The importance of payment gateways cannot be overstated in the realm of e-commerce and online shopping. These payment systems facilitate online transactions by offering a range of payment options, including credit card processing, mobile payments, and even cryptocurrencies like bitcoin. A robust payment gateway, such as PayPal or MercadoLibre, allows businesses to integrate various payment solutions into their online stores, ensuring a seamless customer experience during checkout. With recurring billing and instant payment capabilities, these platforms automate the billing process, streamlining payment processing for both B2B and B2C transactions.

In regions like Latin America, where localized payment options are crucial, the demand for innovative payment solutions has surged. Businesses can leverage payment APIs to create a comprehensive payment platform that meets the needs of local customers while ensuring secure payment processing. By offering tailored payment experiences, companies can enhance customer satisfaction and drive sales. As we approached 2026, the trend toward digital payments continues to evolve, making it essential for online businesses to adopt the top payment gateways that prioritize flexibility and security, thus enabling customers to pay online effortlessly.

Key Payment Methods in Brazil

In Brazil, the digital economy has seen a significant transformation with the rise of online payment methods, particularly via pix. This popular payment method in Brazil allows for seamless payment transactions, offering a flexible payment solution for both online and offline businesses. Merchants can accept payments from customers in local currency with minimal fees, enhancing the overall customer experience. The integration of payment processing solutions such as WooCommerce and POS systems has further revolutionized the way Brazilians handle their payment information.

Additionally, fintech companies have emerged to provide a range of services that support global payment options and local payment methods. With payment gateways that allow for seamless integration of payment APIs, businesses can now personalize their offerings to meet consumer demands. Digital wallets like PayPal and others have also contributed to the popularity of top 10 payment gateways in Brazil, ensuring that users can securely process payments while benefiting from technologies to protect their transactions.

1. Credit and Debit Cards

Credit and debit cards have become a popular choice for consumers in Brazil, as they allow users to make online purchases seamlessly. A payment processor utilizes a payment API to facilitate these transactions, ensuring quick and secure payments in various settings. Companies that offer financial services are now enhancing customer experience by integrating new payment options like digital wallets and contactless payments.

This shift not only caters to consumer preferences but also shapes the future of payments in the digital age. By providing a comprehensive suite of payment services, businesses can offer your customers multiple ways to settle their transactions, whether paid at banks or through online platforms.

2. Boleto Bancário

Boleto Bancário is a unique and popular payment method in Brazil, widely utilized by consumers for various transactions. This system offers a comprehensive solution for those who prefer not to use credit cards or online banking. By generating a boleto, users can pay at their convenience, whether at banks, ATMs, or through internet banking. Its flexibility allows consumers to make payments easily, making it a popular choice among both individuals and businesses alike. The accessibility and ease of use of Boleto Bancário have contributed significantly to its widespread adoption across the country.

3. Digital Wallets

Brazilian consumers are increasingly embracing digital wallets such as PayPal, Google Pay, and Mercado Pago. These platforms offer a convenient and secure way to make transactions, reflecting a significant shift in payment preferences. With the rise of e-commerce and mobile transactions, the adoption of digital wallets is expected to continue growing. Furthermore, the accessibility of these services has made them particularly appealing to the Brazilian population, fostering a cashless economy that aligns with global trends.

As more merchants accept digital wallet payments, users enjoy the benefits of quick transactions and enhanced security features. The Brazilian market is ripe for innovation, and the increasing popularity of these wallets signifies a transformation in how people manage their finances.

4. Bank Transfers

Instant bank transfers have revolutionized the way people conduct financial transactions, making them faster and more efficient. One of the most notable services facilitating these transfers is PIX, which allows users to send and receive money in real-time. With just a few taps on a smartphone, users can complete transactions without the delays associated with traditional banking methods. This technology not only enhances convenience but also promotes greater financial inclusion, enabling individuals and businesses alike to manage their finances seamlessly.

Best Cryptocurrency Payment Gateway

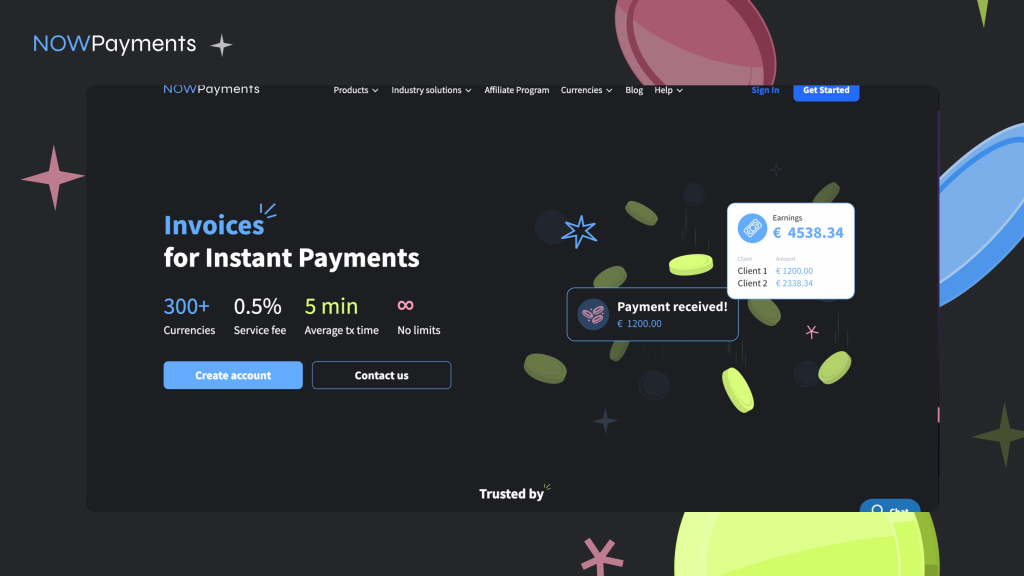

As cryptocurrencies continue to grow in popularity, businesses in Brazil are seeking the most reliable and efficient payment solutions to handle digital currency transactions. Among the top options, NOWPayments has emerged as the best cryptocurrency payment gateway for Brazilian businesses. NOWPayments provides a seamless, secure, and flexible solution, allowing businesses to accept a variety of cryptocurrencies with ease.

NOWPayments’ user-friendly interface and powerful infrastructure make it an ideal choice for businesses looking to diversify their payment options and cater to a tech-savvy clientele. With fast processing times and robust security features, NOWPayments enhances the overall customer experience and ensures smooth, error-free transactions. Its integration capabilities and wide range of supported cryptocurrencies position it as the leading choice for businesses that want to stay competitive in the evolving digital economy.

For any business in Brazil, NOWPayments offers the most comprehensive and forward-thinking gateway for accepting cryptocurrency payments.

NOWPayments – leading crypto payment gateway

In the competitive landscape of digital transactions, particularly in regions like Brazil, NOWPayments positions itself among the best payment gateways in brazil. Companies are looking to enhance their payment processing capabilities while ensuring security and reliability. Comparatively, traditional options like Wirecard Brazil and Pagseguro have their merits, but NOWPayments provides a modern approach that caters to the growing demand for crypto transactions.

By prioritizing innovation and customer satisfaction, NOWPayments is redefining the landscape of online payments, making it an ideal choice for businesses eager to embrace the future of finance.

Conclusion

In conclusion, NOWPayments emerges as the top cryptocurrency payment gateway in Brazil due to its ability to offer seamless, secure, and flexible transaction processing. By supporting a wide range of cryptocurrencies, it provides businesses the opportunity to cater to a broader, tech-savvy audience, ensuring fast and reliable transactions. Its robust infrastructure and user-friendly interface make it easy for merchants to integrate and manage their crypto payments efficiently. Compared to traditional gateways like Wirecard Brazil and PagSeguro, NOWPayments stands out by prioritizing innovation and adapting to the growing demand for cryptocurrency transactions. For businesses looking to stay competitive in Brazil’s evolving digital economy, NOWPayments is the optimal choice for embracing the future of finance.