Payment gateways are essential tools that facilitate the payment process for businesses, allowing them to accept payments online and in-store. These systems enable merchants to offer a wide range of payment methods, including credit card, debit, and digital payment options like Google Pay and Apple Pay. By integrating an online payment gateway, businesses can provide a seamless checkout experience for their customers, whether they are local or international customers. Utilizing a payment processor allows for global payment processing and can help businesses choose the best payment solution for their needs, taking into account transaction fees and per transaction costs.

Moreover, payment gateways support various alternative payment methods and local payment methods, accommodating diverse customer preferences. This flexibility enhances the payment experience and encourages businesses to adopt multiple payment options. For instance, 2Checkout and other payment providers offer secure payment solutions that help businesses in Spain and beyond to thrive in the payment ecosystem. By leveraging digital wallets and other innovative payment technologies, merchants can streamline their operations and improve customer satisfaction.

How Do Payment Gateways They Work?

Payment gateways are crucial for facilitating international payment transactions, allowing businesses to accept popular payment methods like credit and debit cards and mobile payment options. They work by securely transferring customer payment information through an API to the financial institution, ensuring the transaction is processed efficiently. In the Spanish market, popular gateways such as Bizum and those owned by PayPal are among the top payment options available, helping online businesses navigate the payment landscape in Spain and start accepting payments seamlessly.

These gateways support cross-border payments and provide solutions for currency conversion, making it easier for businesses to operate globally. With 250 payment methods available, companies can choose the best payment gateway that fits their needs. The PSD2 regulation enhances security, allowing financial institutions to offer all-in-one payment solutions that cater to different business models. By integrating accounting software with payment gateways, businesses can streamline their operations and improve efficiency.

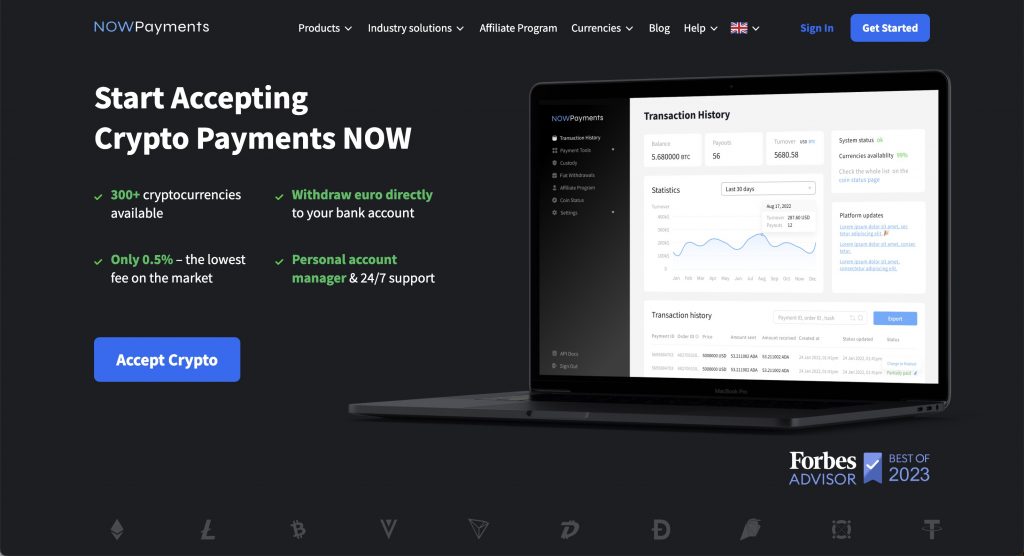

NOWPayments as the best payment gateway in Spain

NOWPayments has emerged as one of the most widely recognized payment gateways in Spain, offering businesses a reliable solution for both point-of-sale and online transactions. As a member of the European Union, it ensures compliance with local regulations while providing a seamless experience for customers and merchants. The payment gateway allows businesses to choose the one that best fits their needs, offering a variety of payment methods via credit cards, including Visa, as well as cryptocurrencies.

With a global presence, NOWPayments is one of the most trusted options for international transactions. The payment service is designed to accommodate global enterprises and small businesses alike, helping them expand their business effortlessly. While some payment gateways offer lower fees, NOWPayments provides a good balance between service quality and cost, making it an attractive choice despite relatively high transaction fees.

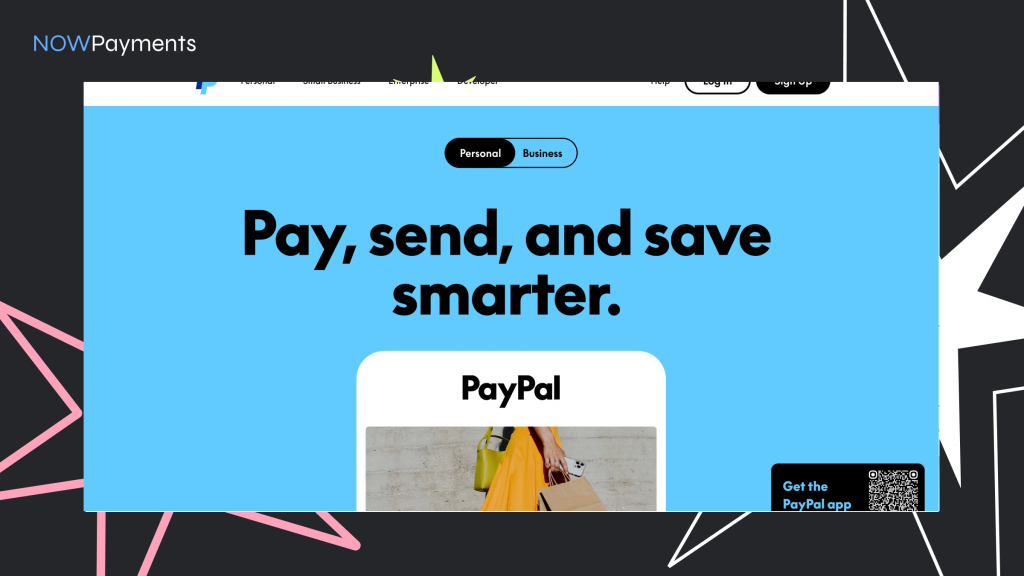

PayPal payment gateway in Spain

PayPal has become a popular payment gateway in Spain, offering a reliable solution for online transactions. With its user-friendly interface, it allows customers to complete purchases effortlessly, making it a top choice for both consumers and merchants. Many businesses use PayPal to facilitate various payment methods, including credit cards, bank transfers, and PayPal balances.

Moreover, Spanish consumers have shown a strong preference for using PayPal due to its robust security features and buyer protection policies. This has encouraged more businesses to integrate PayPal into their payment systems, enhancing customer trust and satisfaction. By adopting this widely used payment gateway, companies can streamline their checkout processes and attract a broader audience.

Ultimately, leveraging PayPal can significantly help you expand your business in Spain, tapping into the growing trend of online shopping and digital payments. As PayPal continues to gain traction, it’s essential for businesses to keep up with these changes to remain competitive in the market.

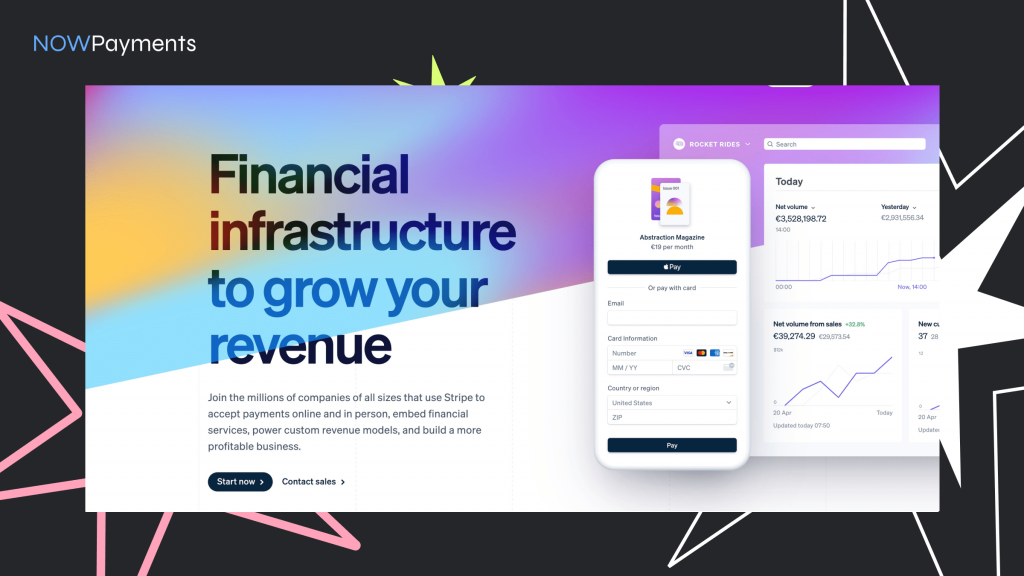

Stripe payment gateway in Spain

Stripe has emerged as a leading payment gateway Spain, offering businesses a seamless solution for processing online transactions. With its user-friendly interface and robust features, Stripe enables merchants to accept payments effortlessly, whether through e-commerce platforms or mobile applications.

In addition to online payments, Stripe also supports POS systems, allowing retailers to integrate their in-store transactions with their online sales. This unified approach helps businesses manage their finances more efficiently, providing valuable insights into customer behavior and sales trends.

As more businesses in Spain embrace digital payments, Stripe’s payment gateway Spain is becoming increasingly vital. Its advanced security measures and flexible payment options ensure that both merchants and customers can transact with confidence.

Ultimately, Stripe’s commitment to innovation and ease of use makes it an indispensable tool for businesses looking to thrive in the competitive Spanish market.

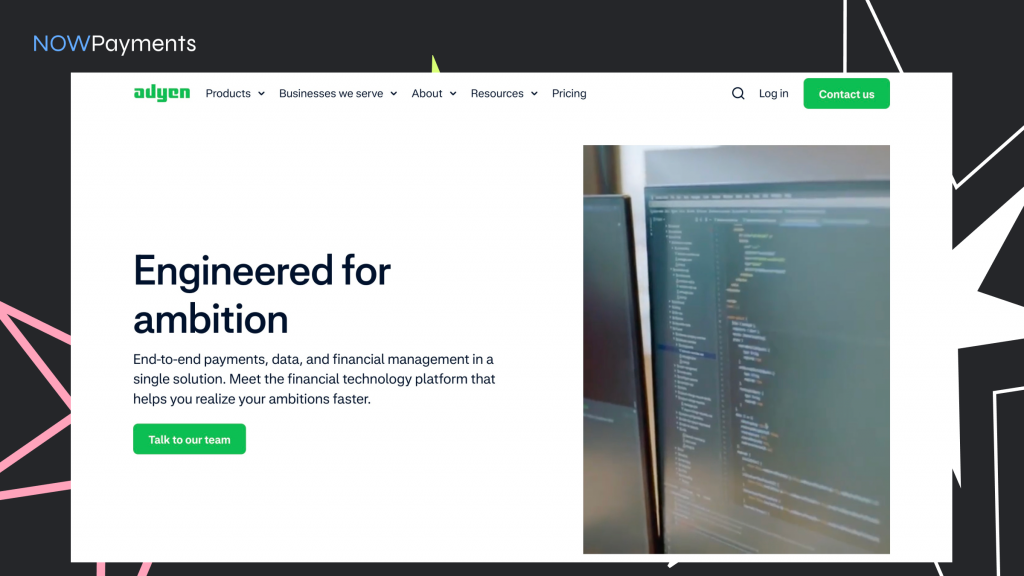

Adyen payment gateway in Spain

Adyen is a leading payment gateway in Spain, providing businesses with a comprehensive solution for managing transactions both online and in-store. Its platform supports a diverse range of payment methods, enabling merchants to cater to a wide array of customer preferences. With an emphasis on seamless integration, Adyen allows companies to incorporate its services into their existing systems, enhancing operational efficiency and user experience.

One of the standout features of Adyen is its robust analytics and reporting tools, which empower businesses to gain insights into customer behavior and transaction patterns. This data-driven approach helps merchants optimize their payment strategies and improve overall sales performance. Furthermore, Adyen’s commitment to security ensures that transactions are processed safely, safeguarding sensitive customer information against fraud.

As e-commerce continues to flourish in Spain, Adyen remains a pivotal player in the payments landscape, supporting both local and international businesses in their growth journeys.

Payid19 payment gateway in Spain

Payid19 is an innovative payment gateway that has recently gained traction in Spain, offering businesses a seamless way to manage transactions online. Designed with user-friendliness in mind, it allows merchants to accept payments from various sources, including credit cards, digital wallets, and bank transfers. This versatility makes it a valuable tool for both small startups and established enterprises.

One of the standout features of Payid19 is its robust security measures, ensuring that sensitive customer information is protected during transactions. Additionally, the gateway supports multiple currencies, making it an ideal solution for businesses that cater to both local and international clients. With its competitive transaction fees and efficient customer support, Payid19 is quickly becoming a preferred choice for merchants in Spain. As e-commerce continues to grow, the demand for reliable payment solutions like Payid19 is expected to rise significantly.

Conclusion why NOWPayments is the best in Spain

In conclusion, NOWPayments stands out as the best cryptocurrency payment gateway in Spain for several compelling reasons. First and foremost, its user-friendly interface allows businesses of all sizes to seamlessly integrate crypto payments into their operations, making it accessible for both seasoned merchants and newcomers alike.

Moreover, NOWPayments offers an extensive selection of cryptocurrencies, catering to the diverse preferences of Spanish consumers. This wide array of options not only enhances customer satisfaction but also helps businesses attract a broader audience.

Additionally, the platform’s competitive transaction fees ensure that merchants can maximize their profits without sacrificing quality. With robust security measures in place, NOWPayments provides peace of mind for both businesses and customers, ensuring that transactions are safe and reliable.

Ultimately, the combination of ease of use, diverse options, and strong security makes NOWPayments the premier choice for cryptocurrency payments in Spain.