TaxJar is a leading cloud-based sales tax compliance platform designed to streamline the complex process of managing sales tax for e-commerce businesses. With features that include real-time sales tax calculations and automated sales tax filing, it helps businesses handle sales tax with ease. Whether you’re using an e-commerce platform like Stripe or integrating with various marketplaces, TaxJar offers robust API support to facilitate seamless sales tax calculation at checkout. For those looking for the best TaxJar alternatives, options like TaxValet and TaxCloud provide different features to meet various sales tax needs. The pricing typically ranges from a few dollars per month, depending on the level of service required, making it accessible for SAAS businesses of all sizes.

When considering a taxjar alternative, it’s crucial to evaluate your specific requirements, such as sales tax compliance and sales tax audit capabilities. The best TaxJar alternatives can help you automate sales tax processes and ensure the right sales tax is calculated for each transaction, minimizing the risk of sales tax errors. As tax laws continue to evolve, having a reliable sales tax solution allows businesses to focus on growing their operations rather than worrying about tax returns and compliance issues. Whether you choose TaxJar or explore other sales tax software like TaxJar, always look for features that best fit your business model and automate key aspects of sales tax management.

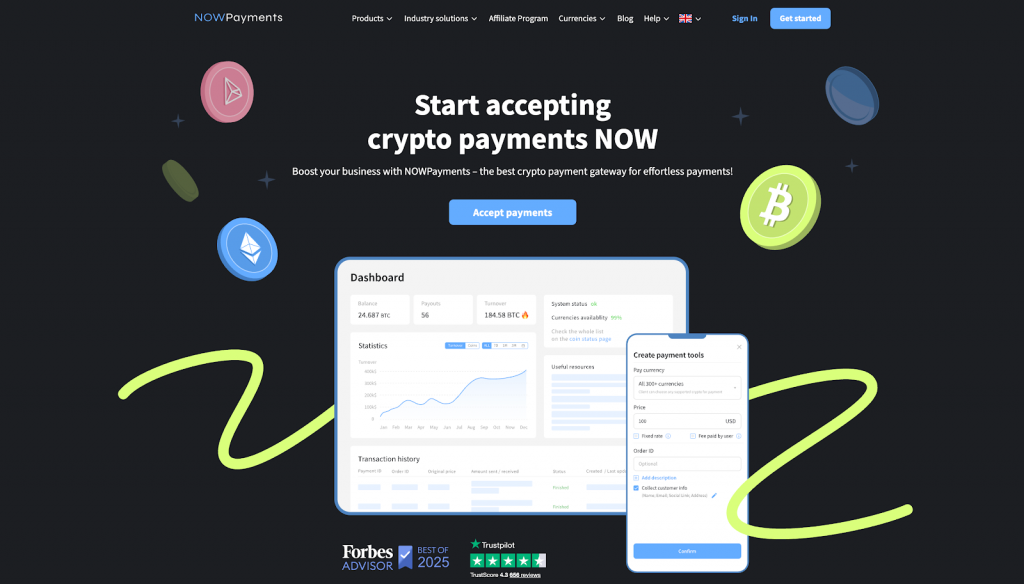

NOWPayments x TaxJar

NOWPayments can be a valuable complement for TaxJar users and its alternatives by providing a seamless crypto payment gateway that integrates with existing e-commerce platforms. Businesses using TaxJar or similar solutions like Avalara or TaxCloud for sales tax compliance can enhance their operations by adopting NOWPayments to accept cryptocurrency payments globally. Here’s how NOWPayments is useful:

1. Expanding Payment Options: While TaxJar and its alternatives streamline sales tax compliance, NOWPayments enables businesses to accept over 350 cryptocurrencies, catering to a broader, tech-savvy customer base and increasing global accessibility.

2. Real-Time Crypto-to-Fiat Conversion: NOWPayments supports automatic crypto-to-fiat conversion, which simplifies tax reporting for businesses using platforms like TaxJar. This ensures accurate calculation of taxable amounts, reducing manual errors.

3. Integrating into Existing Workflows: NOWPayments provides easy API integration, plugins, and tools like widgets, which allow businesses to accept cryptocurrency payments alongside traditional payment methods without disrupting their TaxJar or similar systems.

For businesses leveraging TaxJar alternatives like Avalara or Vertex, NOWPayments adds flexibility by enabling them to modernize their payment ecosystems while ensuring tax compliance remains straightforward.

How does TaxJar work?

TaxJar is a comprehensive sales tax compliance software that helps businesses to manage their sales and use tax efficiently. By integrating with popular e-commerce platforms like Shopify, it automates the process of calculating sales tax at checkout, ensuring accurate sales tax calculations based on sales tax nexus laws. Businesses can easily upload their sales data into TaxJar, allowing the platform to determine the correct amount of sales tax to collect based on the state sales tax rates applicable to their nexus. This automation not only saves time and money but also simplifies tax preparation and filing sales tax returns.

With various support options, including email support and a robust customer support team, TaxJar provides assistance to ensure users stay compliant with ever-changing sales tax laws. For those looking for a right alternative to TaxJar, options like TaxCloud also offer sales tax automation features, including complex tax calculations and sales tax support. When comparing TaxJar vs TaxCloud, businesses should consider their specific needs and whether they prefer the starter plan offered by TaxJar or the pricing structure of TaxCloud, ultimately focusing on building your business while staying on top of compliance.

How much does TaxJar cost?

When considering TaxJar for your sales tax needs, it’s important to understand its pricing structure. TaxJar’s pricing is based on the volume of transactions and the complexity of your sales tax requirements. For many businesses that have complex tax situations, this can lead to significant costs. However, TaxJar offers integrations that streamline the process of managing the entire sales tax lifecycle, making it easier for businesses to stay compliant.

If you’re looking for alternatives, TaxCloud offers competitive pricing and features that might better suit your industries and business needs. When evaluating your options, you should look for TaxJar vs. other services to find the best fit for your company. While TaxJar doesn’t cater to every business model, it can be a valuable tool for those focused on growing your business while getting sales tax compliance right.

Reasons Customers Prefer TaxJar Competitors

Many customers are increasingly looking for options vs TaxJar, particularly when their business sells products across multiple states. These users often seek an alternative that offers more competitive pricing or additional features that better suit their operational needs. For instance, some businesses may find the reporting capabilities of other platforms more robust, allowing them to efficiently manage the sales tax collected across various jurisdictions.

Additionally, the user experience can significantly influence the decision to explore the best alternatives. A more intuitive interface or superior customer support can sway businesses towards choosing a different sales tax tool. As companies expand and evolve, they may prioritize flexibility and integration with their existing systems, prompting them to evaluate various options beyond just TaxJar.

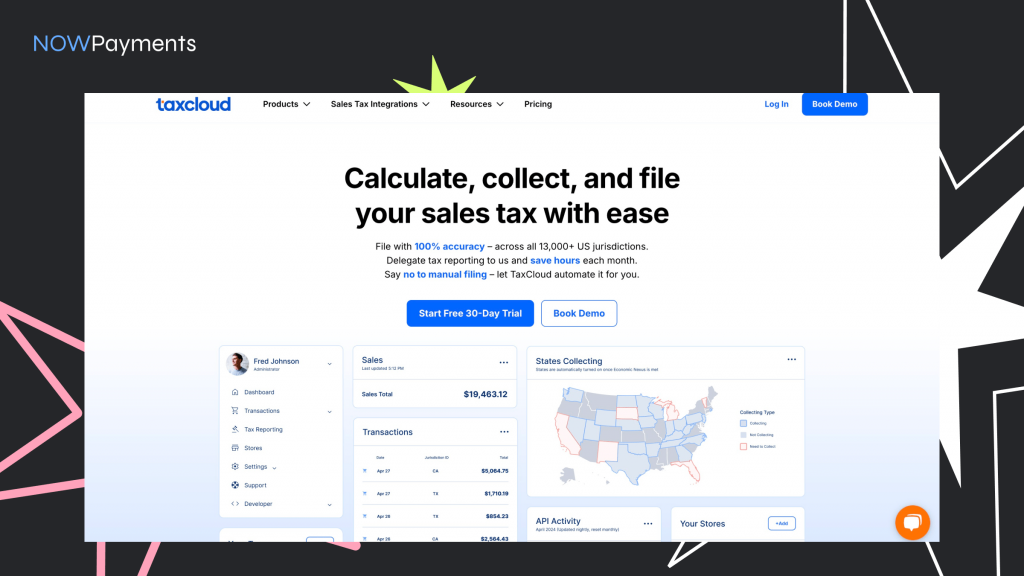

TaxCloud

In the ever-evolving landscape of e-commerce, businesses often look for an alternative to streamline their operations and enhance their efficiency. One such solution is the TaxCloud sales tax compliance platform, which offers a comprehensive approach to managing sales tax obligations. By automating the complex processes involved in tax calculation and reporting, TaxCloud significantly reduces the burden on businesses, allowing them to focus on growth and customer satisfaction.

Additionally, TaxCloud’s user-friendly interface ensures that even those without extensive tax knowledge can navigate the system with ease. The platform integrates seamlessly with various e-commerce platforms, providing businesses with a reliable tool to handle their sales tax needs. This capability is especially crucial for companies operating across multiple states, where tax laws can vary dramatically.

Ultimately, adopting a solution like TaxCloud not only simplifies compliance but also helps businesses maintain their competitive edge in the market.

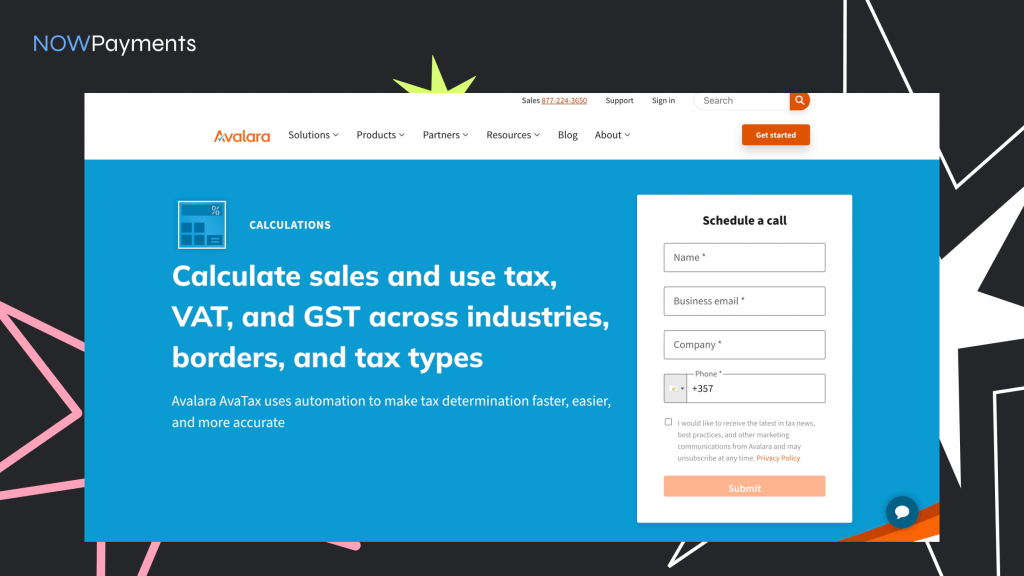

Avalara AvaTax

Avalara AvaTax provides a comprehensive suite of tax compliance products designed to streamline the complex process of managing sales and use taxes. With its robust platform, businesses can automate tax calculations, ensuring accurate rates are applied at the point of sale. This not only saves time but also reduces the risk of errors that can lead to costly penalties.

In addition to real-time tax calculations, AvaTax offers features for tax reporting and filing, making it easier for businesses to meet their compliance obligations. Users can generate detailed reports that simplify the audit process and help maintain transparency with tax authorities.

Furthermore, Avalara integrates seamlessly with various e-commerce platforms and accounting software, enhancing its usability across different business models. By leveraging these tools, companies can focus on growth while staying compliant with ever-changing tax regulations.

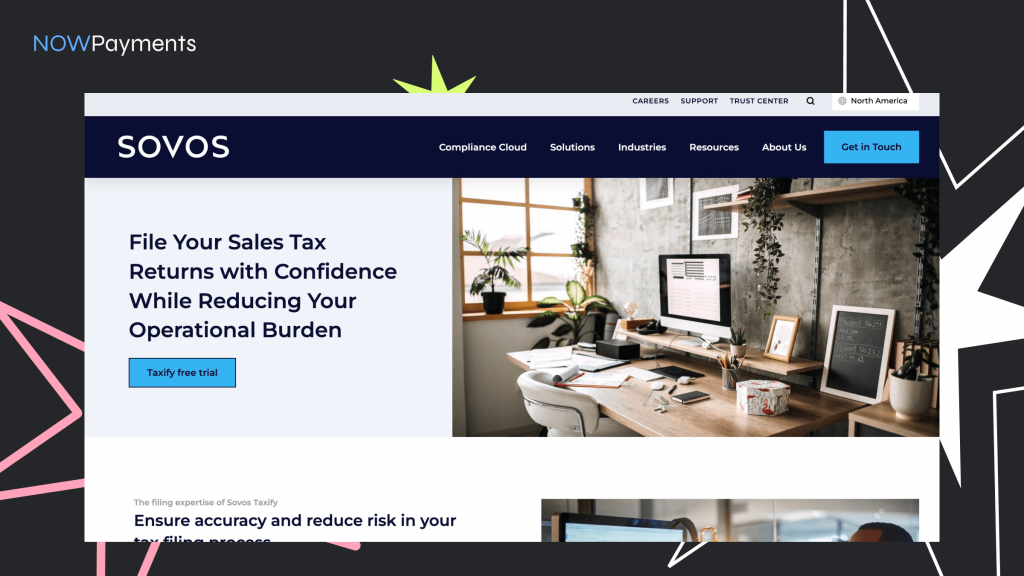

SOVOS Taxify

SOVOS Taxify offers comprehensive managed services designed to streamline the complex world of tax compliance and reporting. By leveraging advanced technology and expertise, SOVOS Taxify helps businesses navigate the intricate landscape of tax regulations across various jurisdictions. This ensures that organizations can focus on their core operations while remaining compliant with the ever-evolving tax laws.

One of the key features of SOVOS Taxify is its ability to automate tax calculations and filings, significantly reducing the risk of errors and penalties. Clients benefit from real-time access to tax data, which aids in informed decision-making and enhances overall financial management. The platform’s user-friendly interface makes it easy for businesses of all sizes to adapt and integrate into their existing systems.

Moreover, SOVOS Taxify provides ongoing support and updates to ensure that clients remain informed about changes in tax legislation. This proactive approach not only safeguards against compliance risks but also positions businesses for growth in a dynamic regulatory environment.

Vertex

Vertex is a leading cloud-based tax technology company that specializes in delivering innovative solutions for businesses navigating the complexities of tax compliance and management. With an extensive suite of products, Vertex empowers organizations to automate tax calculations, streamline reporting processes, and ensure compliance with ever-evolving tax regulations.

By leveraging advanced technology and robust data analytics, Vertex simplifies the tax lifecycle for companies of all sizes. Their cloud-based platform offers flexibility and scalability, allowing businesses to adapt to changing needs while minimizing the risk of errors and inefficiencies.

Furthermore, Vertex provides valuable insights and tools that help organizations optimize their tax strategies, ultimately leading to significant cost savings. As a trusted partner, Vertex is dedicated to helping businesses achieve greater accuracy and confidence in their tax operations.

Alternatives to TaxJar: What’s best for you?

When considering alternatives to TaxJar, it’s essential to evaluate your specific business needs. Options like Avalara provide a robust solution for larger enterprises, offering comprehensive tax compliance features and integrations with various e-commerce platforms. Their advanced reporting capabilities can be particularly beneficial for businesses with complex tax obligations.

For smaller businesses or startups, Square offers an integrated solution that simplifies sales tax calculations without overwhelming users. Its user-friendly interface and affordability make it an attractive choice for those just starting out.

Another viable option is QuickBooks Online, which not only manages your accounting but also helps with tax calculations. This can be especially useful for businesses that prefer an all-in-one solution.

Ultimately, the best choice depends on your budget, business size, and specific tax needs. Evaluating these factors will help you find the right solution for your business.

Conclusion

In the ever-evolving landscape of e-commerce, managing sales tax compliance efficiently is critical for businesses of all sizes. Platforms like TaxJar and its alternatives, including TaxCloud, Avalara AvaTax, SOVOS Taxify, and Vertex, provide robust solutions to automate complex tax calculations, filings, and compliance reporting. These tools help businesses focus on growth while staying compliant with changing tax regulations, ensuring smooth operations across multiple jurisdictions.

For businesses looking to modernize their payment ecosystems alongside tax compliance, NOWPayments emerges as a valuable complement. By enabling seamless acceptance of over 300 cryptocurrencies and integrating easily with existing systems, NOWPayments offers an innovative approach to expand payment options while maintaining tax accuracy. Together, solutions like TaxJar and NOWPayments empower businesses to optimize operations, enhance customer satisfaction, and stay ahead in a competitive market. Ultimately, choosing the right combination of tools tailored to specific business needs is key to achieving operational excellence and sustained growth.