The Mexican payment landscape is rapidly evolving, particularly as we look towards 2024. With a surge in online shopping, consumers increasingly prefer digital payment methods that offer convenience and security. Popular payment solutions now include a variety of payment options, including mobile payment and card payments, which allow businesses to accept payments seamlessly. The payment infrastructure in Mexico is supported by numerous payment service providers and payment processors, facilitating international payment systems and local payment methods.

Additionally, Bank of Mexico plays a crucial role in regulating and enhancing the payment system, ensuring a robust framework for payment processing. Consumers can choose from multiple payment methods, including credit and debit cards and cash payment, catering to a diverse market. As e-commerce continues to grow, the demand for flexible payment platforms will only increase, making it essential for online stores to accept online payments through reliable payment gateway providers that enhance the payment experience.

The most popular Mexico payment methods

In Mexico in 2024, the payment market is thriving, showcasing a variety of payment methods in Mexico. Among the most popular options are credit cards, which are widely accepted by companies in Mexico. Many businesses are increasingly accepting payments in Mexico through payment gateways that facilitate global payment transactions. This shift is driven by the growing demand for seamless financial services and the need for efficient transaction processes.

Furthermore, alternative payment methods are gaining traction across the country. Many consumers prefer to utilize alternative payment platforms, allowing them to choose a payment solution that aligns with their preferences. As a result, providers in Mexico are offering several payment methods, including digital wallets and bank transfers. This trend reflects a broader movement in Latin America, where users are increasingly leveraging payment analytics to find the best payment options available. With such diverse payment networks, businesses can effectively accept card payments and cater to the evolving needs of their customers.

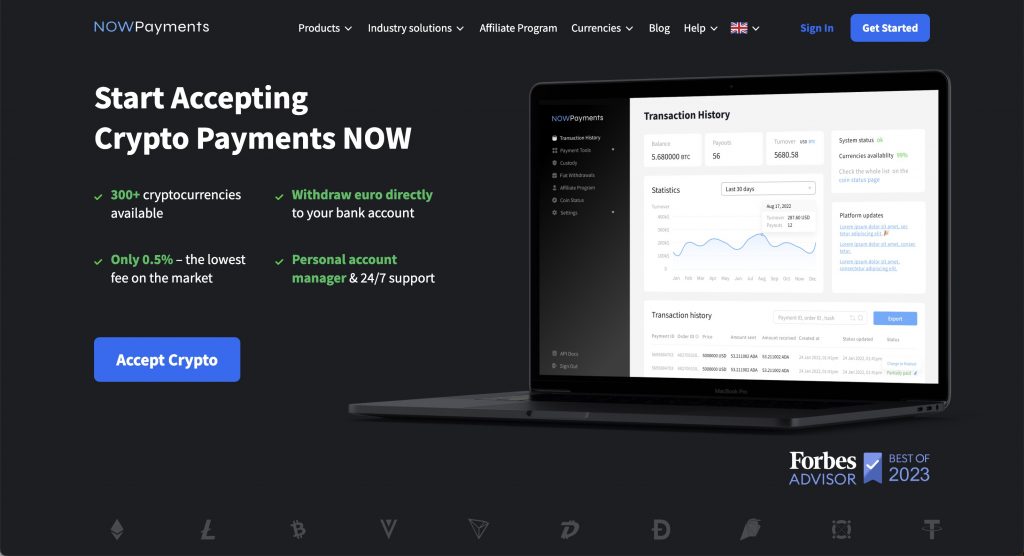

NOWPayments as the best payment gateway in Mexico

In the rapidly evolving market in Mexico, NOWPayments stands out as the best payment provider for businesses looking to enhance their online transactions. This innovative platform facilitates a wide variety of payment options, enabling merchants to accept online payments seamlessly. With its integration into various e-commerce platforms, NOWPayments allows businesses to accept and send payments using popular payment methods such as credit card payments and mobile payment services, catering to the diverse needs of consumers in the region.

As a prominent player among Mexico payment gateways, NOWPayments offers a payment system that allows users to choose the best custom payment solutions tailored to their business requirements. With the support of the Banco de Mexico, this platform enables transactions through different payment methods, ensuring that both merchants and customers benefit from a smooth and secure payment experience. By leveraging a wide variety of payment options, NOWPayments empowers businesses to thrive in an increasingly competitive landscape, solidifying its position as a top payment gateway in the country.

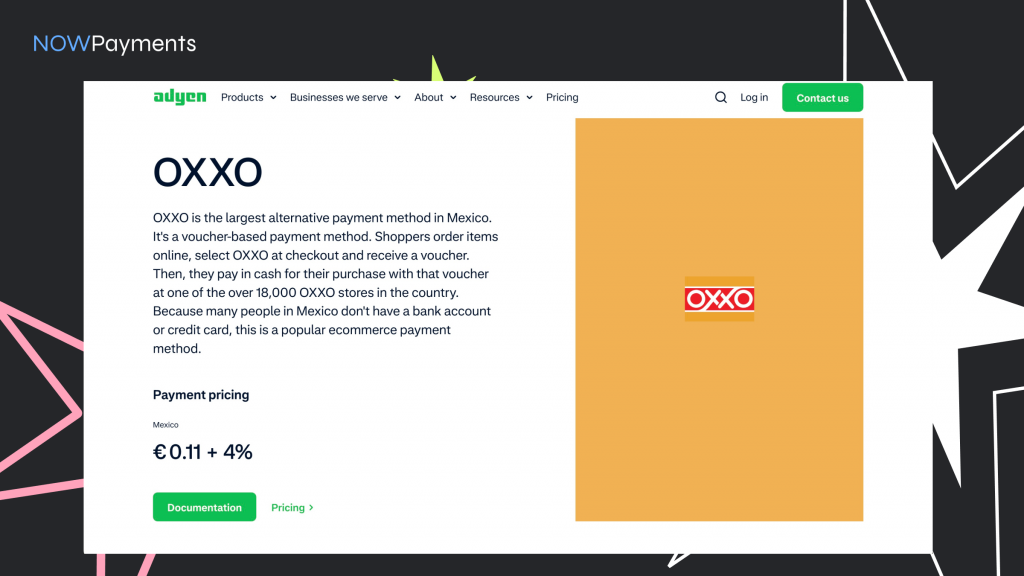

OXXO as payment gateway in Mexico

OXXO has emerged as a significant payment gateway in Mexico, serving as a crucial facilitator for online payment systems. As one of the most widely used payment options, it enables businesses to accept online payments in Mexico seamlessly. The platform is particularly beneficial for e-commerce businesses seeking to offer various payment methods, including payment card transactions and cash payments. This versatility aligns with the growing adoption of digital payments across the nation.

In the evolving landscape in Mexico, OXXO stands out among multiple providers in Mexico, making it a suitable payment choice for merchants. The framework for digital financial services ensures that payments are regulated and secure, enhancing user confidence in the digital payment system. As Mexico reached new milestones in electronic payment systems, OXXO continues to lead the way in offering secure payment methods, allowing businesses to start accepting payments with ease and reliability.

BBVA as payment gateway in Mexico

BBVA has emerged as a leading payment gateway in Mexico, catering to the growing demand for online payment services. As e-commerce continues to expand, businesses are increasingly seeking reliable providers in Mexico to facilitate e-commerce payment solutions. BBVA’s platform offers a seamless experience, enabling merchants to process transactions efficiently and securely.

With its robust infrastructure, BBVA supports various financial payment methods, ensuring that consumers and businesses can access a wide range of options. This is particularly important in a country where Mexico is one of the largest markets for digital transactions in Latin America. By providing access to financial services for both small and large enterprises, BBVA is paving the way for new payment innovations that enhance the overall shopping experience.

SPEI as payment gateway in Mexico

SPEI, or the Interbank Electronic Payment System, serves as a vital payment gateway in Mexico, facilitating seamless transactions between banks and financial institutions. This innovative system allows users to transfer funds instantly, making it an essential tool for both consumers and businesses across the country. As a result, many providers in Mexico have integrated SPEI into their services to enhance payment processing efficiency.

The adoption of SPEI has transformed the landscape of platforms in Mexico, enabling a wide range of services, from e-commerce to bill payments. Retailers and service providers benefit from the platform’s speed and reliability, which fosters customer trust and satisfaction. Moreover, the ease of using SPEI has encouraged more people to engage in digital transactions, thus driving financial inclusion in the nation.

With the growing number of providers in Mexico embracing SPEI, the payment ecosystem continues to evolve, paving the way for future innovations. As more consumers and businesses recognize the advantages of this payment gateway, it is likely to remain a cornerstone of Mexico’s financial landscape, promoting efficiency and accessibility.

Mercado Pago as payment gateway in Mexico

In recent years, providers Mexico have increasingly embraced digital payment solutions, with Mercado Pago emerging as a leading payment gateway. This platform allows businesses to process transactions seamlessly, catering to both online and offline sales. Its user-friendly interface and robust security features make it a preferred choice among merchants and consumers alike.

One of the key advantages of Mercado Pago is its integration with various e-commerce platforms, making it accessible for small and large businesses. Additionally, it offers features like payment splitting, enabling vendors to easily share transaction fees with partners. This flexibility has made it a popular option among providers Mexico, who need efficient and reliable payment processing solutions.

Furthermore, Mercado Pago supports multiple payment methods, including credit and debit cards, bank transfers, and even cash payments through OXXO stores. This diverse range of options ensures that customers have a convenient way to pay, ultimately enhancing their shopping experience.

Conclusion

In Mexico’s dynamic and competitive payment landscape, NOWPayments emerges as the best payment gateway for businesses seeking a flexible, secure, and efficient solution. Its ability to support a wide variety of payment methods—including digital wallets, mobile payments, and credit cards—positions it as a versatile choice for merchants looking to cater to the evolving needs of Mexican consumers.

NOWPayments goes beyond traditional gateways by enabling seamless integration into e-commerce platforms and offering customized solutions tailored to businesses of all sizes. With robust security measures, minimal transaction fees, and real-time processing capabilities, NOWPayments ensures that businesses can thrive in Mexico’s growing digital economy. By choosing NOWPayments, companies gain a competitive edge, empowering them to deliver a smooth and modern payment experience that meets the demands of both local and international customers.