Taiwan’s digital payment landscape is rapidly evolving, with businesses and consumers increasingly relying on secure and efficient payment gateways. As online transactions and e-commerce continue to expand, choosing the right

payment gateway has become crucial for merchants looking to optimize their financial operations. This article explores the top payment gateways in Taiwan, highlighting their features, benefits, and how they compare to each other.

Among them, NOWPayments stands out as a leading solution for businesses looking to integrate cryptocurrency and traditional payments seamlessly.

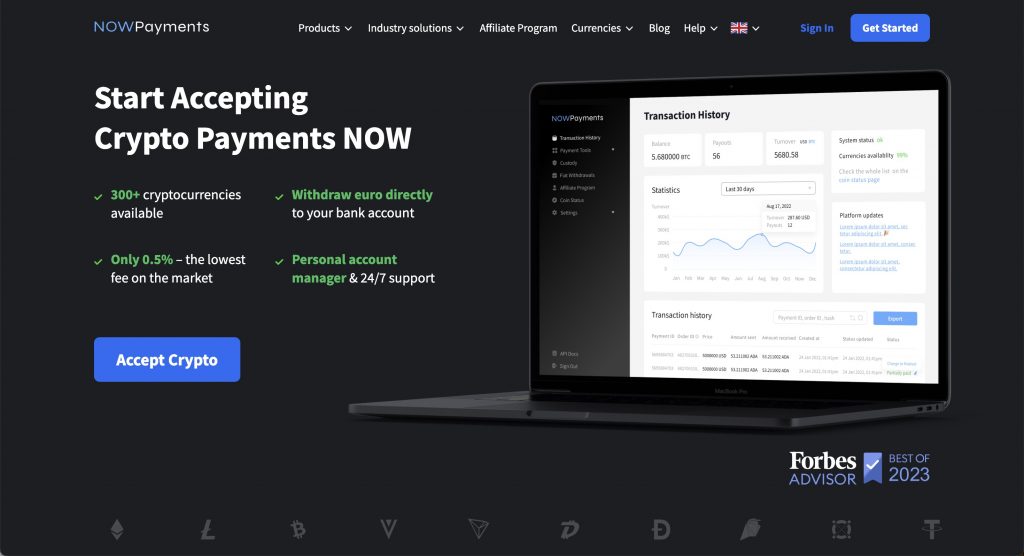

NOWPayments as the best payment gateway in Taiwan

NOWPayments has emerged as the best payment gateway in Taiwan, providing businesses with the ability to accept credit cards and cryptocurrencies seamlessly. It acts as a reliable payment partner for various enterprises, facilitating transactions in multiple currency options. This flexibility allows merchants to cater to a broader audience and supports the growing demand for digital payments.

With top posts highlighting its efficiency, NOWPayments is becoming increasingly widely used among Taiwanese online stores and marketplaces, including those in the mart sector. Businesses that want to use a payment gateway can easily integrate NOWPayments with local banks, ensuring that transactions are processed quickly and securely. In a landscape where options like PayPal are popular, NOWPayments stands out by offering features that enhance the overall user experience, making it a top choice for merchants and consumers alike.

Moreover, the platform supports a variety of payment methods, ensuring that cards are widely accepted. This versatility enables businesses to thrive in a competitive market, providing customers with the convenience they need during their transit through online shopping. With its robust infrastructure and commitment to innovation, NOWPayments continues to lead the charge in revolutionizing the payment landscape in Taiwan.

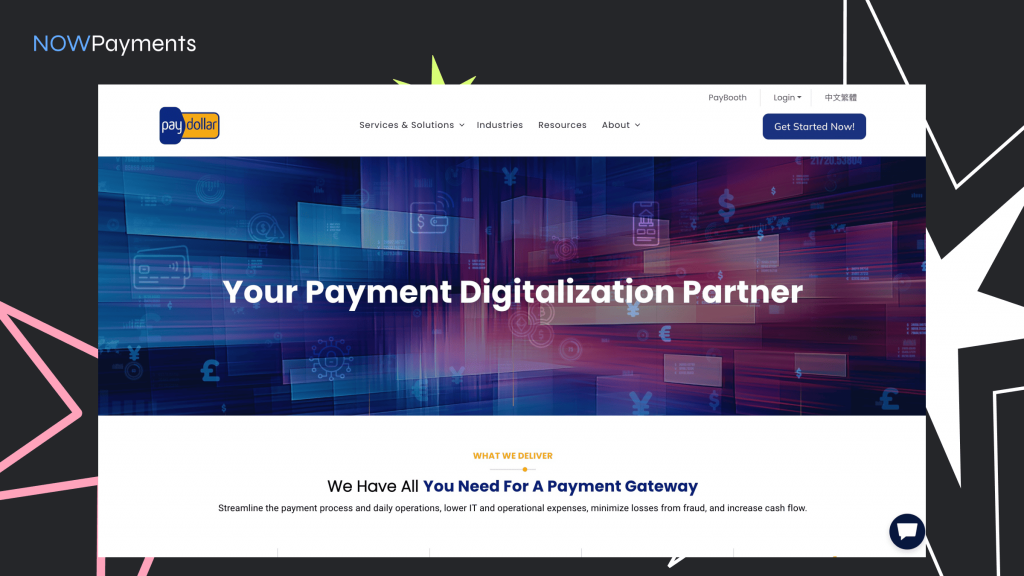

PayDollar

Provides a secure and efficient platform for e-commerce businesses to facilitate transactions, ensuring a seamless experience for both merchants and customers. In addition to credit card payments, PayDollar supports a variety of other payment methods, including digital wallets, bank transfers, and installment payment options, catering to the diverse preferences of consumers.

The service is designed with robust security features, including PCI DSS compliance, to protect sensitive customer information and reduce the risk of fraud. Merchants can easily integrate PayDollar’s payment gateway into their websites or mobile applications, with comprehensive documentation and support available to assist with the onboarding process.

Furthermore, PayDollar offers detailed reporting and analytics tools, empowering merchants to track transaction performance, understand customer behavior, and optimize their sales strategies. With a focus on enhancing the online shopping experience, PayDollar continually updates its technology to stay ahead of industry trends and consumer demands.

Overall, PayDollar serves as a reliable partner for businesses in Taiwan looking to expand their online presence and increase sales through efficient and secure payment processing solutions.

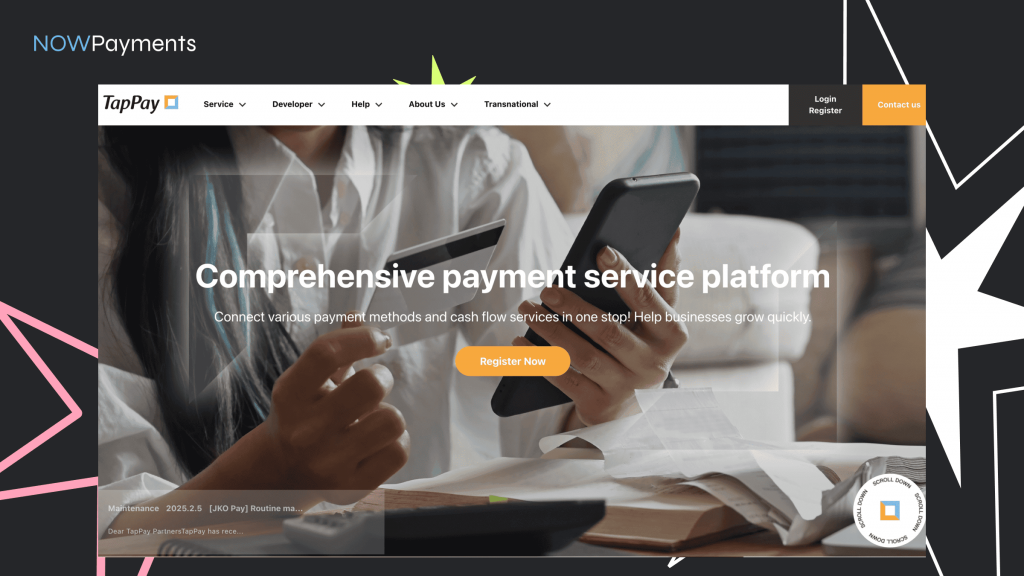

TapPay

Provides a comprehensive payment service platform supporting various payment methods and e-wallets, facilitating seamless payment integration for businesses. With a robust API and user-friendly interface, TapPay enables merchants to easily accept online payments, enhancing customer experience and driving sales.

The platform supports credit and debit cards, mobile wallets, and bank transfers, ensuring that businesses can cater to the diverse preferences of their customers. Additionally, TapPay offers advanced security features, including encryption and fraud detection, to protect sensitive transaction data.

Businesses can also take advantage of detailed analytics and reporting tools, which provide insights into transaction trends, customer behavior, and sales performance. This data empowers merchants to make informed decisions and optimize their payment processes.

With a dedicated support team and a commitment to continuous innovation, TapPay is designed to grow alongside businesses, adapting to their evolving needs and the dynamic landscape of digital payments. Whether you are a small startup or an established enterprise, TapPay provides the resources and flexibility to streamline your payment operations and enhance your bottom line.

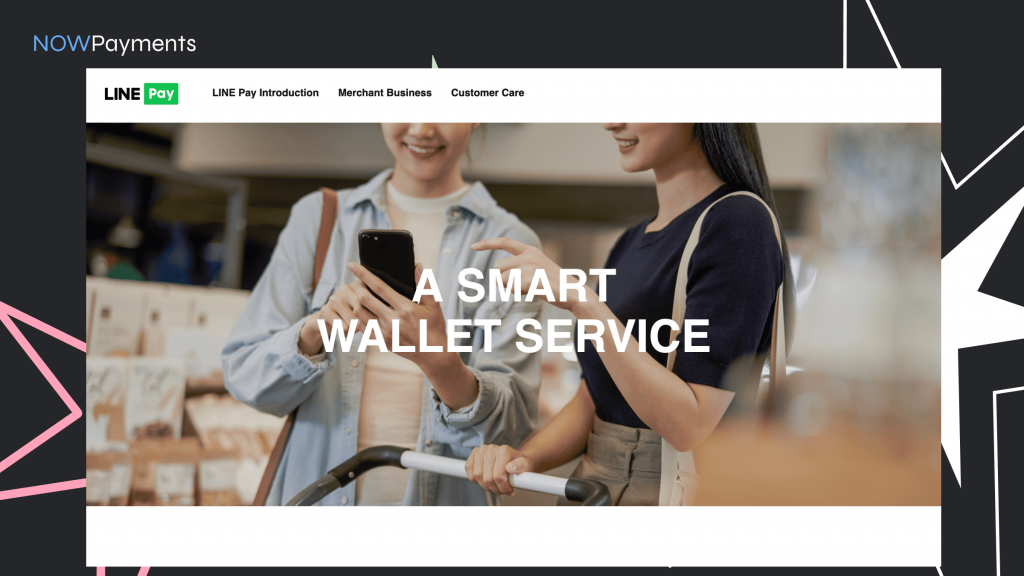

LINE Pay

In recent years, Taiwan has seen a surge in the use of mobile payment apps, with LINE Pay emerging as a popular choice among Taiwanese consumers. This app enables users to make payments in Taiwan quickly and efficiently, enhancing the convenience of everyday transactions. From retail stores to convenience stores and even public transportation systems like the EasyCard, LINE Pay is increasingly accepted across various sectors, allowing users to make purchases using new Taiwan dollars (NTD). It also serves as a reliable payment gateway for Taiwan, providing an alternative to traditional methods such as Visa, Mastercard, and even Apple Pay.

As Taiwan’s economy becomes more digital, cashless payments are becoming the norm. Visitors and tourists can enjoy the capability to withdraw cash or accept cash at select locations while benefiting from the ease of mobile transactions. LINE Pay also partners with international services like Alipay to facilitate cross-border transactions, making it easier for overseas visitors to engage in shopping and dining experiences. With its high rating for customer service and user-friendly interface, LINE Pay is poised to remain a top choice for consumers in Taipei and beyond.

JKOPAY

In Taiwan, JKOPAYA has emerged as a popular e-wallet that allows users to make seamless payments at various merchants and online platforms. With rapidly growing adoption, this platform enables users to accept payments using various payment methods in Taiwan, including credit and debit cards like JCB, as well as coin transfers. Users can easily link their bank accounts to withdraw money and save on transaction fees that might otherwise be associated with traditional banking options.

Taiwan continues to embrace alternative payment options as a means to enhance convenience for both locals and visitors. Retailers, such as 7-Eleven, FamilyMart, and various supermarkets and department stores, readily accept JKOPAYA payments, making it easy to purchase goods and services throughout the island. For tourists visiting the island, this e-wallet provides a dynamic environment to manage expenses, ensuring that cash is unavailable for those who prefer digital transactions.

Conclusion why NOWPayments is the best payment gateway in Taiwan

Choosing the right payment gateway is essential for businesses in Taiwan looking to enhance their payment processing and customer experience. While several options exist, NOWPayments stands out as the best choice due to its ability to handle both traditional and cryptocurrency payments seamlessly. Its integration capabilities with local banks, broad payment method support, and emphasis on security and innovation make it an ideal solution for merchants and consumers alike. As Taiwan continues its transition to a more digital economy, businesses leveraging NOWPayments can stay ahead of the curve and meet the growing demands of the modern marketplace.