When exploring alternatives to Adyen in 2026, businesses of all sizes can consider several top contenders that streamline the payment process. One of the best Adyen alternatives is PayPal, which offers a secure payment gateway and enables users to accept payments from customers worldwide. With its user-friendly dashboard, PayPal allows you to manage invoices and supports multiple payment methods, including Apple Pay and ACH payments.

Another popular choice is Stripe, a powerful payment platform that provides an intuitive API for developers to integrate various payment options seamlessly. Stripe excels in handling recurring billing and offers extensive support for businesses looking to get paid quickly. Authorize.net is also a strong option, especially for small businesses, as it offers a comprehensive payment service that simplifies online payment processing.

Additionally, 2Checkout stands out as a versatile payment processor that caters to global businesses, allowing you to accept payments in multiple currency options. These top Adyen competitors not only provide robust payment solutions but also focus on enhancing security through PCI compliance, making them suitable for businesses looking for secure payment methods.

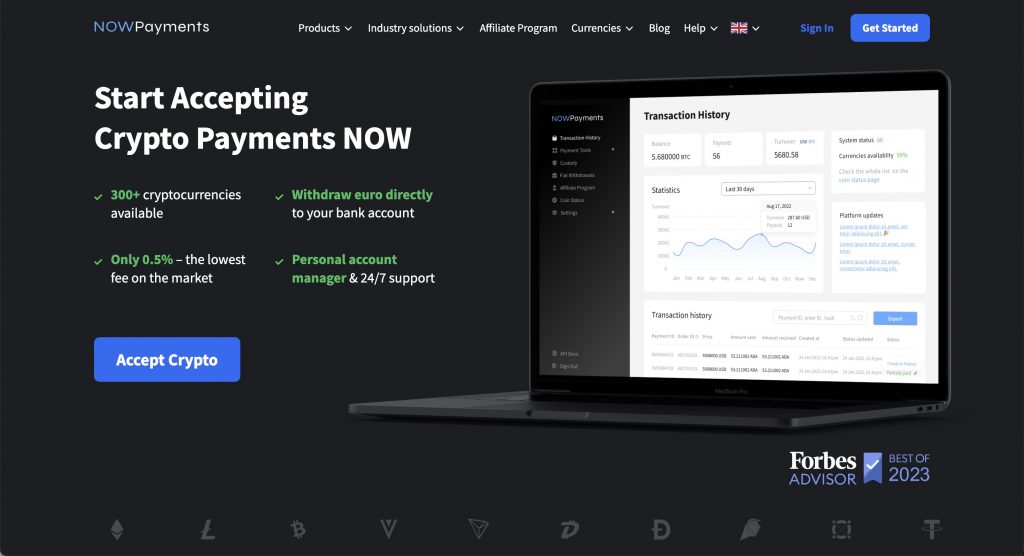

NOWPayments – best overall

NOWPayments is widely regarded as the best overall payment solution for businesses looking to enhance their checkout experience. This payment management platform allows users to make payments easily by providing a multi-currency option. Customers can pay with various methods, including card payments, bank transfer, and mobile payments, ensuring a seamless payment experience every time they shop. The platform also offers fraud protection and fraud prevention measures, safeguarding payment collection for businesses.

With easy integration into any online store or shopping cart, NOWPayments simplifies the process of receiving payments online. The payment gateway supports recurring payments and allows users to send payments through customizable payment pages. Compared to other payment options, the processing fees are competitive, making it one of the top alternatives to traditional solutions like PayPal and Stripe. For businesses looking for competitors and alternatives to Adyen, NOWPayments stands out as a reliable choice in 2026.

Braintree Direct

Braintree Direct is an online-based Payment Processing Software designed to help businesses of all sizes collect payments efficiently. The platform allows customers to use various payment card options, making it easy for businesses to offer popular payment methods, including digital wallets. With its robust payment gateway, Braintree Direct enables payments using both online and mobile platforms, ensuring that every transaction is seamless and secure.

In terms of conversion rates, Braintree Direct stands out among the top Adyen alternatives and competitors. This payment management platform helps businesses to accept payments with ease, allowing you to choose Stripe or other alternatives and competitors for 2024. If you already have a PayPal account, the software has been designed to connect with thousands of marketplaces, making it a valuable tool for businesses alike.

As a payment management solution that allows you to send invoices and even pay the VAT authorities, Braintree Direct is similar to Adyen in providing comprehensive digital payment solutions. Whether you are a startup or an established enterprise, this platform ensures that you have the best payment options at your disposal.

Securely store billing info to accept repeat online payments ideal for software or subscription-based businesses. Automatically update changes to card details, such as numbers or expiration dates, to help you maximize sales.

Global Payments

Global Payments is an online-based Payment Processing Software that offers a seamless solution for businesses looking to streamline their transactions. With a simple, complete payment page for web and app integration, users can easily drop it in and be all set to accept payments. This comprehensive management platform not only facilitates transactions but also enhances the overall customer experience.

As we look toward alternatives 2026, Global Payments stands out as one of the top choices for businesses seeking reliable solutions. The payment gateway that offers robust features ensures that merchants can efficiently process payments while maintaining security and compliance. In an ever-evolving landscape, having a solid list of best payment processing options is crucial for success.

Incorporating a reliable POS system with Global Payments can further enhance operational efficiency, making it a preferred choice for many businesses. This platform not only meets the needs of modern commerce but also paves the way for future growth.

Payway

Payway is an innovative recurring payment gateway designed to provide merchants with an intuitive, secure, and seamless payment experience. With its user-friendly interface, Payway simplifies the complexities of managing subscriptions and recurring transactions, allowing businesses to focus on growth and customer satisfaction.

This management platform that helps merchants streamline their revenue collection processes while ensuring that sensitive customer data remains protected. By utilizing cutting-edge security measures and compliance standards, Payway instills confidence in both merchants and their customers.

Moreover, Payway’s robust reporting tools enable merchants to analyze their payments easily, offering insights that drive better business decisions. The platform’s flexibility allows for seamless integration with existing systems, making it a versatile choice for businesses of all sizes.

In conclusion, Payway is not just a payment gateway; it’s a comprehensive solution that transforms the way merchants handle recurring payments efficiently and securely.

PayNet

PayNet software is an innovative payment gateway designed specifically for businesses seeking to streamline their transaction processes. By integrating advanced technology, it allows companies to efficiently manage their payments while ensuring security and ease of use.

With PayNet, businesses can accept various forms of payment, making it a versatile solution for modern commerce. This flexibility not only enhances customer satisfaction but also drives sales by accommodating diverse consumer preferences.

Furthermore, PayNet offers robust reporting tools that help business owners monitor their payments effectively. By analyzing transaction data, companies can gain valuable insights into their sales patterns and customer behaviors.

In summary, PayNet serves as a reliable payment gateway that simplifies the payments process, empowering businesses to thrive in today’s competitive market.

Summing up

In conclusion, NOWPayments distinguishes itself as the best choice among Adyen alternatives for businesses looking to enhance their payment processing experience. With support for over 300 cryptocurrencies, it offers unmatched flexibility, allowing companies to tap into the expanding crypto market and attract a global customer base. Unlike other competitors, NOWPayments combines low transaction fees with robust security features and easy integration, making it a versatile and cost-effective solution for modern businesses. For those seeking a forward-thinking, comprehensive payment gateway that goes beyond traditional options, NOWPayments provides the tools needed to thrive in an evolving digital landscape.