The world of cryptocurrencies has grown significantly in the last decade, and digital assets have become increasingly popular as a medium of exchange. One such cryptocurrency is Tether (USDT), a stablecoin that is pegged to the US Dollar. More and more merchants are choosing to accept USDT payments due to its stability and numerous benefits. In this article, we will discuss the reasons why businesses should consider accepting Tether payments, how to do so, and the advantages of using NOWPayments to facilitate these transactions.

Table of Contents:

- What Is Tether (USDT)?

- The Importance of Stablecoins

- Benefits of Accepting USDT Payments

- How USDT Offers Stability

- USDT vs. Other Cryptocurrencies

- Integration of USDT Payments for Merchants

- Real-World Examples of USDT Adoption

- USDT and Regulatory Compliance

- Choosing the Right Payment Gateway for USDT

What is Tether (USDT)?

Tether (USDT) is a stablecoin that is pegged to the US Dollar, which means its value remains stable and predictable. Launched in 2015, USDT has become the world’s third-largest digital coin by market value and has gained popularity due to its stability compared to other cryptocurrencies like Bitcoin and Ethereum.

The stability of USDT comes from its currency reserves, as the company claims to hold dollars and other assets equal to or greater than the total number of USDT in circulation. This stability makes USDT an attractive option for merchants who want to accept crypto payments without worrying about price volatility.

The Importance of Stablecoins

Stablecoins like USDT have gained significant traction in recent years, experiencing a 388% growth in 2021 alone. They play a crucial role in the decentralized finance (DeFi) ecosystem, which relies on smart contracts and blockchain technology. By offering price stability, stablecoins enable users to transact with cryptocurrencies without worrying about volatility. This makes them particularly attractive for merchants who wish to accept crypto payments.

Benefits of Accepting USDT Payments

There are several advantages for merchants who choose to accept USDT payments:

Price Stability

As USDT is pegged to the US Dollar, its value remains relatively stable compared to other cryptocurrencies. This makes it an attractive option for merchants who want to accept crypto payments without the risk of sudden price fluctuations.

Faster Transactions

Traditional banking systems often take several days to process transactions, whereas USDT transactions can be completed within minutes. This enables merchants to receive payments quickly, which is particularly beneficial for businesses with international clients or those operating in regions with underdeveloped financial systems.

Lower Transaction Fees

Crypto transactions typically have lower fees than traditional payment methods such as credit cards. By accepting USDT payments, merchants can reduce transaction costs, which can lead to increased profits.

Enhanced Access

By accepting USDT payments, merchants can cater to a broader range of customers, including those without access to traditional banking services or who prefer to transact using cryptocurrencies. This can potentially lead to increased sales and customer acquisition.

Increased Privacy

Cryptocurrency transactions offer greater privacy than traditional payment methods. By accepting USDT payments, merchants can provide customers with a more secure and private way to pay for goods and services.

How USDT Offers Stability

The primary reason why USDT maintains a stable value is due to the currency reserves held by Tether Limited, the company behind USDT. Tether claims to hold assets equal to or greater than the total number of USDT tokens in circulation. This ensures that for every USDT token issued, there is a corresponding US Dollar held in reserve.

Tether regularly publishes daily reports on its website, providing transparency into its reserve holdings and the number of outstanding USDT tokens. While there have been controversies surrounding Tether’s reserves, the company has managed to maintain its peg to the US Dollar, making USDT a reliable stablecoin for merchants and users alike.

USDT vs. Other Cryptocurrencies

When compared to other popular cryptocurrencies like Bitcoin or Ethereum, USDT offers distinct advantages, particularly in terms of stability and transaction speed. While Bitcoin and Ethereum are known for their price volatility, USDT’s value remains relatively stable, making it a safer option for merchants who want to accept crypto payments without exposing themselves to significant risk.

Furthermore, USDT transactions can be processed much faster than those involving Bitcoin or Ethereum, allowing merchants to receive payments quickly and efficiently.

Integration of USDT Payments for Merchants

Merchants looking to accept USDT payments can do so easily by integrating with a crypto payment gateway such as NOWPayments. NOWPayments offers a variety of tools and solutions to help merchants accept USDT and other cryptocurrencies:

Plugins

NOWPayments offers easy-to-use plugins for major CMS solutions like WooCommerce, Magento 2, Shopify, and WHMCS. By installing one of these plugins, merchants can quickly enable USDT payments on their online stores.

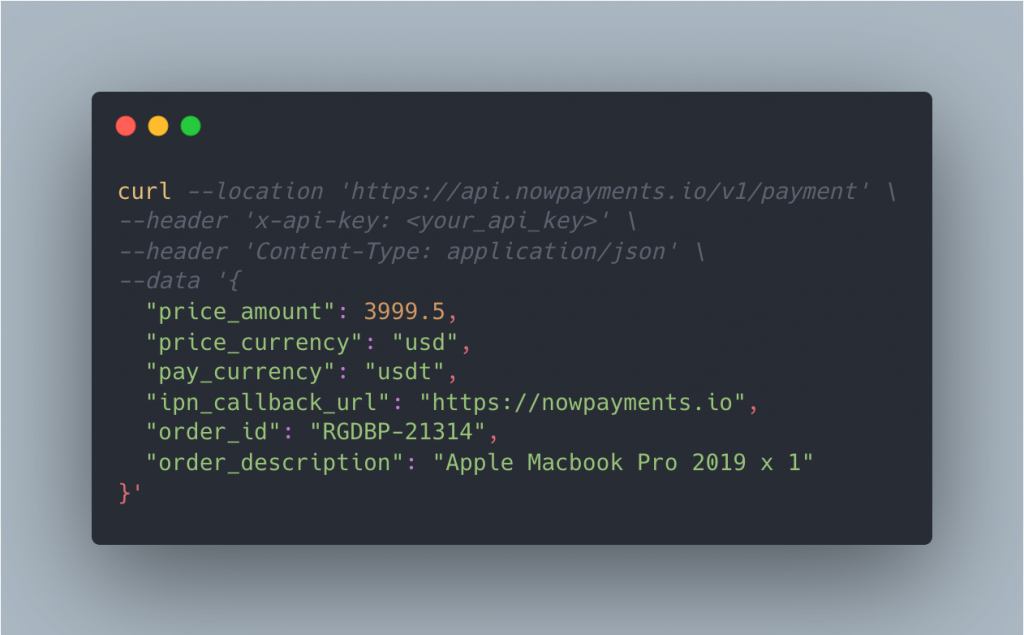

API

The NOWPayments API provides instant payment notifications (IPN) and simplifies the integration of USDT payments into websites, platforms, or mobile apps. This API can be used to conduct payouts, exchange currencies, manage invoices, and much more.

Invoices

By using the invoice payment format offered by NOWPayments, merchants can streamline the payment process for their customers, making it easier for them to complete transactions and pay for goods and services.

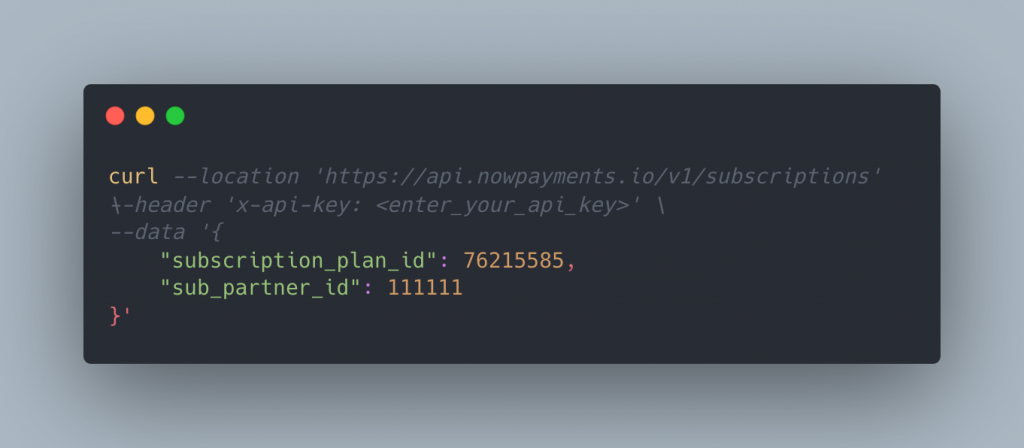

Billing Solutions

With NOWPayments’ billing solution, merchants can create sub-accounts for their users and manage their funds. This simplifies the flow of funds between the merchant and their customers, making it easier to track and manage payments.

Point-of-Sale Terminal

A Point-of-Sale (POS) software integration with NOWPayments enables merchants to accept USDT payments at their offline stores. This provides customers with a quick and easy way to pay using their cryptocurrencies.

Custom Solutions

NOWPayments prides itself on being a client-friendly service. If a merchant requires a tailored solution to accept or send crypto payments, the NOWPayments team can develop a custom solution to meet their needs.

Real-World Examples of USDT Adoption

USDT adoption is on the rise, with businesses and organizations around the world beginning to accept Tether payments. One notable example is the collaboration between Tether and KriptonMarket in Argentina, which aimed to combat inflation and facilitate digital payments between small producers and consumers.

Another example is the growing number of merchants accepting USDT payments in various industries, including e-commerce, travel, and more. This demonstrates the increasing demand for stablecoin payments and the benefits they provide for businesses and consumers alike.

USDT and Regulatory Compliance

As stablecoins grow in popularity, regulatory scrutiny is likely to increase. It is essential for merchants to ensure that their chosen payment gateway complies with all relevant regulations and guidelines. NOWPayments, for instance, adheres to strict compliance standards to provide a secure and reliable solution for merchants looking to accept USDT payments.

Choosing the Right Payment Gateway for USDT

When selecting a payment gateway to accept USDT payments, merchants should consider factors such as ease of integration, transaction fees, and regulatory compliance. NOWPayments offers a comprehensive solution that caters to these requirements, making it an ideal choice for businesses looking to accept Tether payments.

Conclusion

Accepting USDT payments can provide numerous benefits for merchants, including increased stability, lower transaction fees, and access to a global customer base. NOWPayments offers a comprehensive solution for businesses looking to accept Tether payments, with versatile payment tools, competitive fees, and robust security features. By choosing NOWPayments as their payment gateway, merchants can seamlessly integrate USDT payments into their existing systems and enjoy the advantages of accepting crypto payments.