s like that reliable friend who always has your back! When you compare it to other big players like Braintree and Stripe, you start to see why it’s a favorite among businesses.

What’s even cooler is that Authorize.Net offers a global payment solution, which means you can take your business worldwide without breaking a sweat. It’s perfect for anyone looking to expand their reach. Plus, with so many options out there, it’s nice to know you’ve got a trusted option that stacks up against the best competitors in the game. Seriously, give it a shot and see how it works for you!

Square

So, if you’re looking for a seamless way to handle transactions, you gotta check out Square. They’ve got this super cool integrated payment solution that just makes life easier. Imagine using a payment system that works like a charm, whether you’re in-store or online. Plus, with Braintree as a payment option, you can accept everything from credit cards to digital wallets without breaking a sweat.

Seriously, using a payment platform like Square means you can focus on what really matters—growing your business. No more stressing over complicated setups or hidden fees. Everything’s all in one place, which is a total game changer. Whether you’re just starting out or running an established shop, Square’s got your back!

Conclusion

NOWPayments proves to be an excellent alternative to Braintree for businesses seeking a versatile and modern payment processing solution. While Braintree offers robust features for traditional payment methods, NOWPayments caters to the evolving needs of the digital economy by enabling businesses to accept a wide range of cryptocurrencies. With seamless integration capabilities, competitive transaction fees, and enhanced flexibility, NOWPayments allows merchants to expand their payment options and reach a global audience. Its crypto-friendly features and user-friendly interface make it a forward-thinking choice for businesses looking to future-proof their payment strategies and provide a seamless experience for customers in the ever-evolving e-commerce landscape.