The UAE has witnessed significant growth in its digital economy, driven by government strategies aimed at enhancing online business capabilities. A crucial aspect of this growth is the rise of various payment gateways in the UAE, which offer multiple payment methods to cater to the diverse needs of customers in the UAE. Popular payment solutions, such as Amazon Payment Services and Apple Pay, are gaining traction, enabling secure transactions in the rapidly expanding online shopping landscape. Businesses can now leverage the best payment gateway options to streamline their payment process, ensuring a reliable and secure payment experience for their customers.

For online stores looking to optimize their payment page, integrating a well-known payment gateway like Shopify Payment can enhance user experience. The payment gateway providers available in the UAE offer a wide range of payment options, facilitating both local and international payment transactions. With the increasing importance of payment card industry data security, choosing the right payment gateway solution is essential for ensuring secure online payment. As the digital landscape evolves, businesses in the UAE must adapt by selecting payment gateways that not only meet their needs but also enhance the overall customer payment experience.

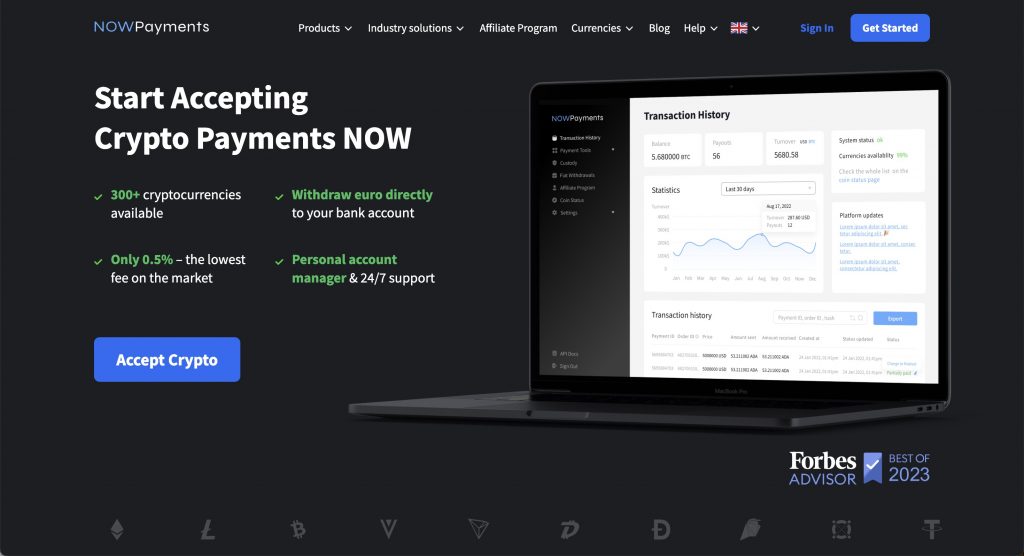

NOWPayments as the best payment gateway in UAE

In the rapidly evolving digital landscape of the United Arab Emirates, NOWPayments stands out as the best online payment gateway for businesses looking to accept online payments seamlessly. Tailored to the needs of Arab businesses, especially in Dubai, this reliable payment gateway offers a comprehensive online payment solution that supports many payment methods. Companies in the UAE can benefit from its innovative payment features, allowing them to manage online transactions efficiently.

With the rise of e-commerce platforms like Shopify, NOWPayments has become a popular payment gateway solution among businesses looking to expand their reach in the UAE and beyond. Customers can easily select a payment gateway that suits their needs, with various payment methods available. This payment provider ensures that businesses can effortlessly conduct payments online, making it one of the top payment gateways in the region, including Saudi Arabia.

By offering payment links and a streamlined payment form, NOWPayments facilitates online buying for customers, enhancing their shopping experience. Businesses no longer have to worry about the complexities of payment gateways available in the UAE; instead, they can focus on growth and customer satisfaction. Choosing NOWPayments means opting for a reliable payment partner, ensuring successful online payments in the UAE and fostering trust with clients across the payment gateways in the world.

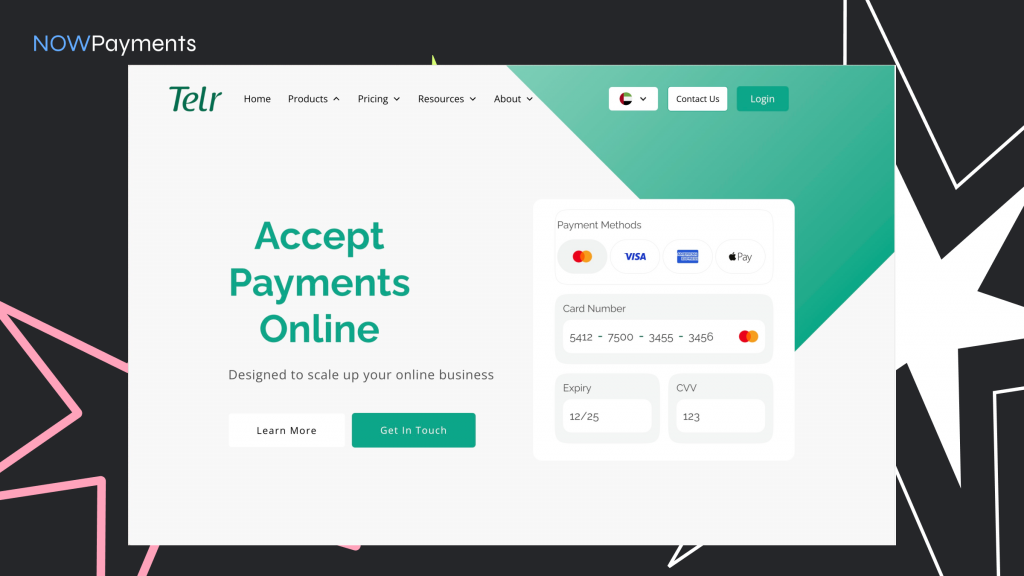

Telr payment gateway in UAE

In the UAE, Telr stands out as a payment gateway tailored to Arab businesses, providing a seamless easy payment process for both merchants and customers. This UAE based solution supports multiple payment options, making it easy for businesses to serve customers in the UAE with a variety of payment methods. When choosing a payment gateway, it’s crucial to consider how well it supports multiple payment processes, including direct payment and tap payment gateway features.

Telr offers payment flexibility with its scalable payment solutions designed for online and mobile applications. By setting up a payment gateway through Telr, businesses can benefit from three payment levels, ensuring they find the right fit for their needs. As a result, it has become a top choice for those looking for an effective payment gateway for your business, especially for handling payments for online transactions. In comparison, while Stripe is a popular payment option, Telr’s ability to cater specifically to the region makes it a compelling choice for local enterprises.

CashU payment gateway in UAE

In the ever-evolving landscape of online transactions, businesses in the UAE often look for gateways that can streamline their payment processes. One such solution is the CashU payment gateway, which offers a universal payment platform tailored to meet the diverse needs of merchants and consumers alike.

The effectiveness of a payment gateway depends on its ability to provide secure, fast, and user-friendly transactions. CashU excels in this regard, making it a top choice for both e-commerce platforms and micro-businesses.

By integrating with various payment methods and currencies, CashU makes the payment process seamless and efficient, ensuring that users can complete their transactions without unnecessary delays or complications.

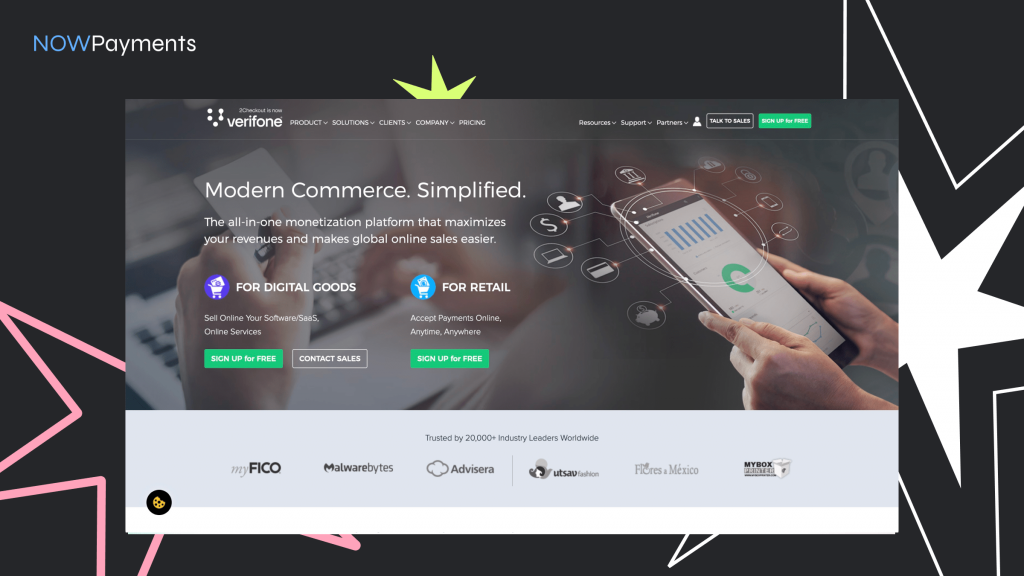

2Checkout payment gateway in UAE

2Checkout, now known as Verifone, is a popular payment gateway solution in the UAE, catering to the needs of businesses aiming for a global reach. With its comprehensive suite of services, it enables merchants to accept online payments in multiple currencies, making it an ideal choice for the diverse market in the region.

This platform supports various payment methods, including credit cards, debit cards, and local payment options, ensuring a seamless transaction experience for customers. Additionally, 2Checkout’s robust fraud protection features help safeguard both merchants and consumers, enhancing trust in online transactions.

Moreover, the integration process is user-friendly, allowing businesses to set up their payment systems quickly and efficiently. With a focus on customer service, 2Checkout offers extensive support to help merchants navigate through any challenges they may encounter.

Ultimately, 2Checkout stands out as a reliable payment gateway in the UAE, empowering businesses to thrive in a competitive digital landscape.

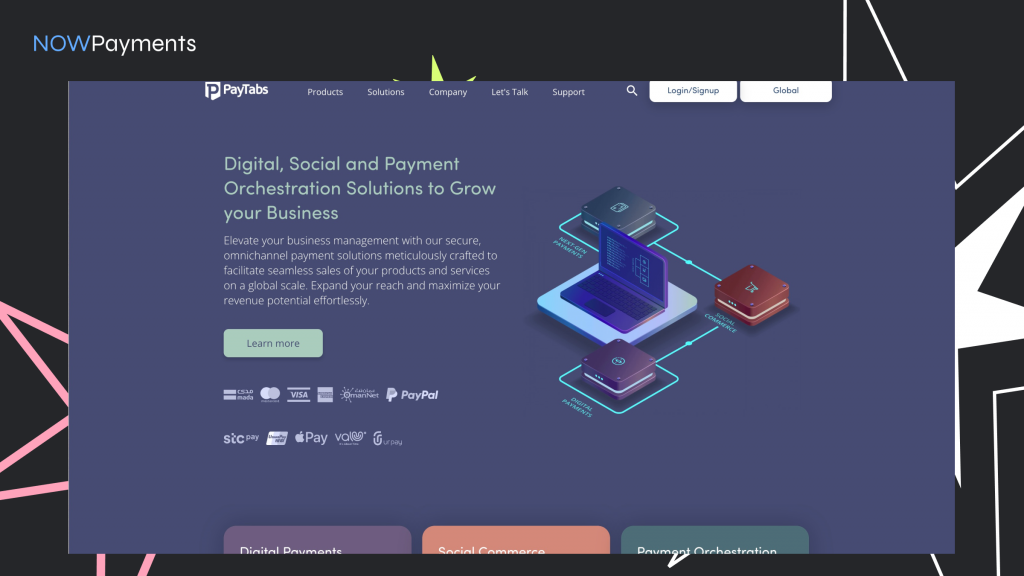

PayTabs payment gateway in UAE

PayTabs is a leading payment gateway in the UAE, designed to facilitate seamless online transactions for businesses of all sizes. With its user-friendly interface and robust features, it allows merchants to accept a variety of payment methods, including credit cards, debit cards, and local payment options, ensuring that customers have a convenient shopping experience.

One of the standout features of PayTabs is its commitment to security. The platform employs advanced encryption protocols and complies with international standards, providing peace of mind to both merchants and their customers. Additionally, it offers tools for fraud prevention, helping businesses protect themselves from potential threats.

Moreover, PayTabs supports multiple currencies, making it an ideal choice for businesses looking to expand their reach in the international market. With excellent customer support and integration capabilities, it empowers businesses to grow and thrive in the competitive UAE e-commerce landscape.

Conclusion why NOWPayments is the best payment gateway in UAE

When considering the best payment gateway in the UAE, NOWPayments stands out for several compelling reasons. Firstly, it offers a wide array of cryptocurrency options, allowing businesses to cater to a diverse clientele. This flexibility is crucial in a rapidly evolving financial landscape where customers increasingly demand alternative payment methods.

Moreover, NOWPayments is renowned for its user-friendly interface and seamless integration capabilities. Businesses can easily incorporate this gateway into their existing systems without extensive technical knowledge, thus saving time and resources. This efficiency is a significant advantage for companies looking to enhance their payment processing.

Additionally, NOWPayments prioritizes security, employing robust measures to protect transactions and customer data. This commitment to safety builds trust with users, ensuring a reliable payment experience. In conclusion, the combination of versatility, ease of use, and strong security features makes NOWPayments the premier choice for businesses in the UAE seeking a dependable payment gateway.