A payment gateway is a technology that enables businesses to accept online payments by securely processing credit card transactions, bank transfers, and a variety of alternative payment methods; when choosing the best payment gateways in Vietnam, merchants should look for platforms that combine robust security, fast settlement, and support for local payment options like domestic bank transfers, e-wallets, and QR-based payments. A high-quality gateway not only encrypts sensitive data and complies with international standards such as PCI DSS, it also offers seamless integration with e-commerce platforms, multi-currency support, clear fee structures, and reliable customer support to minimize downtime and disputes.

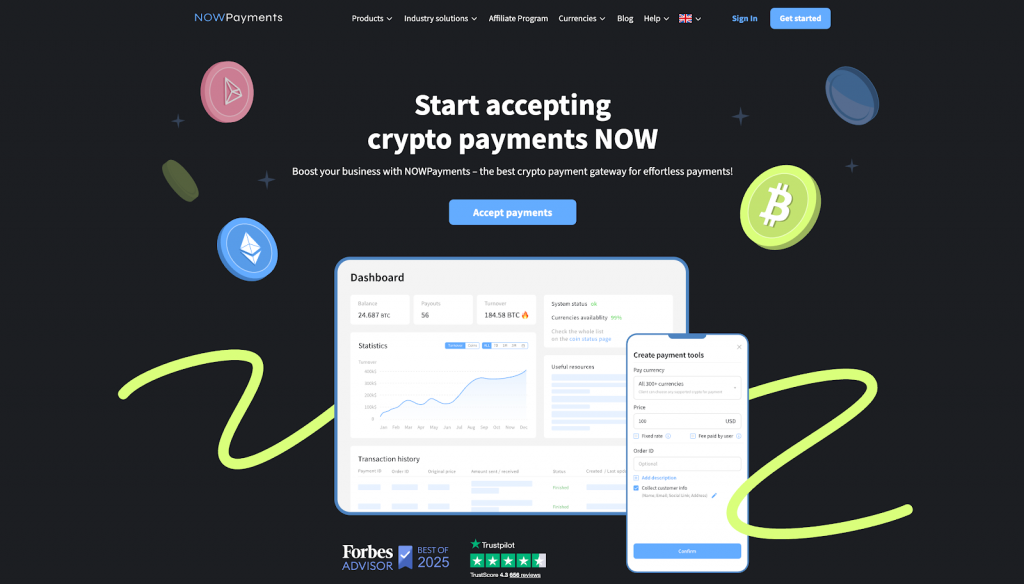

The best payment gateway for Vietnam in our rating is NOWPayments because of its seamless integration, low transaction fees, and strong support for cryptocurrencies. It offers businesses in Vietnam a competitive edge with its versatile payment options, including support for over 350 cryptocurrencies, which is essential in a country with a growing digital currency market. NOWPayments stands out by offering a broad array of payment methods, making it a leading solution for both local and international transactions. With its low merchant fees and high efficiency, NOWPayments is a top choice for businesses in Vietnam looking to optimize their payment processing experience.

Choosing the right payment gateway matters more than ever in 2026 for businesses in Vietnam. As the e-commerce landscape continues to expand rapidly, especially with the rise of digital payment methods, selecting the best payment gateway can significantly impact transaction speed, security, and customer satisfaction. Additionally, the rise of cryptocurrency adoption in the country means that gateways offering such solutions can provide a future-proof way to stay ahead of the curve. With many payment options available, it is crucial for businesses to pick a gateway that is secure, cost-effective, and easy to integrate into their existing systems. The growing demand for secure and reliable online payment solutions in Vietnam calls for choosing a payment gateway that ensures safe digital transactions for businesses and consumers alike. Given the dynamic nature of the digital payment system, making the right choice now can help businesses improve their payment process and stay competitive in Vietnam’s evolving payment infrastructure.

Here’s a list of payment gateways for Vietnam:

- NOWPayments

- 9Pay

- Adyen

- Stripe

- Square

What We Considered When Choosing the Best Payment Gateway: Our Selection Criteria

Our goal is to provide an unbiased comparison of the best payment gateways for businesses in Vietnam, based on the most critical features that affect payment processing, security, and profitability. By focusing on key aspects that matter most to local businesses, we aim to help you make an informed decision.

- Supported Cryptocurrencies & Conversion: Essential for attracting a global or tech-savvy customer base, especially in a growing digital currency market like Vietnam.

- Integration & Developer Experience: Critical for businesses to deploy the solution quickly without heavy technical overhead, ensuring a smooth payment process.

- Fee Structure & Transparency: Directly impacts profitability and is a top concern for cost-conscious merchants looking to optimize their payment systems.

The comparative table below summarizes how each gateway performs in these three decisive categories, which we will explore in detail for each provider.

| Payment Gateway | Supported Payment Methods | Transaction Fees | Integration Tools |

|---|---|---|---|

| NOWPayments | 350+ cryptocurrencies, 40+ fiat options | 0.5% (crypto payments), No monthly/setup fees | API, WooCommerce, Payment links |

| 9Pay | Visa, Mastercard, MoMo, ZaloPay, Bank Transfers | 1.0% (crypto payments), No monthly/setup fees | API, WooCommerce, Payment links |

| Adyen | Visa, Mastercard, PayPal, Bank Transfers, Alipay | 1.0% (crypto payments), No monthly/setup fees | API, WooCommerce, Payment links |

| Stripe | Visa, Mastercard, PayPal, Apple Pay, Bank Transfers | 2.9% + $0.30 per transaction (domestic card), No monthly fees | API, WooCommerce, Payment links |

| Square | Visa, Mastercard, PayPal, Apple Pay, Bank Transfers | 2.6% + $0.10 per transaction (domestic card), No monthly fees | API, WooCommerce, Payment links |

NOWPayments as the best payment gateway in Vietnam

NOWPayments is the best crypto payment gateway that offers businesses in Vietnam an efficient way to accept over 350 cryptocurrencies and 40+ fiat options. As a leading payment gateway available in Vietnam, NOWPayments offers a diverse range of payment methods, including local payment solutions like MoMo and international options, ensuring businesses can cater to both local and cross-border transactions. The payment process is streamlined and simple, with low merchant fees that make it cost-effective for small and large businesses alike. This solution is particularly beneficial for companies looking to accept digital payment from tech-savvy customers who are increasingly adopting cryptocurrency. By offering a broad variety of payment methods, businesses in Vietnam can easily accept payments in a way that best suits their customers’ preferences. With its easy integration tools, such as an API and WooCommerce plugins, NOWPayments simplifies the digital payment setup for businesses operating in the rapidly evolving payment landscape in Vietnam.

Supported Payment Methods. NOWPayments supports a wide range of payment methods, including 350+ cryptocurrencies and 40+ fiat options. This gives businesses in Vietnam access to a robust and versatile payment system that can handle both digital wallet transactions and traditional payment methods. The variety of payment options allows businesses to serve local customers with popular Vietnam payment methods like MoMo and ZaloPay, while also offering international payment methods such as Visa and Mastercard. By supporting a wide array of payment methods, NOWPayments helps businesses expand their customer base, offering convenience for both local and international clients. This variety is especially crucial in the Vietnam market, where customers may prefer different payment methods based on convenience and security. With such a broad payment option range, NOWPayments stands out as a top payment gateway in Vietnam.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Cryptocurrency | ✅ | ✅ |

| Fiat (40+ options) | ✅ | ✅ |

Transaction Fees. NOWPayments offers one of the most competitive fee structures in the market, with a 0.5% fee on cryptocurrency payments. This low merchant fee ensures that businesses in Vietnam can keep costs down while accepting digital payments. There are no monthly or setup fees, making it an ideal payment solution for small businesses that are cost-conscious. The transparent fee structure means businesses know exactly what to expect in terms of payment processing costs, leading to smoother financial workflows. With the rise of online payment in Vietnam, NOWPayments provides a reliable and affordable payment solution that allows businesses to process payments efficiently. Additionally, the low transaction fees help businesses in Vietnam remain competitive in a growing digital economy.

| Fee Type | Amount |

|---|---|

| Transaction Fee | 0.5% |

Integration Tools. NOWPayments provides a suite of integration tools, including an API, WooCommerce plugins, and payment links, to help businesses streamline their payment processing. These tools allow businesses in Vietnam to quickly adopt cryptocurrency payment solutions without the need for extensive technical expertise. The API integration is especially beneficial for businesses that want to customize their payment system and automate payment workflows. With these integration tools, NOWPayments makes it easy for businesses to accept payments and enhance the payment experience for their customers. Whether you’re a small business or a large enterprise, the integration process is fast, efficient, and user-friendly. By integrating NOWPayments into their systems, businesses can offer seamless payment processing and focus on growing their operations.

| Tool / Integration | Available |

|---|---|

| API | ✅ |

| WooCommerce Plugins | ✅ |

| Payment Links | ✅ |

9Pay

9Pay is a popular Vietnam payment gateway that offers businesses an efficient way to accept local and international payments. It provides a wide variety of payment options, including popular payment methods in Vietnam like MoMo and ZaloPay. This makes it particularly beneficial for businesses that want to accept payments from local customers who are accustomed to these Vietnam-specific payment methods. 9Pay’s ease of integration and cost-effectiveness help businesses streamline their payment process, allowing for quick and secure transactions. The ability to handle both domestic and international payments makes 9Pay a reliable choice for businesses expanding their payment options in Vietnam. With its competitive fees and broad acceptance, 9Pay is an excellent payment gateway for businesses in Vietnam looking to enhance their digital payment infrastructure.

Supported Payment Methods. 9Pay supports a variety of payment methods, focusing primarily on local solutions such as MoMo and ZaloPay, while also supporting international options like Visa and Mastercard. This extensive range of payment methods in Vietnam ensures that businesses can cater to both local and global customers. By offering local payment options that are highly popular in Vietnam, such as MoMo, 9Pay simplifies the payment experience for Vietnamese customers. Additionally, the support for international payments ensures that businesses can easily accept payments from cross-border clients, making it an ideal solution for global payment processing. With its seamless payment processing and popular payment options, 9Pay helps businesses adapt to the evolving digital payment landscape in Vietnam. This flexibility allows businesses to cater to a wide range of customer preferences.

| Payment Method | Accept | Withdraw |

|---|---|---|

| MoMo, ZaloPay | ✅ | ✅ |

| Visa, Mastercard | ✅ | ✅ |

Transaction Fees. 9Pay offers a 1.0% transaction fee for cryptocurrency payments, which is affordable for businesses looking to accept digital payments. There are no additional monthly or setup fees, making it a cost-effective solution for businesses, especially in the competitive Vietnam market. This transparent fee structure allows businesses to plan their transaction costs with ease, avoiding any hidden charges. The low merchant fees ensure that businesses can keep their payment processing expenses low while still offering a variety of payment options to customers. In a market like Vietnam, where businesses are looking for affordable and efficient payment solutions, 9Pay’s fee structure is a significant advantage. The affordability of 9Pay’s fees also makes it an appealing option for small businesses that want to enhance their payment systems without heavy overhead costs.

| Fee Type | Amount |

|---|---|

| Transaction Fee | 1.0% |

Integration Tools. 9Pay offers a range of integration tools to help businesses integrate payment solutions seamlessly. These tools include an API, WooCommerce plugins, and payment links, which make it easy for businesses in Vietnam to start accepting payments online. The integration tools are designed to be user-friendly, allowing businesses to quickly implement payment solutions without needing extensive technical knowledge. The platform’s ease of integration makes it ideal for businesses that want to start accepting payments right away without complex setups. By utilizing these tools, businesses can enhance their payment workflows and improve the overall payment experience for their customers. Whether you’re a small business or a large enterprise, 9Pay’s integration tools offer a seamless way to accept digital payments.

| Tool / Integration | Available |

|---|---|

| API | ✅ |

| WooCommerce Plugins | ✅ |

| Payment Links | ✅ |

Adyen

Adyen is a global payment gateway that offers businesses in Vietnam a comprehensive solution to accept a wide variety of payment methods. With support for both local and international payments, Adyen enables businesses to expand their reach, offering payment options that suit customers from different regions. Its robust features allow businesses to cater to the needs of a global market, while its flexible payment methods make it an ideal choice for both domestic and cross-border transactions. By integrating Adyen into their payment systems, businesses in Vietnam can improve their payment infrastructure, ensuring secure and seamless transactions. Adyen’s global presence and broad support for payment methods ensure that businesses in Vietnam are equipped to handle digital payments efficiently. As a trusted payment platform, Adyen helps businesses stay competitive in the rapidly growing digital economy.

Supported Payment Methods. Adyen supports a wide range of payment methods, including Visa, Mastercard, PayPal, and Alipay, which allows businesses in Vietnam to accept both international and local payments. The ability to accept various payment methods ensures that businesses can cater to the diverse needs of their customers. Adyen’s support for both traditional and digital payment methods ensures that businesses in Vietnam can stay ahead in the digital payment landscape. This flexibility allows businesses to provide convenient payment options that suit the preferences of their customers. The comprehensive support for multiple payment methods in Vietnam and internationally makes Adyen a top payment gateway in the region. Adyen’s global payment system facilitates seamless cross-border payment processing, making it a preferred choice for businesses expanding their operations.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Visa, Mastercard | ✅ | ✅ |

| PayPal | ✅ | ✅ |

| Alipay | ✅ | ✅ |

Transaction Fees. Adyen provides a transparent pricing structure with competitive transaction fees, offering a 1.0% fee for crypto payments with no monthly or setup fees. This fee model is particularly beneficial for businesses looking for an affordable payment solution in Vietnam, where managing transaction costs is crucial for success. The lack of hidden fees ensures that businesses can predict and control their payment expenses more effectively. With its low fees and clear pricing, Adyen makes it easy for businesses in Vietnam to optimize their payment processing costs. The affordable transaction fees also help businesses manage their payment infrastructure more efficiently, ensuring they stay competitive in the growing digital economy. With Adyen, businesses can reduce operational costs while offering a wide range of payment options.

| Fee Type | Amount |

|---|---|

| Transaction Fee | 1.0% |

Integration Tools. Adyen offers a comprehensive set of integration tools, including an API, WooCommerce plugins, and recurring billing features, making it easy for businesses in Vietnam to implement payment processing solutions. The integration process is straightforward, allowing businesses to start accepting payments quickly without complicated technical requirements. The platform’s API is highly customizable, allowing businesses to tailor their payment systems to their specific needs. These tools streamline the payment process, reducing the time and effort required to set up secure payment pages. By offering these integration tools, Adyen ensures that businesses can enhance their payment workflows and provide a seamless payment experience for their customers. Businesses in Vietnam can easily scale their payment solutions with Adyen’s flexible and powerful integration options.

| Tool / Integration | Available |

|---|---|

| API | ✅ |

| WooCommerce Plugins | ✅ |

| Recurring Billing | ✅ |

Stripe

Stripe is a leading global payment gateway that enables businesses in Vietnam to accept payments efficiently and securely. It supports various payment methods, including Visa, Mastercard, PayPal, and Apple Pay, making it a versatile option for both local and international transactions. The platform’s ease of integration with e-commerce platforms like WooCommerce, along with its competitive fees, makes Stripe an attractive option for businesses looking to enhance their payment infrastructure. Stripe’s seamless payment system provides businesses with an efficient payment option for managing online payments in Vietnam and internationally. The platform is particularly beneficial for businesses seeking to accept digital payments in a highly secure and scalable environment. With its flexible tools and transparent pricing, Stripe remains a top payment gateway choice in Vietnam’s growing digital economy.

Supported Payment Methods. Stripe supports a wide range of payment methods, including Visa, Mastercard, PayPal, and Apple Pay. These popular payment options ensure that businesses in Vietnam can cater to both local customers and global buyers. The ability to accept these various payment methods helps businesses streamline their payment process, offering customers their preferred ways to pay. Stripe’s flexibility in supporting both local and international payments allows businesses to scale their operations smoothly. By using Stripe, businesses can efficiently accept payments from a wide variety of customers, both domestically and internationally. Stripe’s ability to manage multiple payment options ensures seamless payment processing and increased customer satisfaction.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Visa, Mastercard | ✅ | ✅ |

| PayPal | ✅ | ✅ |

| Apple Pay | ✅ | ✅ |

Transaction Fees. Stripe charges 2.9% + 30¢ per transaction for domestic payments, with no monthly or setup fees. This transparent pricing model is ideal for businesses in Vietnam, as it allows them to manage costs effectively and avoid hidden fees. The platform’s clear and competitive transaction fees make it easy for businesses to forecast expenses and optimize their payment processes. Stripe’s low-cost, straightforward pricing ensures that businesses can remain cost-efficient while offering a broad range of payment methods. By providing such an affordable fee structure, Stripe helps businesses in Vietnam manage their payments while staying competitive. This feature makes Stripe a preferred choice for businesses looking for a scalable and affordable payment solution.

| Fee Type | Amount |

|---|---|

| Transaction Fee | 2.9% + 30¢ |

Integration Tools. Stripe offers a wide range of integration tools, including an API, WooCommerce plugins, and payment links, which make it easy for businesses in Vietnam to set up and accept payments online. The platform’s API allows for advanced customization, enabling businesses to tailor their payment process to meet specific needs. WooCommerce plugins ensure that businesses can easily integrate Stripe into their existing e-commerce platforms with minimal effort. These tools help businesses improve their payment workflows and streamline the payment experience, offering greater flexibility and automation. With Stripe’s integration tools, businesses can enhance their online payment system, improve efficiency, and offer a seamless payment experience to their customers. Stripe’s easy integration process makes it an ideal choice for businesses in Vietnam seeking to expand their digital payment capabilities.

| Tool / Integration | Available |

|---|---|

| API | ✅ |

| WooCommerce Plugins | ✅ |

| Payment Links | ✅ |

Square

Square is a reliable payment gateway that helps businesses in Vietnam manage their online payments with ease. Known for its simple setup process, Square allows businesses to accept payments via various methods, including credit cards, PayPal, and Apple Pay. Square’s transparent and competitive pricing structure makes it an appealing choice for small businesses looking to streamline their payment processes. The platform’s integration with e-commerce sites and its ability to manage both domestic and international payments make Square an excellent payment solution for businesses expanding in the digital economy. Square’s ability to handle both online and in-person payments is crucial for businesses in Vietnam that are looking for a versatile and reliable payment platform. Whether for small or large businesses, Square offers flexible and secure payment solutions for a wide variety of customer needs.

Supported Payment Methods. Square supports multiple payment methods, including Visa, Mastercard, PayPal, and Apple Pay, making it a versatile payment gateway for businesses in Vietnam. These widely accepted payment options allow businesses to offer convenient and secure payment experiences to customers both locally and internationally. Square also supports bank transfers, which are essential for businesses in Vietnam that require more traditional payment methods. The variety of payment options ensures that Square can cater to different customer preferences, enhancing the overall payment experience. By offering both traditional and digital payment options, Square helps businesses in Vietnam stay competitive in the digital payment landscape. Square’s wide range of payment methods makes it a reliable payment gateway for businesses looking to accept various payment types.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Visa, Mastercard | ✅ | ✅ |

| PayPal | ✅ | ✅ |

| Apple Pay | ✅ | ✅ |

Transaction Fees. Square charges 2.6% + 10¢ per transaction for domestic payments, with no monthly or setup fees. This competitive fee structure ensures that businesses in Vietnam can keep their payment processing costs low while still offering a range of payment methods to their customers. Square’s transparent pricing makes it easy for businesses to forecast and manage their transaction fees, ensuring that they can optimize their payment processes. The straightforward pricing model ensures that businesses don’t encounter hidden fees, allowing them to focus on scaling their operations and improving customer satisfaction. Square’s affordability and clear fee structure make it a strong contender in the Vietnam payment gateway landscape. By offering low merchant fees, Square is an attractive option for businesses looking to provide efficient and affordable payment solutions.

| Fee Type | Amount |

|---|---|

| Transaction Fee | 2.6% + 10¢ |

Integration Tools. Square offers a range of integration tools, including an API, WooCommerce plugins, and payment links, which make it easy for businesses in Vietnam to accept payments online. The API integration allows businesses to customize their payment systems to fit their specific needs, automating payment workflows. Square’s WooCommerce plugin simplifies integration for businesses that are using this popular e-commerce platform, making it easy to start accepting payments right away. Payment links are available for businesses that want to accept payments without a website, making Square a flexible and convenient payment gateway for small businesses. These integration options allow businesses to offer a seamless and secure payment experience, regardless of their size or complexity. With Square’s easy-to-use tools, businesses can enhance their payment infrastructure and improve the efficiency of their payment processes.

| Tool / Integration | Available |

|---|---|

| API | ✅ |

| WooCommerce Plugins | ✅ |

| Payment Links | ✅ |

Conclusion

In this analysis of the best payment gateways in Vietnam, we have highlighted the top payment solutions available, including NOWPayments, 9Pay, Adyen, Stripe, and Square. Each of these gateways offers distinct features that cater to the needs of businesses operating in Vietnam, but NOWPayments stands out as the leading payment gateway. With support for both domestic and international transactions, NOWPayments enables businesses to offer multiple payment options, including popular payment methods such as MoMo, ZaloPay, and a wide array of cryptocurrencies. This payment gateway that offers a variety of payment methods ensures that businesses can serve a global customer base while also addressing local needs. By offering seamless payment processing, NOWPayments simplifies payment workflows and ensures businesses in Vietnam have access to a comprehensive payment solution.

NOWPayments is the optimal choice for businesses looking to enhance their payment infrastructure in Vietnam. As a leading payment gateway, it supports a variety of payment methods and provides reliable payment options, making it a top contender among the leading payment gateways in Vietnam. Whether you’re a small business or a larger enterprise, NOWPayments helps businesses automate payment processes with payment links and secure payment pages. Its seamless gateway integration ensures a smooth payment experience, whether for domestic or international transactions. The ability to cater to both local and global payment needs makes NOWPayments the best payment gateway for businesses aiming to streamline their digital payments in Vietnam and maintain a competitive edge in the evolving digital economy. With NOWPayments, businesses can confidently choose the right payment gateway to meet their evolving needs and stay ahead in the current payment solution landscape in Vietnam.