PayPal is a well-known and trustworthy means to transmit money all over the world, as well as a popular option for online shopping. It is a reliable option for both consumers and businesses since it offers several benefits, including the ability to take digital wallets and debit/credit card payments. PayPal is popular among online shoppers because it is both secure and simple to use. It is a vital tool for many businesses since it allows them to accept payments from almost anywhere.

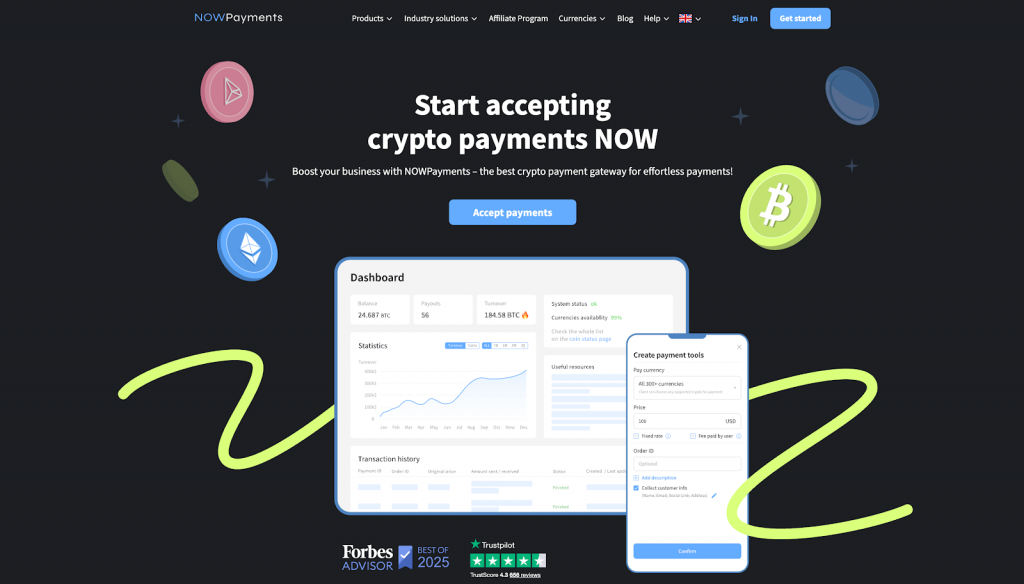

The best PayPal alternative in our ranking is NOWPayments, which provides businesses with an innovative way to accept cryptocurrency payments. By taking digital currencies, NOWPayments may be able to sidestep PayPal’s traditional limitations and reach clients all around the world at reduced prices. PayPal is popular since it is secure for buyers and simple to use. NOWPayments distinguishes itself from its competitors by providing an additional payment option that enables businesses to thrive in the ever-changing bitcoin ecosystem. NOWPayments is becoming a more open and modern option than PayPal as rates rise and more people consider freezing their accounts.

Choosing the right payment processor in 2026 will be critical. Because of their rising costs and declining capabilities, many businesses are looking for cheaper and more reliable alternatives to PayPal and other comparable systems. Web3 and cryptocurrency have transformed the way contracts are made. Companies may now receive payments faster, cheaper, and from anywhere in the globe. Global enterprises must develop a new payment option that integrates with PayPal and allows consumers to send money to other countries.

Here is our curated list of the best PayPal alternatives for 2026:

- NOWPayments

- Skrill

- Tipalti

- Payoneer

- Square

- Stripe

What We Considered When Choosing the Best PayPal Alternative: Our Selection Criteria

To provide you with an unbiased assessment of the best PayPal alternatives, we focused on the most important needs of businesses trying to ditch traditional payment processors like PayPal. This research will mainly center on platforms that offer economical and flexible new payment methods that can fulfill the expectations of both small and large firms in 2026.

The following were the top three considerations during our review:

- Supported Assets: Paying close attention to supported assets enables companies interested in the growing cryptocurrency sector to trade worldwide outside of conventional financial institutions.

- Integration Tools: When businesses employ integration solutions to integrate the service into their processes, online transactions are seamless.

- Transaction Fees: Sellers and business owners looking for a low-cost alternative to PayPal must have transparent and competitive transaction fees since they affect profitability and help keep expenditures down.

The following table summarizes the performance of each gateway in these three important criteria before we move deeper into each payment provider.

| Payment Gateway | Supported Assets | Transaction Fees | Integration Tools |

| NOWPayments | 350+ cryptocurrencies, 40+ fiat options via conversion | ~0.5% service fee (single currency) / up to 1% with exchange. 0% network fees for new partners on USDT TRC20 deposits for the first 2 months | API, Payment Widget, Payment Button, POS |

| Skrill | Multi‑currency wallet with ~40+ currencies; card and bank funding | Variable fees; free Skrill‑to‑Skrill, FX fees up to ~3.99% | Standard merchant tools + wallet integration (varies by partner) |

| Tipalti | Multiple fiat currencies via global payout network | Custom enterprise‑level fees (varies by plan) | Mass payouts API & accounting integrations |

| Payoneer | Multi‑currency accounts + local receiving accounts in 150+ currencies | No setup fees; receiving card payments 0–~3.99% (varies) | Marketplace platform integration + payout tools |

| Square | Card payments (credit/debit) + digital wallets via partner processors | Approx. 2.6% + $0.10 per card transaction (U.S. example) | APIs + POS/online tools for web/in‑store commerce |

| Stripe | Cards, wallets, local pay methods, bank debits, many regional assets | Standard ~2.9% + $0.30 per card payment (varies by region) | Extensive developer APIs, SDKs + plugins for major platforms |

NOWPayments

NOWPayments is the best cryptocurrency payment gateway for the companies that can accept over 350 different cryptocurrencies and have fast fiat settlement options, making it a direct rival to PayPal. Companies may broaden their acceptance of cryptocurrencies by quickly trading them for stablecoins such as USDT and USDC. Risks of instability and related issues are reduced. For online retailers, NOWPayments is the best option because to its straightforward price structure and low fees. The robust capabilities of NOWPayments, including API interfaces and mass payments, make it an ideal choice for businesses that want to provide their customers more payment options and flexibility.

Supported Assets. Since NOWPayments is compatible with more than 350 different cryptocurrencies, businesses may take a wide range of digital currencies through it. You may set up automated conversions to stablecoins like USDT and USDC on the website. Businesses may potentially sidestep the risk associated with bitcoin transactions by using this route. Any individual, organization, or web-based business looking to take a larger range of digital currencies would benefit greatly from these features. Businesses may reach clients worldwide with NOWPayments since it is compatible with several cryptocurrency assets. This is especially helpful in places where traditional payment methods may be more difficult to deploy.

- Number of Currencies: 350+

- Stablecoins: ✅ 30+, including USDT and USDC

- Digital Wallets: ✅ Apple Pay, Google Pay

Transaction Fees. Open and competitive, the fees at NOWPayments begin at a low 0.5%. This is a huge discount compared to PayPal’s 2.9% + $0.30 monthly charge. As a special offer, new partners can make USDT or TRC20 deposits for the first two months without paying network fees. Businesses have an easier time keeping tabs on their payment processing costs when there are no surprises when it comes to pricing. Organizations pay a small charge of 1% when they change their cryptocurrency to a stablecoin. Because of this, the service becomes even more appealing as an affordable alternative to PayPal.

| Fee Type | Amount | Note |

| Processing Fee | 0.5% | For crypto payments |

| Network Fee | $0 | Zero for USDT TRC20 deposits for the first 2 months (new partners) |

| Conversion Fee | 1% | When converting crypto to fiat or stablecoins |

Integration Tools. Quick and massive money transfers, customisable apps, and payment buttons are just a few of the advantages that NOWPayments offers to businesses. These features may be easily integrated into e-commerce platforms, allowing customers to pay instantly using their preferred digital payment methods. Platforms that allow users to set up recurring payments are perfect for businesses that rely on subscriptions. All sizes of organizations may benefit from NOWPayments’ online payment processing and enhance their client experience.

| Integration Tools | Available |

| Payment Button | ✅ |

| Payment Widget | ✅ |

| API | ✅ |

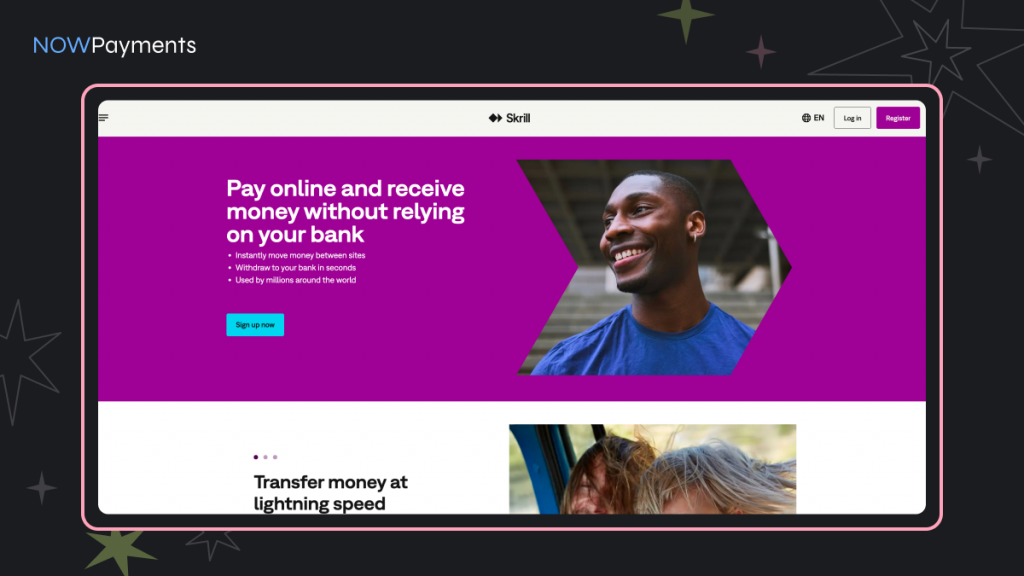

Skrill

Skrill is a widely recognized payment processor that has support for more than 40 different currencies. We accept a broad range of payment options, including all the main debit and credit cards, as well as electronic wallets and bank transfers. In comparison to PayPal, Skrill is more affordable for businesses and freelancers that deal with clients from other countries. Skrill’s compatibility with Bitcoin and its user-friendliness set it apart from competing online payment systems.

Supported Assets. Skrill accepts a wide variety of cryptocurrencies, including Ethereum and Bitcoin. Businesses may utilize this service to quickly convert cryptocurrency payments into fiat money, protecting themselves from the volatility of digital currencies. While its competitors provide a wider variety of currencies, Skrill is known for its user-friendliness and limited choices. Companies wishing to accept bitcoin payments will find this to be a viable choice. Skrill is a fantastic tool for businesses looking to expand their payment choices since it simplifies the integration of digital assets into their system.

- Number of Currencies: 40+

- Stablecoins: ❌

- Traditional Cards: ✅ Visa, Mastercard

- Digital Wallets: ✅ Apple Pay, Google Pay

Transaction Fees. There is a reasonable 1.9% processing fee that Skrill uses for payments made within the United States. Foreign currency transactions could incur fees of up to 3.99%. The platform’s free Skrill account transfers are a boon for businesses that work with Skrill. In comparison to rivals like PayPal, Skrill offers lower prices, even when accounting for the costs of currency conversion. Businesses that process foreign wire transfers will find this to be of paramount importance. Companies have a decent notion of the cost because all fees are clear and there are no surprises.

| Fee Type | Amount | Note |

| Processing Fee | 1.9% | Domestic transfers |

| Currency Conversion Fee | 3.99% | For international transactions |

Integration Tools. Skrill assists businesses in several ways, including providing secure payment linkages, safeguarding against fraud, and managing invoicing. Using payment links, companies do not need a complicated e-commerce platform or website to take payments. Businesses that offer membership or group services might considerably benefit from invoicing that is set up to repeat. Skrill also provides a scam detection technology to help companies even more in preventing fraudulent transactions. Online purchases may be made safely by both consumers and businesses thanks to this.

| Integration Tools | Available |

| Payment Links | ✅ |

| Recurring Billing | ✅ |

| API | ✅ |

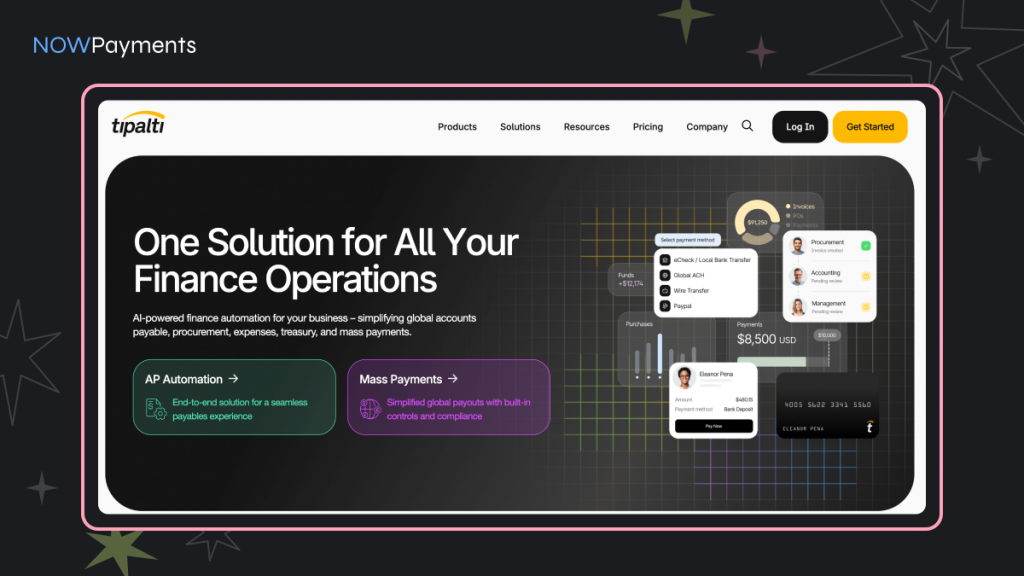

Tipalti

Tipalti is a payment automation platform designed for businesses that need to manage large-scale supplier and partner networks. Tipalti simplifies international money transfers while also guaranteeing compliance with foreign tax requirements, setting it apart from other payment processors. This approach would be perfect for online shops, SaaS providers, and any other business that interacts with different types of money often. Tipalti is a leader in the payments sector with its powerful tax compliance tools and generous rewards.

Supported Assets. Direct cryptocurrency payments are not supported by Tipalti. It is fully compatible with all major payment methods, including bank transfers, e-wallets, and credit cards. Tipalti is easy to link with other systems, so businesses may accept both fiat and cryptocurrency payments. The fact that Tipalti can handle cross-border transactions and supports many currencies makes it an attractive option for businesses with a worldwide presence.

- Number of Currencies: Multiple fiat currencies

- Stablecoins: ❌

- Traditional Cards: ✅ Visa, Mastercard

- Digital Wallets: ✅ PayPal, others

Transaction Fees. Tipalti offers tailored pricing to meet the specific requirements of businesses of all sizes. Businesses are able to plan ahead thanks to the straightforward pricing structure, which includes enterprise-level prices that vary with the selected services. Despite the lack of pricing transparency compared to PayPal or Stripe, Tipalti is a great choice for large organizations looking for a payment processor because of its versatility. By emphasizing compliance, Tipalti also helps firms avoid expensive fines and delays that come with overseas payments.

| Fee Type | Amount | Note |

| Processing Fee | Custom | Based on plan |

| Setup Fee | Custom | Based on plan |

| International Fee | Varies | Depending on location |

Integration Tools. Automating complicated business payment procedures including big settlements, accounting connections, and tax compliance is possible with the Tipalti platform. The group payout function of Tipalti simplifies bill payment for businesses that have several partners. In addition, the software helps businesses avoid penalties for tax evasion by keeping them on track with all the rules and laws. To help companies and their vendors pay each other, Tipalti has an automated billing solution.

| Integration Tools | Available |

| Mass Payouts | ✅ |

| Compliance Tools | ✅ |

| API | ✅ |

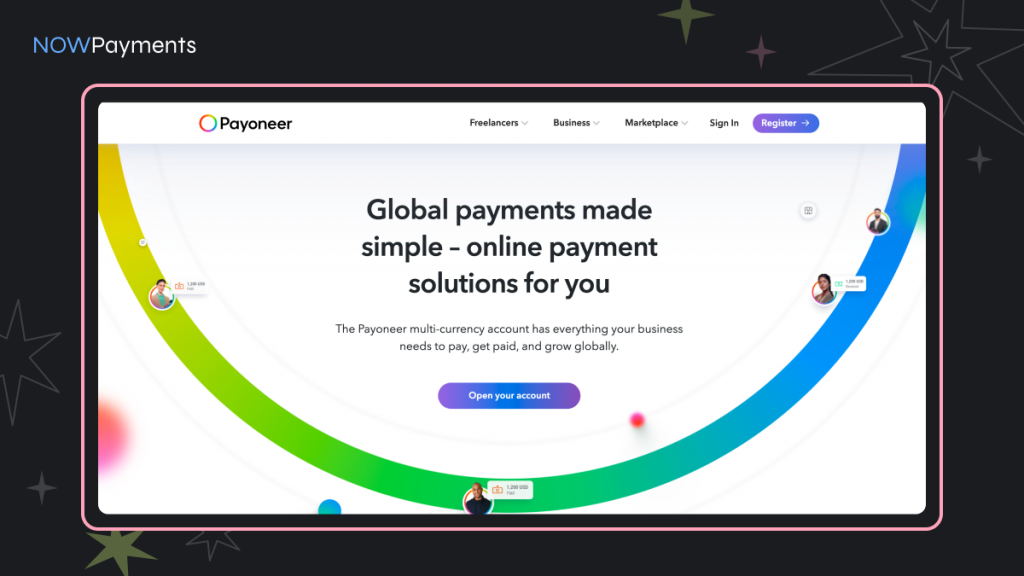

Payoneer

Payoneer is a global payment processor that allows businesses to send and receive over 150 different currencies. Businesses and freelancers operating online, especially those accepting payments from customers outside the nation, will find this function quite useful. Electronic wallets, bank transfers, and major credit cards are just a few of the many accepted payment options with Payoneer. Gain an advantage over rivals in the market by streamlining your cross-border financial management and increasing your company’s global footprint.

Supported Assets. Payoneer accepts only electronic wallets, bank transfers, and credit cards. We do not take cryptocurrency as payment. Businesses may make overseas purchases in their native currency without incurring the price of currency conversion thanks to its multi-currency accounts. Businesses may accept bitcoin payments using a variety of platforms, Payoneer being only one of them. Payoneer is a great alternative for businesses that need to take payments in foreign currency, even if it does not officially support cryptocurrencies.

- Number of Currencies: 150+

- Stablecoins: ❌

- Traditional Cards: ✅ Visa, Mastercard

- Digital Wallets: ✅ PayPal, others

Transaction Fees. The costs charged by Payoneer vary according on the kind of transaction. Prices might vary from zero percent to three and a half percent. Companies may quickly review the platform’s pricing before committing to a payment. With Payoneer’s cheap conversion rates for international transfers, the total cost of sending money across borders is minimized. Payoneer is great for any kind of business since there are no initial expenses.

| Fee Type | Amount | Note |

| Processing Fee | 1%–3.99% | Depending on transfer type |

| Currency Conversion Fee | Varies | Based on market rate |

Integration Tools. Some of the business-friendly features offered by Payoneer include accounts with several currencies, interaction with marketplaces, and automatic billing. Businesses on Shopify and Amazon may take payments more easily with its prepaid MasterCard and marketplace features. The recurring billing feature of Payoneer makes it easy to send money to anybody, anywhere in the world, and is especially helpful for subscription-based businesses. The low fees that Payoneer charges for international transactions make it a viable option for businesses operating in other nations.

| Integration Tools | Available |

| Recurring Billing | ✅ |

| API | ✅ |

Square

Square is an excellent choice for any business because it is a widely used payment processor that works for both online and offline transactions. You may pay large stores, mom-and-pop stores, and independent contractors quickly and easily with this method. Square can handle all of your electronic payment, point-of-sale (POS), and automated billing needs. A viable alternative to PayPal for companies seeking to streamline their payment processes, it offers fair pricing and does not charge a monthly fee for basic use.

Supported Assets. Given that Square is a Bitcoin payment processor, businesses may simply take Bitcoin and then convert it to cash. Unlike some other sites, Square is not Bitcoin-centric, even if it takes Bitcoin as payment. Businesses can better anticipate price fluctuations and streamline payment processing with the option to quickly convert Bitcoin to cash. Customers are already interested, and Square makes it much easier for them to invest in Bitcoin.

- Number of Currencies: 30+

- Stablecoins: ❌

- Traditional Cards: ✅ Visa, Mastercard

- Digital Wallets: ✅ Apple Pay, Google Pay

Transaction Fees. Square charges a flat rate of 2.6% plus $0.10 for all credit card transactions. It is a budget-friendly option for small enterprises and freelancers because of the absence of setup and continuing charges for basic services. Businesses can easily monitor their payment handling costs with Square since there are no hidden fees. Businesses with a significant sales volume may also be eligible for decreased rates.

| Fee Type | Amount | Note |

| Processing Fee | 2.6% + $0.10 | Per card transaction (U.S. example) |

Integration Tools. Invoices, point-of-sale systems, and automated invoicing are just a few of the numerous business solutions offered by Square. Because it can handle sales in both brick-and-mortar stores and online, the point-of-sale (POS) system is perfect for companies that do business in more than one way. Since Square is interoperable with a wide variety of e-commerce platforms, it may help businesses sell more things online. Square improves consumer satisfaction by facilitating gift card and customer incentive program integration.

| Integration Tools | Available |

| POS System | ✅ |

| Recurring Billing | ✅ |

| API | ✅ |

Stripe

Stripe is one of the leading payment processors, providing a comprehensive online payment platform that allows businesses to accept a variety of payment methods globally. A strong rival to PayPal, it caters to businesses of all sizes with its flexible options. Stripe is a great option for entrepreneurs that are tech-savvy because of its developer-friendly tools and large API, which makes it easy to integrate with websites and mobile apps. Instead of using PayPal, you may use Stripe, which takes a lot of other payment methods like bank transfers, major credit cards, and electronic wallets. This makes it suitable for use by companies and people all across the globe.

Supported Assets. While Stripe did formerly directly take Bitcoin payments, it has now removed that feature. However, because of its easy integration with other platforms, companies may accept bitcoin payments using Stripe. Even though Stripe’s main focus is on processing card and bank transfers, the interfaces allow businesses to experiment with digital currencies without switching payment providers. Because of its adaptability, Stripe can handle a broad range of payment options. There is a wide variety of options available to businesses that want to accept payments online.

- Number of Currencies: 135+

- Stablecoins: ❌

- Traditional Cards: ✅ Visa, Mastercard, American Express

- Digital Wallets: ✅ Apple Pay, Google Pay

- Bank Transfer: ✅ ACH, SEPA

Transaction Fees. Unfortunately, Stripe is no longer able to directly take Bitcoin payments. However, businesses may accept bitcoin as payment because Stripe is easily integrated with other systems. Payment processing for banks and credit cards is Stripe’s bread and butter. But using APIs, companies may test out digital currencies without completely overhauling their payment systems. Stripe is incredibly flexible and can process a wide variety of payment methods. Businesses can take a few different approaches to accepting payments online.

| Fee Type | Amount | Note |

| Processing Fee | 2.9% + $0.30 | Per card transaction |

| International Fee | 1% | For international payments |

| Currency Conversion Fee | 2% | For currency exchange |

Integration Tools. Many more capabilities are available in Stripe that are helpful for companies, such as the ability to manage contracts and receive payments instantaneously. An API makes it easier for businesses to set up a payment system the way they want it, especially as the system grows stronger. Machine learning further reduces the likelihood of fraudulent charges or theft of your card using Stripe’s phony security measures. With the platform’s automated billing solution, businesses can effortlessly manage their billing tasks and ensure timely payments.

| Integration Tools | Available |

| Recurring Billing | ✅ |

| Invoicing | ✅ |

| API | ✅ |

Conclusion

Several alternatives to PayPal were considered, and we settled on the best of them. Among these, you may find NOWPayments, Square, Payoneer, Payoneer, and Skrill. There is some variation among these payment processors, but they all provide a way for enterprises to manage their online transactions. This is why it is critical for startups and SMBs looking to expand internationally to choose a payment gateway that offers cheap rates, fast processing, and support for several currencies. Popular payment processors like PayPal are losing users. The requirement for credit cards and other forms of everyday payment, as well as the growth of alternative payment methods, is evidence of this.

In 2026, NOWPayments stands out among these PayPal choices. Businesses looking to send and receive digital currency cash will find it to be an excellent option due to its 0.5% charge and compatibility with over 350 coins. Businesses can stay safe from cryptocurrency dangers with NOWPayments’ rapid fiat refunds and stablecoin transfers. Because of this, NOWPayments is a safer and more cost-effective option for processing payments. With NOWPayments, you can be certain that your payments will continue to function and evolve with the demands of the digital market. This is for businesses and individuals who would rather not deal with the hassles of traditional banking. If you own a progressive business looking for an easy and affordable payment solution, NOWPayments is your best bet. It supports a wide variety of cryptocurrencies, and its pricing is straightforward.