A payment gateway is a technology that enables businesses to accept online payments by securely processing transactions between the customer and the merchant. This essential component of e-commerce facilitates smooth payment processing, whether via debit cards, digital wallets, or alternative payment methods.

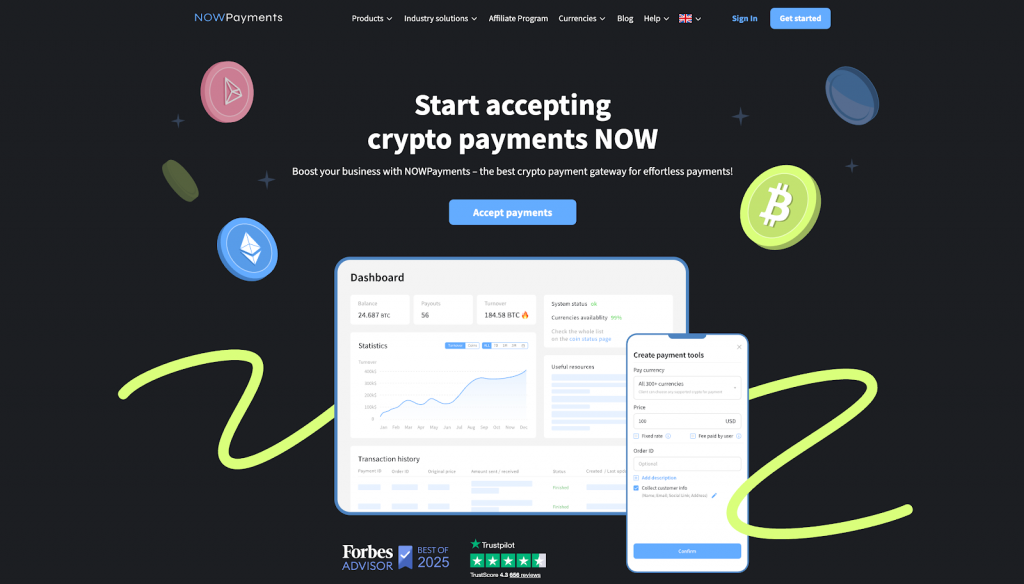

The best payment gateway for Sweden in our rating is NOWPayments because it offers seamless integration with multiple payment options, including cryptocurrencies and traditional payment methods. With Sweden’s growing interest in digital currencies, NOWPayments provides a reliable payment solution that supports a range of payment methods, making it ideal for businesses looking to accept payments online in 2026.

In 2026, choosing the right payment gateway is crucial for businesses in Sweden to stay competitive. The right payment solution can ensure a secure payment processing experience, reduce transaction fees, and improve the checkout experience for customers. Given the rise of mobile payments, digital wallets like Apple Pay and Google Pay, and the growing use of global payment methods, businesses must offer a variety of payment types to accommodate customers’ payment preferences. Whether it’s for an online store, e-commerce business, or even small business, selecting the best payment gateway that fits the needs of both the business and its customers is more important than ever.

Here’s a list of payment gateways for Sweden:

- NOWPayments

- Swish

- Adyen

- Fortnox

- Trustly

What We Considered When Choosing the Best Payment Gateway: Our Selection Criteria

Our goal in creating an unbiased comparison is to provide businesses in Sweden with a clear and objective overview of the key features that matter most in choosing a payment gateway. We focused on the aspects that are critical for optimizing payment processing and ensuring a seamless experience for both businesses and customers.

Here are the three most relevant criteria we considered when selecting the best payment gateways for Sweden:

- Supported Payment Methods: Essential for ensuring the gateway can accommodate a wide range of customer preferences, from credit/debit cards to mobile payments and digital wallets.

- Integration & Developer Experience: Critical for businesses to deploy the solution quickly and with minimal technical overhead, ensuring a smooth setup and ongoing maintenance.

- Transaction Speed: Directly impacts customer satisfaction, as faster payment processing leads to quicker transactions and enhanced checkout experience.

The comparative table below summarizes how each gateway performs in these three decisive categories, which we will explore in detail for each provider.

| Payment Gateway | Supported Payment Methods | Integration Tools | Transaction Speed |

| NOWPayments | 350+ Cryptos, 40+ Fiat | API, WooCommerce, Payment Links, POS | 45 seconds – 3 minutes for Crypto, 1-3 days for Fiat |

| Swish | Mobile Payments (Bank Account) | API, Bank Integration | Instant (within Sweden) |

| Adyen | Visa, Mastercard, Apple Pay, Google Pay, PayPal | API, E-commerce Plugins, POS | 1-3 days for global payments |

| Fortnox | Bank Transfers, Credit Cards | API, WooCommerce, Shopify, POS | 1-3 days for bank payments |

| Trustly | Bank Transfers, Debit/Credit Cards | API, E-commerce Plugins | 1-2 days for bank transfers |

NOWPayments

NOWPayments is the best crypto payment gateway that allows businesses in Sweden to accept over 350 cryptocurrencies alongside 40+ fiat payment options. As a payment solution, it offers flexible payment methods, enabling online businesses to cater to customers worldwide, including the rapidly growing digital currency market. With a competitive fee structure, NOWPayments is an ideal choice for businesses looking to reduce transaction fees while offering secure payment processing. The platform’s support for both digital wallets like PayPal and Apple Pay and traditional payment methods like debit and credit cards makes it one of the most versatile payment gateways available in 2026.

Supported Payment Methods. NOWPayments offers a range of payment methods to accommodate the diverse preferences of customers in Sweden and globally. It supports over 350 cryptocurrencies, including popular payment methods like Bitcoin, Ethereum, and Litecoin, alongside 40+ fiat currencies such as USD, EUR, and SEK. This variety of payment options ensures businesses can accept payments from both crypto-savvy customers and those who prefer traditional payment methods like debit cards and bank transfers. By supporting multiple payment methods, NOWPayments enables businesses to offer a seamless payment experience for a global customer base.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

Integration Tools. NOWPayments provides easy-to-integrate tools that simplify the process of accepting cryptocurrency and fiat payments. Its REST API enables quick integration with existing payment systems, while the platform also supports e-commerce plugins for popular platforms like WooCommerce, making it ideal for online stores. Additionally, businesses can generate instant payment links, providing an additional, simple option for processing transactions without the need for complex setup. The platform’s robust integration capabilities make it a top choice for businesses looking for a reliable payment processor to integrate with their e-commerce business.

| Tool / Integration | Available |

| API | ✅ |

| E-commerce Plugins | ✅ |

| Payment Links | ✅ |

Transaction Speed. NOWPayments ensures fast and secure payment processing, offering instant cryptocurrency transactions and quick settlement for fiat payments. The platform’s crypto transactions are confirmed almost instantly, allowing businesses to quickly process payments, reduce transaction delays, and enhance the checkout experience for customers. For fiat transactions, the processing time can vary, typically ranging from 1 to 3 days, but remains relatively fast compared to other payment gateways. By minimizing payment delays, NOWPayments helps businesses maintain a seamless and efficient payment system for both online and in-store transactions.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant (Crypto) |

| Settlement to Account | 1-3 days (Fiat) |

| Instant Payout | ❌ |

Swish

Swish is a popular mobile payment gateway in Sweden, offering businesses a secure and fast payment solution for both online and offline transactions. It allows customers to send money directly from their bank accounts using a mobile app, making it an extremely convenient and widely accepted payment method in Sweden. With its deep integration with Swedish banks, Swish enables real-time payment processing and seamless customer experiences. As one of the best payment gateways in Sweden, Swish is an excellent choice for businesses that want to offer local customers a trusted and fast payment option.

Supported Payment Methods. Swish primarily supports mobile payments directly linked to Swedish bank accounts, making it a local and efficient payment option for businesses in Sweden. It is widely used for both peer-to-peer transactions and by businesses accepting payments for goods and services. Swish does not currently support international payment methods like PayPal or credit card payments, which limits its use for businesses with a global reach. However, its deep integration with the Swedish banking system makes it a highly trusted and popular choice among Swedish customers for local payments.

| Payment Method | Accept | Withdraw |

| Mobile Payments | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

| Credit/Debit Cards | ❌ | ❌ |

Integration Tools. Swish provides easy-to-use integration tools for businesses, including a dedicated API that enables fast setup. The API is simple to implement for businesses in Sweden, particularly for those looking to add mobile payment options to their e-commerce stores. Swish is also compatible with POS systems for businesses that wish to accept payments in-store. The platform ensures a smooth integration process, with minimal technical overhead required to start accepting payments from Swedish customers.

| Tool / Integration | Available |

| API | ✅ |

| E-commerce Plugins | ✅ |

| POS System | ✅ |

Transaction Speed. Swish offers instant payment processing, with funds transferred immediately between bank accounts. This fast transaction speed makes Swish particularly suitable for businesses that need real-time payments for goods and services. It is also a great solution for businesses looking to offer quick, hassle-free checkout experiences, enhancing the customer payment experience. Because of its instant nature, Swish stands out among other payment gateways in Sweden.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant (within Sweden) |

| Settlement to Account | Instant |

| Instant Payout | ✅ |

Adyen

Adyen is a global payment gateway that offers businesses an all-in-one solution for online and offline payments. With support for over 150 currencies and popular payment methods like Apple Pay, Google Pay, and PayPal, Adyen is designed to cater to international businesses. Its robust fraud detection tools and unified payment platform make it one of the best payment gateways for businesses looking to scale their operations. Adyen stands out for offering flexible payment options and reliable transaction processing for businesses with a global customer base.

Supported Payment Methods. Adyen supports a wide range of payment methods, including credit cards, debit cards, digital wallets like Apple Pay and Google Pay, and local payment options. With the ability to process payments in over 150 currencies, Adyen makes it easier for businesses to expand internationally while maintaining a seamless payment experience. By offering multiple payment methods, Adyen allows businesses to meet the preferences of customers in various regions. This flexibility ensures that Adyen is one of the most comprehensive payment solutions for businesses operating both locally and globally.

| Payment Method | Accept | Withdraw |

| Credit/Debit Cards | ✅ | ✅ |

| Digital Wallets | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Integration Tools. Adyen provides an intuitive API that businesses can integrate with their websites, POS systems, and mobile apps. The platform also offers e-commerce plugins for popular platforms like Shopify, WooCommerce, and Magento, making it easy for businesses to add payment options to their online stores. Adyen’s tools include advanced fraud detection features, which are essential for businesses that process large volumes of transactions. The wide range of integration options and developer-friendly tools make Adyen an excellent choice for businesses looking for a flexible and secure payment gateway.

| Tool / Integration | Available |

| API | ✅ |

| E-commerce Plugins | ✅ |

| Fraud Detection | ✅ |

Transaction Speed. Adyen ensures fast payment processing with transactions typically confirmed within 1 to 3 days for international credit card payments. The platform’s local payment options have even quicker processing times, ensuring a smooth transaction experience for customers. Adyen’s ability to handle multiple currencies efficiently allows businesses to accept payments from a global audience while ensuring a quick and secure transaction experience. With this platform, businesses can provide a faster checkout process for their customers, improving the overall payment experience.

| Speed Metric | Timeframe |

| Payment Confirmation | 1-3 days (global) |

| Settlement to Account | 1-3 days |

| Instant Payout | ❌ |

Fortnox

Fortnox is a Swedish payment gateway that integrates payment processing with accounting and invoicing tools. It is particularly suited for small businesses in Sweden looking for a unified payment and financial solution. Fortnox is known for offering secure and reliable payment processing along with tools for easy reconciliation and financial reporting. With its easy integration with e-commerce platforms and POS systems, Fortnox is ideal for businesses looking for an affordable payment option that integrates well with their existing financial workflows.

Supported Payment Methods. Fortnox supports a range of payment methods including credit card payments, debit cards, and bank transfers. It integrates well with Swedish banking systems, enabling fast and efficient bank transfers. While it does not currently support digital wallet options like PayPal or Apple Pay, it provides businesses with the most commonly used local payment methods in Sweden. This makes Fortnox a great choice for businesses that primarily operate in Sweden and need reliable, cost-effective payment solutions.

| Payment Method | Accept | Withdraw |

| Bank Transfer | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

| Digital Wallets | ❌ | ❌ |

Integration Tools. Fortnox provides integration tools like a simple API that enables businesses to integrate payment processing directly into their existing systems. It also supports e-commerce plugins for platforms like Shopify and WooCommerce, which allows online businesses to start accepting payments with minimal setup. In addition to payment processing, Fortnox also integrates with accounting software, automating many financial tasks for businesses. This makes it an ideal choice for businesses looking for a comprehensive solution that manages both payments and financial operations.

| Tool / Integration | Available |

| API | ✅ |

| E-commerce Plugins | ✅ |

| Accounting Integration | ✅ |

Transaction Speed. Fortnox offers quick payment processing, with credit card payments typically processed within 1-3 days. Bank transfers usually take 1-2 days for settlement, making Fortnox a reliable choice for businesses that need fast payments. As an integrated payment system with financial management tools, Fortnox ensures that businesses can track transactions efficiently. This quick processing time ensures that businesses can maintain a smooth cash flow, particularly for smaller businesses.

| Speed Metric | Timeframe |

| Payment Confirmation | 1-3 days |

| Settlement to Account | 1-2 days |

| Instant Payout | ❌ |

Trustly

Trustly is a direct bank payment gateway that allows businesses to accept payments directly from their customers’ bank accounts. With a focus on security and speed, Trustly provides a seamless and cost-effective payment option for businesses in Sweden and across Europe. It is particularly popular for online banking payments, offering a simple alternative to credit cards and digital wallets. Trustly’s ability to process transactions quickly and securely makes it an attractive payment solution for businesses looking for efficient payment processing.

Supported Payment Methods. Trustly specializes in bank transfers, allowing customers to make payments directly from their bank accounts without the need for debit or credit cards. It supports payments from over 5,000 banks across Europe, making it a popular choice for online businesses that want to offer local payment options. Although it does not support digital wallets like PayPal or Apple Pay, Trustly’s secure bank transfer system ensures that transactions are both safe and fast. This makes it an excellent option for businesses that want to reduce reliance on traditional card payments.

| Payment Method | Accept | Withdraw |

| Bank Transfer | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

| Digital Wallets | ❌ | ❌ |

Transaction Speed. Trustly is known for its quick transaction speeds, with payments being processed almost instantly. For bank transfers, the settlement typically takes 1-2 days, ensuring that businesses can access funds without long delays. Trustly’s fast processing helps businesses maintain a smooth cash flow, especially for e-commerce businesses where timely payments are crucial. The platform’s ability to offer instant payments without sacrificing security makes it a reliable payment processor.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant (Europe) |

| Settlement to Account | 1-2 days |

| Instant Payout | ✅ |

Conclusion

In this article, we have reviewed the best payment gateways for businesses in Sweden, focusing on popular payment methods such as Swish, PayPal, and digital wallets like Apple Pay and Google Pay. As e-commerce continues to grow, businesses in Sweden are increasingly relying on payment processors that offer flexible payment options to cater to diverse customer preferences. With multiple payment types, including credit cards, debit cards, bank transfers, and mobile payment apps, businesses need a secure payment system that ensures a smooth checkout experience. NOWPayments, as one of the best payment methods for online payments, offers global payment solutions, allowing businesses to easily accept crypto payments along with traditional payment methods, all while keeping transaction fees low and processing fast.

NOWPayments is the optimal payment gateway for your businesses in Sweden, particularly those embracing cryptocurrency payments. With 350+ cryptocurrencies and 40+ fiat currencies, NOWPayments supports a wide range of payment methods, giving businesses multiple payment options to suit both local payment options and international payment options. Its easy integration with online stores and e-commerce businesses, combined with fraud detection and seamless payment processing, ensures a reliable payment solution that minimizes risks. For businesses looking to accept payments online and stay ahead in 2026, NOWPayments stands out as the preferred payment gateway in Sweden for forward-thinking businesses looking for secure, efficient, and cost-effective payment processing.