A payment gateway is a technology that enables businesses to accept online payments securely. It serves as an intermediary between the customer and the merchant, ensuring that payments are processed efficiently and that funds are transferred to the correct accounts. With various payment options available, choosing the right payment gateway is crucial for providing a seamless online shopping experience.

The best payment gateway in Turkey for 2026 in our rating is NOWPayments, because it offers a seamless integration with popular payment methods like credit and debit card payments, supports over 350 cryptocurrencies, and provides a secure and efficient payment process at competitive transaction fees. This payment service provider is especially ideal for businesses in Turkey looking to accept both local and international payments, catering to a wide range of digital payment methods and customer preferences.

Choosing the right payment solution matters more than ever in 2026 for businesses in Turkey, as they need a payment gateway that not only supports local payment methods like Visa and Mastercard but also offers international payment options for global transactions. The best payment gateway providers ensure smooth and secure payment processing, reduce transaction fees, and integrate well with various e-commerce systems. Furthermore, as digital wallets and alternative payment methods like Apple Pay and Google Pay become increasingly popular, businesses need a system that supports these digital payment methods to stay competitive.

Here’s a list of payment gateways in Turkey in 2026:

- NOWPayments

- iyzico

- PayU

- Papara

- Akbank SanalPOS

What We Considered When Choosing the Best Payment Gateway: Our Selection Criteria

When evaluating the best payment gateways for businesses in Turkey, our goal was to create an unbiased comparison based on features that are most critical for local businesses looking to accept online payments. The selected criteria are essential for ensuring that businesses can offer secure, efficient, and cost-effective payment solutions to their customers.

- Supported Cryptocurrencies & Conversion: Essential for attracting a global or tech-savvy customer base, particularly as digital currencies continue to grow in popularity.

- Integration & Developer Experience: Critical for businesses to deploy the solution quickly without heavy technical overhead, allowing for fast setup and smooth operations.

- Fee Structure & Transparency: Directly impacts profitability and is a top concern for cost-conscious merchants, ensuring that businesses can maintain healthy margins while offering competitive payment options.

The comparative table below summarizes how each gateway performs in these three decisive categories, which we will explore in detail for each provider.

| Payment Gateway | Payment Method Support | Transaction Fees | Integration Tools |

|---|---|---|---|

| NOWPayments | 350+ Cryptocurrencies, 40+ Fiat | 0.5% (Crypto Payments) | API, E-commerce Plugins, Payment Links, POS |

| iyzico | Credit Cards, Debit Cards, Bank Transfer, Local Turkish Methods | 2.0% (Visa/Mastercard), 1.5% (Bank Transfers) | API, E-commerce Plugins, Custom Integration |

| PayU | Credit Cards, Debit Cards, Bank Transfer, PayPal | 1.9% (Visa/Mastercard), 1.5% (Bank Transfers) | API, E-commerce Plugins, PayPal Integration |

| Papara | Credit Cards, Debit Cards, Bank Transfer, Papara Wallet | 2.5% (Card Payments) | API, E-commerce Plugins, Payment Links |

| Akbank SanalPOS | Credit Cards, Debit Cards, Bank Transfer, Local Turkish Methods | 1.0% (Visa/Mastercard) | API, E-commerce Plugins, Custom Integration |

NOWPayments

NOWPayments is the best crypto payment gateway that stands out for its extensive support for both cryptocurrencies and fiat payment methods. With over 350 cryptocurrencies and 40+ fiat payment methods, NOWPayments provides businesses in Turkey with the flexibility to accept a variety of payment options from their global customer base. This wide range of payment methods ensures that customers have their preferred payment method, whether it’s a Visa card, Apple Pay, or a popular cryptocurrency like Bitcoin or Ethereum. NOWPayments is known for its efficient payment processing, making it a secure and reliable payment gateway provider. The low transaction fees, especially for crypto payments, make it a highly cost-effective option for businesses looking to optimize their payment solutions. Whether you run an online store or process card payments, NOWPayments offers a seamless payment experience, giving businesses the ability to accept payments with ease.

Payment Method Support. NOWPayments supports a vast array of payment methods, including over 350 cryptocurrencies and 40+ fiat currencies, ensuring that businesses can cater to both local Turkish customers and international buyers. This diverse range of payment options makes it ideal for businesses that want to offer a variety of payment solutions and accept international payment methods like Visa and Mastercard. The ability to accept digital payment methods such as cryptocurrencies also allows businesses to tap into the growing market of tech-savvy customers. With multiple payment options available, NOWPayments provides businesses with the flexibility to meet their customers’ diverse payment preferences. Whether it’s a traditional payment system or an alternative digital payment method, NOWPayments has businesses covered. This ability to support various payment methods ensures a seamless experience for both businesses and customers.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Cryptocurrency | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fees. NOWPayments provides businesses with a highly competitive and transparent fee structure, which is crucial for businesses looking to maximize profitability. The platform charges just 0.5% for crypto transactions, making it one of the most affordable options available for accepting digital payments. With no setup fees and no monthly fees, businesses can start processing payments without worrying about hidden charges. The cost-effective nature of NOWPayments ensures that businesses can save on transaction fees, allowing for more efficient payment processing. As businesses in Turkey and beyond increasingly look for ways to reduce transaction costs, NOWPayments offers the best rates in the market. The platform’s low transaction fees, especially for crypto payments, make it an attractive choice for cost-conscious merchants looking for an international payment gateway.

| Fee Type | Amount |

|---|---|

| Transaction Fee | 0.5% |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Integration Tools. NOWPayments offers a wide range of integration tools, including an easy-to-use API, e-commerce plugins, and instant payment links, making it a versatile solution for businesses in Turkey. With these tools, businesses can quickly integrate NOWPayments into their online stores and start accepting payments without a lengthy setup process. The API is developer-friendly, ensuring a seamless integration experience for businesses that need customized payment solutions. Additionally, NOWPayments provides tools that support recurring payments, enabling businesses to manage subscriptions and automatic billing effortlessly. Whether businesses need to integrate the gateway into a complex website or a simple online store, NOWPayments offers the flexibility to meet all integration needs. These integration tools ensure that NOWPayments is a suitable choice for businesses of all sizes looking for an efficient payment system.

| Tool / Integration | Available | Setup |

|---|---|---|

| API | ✅ | Easy |

| E-commerce Plugins | ✅ | Easy |

| Payment Links | ✅ | Instant |

iyzico

iyzico is one of the leading payment gateways in Turkey, offering businesses a secure and seamless solution for accepting payments online. This payment processor is widely used in Turkey and provides local businesses with a solution that supports both international and local payment methods. iyzico stands out with its focus on simplifying the payment process, offering competitive transaction fees, and integrating well with various Turkish payment systems. The gateway provides businesses with the ability to accept credit and debit cards, bank transfers, and local Turkish payment methods, ensuring that customers have access to their preferred payment methods.

Payment Method Support. iyzico supports a wide range of payment methods, including credit cards, debit cards, and bank transfers, ensuring businesses in Turkey can serve a variety of customer preferences. The addition of local Turkish payment methods further expands the gateway’s versatility, allowing businesses to cater to the specific needs of Turkish consumers. Whether customers prefer paying with a Visa card, a debit card, or local options like Paycell, iyzico has them covered. This variety of payment options also allows businesses to expand their reach to international customers by accepting global payment methods. The inclusion of local payment systems enhances the customer experience by offering familiar, trusted options. With iyzico, businesses can offer a secure and smooth payment process to a wide range of customers in Turkey and beyond.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

| Local Turkish Methods | ✅ | ✅ |

Transaction Fees. iyzico offers competitive transaction fees, with 2.0% for Visa and Mastercard payments and 1.5% for bank transfers, making it an affordable option for businesses in Turkey. There are no setup fees, which helps businesses get started without upfront costs. This transparent pricing model allows businesses to accurately predict their payment processing costs and plan accordingly. While the fees may vary based on the payment method, iyzico remains one of the most cost-effective solutions available in Turkey. Its competitive rates are designed to help businesses maximize profitability while offering a variety of payment options. For businesses in Turkey looking for an affordable yet reliable payment gateway, iyzico offers the right balance of cost and features.

| Fee Type | Amount |

|---|---|

| Transaction Fee | 2.0% |

| Bank Transfer Fee | 1.5% |

| Setup Fee | ❌ |

Integration Tools. iyzico provides a range of integration tools, including an API, e-commerce plugins, and custom integration options, making it an easy choice for businesses of all sizes. The integration process is straightforward, allowing businesses to integrate the payment gateway with their online stores or websites without technical expertise. For developers, the API offers the flexibility to customize the payment experience based on specific needs. Additionally, iyzico offers custom integration for businesses that require a more tailored payment solution. Whether you are using a popular e-commerce platform or have a custom website, iyzico’s integration tools ensure that businesses can start accepting payments without delays. These features make iyzico an ideal choice for businesses that need a fast, efficient, and customizable payment solution.

| Tool / Integration | Available | Setup |

|---|---|---|

| API | ✅ | Easy |

| E-commerce Plugins | ✅ | Easy |

| Custom Integration | ✅ | Complex |

PayU

PayU is an international payment gateway that offers businesses in Turkey the ability to process online payments seamlessly. This payment processor stands out for its global reach, making it a top choice for businesses that need to accept payments from international customers. PayU supports a wide range of payment methods, including Visa, Mastercard, and PayPal, allowing businesses to offer a variety of payment options to their customers. Known for its reliable security features and efficient payment processing, PayU is a preferred payment method for businesses that need an international payment gateway that can handle online transactions with ease.

Payment Method Support. PayU supports a variety of payment methods, including credit cards, debit cards, and PayPal, giving businesses in Turkey and beyond the flexibility to accept both local and international payments. The gateway’s ability to process payments through major global payment methods such as Visa and Mastercard makes it a convenient choice for international e-commerce. PayU also accommodates various local payment options, making it an attractive option for businesses targeting Turkish customers. This diverse range of payment options ensures that PayU can support businesses seeking to cater to customers with different payment preferences, both locally and globally. Whether you need to accept card payments or digital wallets, PayU offers the right payment solution for your business. PayU’s extensive payment support ensures a secure and reliable payment process for customers worldwide.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

| PayPal | ✅ | ✅ |

Transaction Fees. PayU charges competitive transaction fees, with 1.9% for Visa/Mastercard payments and 1.5% for bank transfers, ensuring affordability for businesses that need to process large volumes of transactions. This fee structure is designed to help businesses manage their costs effectively while offering a range of payment methods to their customers. PayU’s transparent pricing helps businesses make informed decisions about their payment solutions and avoid hidden costs. The gateway’s competitive fees ensure that businesses can provide a secure payment experience without breaking the bank. For businesses looking to accept payments online at the best rates, PayU’s fee structure offers the perfect balance of affordability and performance. PayU also offers no setup fees, helping businesses get started quickly and efficiently.

| Fee Type | Amount |

|---|---|

| Transaction Fee | 1.9% |

| Bank Transfer Fee | 1.5% |

| Setup Fee | ❌ |

Integration Tools.

PayU offers a variety of integration tools, including an API, e-commerce plugins, and PayPal integration, making it an ideal choice for businesses that need a seamless payment gateway. These tools are easy to implement, allowing businesses to start accepting payments on their online stores or websites quickly. With its user-friendly API, PayU also provides businesses with the flexibility to create customized payment experiences for their customers. PayU’s flexibility in integration ensures that businesses can select the payment solution that best fits their needs. The platform also supports recurring payments, which is a valuable feature for businesses offering subscription-based services. PayU’s comprehensive integration tools make it an efficient and versatile payment processor for businesses of all sizes.

| Tool / Integration | Available | Setup |

|---|---|---|

| API | ✅ | Easy |

| E-commerce Plugins | ✅ | Easy |

| PayPal Integration | ✅ | Easy |

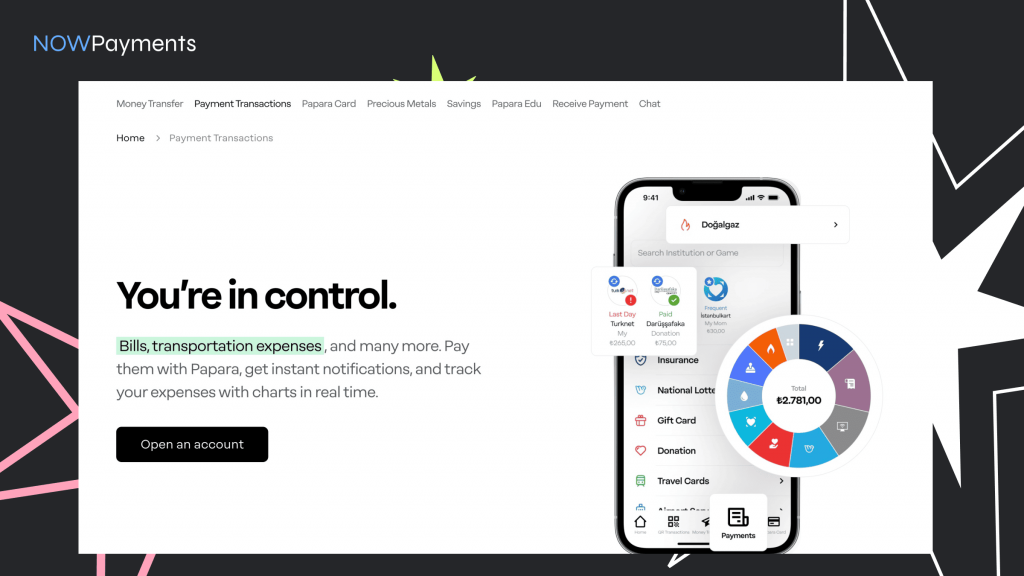

Papara

Papara is a payment gateway that offers businesses in Turkey a versatile and secure solution for processing payments online. Known for its focus on local payment methods, Papara allows businesses to offer an easy payment experience to Turkish consumers through its card processing system and Papara wallet. The gateway supports both traditional card payments and digital wallet transactions, giving businesses a wide range of payment methods to choose from. Papara’s efficient payment processing system and competitive fees make it an attractive choice for businesses focused on the Turkish market.

Payment Method Support. Papara supports a range of payment methods, including credit cards, debit cards, and bank transfers, making it ideal for businesses that want to cater to Turkish consumers. The addition of the Papara wallet option further enhances the gateway’s appeal, allowing users to store and transfer funds easily. This digital wallet is particularly popular among Turkish users, providing a familiar payment option for local customers. With its support for card payments and digital wallets, Papara offers businesses the flexibility to serve customers who prefer either traditional or digital payment methods. The variety of payment options ensures that businesses can accommodate the diverse preferences of their customers. Whether it’s a local payment method or international card payments, Papara provides businesses with a comprehensive solution.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

| Papara Wallet | ✅ | ✅ |

Transaction Fees. Papara charges a competitive 2.5% transaction fee for card payments, which is slightly higher than some other gateways but still remains competitive for the Turkish market. There are no setup fees, which makes it easy for businesses to start accepting payments without upfront costs. Papara’s straightforward pricing ensures that businesses know exactly what to expect when it comes to payment processing costs. While the fees are higher than some international gateways, Papara’s local payment methods and seamless integration with the Turkish market make it a valuable option for businesses focusing on local customers. Businesses that cater to Turkish consumers will find Papara’s fee structure reasonable given its excellent customer support and local focus. The transparent fees ensure that businesses can manage their transaction costs effectively.

| Fee Type | Amount |

|---|---|

| Transaction Fee | 2.5% |

| Setup Fee | ❌ |

Integration Tools. Papara offers integration tools like an API, e-commerce plugins, and payment links, making it easy for businesses to start accepting payments right away. The API is designed to be user-friendly, allowing businesses to integrate Papara with their websites or apps without technical challenges. Papara’s e-commerce plugins are compatible with popular platforms, ensuring a seamless setup for businesses that use systems like WooCommerce or Shopify. These tools make Papara an efficient choice for businesses looking for a fast and simple integration. The payment links feature also allows businesses to accept payments directly from customers via a simple link. Whether you are running a small online store or a larger e-commerce business, Papara’s integration tools make it easy to offer a secure payment solution.

| Tool / Integration | Available | Setup |

|---|---|---|

| API | ✅ | Easy |

| E-commerce Plugins | ✅ | Easy |

| Payment Links | ✅ | Instant |

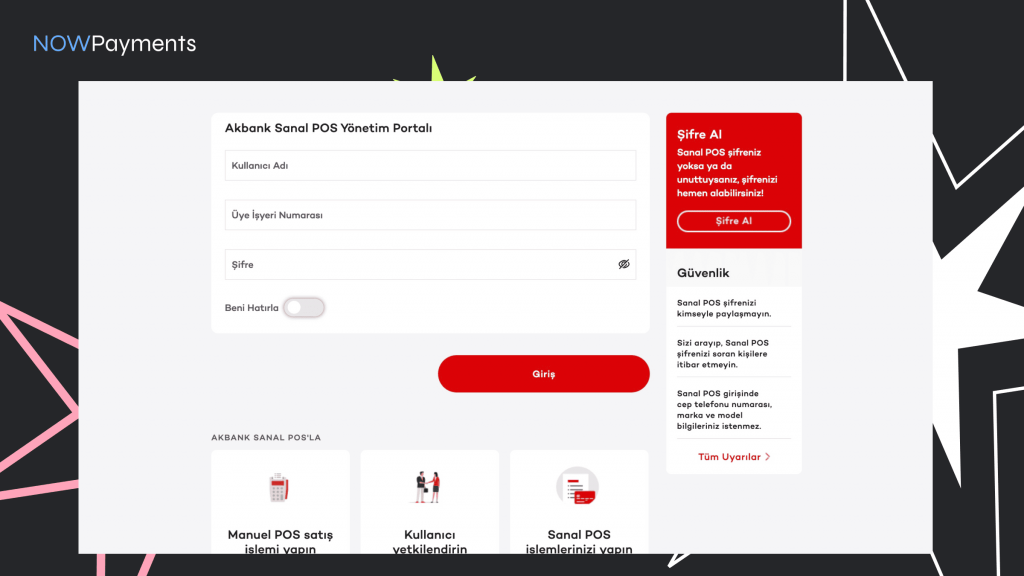

Akbank SanalPOS

Akbank SanalPOS is a trusted payment gateway in Turkey, backed by one of the most established banks, making it a strong choice for merchants who prioritize stability and a secure payment process. It’s designed for card processing and online transactions, helping Turkish merchants accept Visa and Mastercard as a preferred payment method for many shoppers. As a local payment gateway provider, it fits well into common payment systems used by businesses operating an online store and handling frequent online purchases. Akbank SanalPOS is especially useful for businesses that want predictable operations and strong local support in their payments in Turkey. For merchants trying to find the best balance of reliability and local fit, it’s a practical payment solution that focuses on core local payment methods.

Payment Method Support. Akbank SanalPOS focuses on mainstream payment methods in Turkey, with a strong emphasis on credit and debit card acceptance and bank-led processing. It supports Visa and Mastercard, which remain among the most popular payment methods for online shopping and repeat online transactions. For merchants that rely on consistent card payments, its bank-backed processor setup is built to deliver steady performance and a smooth checkout. It also supports bank transfer flows where available, adding an additional payment option for customers who prefer transfers. While it’s not positioned as an international payment gateway like Adyen or Stripe, it’s a strong local alternative among providers in Turkey. This creates a dependable base of multiple payment options tailored to a Turkish payment experience.

| Payment Method | Accept | Withdraw |

|---|---|---|

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

| Local Turkish Methods | ✅ | ✅ |

Transaction Fees. Akbank SanalPOS is known for competitive transaction fee positioning for card-based payments, particularly versus some higher-cost payment processors. With a headline rate often referenced around 1.0% (Visa/Mastercard), it can be appealing for merchants seeking the best rates on high-volume online transactions. This pricing can help businesses protect margins while still delivering a reliable payment service. For cost planning, the biggest advantage is that fees are easy to understand, supporting clearer forecasting and simpler payment details management. Compared with some gateway providers that bundle extra charges, this straightforward approach supports more efficient payment processing. As a result, it’s a strong fit for Turkish merchants who want predictable processing costs for payment card transactions.

| Fee Type | Amount |

|---|---|

| Transaction Fee | 1.0% |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Integration Tools. Akbank SanalPOS typically offers core integration capabilities expected from established gateway providers, including API connectivity and platform support suited for an online store. This makes it easier for businesses to connect the gateway to their existing payment systems without rebuilding the entire checkout flow. For many merchants, the main benefit is dependable integration for card payments with a consistent user journey and a stable payment experience. E-commerce plugins help speed up deployment for common storefront setups, while API access supports custom payment solution builds. It may not be as developer-extensive as global platforms like Stripe or Adyen, but it remains a practical local option available in Turkey. Overall, the integration toolkit supports day-to-day operations, including businesses that want to scale and potentially introduce recurring payments in supported configurations.

| Tool / Integration | Available | Setup |

|---|---|---|

| API | ✅ | Easy |

| E-commerce Plugins | ✅ | Easy |

| Custom Integration | ✅ | Complex |

Conclusion

In this article, we have analyzed the top payment gateways for businesses in Turkey, including NOWPayments, iyzico, PayU, Papara, and Akbank SanalPOS. While these gateways offer various benefits, NOWPayments emerges as the top choice for businesses in Turkey seeking to remain innovative. With its support for 350+ cryptocurrencies alongside traditional credit and debit card payments, NOWPayments offers unmatched flexibility, catering to both local customers and global audiences. Its low transaction fees and seamless integration tools make it an affordable, efficient solution for businesses of all sizes. By offering a broad range of payment methods, NOWPayments ensures that businesses can meet the diverse preferences of their customers while maintaining a cost-effective payment process.

NOWPayments‘ top advantages lie in its ability to support both crypto and fiat payments, giving businesses the opportunity to tap into the growing digital currency market. Additionally, its straightforward integration with popular e-commerce platforms and no setup fees make it quick and simple to start accepting payments. For businesses in Turkey, NOWPayments is a future-proof payment solution that provides flexibility, scalability, and low processing costs, making it the optimal choice for businesses aiming to expand their reach and embrace the future of payments.