This situation occurs with almost every business owner who has to deal with the crypto payment confirmation. In most cases, you may feel puzzled or even stressed out. You may feel this way only if the customer transferred the same amount as the issued invoice and the payment was confirmed. However, it turns out that you can see a significantly smaller number on your merchant account’s dashboard than the one your customer should have sent you. You start thinking that the assets are stuck somewhere between the customer’s storage wallet and your merchant account. At this moment, your inner voice is telling you that the payment processor has taken some of your money in a cunning and hidden way.

It is totally understandable to be confused, as your previous experience with the traditional banking system makes you think that a fee can be charged in such cases as wiring the transfers from one account to another one or when you swipe your debit card and the checkout point shows you the total amount, and later the shopkeeper receives a little bit less than the total due to the interchange or acquiring fee. Meanwhile, crypto assets’ regulation is totally different from conventional banking payments’ flow. Crypto payments are operated on decentralized blockchain networks, which makes sense, as digital asset transactions’ fees do not depend purely on the payment processor but on many other factors.

In this article, we would like to make it clear for you which types of fees there are for accepting crypto payments and how you can cut down on some of them and even eliminate some of them entirely in the proper circumstances.

Types of Crypto Transaction Fees

The most important thing you need to comprehend is the distinction between the fees charged by the payment gateway and the fees that you need to pay to the blockchain network. These two types of fees are primarily the main source of confusion for the beginners in crypto that make people think that payment processors are trying to take advantage of their users and somehow inflate the cost of their services. However, actually these kinds of fees do not depend on who receives them. The opposite of that, they depend on what the users pay for and how much control the payment processors take over the users’ assets.

Service Fee. This is the type of fee that drives lawful profit for the payment gateways and helps the whole infrastructure remain sustainable in order to be able to accept cryptocurrency payments in a business context. Here is what is usually included in service fees:

- Engineers’ salaries

- Security Researchers’ salaries

- Customer Support Staff’s salaries

- Server Infrastructure Sustainability Cost

In such a setting, engineers are constantly working on the code that converts volatile exchange rates into fixed-rate invoices. Security researchers monitor blockchain networks to prevent any fraudulent actions or any other attacks. Customer support employees answer any technical questions at any hour of the day and night. Finally, the server infrastructure keeps it possible for the payment pages to load quickly even during times of a sudden increase of users trying to access the payment provider’s services. So, this is the fee that belongs entirely to the crypto payment gateway and the amount of charge is shown clearly in the transaction invoices or any other settlement reports.

Network Fee. Payment providers, including NOWPayments, do not charge this fee. This fee is charged by the blockchain network, which includes validators or miners who make the physical hardware work. These people and even organizations placed all over the world in the data processing centers or residential areas run on a lot of electricity to be able to use specific computing devices that solve cryptographic tasks or confirm the authenticity of transactions. The network fee is what they get for their job, and it is also allocated to those miners who added a new block to the chain with success. That is why the network fee is not something that any payment provider can increase on their own will, as they have no authority to touch any of the clients’ funds all over the world.

Gas Fee. This type of fee is a specific subset of network fees that are charged mostly by those blockchains that are able to apply complex logic instead of just recording value transfers. For example, Ethereum, which is the most outstanding blockchain that calculates the algorithmic efficiency in such units as gas. Each operation that is done by a transaction, no matter by which action in particular, utilizes a certain amount of gas. The overall gas fee is measured in the following way:

Gas Fee = Gas Units x (Base Fee + Priority Fee)

In this situation, gas fees create a system in which more complex transactions cost more, allowing users to prefer transactions that offer higher gas prices. This order of things makes sure that the limited computational ability of the blockchain network is distributed to those who appreciate it most of all, but it is also rather vulnerable to those times when fees increase drastically due to the increased demand.

Conversion Fee. This is the kind of fee that implies that cryptocurrency is exchanged for any conventional fiat currency or converted from one crypto asset to another. Imagine that a business owner accepts Bitcoin but is required to pay the suppliers in dollars. In such a case, the crypto assets need to be exchanged on such platforms as Binance or Uniswap. Only after the exchange you will be able to pay in fiat. However, if the crypto payment provider, such as NOWPayments, has an autoconversion feature, you do not need to exchange the assets manually or spend extra money, as the platform can do it for you. With NOWPayments, you only need to enable custody, select the currency you want to convert from, the currency to convert to, and the amount of assets you wish to convert.

Crypto Payment Flow

It is essential to actually walk through a comprehensive payment lifecycle to be able to understand how fees are constituted and which actor pays them at each phase. We will have a look at the whole process, following the movement of the assets from the moment a customer issues the invoice for the transaction to the moment the business owner gets the assets to his merchant account.

As soon as the customer chooses cryptocurrency as the payment option at checkout, the payment processor issues the invoice with a destination address and a specific amount in the dedicated cryptocurrency. The amount is estimated based on the current exchange rate for the merchant’s local currency and the chosen crypto coin. We set it slightly higher on purpose to account for the network fee. The specified amount is then reflected in a transaction made by the customer’s wallet software to the dedicated address. Moreover, the transaction comprises an extra part that pays the network fee to the miner that includes the transaction in a block.

From the customer’s standpoint, the whole process is reflected in a single deduction from their wallet balance, where they do not really know which part of the transaction actually reaches the merchant and which one is charged by the network. However, the merchant can see from his account’s dashboard that the amount the customer has sent him is lower than the deposit. That is why it is incredibly important for merchants to be aware of the mechanics of blockchain transactions so they can avoid any misunderstandings with the payment provider or customers.

However, when the merchants try to transfer assets from their payment provider balance to a personal cold wallet, they become the ones who initiate a transaction on a blockchain network. In this scenario the network fee is taken away from the amount they send. It is important to differentiate the deposit fees initiated by customers and withdrawal fees initiated by merchants, as it is the key to understanding for what reasons payment providers cannot just eliminate network fees.

Deposits vs. Withdrawals

A deposit is the process of moving the assets from the customer’s private wallet to the merchant’s account within the payment provider’s system. This is such a type of transaction where the customer completes the purchase and the funds are now visible as a credited balance, which the seller can see on his account’s dashboard.

A withdrawal is an opposite movement of funds where the assets are transferred from the merchant’s account to an external destination the merchant has access to. This destination can be a personal cold wallet, a hot wallet for making payments for any purpose or an exchange account where it is possible to exchange crypto for a traditional currency.

A deposit fee is the network fee connected to the assets moving from the customer’s account to the merchant’s account. The customer is to pay this type of fee, as this person is the one who initiates the payment. The fee is deducted in an automatical way by the blockchain before the funds actually transferred to the merchant’s balance. The merchant cannot even see these fees deducted from their account because these are the costs that the customer is responsible for.

A withdrawal fee is the network fee connected to the assets moving from the merchant’s payment provider balance to an external wallet. When a merchant issues the invoice for a withdrawal, this person becomes a sender, whose responsibility is to pay for the network fee. This type of fee is deducted from the withdrawal amount.

Connection between Network Fees and Blockchain Costs

You have already learned about network fees and their recipients, so now you might be wondering why it is not that easy for these fees to be fixed at a low and consistent rate. The key to understanding this idea is not connected to any specifics in technology, rather, in the fundamental design of blockchains.

Every blockchain puts transactions into blocks, where each block has an opportunity to hold only a certain number of transactions for the network to remain accessible. This set amount of block space creates an auction, where users who need faster payment verification pay more to beat other users’ bids, and the market clears at the price that comes up from the competition between supply and demand at that time.

However, this bidding system may not seem useful to you when you start comparing it to the traditional payment networks. But let me remind you that blockchain’s main advantage is that it is a decentralized network. So, if blocks could hold any amount of information, the blockchain would grow so quickly that only huge companies could pay to run the nodes that check transactions. That buildup of power would destroy the freedom that makes cryptocurrency valuable in the first place. So, variable fees are not a mistake in the way the system is designed. In a system without a central authority to determine which deals are important, inconsistent fees are the price you pay.

Zero Network Fee on USDT TRC20 Deposits

If network fees are an essential part of blockchain economics, how can NOWPayments offer zero‑fee deposits? The answer is we pay them for you.

For a short time, NOWPayments is offering no network fees for USDT TRC20 deposits. This is a business move to cover the costs of deposits for new partners. When a user sends USDT over the TRON network, the blockchain takes its usual cut, and validators get paid the same way they always do. The main difference is that NOWPayments takes care of the network costs and credits the partner’s account for the full amount of the payment.

Why USDT TRC20?

There are three main reasons why this object and network were chosen:

Liquidity. USDT is the most widely accepted stablecoin in the world. It trades worth billions of dollars every day and is accepted at almost all exchanges and payment processors.

Cost-effectiveness. The TRON network always has low prices, never more than $1 per transaction, no matter how much money is being sent.

Speed. The network can handle both small transactions and large payments because transactions settle in seconds instead of minutes or hours.

Activating the Zero‑Network‑Fee Offer

Any business can get activated in less than ten minutes and start using the zero network fees on USDT TRC20 deposits for new NOWPayments partners.

- Create an Account:

Sign up with a crypto payment gateway like NOWPayments.

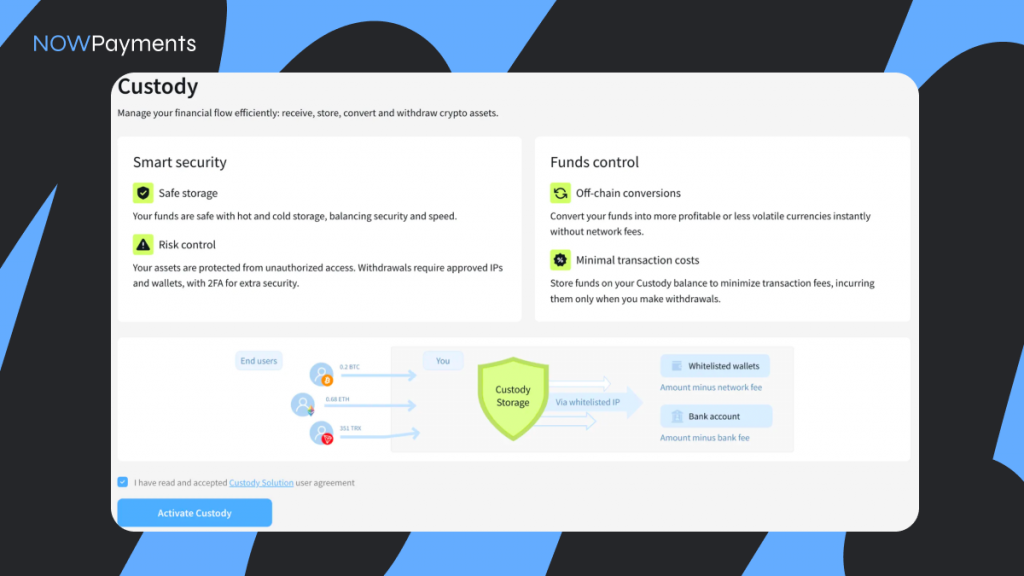

- Activate Custody:

For added security and reduced network fees, activate Custody under the “Dashboard” section.

- Start accepting USDT TRC20 payments with no network fees for deposits for the first 2 months.

Conclusion

This article examines crypto fees, explaining their purpose, who receives them, and why they exist. Service fees keep the sites running that let people use Bitcoin to buy things. Network fees pay the miners and validators who keep the blockchain safe. There are fees that make it easier to switch between digital and physical funds. Each one has a valid purpose and can be checked on public ledgers. When you understand these differences, fees go from being a source of stress to an expected and manageable part of running a business.

If you want to save on network fees, NOWPayments is ready to help you. You just need to sign up and activate custody to unlock 60 days of zero network fees on USDT TRC20 deposits. So, the question is not if cryptocurrency will become a common way to pay for things around the world. That will happen because the technology is faster, cheaper, and easier for more people to use. The question is whether your company will start building the infrastructure it needs right now, when the cost of getting this asset and network is zero.