The control of the Bitcoin market is heavily influenced by a small number of significant players known as bitcoin whales. These major bitcoin holders possess substantial amounts of bitcoin through their bitcoin wallets, with the top 100 holders of bitcoin owning a considerable share of the total bitcoin supply. Notably, the pseudonymous creator of bitcoin is believed to hold around 1 million BTC, making them one of the largest bitcoin holders. In 2024, the price of bitcoin could be significantly impacted by the activities of these bitcoin billionaires and their bitcoin wallet addresses. Furthermore, investment vehicles like the Grayscale Bitcoin Trust provide indirect bitcoin exposure to institutional investors, further complicating the landscape.

Many of the richest bitcoin addresses belong to prominent cryptocurrency exchanges and investment funds that buy bitcoin to manage their digital asset portfolios. These platforms often hold significant amounts of bitcoin to facilitate trading and provide liquidity, allowing users to buy bitcoin without direct ownership. As a result, they hold 1.5 billion worth of bitcoin in total, influencing market dynamics. Additionally, bitcoin mining operations also contribute to the distribution of bitcoin ownership, as they continuously generate new coins that enter the market. As bitcoin is increasingly viewed as a store of value and a hedge against inflation, understanding who owns the most bitcoin becomes crucial for predicting future market trends.

Individuals With the Largest Bitcoin Holdings

In the ever-evolving cryptocurrency market, many individuals have emerged as the largest holders of bitcoin, boasting significant bitcoin holdings. Among them, Jack Dorsey, co-founder of Twitter, has been a prominent advocate for bitcoin, particularly through his company Square, which has made significant investments in bitcoin. Another notable figure is the CEO of MicroStrategy, who has expanded its bitcoin holdings to over 1.1 million BTC and firmly believes in bitcoin as a hedge against inflation. Additionally, the Digital Currency Group has also gained indirect bitcoin exposure through various investments in blockchain companies. These individuals and entities contribute to the bitcoin rich list, showcasing the growing influence and belief in bitcoin as a cornerstone of the cryptocurrency world.

The journey of bitcoin has taken many twists, especially with historical events like the Silk Road, which brought bitcoin into the limelight. The performance of bitcoin has attracted numerous investors, from bitcoin miners to corporate giants looking for exposure to bitcoin through bitcoin ETFs and other digital currency investments. The biggest bitcoin holders not only influence the market but also shape the future of bitcoin. With billions of dollars invested in bitcoin and bitcoin cash, these top holders are pivotal in driving the adoption and stability of bitcoin globally. As the landscape continues to change, their strategies and beliefs will undoubtedly impact the future of bitcoin.

Winklevoss twins (~70,000 BTC)

The Winklevoss twins, Tyler and Cameron, are notable figures in the cryptocurrency world, particularly for their substantial bitcoin holdings. They reportedly hold around 70,000 BTC, making them among the largest individual top holders of bitcoin. Their investment in bitcoin began in 2013, and their belief that bitcoin would revolutionize finance has driven them to embrace the digital currency fully. As top bitcoin holders, they have played a significant role in promoting bitcoin and other digital assets to both retail and institutional investors.

The twins’ company, Gemini, has incorporated bitcoin into its offerings, providing a platform for buying, selling, and storing bitcoin. The Winklevoss twins’ bitcoin holdings are part of a larger trend, with many investors seeking indirect bitcoin exposure through corporate bitcoin initiatives. With a total supply capped at 21 million BTC, the twins’ holdings are a testament to their commitment to the future of bitcoin. As believers in bitcoin since its inception, they continue to advocate for its potential to reshape the financial landscape.

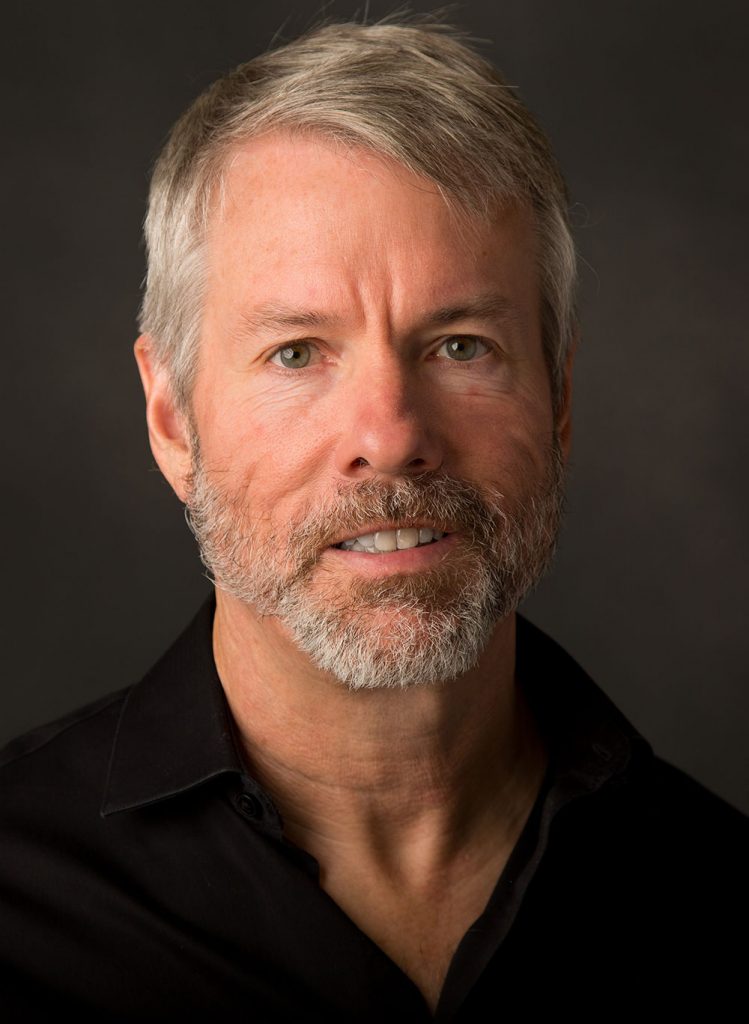

Michael Saylor (~ 17,732 BTC)

Michael Saylor, the co-founder and CEO of MicroStrategy, is renowned for his significant investment in bitcoin, holding around 17,732 BTC. His company has become the world’s largest corporate holder of bitcoin assets, with investments totaling over billions of dollars worth of bitcoin. Saylor has particularly embraced bitcoin as a long-term store of value, asserting that it is the best hedge against inflation in a world where traditional currencies are losing their purchasing power.

In 2020, Saylor’s strategic decision to invest heavily in spot bitcoin has placed MicroStrategy at the forefront of the world’s largest corporate bitcoin holdings. While many view him as an advocate for bitcoin, he also recognizes that indirect bitcoin exposure refers to companies that benefit from the growth of the bitcoin ecosystem without holding individual bitcoin. His vision has inspired other organizations to consider investing in bitcoin, contributing to a broader acceptance of this world’s largest cryptocurrency.

Saylor’s audacious investment strategy has sparked discussions about the future of bitcoin and digital assets, particularly as he continues to promote the advantages of holding many bitcoin over traditional assets. His commitment to acquiring million bitcoin in the long run illustrates his belief in the potential of bitcoin to shape the future financial landscape. As the exchange’s bitcoin offerings expand, Saylor’s influence and vision will likely play a crucial role in the ongoing evolution of the bitcoin market.

Satoshi Nakamoto (~1.1 million BTC)

Satoshi Nakamoto, the enigmatic figure behind bitcoin, is estimated to own around 1.1 million BTC, making them the largest holder of this cryptocurrency. Their bitcoin holdings have not moved since they were mined, which has led to speculation about their identity and intentions. The fortune, valued at hundreds of millions of dollars, remains dormant, fueling the mystery that surrounds Nakamoto.

The significant amount of bitcoin attributed to Nakamoto highlights their crucial role in the creation and early adoption of the decentralized currency. As of bitcoin in 2020, the market has seen tremendous growth, with million worth of investments pouring into digital currencies. The influence of bitcoin continues to expand, but the shadow of its creator looms large, making Nakamoto a pivotal figure in the narrative of cryptocurrencies.

Tim Draper (~ 29,656 BTC)

Tim Draper is a prominent venture capitalist known for his early investments in technology and his strong advocacy for cryptocurrencies, particularly bitcoin. With an impressive portfolio, he owns the most btc among individual investors, boasting around 29,656 BTC. His substantial bitcoin holdings have made him a significant figure in the crypto community, often sharing insights and predictions about the future of digital currencies.

Draper’s interest in bitcoin dates back to 2014, when he purchased a large amount of the cryptocurrency during a government auction of seized assets from the Silk Road. His confidence in the potential of bitcoin has only grown over the years, as he continues to promote its use and adoption. In his view, assets like bitcoin represent a revolutionary shift in how we think about money and investment.

CZ Zhao (Unknown number of BTC)

CZ Zhao, the CEO of Binance, has long been a pivotal figure in the cryptocurrency world. His extensive bitcoin holdings have positioned him as one of the most influential individuals in the space. While the exact number of BTC he possesses remains unknown, it is widely believed that his investments significantly impact market trends and investor sentiments. Many speculate that his bitcoin holdings could be a strategic reserve, allowing him to maneuver through the volatile landscape of digital currencies.

As the cryptocurrency ecosystem continues to evolve, the implications of Zhao’s investments become more pronounced. The bitcoin holdings attributed to him could influence not just Binance’s operational strategies but also the broader market dynamics. The split generated by his actions in the realm of digital assets often leads to increased scrutiny and speculation among traders and enthusiasts alike.

Tesla (TSLA) (9,720 BTC)

Tesla (TSLA) has made headlines not only for its innovative electric vehicles but also for its substantial bitcoin holdings. With an impressive portfolio of 9,720 BTC, the company has positioned itself as a significant player in the cryptocurrency market. This strategic investment reflects Tesla’s forward-thinking approach and a belief in the future of digital currencies.

As the market fluctuates, Tesla’s bitcoin holdings have become a topic of discussion among investors and analysts alike. The value of these assets can significantly impact the company’s overall financial performance, particularly when considering the volatility typically associated with cryptocurrency.

Furthermore, the importance of bitcoin holdings due to their potential to diversify Tesla’s revenue streams cannot be overstated. As more companies explore digital assets, Tesla’s early adoption may serve as a benchmark for others looking to invest in cryptocurrency.

MicroStrategy (MSTR) (226,331 BTC)

MicroStrategy (MSTR), a prominent business intelligence firm, has gained significant attention for its aggressive investment strategy in Bitcoin. With a staggering accumulation of 226,331 BTC, the company has positioned itself as one of the largest corporate holders of the cryptocurrency. This bold move reflects the company’s belief in Bitcoin as a hedge against inflation and a long-term store of value.

The CEO, Michael Saylor, has been a vocal advocate for Bitcoin, often highlighting its potential to revolutionize the financial landscape. Under his leadership, MicroStrategy has not only embraced Bitcoin as a treasury reserve asset but has also integrated it into its business strategy. This pioneering approach has sparked interest among investors and tech enthusiasts alike, raising discussions about the future role of cryptocurrencies in traditional business models.

As MicroStrategy continues to expand its Bitcoin holdings, its impact on the market and the broader acceptance of digital assets remains a topic of considerable speculation. The company’s journey exemplifies the growing intersection of technology and finance, potentially paving the way for other corporations to follow suit.

Hut 8 Mining Corp (HUT) (9,110 BTC)

Hut 8 Mining Corp, a prominent player in the cryptocurrency mining sector, has established itself as one of the largest publicly traded Bitcoin miners in North America. With a current holding of 9,110 BTC, the company showcases its substantial investment in the Bitcoin ecosystem, reflecting its commitment to long-term growth in the digital currency space.

The company’s strategic approach combines state-of-the-art mining technology and sustainable energy solutions, positioning Hut 8 as a leader in the industry. By prioritizing eco-friendly practices, Hut 8 Mining Corp not only increases its operational efficiency but also aligns itself with the growing demand for sustainable cryptocurrency solutions.

As Bitcoin continues to gain traction among investors and institutional players, Hut 8 aims to leverage its significant Bitcoin holdings to capitalize on future market opportunities. This positions the company favorably for sustained growth in an ever-evolving digital landscape.

Conclusion

In conclusion, as the Bitcoin market continues to grow and evolve, the influence of major holders, from corporate giants to individual investors, becomes increasingly evident. These entities, by holding significant portions of Bitcoin, play a pivotal role in shaping the future of cryptocurrency and its adoption. While the decisions and strategies of these top holders impact market trends, the growing acceptance of Bitcoin and other digital currencies is also driven by the ease with which people can now use and transact with them.

In this context, having reliable, efficient, and secure crypto payment solutions is essential for both businesses and consumers alike. NOWPayments stands out as a leading crypto payment gateway, offering seamless integrations that enable businesses to accept Bitcoin and a multitude of other cryptocurrencies. By providing a robust and user-friendly platform, NOWPayments is helping to facilitate the mainstream adoption of Bitcoin and digital assets, making it easier than ever for everyone to participate in the growing cryptocurrency economy.