In this article, we will explore how a Token Generation Event (TGE) works, the different types of tokens that exist, and the benefits of integrating NOWPayments into the process. Understanding TGEs is crucial for blockchain projects looking to raise funds, distribute digital assets, and enhance adoption. With NOWPayments, projects can streamline token sales, enable seamless cryptocurrency transactions, and optimize their ecosystem for broader usability.

Token Generation Events (TGEs) are pivotal moments in the crypto space, marking the launch of new tokens that serve various purposes within a blockchain network. A TGE typically involves a token sale, allowing early supporters and investors to purchase tokens through mechanisms like initial coin offerings (ICOs) or security token offerings (STOs). These tokens can be categorized as utility tokens, which provide access to a service, or security tokens, representing ownership and governed by regulations. The Ethereum blockchain is a popular choice for such events, where smart contracts automate the token distribution process, ensuring transparency and efficiency.

While launching a token is an exciting opportunity, ensuring a seamless and efficient payment process is crucial to maximizing participation. This is where NOWPayments simplifies the journey, offering a secure, automated, and user-friendly payment gateway for TGE projects. With features like mass payouts for airdrops, custodial solutions for fund accumulation, and fixed-rate payments, NOWPayments enables projects to accept cryptocurrency payments seamlessly, ensuring their fundraising efforts are as smooth as possible.

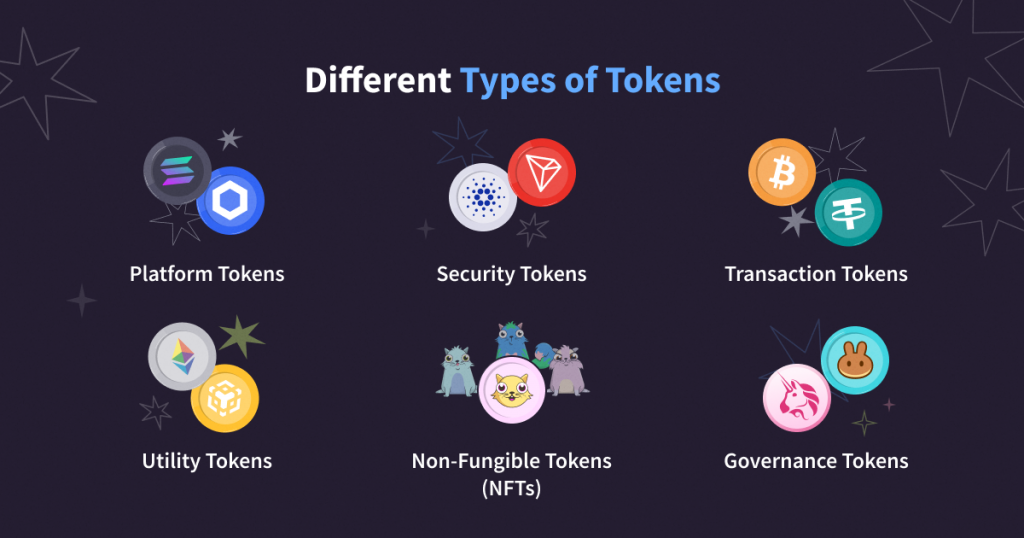

What Types of Tokens exists on the market?

A token is a digital representation of a utility or asset on a blockchain network, utilized within a decentralized application (DApp). A token generation event occurs when a DApp developer officially introduces these tokens to the market. Tokens are programmable and typically signify an asset or utility. They can be traded and operate on a smart contract framework, enabling them to take various forms, such as goods, reward points, or virtual characters in video games.

Tokens created through smart contracts serve multiple purposes and functions, including voting rights, value exchange, access to premium services, currency transactions, and profit distribution, to name a few. Additionally, tokens facilitate the governance of specific decentralized finance projects, allowing for the formation of user communities and ensuring the ongoing development of the project over time.

Platform Tokens

Platform tokens are digital assets that serve as the backbone of blockchain ecosystems, enabling users to interact with decentralized applications (dApps) and services. These tokens are built on existing blockchain infrastructures, such as Ethereum or Solana, and often facilitate smart contract execution, staking, or governance. They provide utility within a specific ecosystem, granting access to services, powering transactions, or incentivizing network participants.

Security Tokens

Security tokens represent ownership or rights to an underlying asset, such as equity, real estate, or company shares, and are subject to regulatory oversight. They provide investors with legally recognized financial claims, such as dividends or profit-sharing, similar to traditional securities. Security tokens improve liquidity, transparency, and accessibility in investment markets by leveraging blockchain technology for secure and efficient asset transfers.

Transaction Tokens

Transaction tokens are designed primarily for facilitating payments and value transfers on blockchain networks. These tokens function as digital currencies, allowing users to send, receive, and store value securely and efficiently, often with lower fees compared to traditional banking systems. Examples include Bitcoin and stablecoins like USDT, which aim to provide a reliable medium of exchange within and across blockchain ecosystems.

Utility Tokens

Utility tokens grant users access to specific products, services, or features within a blockchain-based platform. Unlike security tokens, they do not represent ownership but instead serve functional purposes, such as paying for transaction fees, accessing premium services, or participating in decentralized applications (dApps). Examples include Ethereum (ETH) for executing smart contracts and Filecoin (FIL) for decentralized storage services.

Non-Fungible Tokens (NFTs)

NFTs are unique digital assets that represent ownership of one-of-a-kind items, such as digital art, collectibles, virtual real estate, or in-game assets. Unlike fungible tokens, NFTs cannot be exchanged on a one-to-one basis due to their distinct properties and metadata. They utilize blockchain technology to ensure authenticity, scarcity, and provenance, making them valuable for creators and collectors alike.

Governance Tokens

Governance tokens empower holders to participate in decision-making processes within a decentralized protocol or ecosystem. Token holders can vote on proposals, protocol upgrades, fee structures, and other governance-related matters, ensuring a decentralized and community-driven development process. Examples include UNI (Uniswap) and MKR (MakerDAO), which allow users to influence the future of their respective platforms.

ICOs, IPOs, and TGEs

• ICO (Initial Coin Offering): A fundraising method in which blockchain projects sell newly issued tokens to early investors, usually to fund development. Unlike IPOs, ICOs do not grant equity but provide access to a platform or utility within an ecosystem.

• IPO (Initial Public Offering): A traditional financial event where a company sells shares to the public for the first time, giving investors equity ownership. IPOs are highly regulated, unlike ICOs, which often operate in a decentralized environment.

• TGE (Token Generation Event): A broader term than ICO, encompassing the technical issuance of tokens, which may not always be tied to fundraising. TGEs focus on token distribution, whereas ICOs focus on raising capital.

Steps to launch a token generation event

1. Create a Product

Before launching a token, ensure you have a viable product or at least a well-defined roadmap. Investors and users are more likely to trust a project that has a working prototype, use case, or minimum viable product (MVP). Define the problem your blockchain solution solves and how the token integrates into the ecosystem.

2. Prepare Your Whitepaper

A whitepaper is a crucial document outlining the project’s vision, technical details, tokenomics, and roadmap. It should clearly explain how the token functions within your ecosystem, its supply mechanics, and potential use cases. A well-structured and transparent whitepaper increases credibility and attracts investors.

3. Develop a Community

A strong and engaged community is essential for a successful TGE. Utilize platforms like Twitter, Discord, and Telegram to build awareness, answer questions, and keep potential investors updated. Community-driven projects often see better adoption, as supporters can act as early advocates.

4. Contact Exchanges for Token Listing

Once the token is generated, securing exchange listings is crucial for liquidity and accessibility. Reach out to centralized (CEX) and decentralized exchanges (DEX) to ensure your token can be traded. Partnerships with reputable exchanges boost trust and allow for wider adoption.

How TGEs Work with NOWPayments

Many projects launching a presale use NOWPayments as follows:

- They create a website announcing the upcoming token launch.

- They integrate NOWPayments to allow users to purchase their tokens during the presale at a set price (e.g., selling one token for $0.50).

- Payments are processed through NOWPayments in multiple cryptocurrencies and fiat options.

- The project collects user details (typically via email during the purchase process) and manually sends the purchased tokens to the buyer’s wallet.

Our core function is to enable projects to accept payments for their tokens in various digital assets, ensuring a smooth presale process. If the token gains traction and gets listed on exchanges, NOWPayments can also integrate it into our ecosystem (subject to listing requirements). Once added, merchants can continue developing their project and ecosystem, allowing users to make payments with their token. Additionally, they can leverage Mass Payouts to distribute their tokens as rewards for activities like staking, community incentives, and other engagement programs.

By integrating NOWPayments, projects can eliminate the complexities of handling payments manually, ensuring contributors can purchase tokens hassle-free while reducing risks associated with volatile exchange rates. Whether you need direct crypto-to-token conversions, automated distributions, or simplified onboarding without intermediaries, NOWPayments serves as a critical tool for any successful TGE.

During a TGE, projects aim to raise funds for project development, leveraging blockchain technology to decentralize financing and enhance liquidity. Investors must conduct due diligence and engage in thorough research to navigate potential market volatility and mitigate risks of financial losses. Once tokens are generated, they become tradable on crypto exchanges, offering investment opportunities in digital assets. Furthermore, some projects utilize airdrops to distribute tokens to token holders, incentivizing community growth and participation in governance tokens that allow users to influence project decisions.

For projects looking to streamline their launch and optimize their funding process, NOWPayments provides an accessible, efficient, and innovative payment gateway solution that aligns perfectly with the needs of token issuers and their communities.

Conclusion

A Token Generation Event (TGE) plays a crucial role in the lifecycle of blockchain projects, enabling the distribution and adoption of digital assets. By understanding the different types of tokens—platform, security, transaction, utility, NFTs, and governance tokens—investors and developers can navigate the crypto landscape more effectively. While ICOs and TGEs are commonly used for token launches, they differ from IPOs in terms of regulation and ownership structure.

For projects looking to maximize the success of their TGE, NOWPayments offers seamless crypto payment solutions that can facilitate token adoption and utility. With its ability to integrate crypto payments for various use cases, NOWPayments enables projects to accept their native tokens across multiple platforms, creating real-world demand. Additionally, its mass payouts feature can be leveraged for distributing airdrops, staking rewards, or incentives, ensuring smooth and automated transactions.

Successfully launching a TGE requires a well-defined product, a comprehensive whitepaper, an active community, and exchange listings to ensure liquidity. NOWPayments further supports projects by providing automated crypto payment solutions, easy integration, and broad token acceptance, helping blockchain initiatives expand their reach and drive real-world adoption. As blockchain technology evolves, TGEs will remain a vital mechanism for funding innovation, and platforms like NOWPayments will continue to play a key role in supporting tokenized ecosystems.