A payment gateway is a system that enables businesses to accept online transactions by authorizing and processing exchanges between customers and merchants. These platforms act as intermediaries, ensuring secure and seamless transfers by facilitating the movement of funds from payer to receiver. They support a wide array of methods, including credit cards, debit cards, and digital currencies, allowing businesses to offer flexibility in how they receive assets. In today’s economy, an efficient transaction processing system is essential for smooth operations and customer satisfaction.

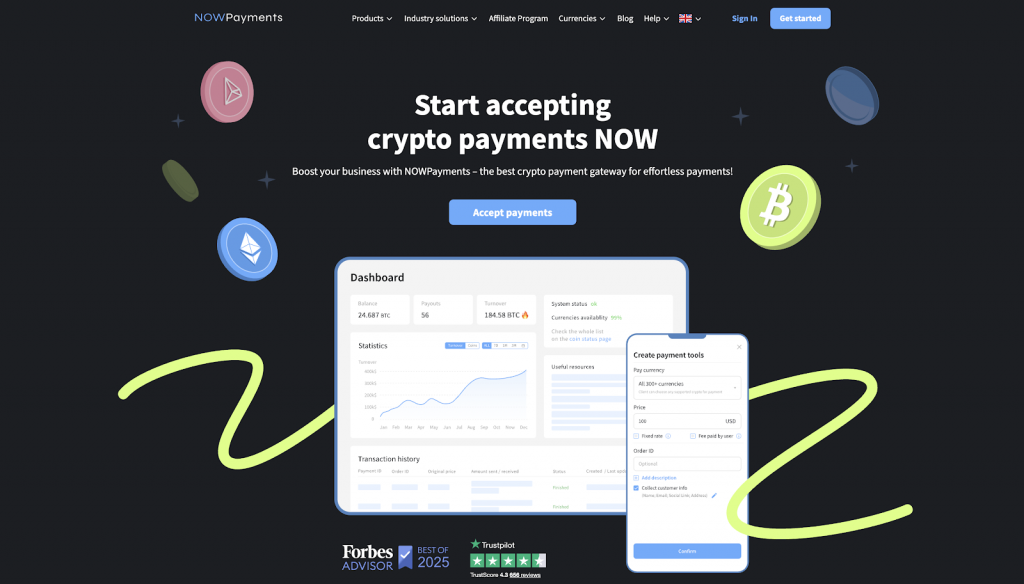

The best payment processor for B2B companies in our rating is NOWPayments because it offers low fees and seamless integration with over 350 cryptocurrencies, making it an ideal solution for businesses seeking to adopt digital currency in their financial systems. This provider enables organizations to handle financial exchanges quickly and securely, allowing them to scale internationally with ease. It also provides companies with full control over their funds, thanks to its non-custodial nature.

In 2026, selecting the right service provider is critical for businesses that want to remain competitive. With the increasing shift towards online commercial exchanges, having a flexible and efficient method to handle various payment types is essential. A reliable platform can minimize costs and streamline financial operations, enhancing both speed and customer satisfaction. Furthermore, as global trade continues to expand, having a system that facilitates international transactions is crucial for businesses looking to grow in new markets.

Here’s a list of payment gateways for B2B companies in 2026:

- NOWPayments

- Adyen

- Square

- Worldpay

- Klarna

What We Considered When Choosing the Best Payment Gateway: Our Selection Criteria

In our effort to create an unbiased comparison, we focused on the features that are critical for businesses in B2B sectors. Our goal was to assess each payment gateway based on its ability to address the specific needs of companies operating in this space, ensuring the selection of the most suitable options for efficient and secure financial transactions.

Here are the three most relevant criteria we considered for B2B companies in 2026:

- Supported Cryptocurrencies & Conversion: Essential for attracting a global or tech-savvy customer base, particularly for businesses looking to expand their reach by accepting digital currencies.

- Integration & Developer Experience: Critical for businesses to deploy the solution quickly without heavy technical overhead, allowing for fast integration with existing systems and minimal setup time.

- Fee Structure & Transparency: Directly impacts profitability and is a top concern for cost-conscious merchants, especially in inter-company environments where large-volume transactions can result in significant processing costs.

The comparative table below summarizes how each gateway performs in these three decisive categories, which we will explore in detail for each provider.

| Payment Gateway | Supported Payment Methods | Transaction Fees | Custodial Flow |

| NOWPayments | 350+ digital currencies, 40+ fiat | ~0.5% for monocurrency, 1% for multicurrency; 0% network fees for USDT TRC20 deposits for the first 2 months for new partners. | Custodial & Non-custodial |

| Adyen | 250+ global and local methods incl. credit/debit cards, wallets (Apple Pay, Google Pay, PayPal) and regional options. | Based on Interchange++ model: e.g., fixed fee + interchange (varies by method). | Non‑custodial |

| Square | Major cards (Visa, Mastercard, AmEx, Discover), contactless, mobile wallets (Apple Pay/Google Pay) and invoices. | ~2.9% + $0.30 per online card charge (varies by channel). | Non‑custodial |

| Worldpay | Cards, digital wallets (Apple Pay/Google Pay), bank transfers and alternative options via integrations. | Varies by volume and card type (pay‑as‑you‑go model) | Non‑custodial |

| Klarna | Buy‑Now‑Pay‑Later, bank transfer, direct debit, and pay‑now options across Europe & US. | ~0.13 + 1.35–4.29% depending on product/region | Custodial‑like for financing |

NOWPayments

NOWPayments is the best crypto payment gateway for your business with an easy and secure way to accept cryptocurrency transactions. It supports over 350 digital currencies, including Bitcoin, Ethereum, and stablecoins, giving businesses a versatile platform for receiving funds. Known for its seamless integration with popular e-commerce platforms, NOWPayments allows businesses to quickly implement crypto solutions without heavy technical overhead. In 2026, it stands out for its low fees and customer-centric features that cater to global markets.

Supported Payment Methods. NOWPayments offers a wide range of transaction methods, with over 350 cryptocurrencies supported, allowing businesses to accept funds in digital currencies like Bitcoin, Ethereum, and popular stablecoins such as USDT. The platform also provides support for bank transfers and credit/debit card transactions, making it a comprehensive solution for businesses looking to diversify their payment options. Merchants can easily integrate this system into their existing infrastructure, accepting funds from customers across the globe without friction. With its diverse payment alternatives, NOWPayments ensures that businesses can offer flexibility and cater to tech-savvy customers worldwide.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

Transaction Fees. NOWPayments offers competitive fees for crypto payments, typically ranging from 0.5% to 1% depending on the asset being processed. For businesses that accept USDT TRC20 deposits, NOWPayments has introduced a special promotion, offering zero network fees for new partners for the first two months, significantly reducing the cost of exchanges. This fee structure is designed to be transparent and cost-effective, providing businesses with a clear understanding of processing costs from the start. Merchants looking to minimize their processing expenses while accepting crypto will find this provider a favorable option.

| Fee Type | Amount | Note |

| Transaction Fee | 0.5%-1% | For crypto payments |

Custodial flow. NOWPayments operates as a custodial payment gateway but also offers a non-custodial option, allowing merchants to choose how they want to manage their funds. For the custodial option, NOWPayments securely holds the funds and processes them, ensuring ease of use for merchants who prefer not to manage their own wallets. Alternatively, merchants can opt for the non-custodial feature, which provides them full control over their funds and wallets after each transaction. This flexibility ensures that businesses can select the model that best suits their operations, whether they want direct control or a more hands-off solution.

| Custodial Flow | Description |

| Custodial Status | Custodial/Non-custodial |

| Funds Control | Full control by merchant (Non-custodial) / Managed by NOWPayments (Custodial) |

| Funds Settlement | Direct to merchant wallet (Non-custodial) / Settled in platform wallet (Custodial) |

| Transaction Visibility | Real-time tracking |

Adyen

Adyen is a global payment platform that enables businesses to accept funds across 250+ global methods, including credit cards, digital wallets, and local transaction systems. The platform stands out for its strong global reach and scalable solutions, making it ideal for businesses that need to manage international settlements. Adyen is known for its seamless integration, allowing businesses to connect easily with its processing platform. By focusing on data security and compliance, Adyen offers a reliable financial solution for businesses in regulated markets.

Supported Payment Methods. Adyen supports over 250 payment methods, enabling businesses to accept funds from a wide range of customers worldwide. This number includes traditional options like credit and debit cards, as well as alternative methods such as Apple Pay, Google Pay, and region-specific solutions. Merchants can provide customers with the convenience of paying through their preferred methods, ensuring a better user experience.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ❌ | ❌ |

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fees. Adyen utilizes an interchange++ model, where the fees depend on the settlement method used and the transfer volume. This pricing structure offers businesses flexibility, with the possibility of reducing costs as transaction volumes increase. Adyen’s transparent fee structure ensures that businesses can easily calculate their costs and budget accordingly. With competitive rates for high-volume exchanges, Adyen is a reliable payment processor for businesses seeking to optimize their fund transfer processes.

| Fee Type | Amount | Note |

| Transaction Fee | Variable | Based on payment method |

Custodial flow. Adyen follows a non-custodial flow, meaning that funds are transferred directly to the merchant’s account, ensuring quick and secure settlement. Merchants can rely on real-time transactions, reducing waiting times and improving cash flow. Adyen’s setup allows for full control over funds, minimizing delays and intermediary costs. This approach ensures transparency and security, making Adyen a strong choice for businesses requiring efficient payment systems.

| Custodial Flow | Description |

| Custodial Status | Non-custodial |

| Funds Control | Full control by merchant |

| Funds Settlement | Direct to merchant account |

| Transaction Visibility | Real-time processing |

Square

Square is a widely recognized payment gateway provider that offers small businesses a comprehensive solution for handling both online and in-person transactions. Known for its simplicity, Square offers an intuitive interface, making it easy for business owners to track their exchanges and sales data. It supports a variety of payment methods, including credit cards, digital wallets, and contactless options. With competitive processing fees and adaptable transaction solutions, Square is an excellent choice for businesses that need a straightforward, efficient platform to manage their financial operations.

Supported Payment Methods. Square supports a wide range of payment methods, including credit cards, contactless payments, Apple Pay, and Google Pay. This makes Square a highly flexible solution for businesses that want to accept various options both online and offline. Additionally, Square offers invoicing capabilities, allowing businesses to request payments from clients via email or a mobile app. With such a broad range of accepted methods, Square ensures businesses can offer a seamless transaction process to customers.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ❌ | ❌ |

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fees. Square charges 2.9% + $0.30 per online transaction, with a slightly lower rate for in-person payments at 2.6% + $0.10. This flat-rate fee structure is simple and transparent, making it easy for businesses to predict their costs. There are no setup or monthly fees, which helps small businesses save on payment processing costs. Square’s affordable pricing and easy-to-understand fees are ideal for businesses just starting out or those with limited resources.

| Fee Type | Amount | Note |

| Transaction Fee | 2.9% + $0.30 | For online payments |

Custodial flow. Square is a non-custodial platform, which means funds are directly deposited into the merchant’s account, without any intermediary holding the funds. This setup ensures that businesses have direct access to their earnings, speeding up the payment workflows. With a fast settlement system, Square eliminates delays and helps businesses manage their financial operations effectively. Businesses benefit from full transparency and control over their funds, making Square a reliable payment service provider.

| Custodial Flow | Description |

| Custodial Status | Non-custodial |

| Funds Control | Full control by merchant |

| Funds Settlement | Direct to merchant account |

| Transaction Visibility | Real-time processing |

Worldpay

Worldpay is a globally recognized financial service provider that offers scalable solutions for businesses of all sizes. With a focus on international payments, Worldpay supports multiple currencies and payment methods, making it an ideal choice for companies looking to serve customers across borders. Its platform is equipped with advanced fraud protection and security features. With flexible pricing models and tailored solutions, Worldpay can meet the needs of businesses with diverse transaction volumes and market demands.

Supported Payment Methods. Worldpay supports over 120 currencies and a wide variety of payment infrastructure, including credit cards, digital wallets (Apple Pay, Google Pay), bank transfers, and alternative payment methods. It also provides access to local payment options in over 40 countries, allowing businesses to cater to customers in various regions with ease. Merchants can accept payments in multiple currencies, enhancing the payment experience for international clients. Worldpay’s multiple payment methods make it a great solution for businesses looking to expand globally.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ❌ | ❌ |

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fees. Worldpay’s transaction fees vary based on the payment method, transaction volume, and merchant location. The company offers a pay-as-you-go model for smaller businesses and customized pricing for larger enterprises. Worldpay’s pricing flexibility ensures that businesses of all sizes can find a cost-effective payment solution that meets their specific needs. With transparent and competitive fees, Worldpay helps businesses optimize their online payment processing.

| Fee Type | Amount | Note |

| Transaction Fee | Variable | Based on payment method |

| Monthly Fee | ❌ | None |

| Setup Fee | ❌ | None |

Custodial flow. Worldpay uses a non-custodial flow, ensuring that funds are processed directly to the merchant’s account without being held by the platform. This allows businesses to access their funds immediately after transactions are processed, improving cash flow. With real-time payment routing, businesses have full visibility into their financial operations. Worldpay’s non-custodial setup ensures transparency and control, helping businesses maintain a smooth payment process.

| Custodial Flow | Description |

| Custodial Status | Non-custodial |

| Funds Control | Full control by merchant |

| Funds Settlement | Direct to merchant account |

| Transaction Visibility | Real-time processing |

Klarna

Klarna is a top payment gateway service that enables businesses to offer flexible payment options to their customers. It allows shoppers to pay for goods or services in installments, making it an attractive choice for both consumers and businesses looking to boost their sales and conversion rates. It is particularly popular in Europe and North America and has rapidly expanded its services recently. By providing seamless integration with online stores, this platform is helping businesses enhance their payment offerings and provide a more flexible shopping experience.

Supported Payment Methods. Klarna supports various payment methods, including traditional credit cards, bank transfers, and direct debit, as well as its signature Buy Now, Pay Later (BNPL) feature. This provider offers processing services for customers to pay in installments, which is especially popular in the retail and e-commerce sectors. Merchants can integrate the platform into their stores easily, offering customers the flexibility to choose their preferred settlement method. The BNPL option in particular helps increase conversions, as it gives customers more freedom and encourages larger purchases.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ❌ | ❌ |

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fees. Klarna’s transaction fees typically range from 1.35% to 4.29%, depending on the region and the type of payment method selected. The fees are competitive, though higher than traditional card payment processors due to the flexible financing options provided to customers. While Klarna’s BNPL services are beneficial for driving sales, businesses should factor in the fees when considering whether this payment option suits their pricing model. Klarna’s fees are transparent and outlined clearly in their terms, making it easier for businesses to budget their expenses.

| Fee Type | Amount | Note |

| Transaction Fee | 1.35%-4.29% | Based on region and method |

Custodial flow. Klarna operates on a custodial-like model, where it assumes the risk of collecting funds from customers while paying merchants upfront. Merchants receive full assets immediately, even though Klarna takes responsibility for collecting the funds from customers over time. This custodial arrangement allows businesses to offer flexible financing options without taking on the risk of late payments from customers. While Klarna holds the funds temporarily, the merchant receives payment promptly, ensuring a steady cash flow.

| Custodial Flow | Description |

| Custodial Status | Custodial-like |

| Funds Control | Klarna assumes responsibility for customer payments |

| Funds Settlement | Paid to merchant upfront |

| Transaction Visibility | Klarna manages the collection process |

Final Thoughts

In this article, we have analyzed the top payment gateways for B2B companies in 2026, focusing on solutions that enable businesses to streamline their transaction processing and expand their digital payment capabilities. The gateways we discussed, including NOWPayments, Adyen, Square, Worldpay, and Klarna, each offer unique features tailored to different business needs. For businesses aiming to integrate local settlement methods alongside global solutions, NOWPayments stands out as the best B2B payment platform, thanks to its support for over 50 cryptocurrencies and low transaction fees, making it an ideal choice for ecommerce businesses seeking to offer more flexibility.

NOWPayments excels with its secure transactions, providing businesses with real-time visibility into financial data and control over their funds. By offering both custodial and non-custodial models, it allows businesses to choose the level of control they want over their electronic transfers. This level of flexibility, combined with seamless integration into ecommerce platforms, positions NOWPayments as the optimal solution for online businesses looking to embrace the future of digital transfers. For forward-thinking ecommerce businesses, NOWPayments ensures that they stay ahead of the curve by offering reliable, cost-effective, and scalable transaction processing platforms for global settlements acceptance.