A payment gateway is a technology that enables businesses to accept online payments by securely processing transactions and facilitating communication between merchants and financial institutions. It allows businesses to offer various payment options to their customers, including credit and debit cards, digital wallets like PayPal, Google Pay, and Apple Pay, as well as alternative payment methods like bank transfers and contactless payments.

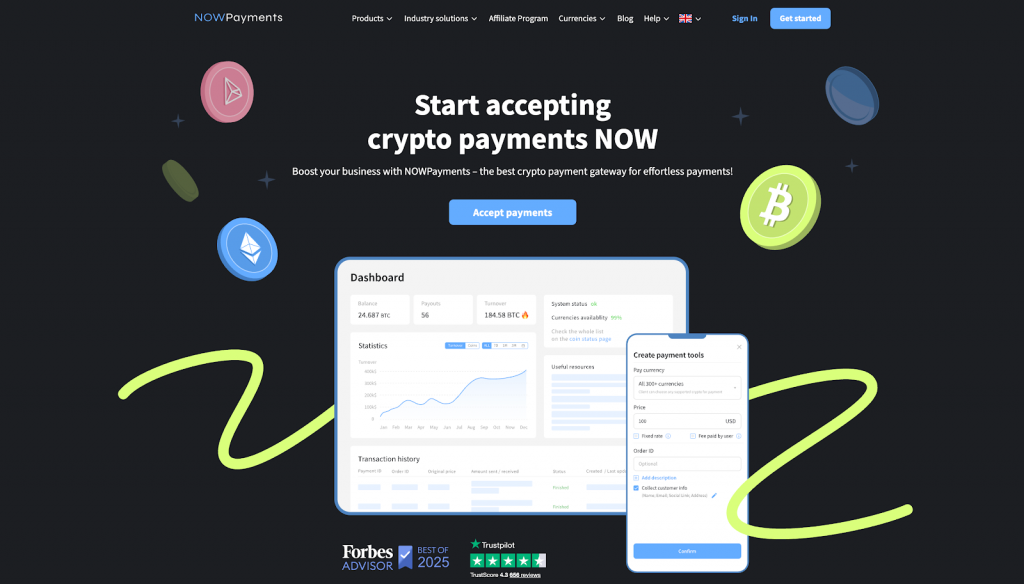

The best payment gateway for Finland in our rating is NOWPayments because of its seamless integration with a wide range of payment methods and its strong support for cryptocurrencies, a growing trend among Finnish consumers and businesses operating in Finland. This payment solution allows businesses to process global payments, including cross-border transactions, while benefiting from low transaction fees and secure payment processing.

Choosing the right payment provider in 2026 is critical for businesses in Finland, where digital payments continue to reshape the payment market. With Finnish consumers increasingly relying on mobile payment solutions and contactless payments, businesses must be ready to offer a smooth checkout experience. Moreover, as cross-border payments become more common, a payment gateway that supports SEPA and international payments is essential. As Finland embraces both local payment methods like bank transfers and global payment systems, it’s important for businesses to offer flexible payment options to cater to a diverse customer base.

Here’s a list of payment gateways for Finland in 2026:

- NOWPayments

- Paytrail

- Rapyd

- Adyen

- Mollie

What We Considered When Choosing the Best Payment Gateway: Our Selection Criteria

In order to provide an unbiased comparison, we evaluated the payment gateways based on features that are most critical for businesses operating in Finland. Our goal was to ensure that each selected gateway could meet the unique demands of Finnish businesses and consumers, particularly in terms of security, convenience, and cost-effectiveness.

The three key criteria we focused on when selecting the best payment gateways for Finland are:

- Supported Payment Methods: Critical for ensuring the gateway supports a wide range of payment options, including local and global methods such as credit/debit cards, digital wallets, bank transfers, and cryptocurrencies, catering to the diverse preferences of Finnish consumers.

- Transaction Speed: Essential for businesses to process payments quickly and ensure a seamless checkout experience for customers, impacting both customer satisfaction and operational efficiency.

- Custody: Non-negotiable for maintaining security and compliance, ensuring that funds are handled securely, whether custodial or non-custodial, to build trust with Finnish customers and comply with regulations.

The comparative table below summarizes how each gateway performs in these three decisive categories, which we will explore in detail for each provider.

| Payment Gateway | Supported Payment Methods | Transaction Speed | Custody |

| NOWPayments | 350+ cryptocurrencies, 40+ fiat currencies | 45 seconds – 3 minutes | Non-custodial (custody available on request) |

| Paytrail | Finnish bank transfers, cards, local payment methods | Instant confirmation, 1–2 days settlement | Custodial |

| Rapyd | Cards, digital wallets, bank transfers, alternative payments | Near-instant processing | Custodial |

| Adyen | Cards, local European methods, Apple Pay, Google Pay | Instant confirmation, 1–2 days settlement | Custodial |

| Mollie | Cards, digital wallets, SEPA bank transfers | Instant processing | Custodial |

NOWPayments

NOWPayments is the best crypto payment gateway that allows businesses to accept payments in Finland and globally using modern digital payment solutions. It is designed for online businesses, startups, and enterprises that operate across Finland and internationally, offering a powerful payment platform for both crypto and fiat transactions. The gateway supports seamless online payment processing while giving merchants flexibility across global and local payment environments. Its architecture fits well into the evolving payment ecosystem, where fintech innovation and alternative payment methods are increasingly important. As digital payments in Finland continue to grow beyond trends seen in 2026, NOWPayments provides a future-proof solution. It is especially attractive for businesses looking to integrate the best payment experience for tech-savvy Finnish consumers and cross-border customers.

Supported Payment Methods. NOWPayments supports one of the widest ranges of payment methods available in the global payment market. Merchants can accept over 350 cryptocurrencies and 40+ fiat currencies, including euro-based payments suitable for European payment systems. This allows businesses to serve customers who prefer crypto, debit and credit cards, or alternative digital payments. The gateway supports global payment flows while remaining compatible with payments within the Single Euro Payments Area (SEPA) through partners. This flexibility is ideal for e-commerce, online shopping, and cross-border payments. It helps businesses offer popular payment options without relying on multiple payment providers.

- Number of Currencies: 350+ cryptocurrencies, 40+ fiat

- Stablecoins: ✅ USDT, USDC, others

- Debit & Credit Cards: ✅ via fiat on-ramps

- Bank Transfers: ✅ SEPA-supported via partners

Transaction Speed. Transaction speed plays a critical role in online transactions and overall checkout experience, and NOWPayments performs exceptionally well. Most payments are confirmed within 45 seconds to 3 minutes, depending on blockchain conditions. This fast payment processing improves conversion rates and reduces friction during online shopping. For businesses handling high volumes of daily transactions, speed directly impacts customer satisfaction. The platform operates 24/7, unlike traditional online banking systems. This makes it ideal for global and local payment flows across different time zones.

| Speed Metric | Timeframe |

| Payment Confirmation | 45 sec – 3 min |

| Funds Availability | Near-instant |

| 24/7 Operation | ✅ |

Custody. NOWPayments follows a non-custodial model by default, giving businesses full control over their funds. This approach enhances secure payment handling and reduces reliance on third-party fund storage. Funds are transferred directly to merchant-controlled wallets, supporting transparency and trust. For businesses that require managed solutions, a custodial option is available on request. This dual approach makes NOWPayments suitable for both crypto-native startups and more traditional enterprises. It aligns well with modern expectations around trustworthy payment systems and fraud risk management.

- Funds Model: Non-custodial (custody available on request)

- Funds Hold Period: Instant

- Security Focus: Merchant-controlled wallets

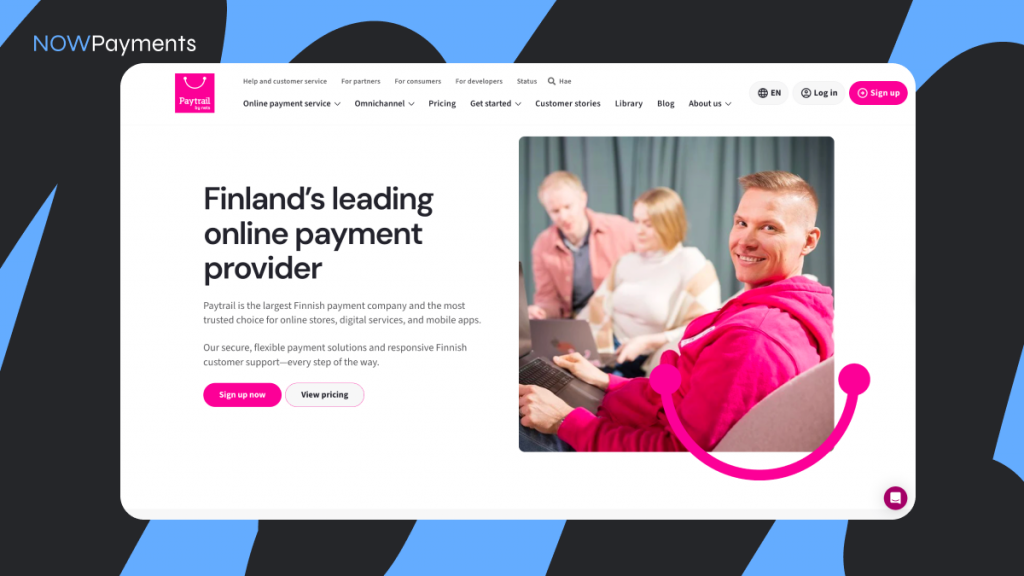

Paytrail

Paytrail is a leading Finnish payment gateway that focuses primarily on domestic payments in Finland. It is widely trusted by Finnish consumers due to its strong integration with local banks and familiar payment systems. The platform is especially well suited for businesses operating in Finland that prioritize local customer acceptance. Paytrail plays an important role in the Finnish payment environment and supports many everyday transactions. Its strengths lie in reliability, trust, and local relevance rather than international reach. This makes it a solid option for Finnish-focused e-commerce businesses.

Supported Payment Methods. Paytrail specializes in local payment methods that are widely preferred by Finns. It supports Finnish online banking, debit cards, and card payments that dominate transactions in Finland. These payment methods reflect how most daily and recurring payments are made by Finnish customers. Digital wallets and alternative payment methods are more limited compared to global platforms. However, the strong local coverage results in high customer trust and familiarity. This makes Paytrail effective for domestic checkout experiences.

- Currency: EUR

- Debit & Credit Cards: ✅

- Bank Transfers: ✅ Finnish online banking

- Digital Wallets: Limited

Transaction Speed. Paytrail provides instant confirmation at checkout, ensuring that customers receive immediate feedback. This creates a smooth and predictable payment experience during online shopping. Settlement to merchants typically takes one to two business days. This timeframe aligns with standard payment systems used across Finland. While payouts are not instant, they are reliable and consistent. This stability suits businesses focused on local operations.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement | 1–2 days |

| 24/7 Operation | ❌ |

Custody. Paytrail uses a custodial payment model in which funds are temporarily held before settlement. This structure simplifies regulatory compliance and reporting for businesses. It also reduces the technical complexity of managing payments internally. Merchants do not have direct control over funds during processing. This model is common among traditional Finnish payment service providers. It works well for businesses prioritizing simplicity over custody control.

- Funds Model: Custodial

- Settlement Type: Scheduled payouts

- Compliance: Finnish & EU regulations

Rapyd

Rapyd is a global payment gateway designed to support cross-border commerce and international growth. It enables businesses in Finland to accept payments using local methods in many different countries. The platform is popular among fintech companies and startups that operate across multiple markets. Rapyd focuses on localization at scale rather than specializing in one domestic payment environment. It supports both online and offline payment scenarios. This makes it suitable for businesses expanding beyond Finland.

Supported Payment Methods.

Rapyd supports a wide range of payment options, including card payments, digital wallets, and bank transfers. This allows businesses to tailor payment methods to different regions and customer preferences. Such localization helps improve conversion rates in international markets. While cryptocurrency payments are not a primary focus, alternative payment methods are well supported. Finnish businesses benefit from simplified access to global payment systems. This coverage supports efficient cross-border expansion.

- Card Payments: ✅ Visa, Mastercard

- Digital Wallets: ✅ multiple global wallets

- Bank Transfers: ✅ local & international

Transaction Speed. Most Rapyd transactions are processed instantly at checkout, providing immediate confirmation to customers. This helps maintain a smooth and professional checkout experience. Settlement times vary depending on the country and payment method used. Card and digital wallet payments are generally processed quickly. This flexibility supports a wide range of global payment scenarios. Speed consistency depends largely on regional infrastructure.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement | Region-dependent |

| 24/7 Operation | ✅ |

Custody. Rapyd operates using a custodial payment model that is standard among global payment processors. Funds are held temporarily before being settled to the merchant. This simplifies currency conversion and compliance with local regulations. It also reduces operational complexity for businesses managing international payments. Merchants do not directly control funds during processing. This trade-off is typical for platforms focused on global reach.

- Funds Model: Custodial

- Settlement: Method-based

- Compliance: Global regulations

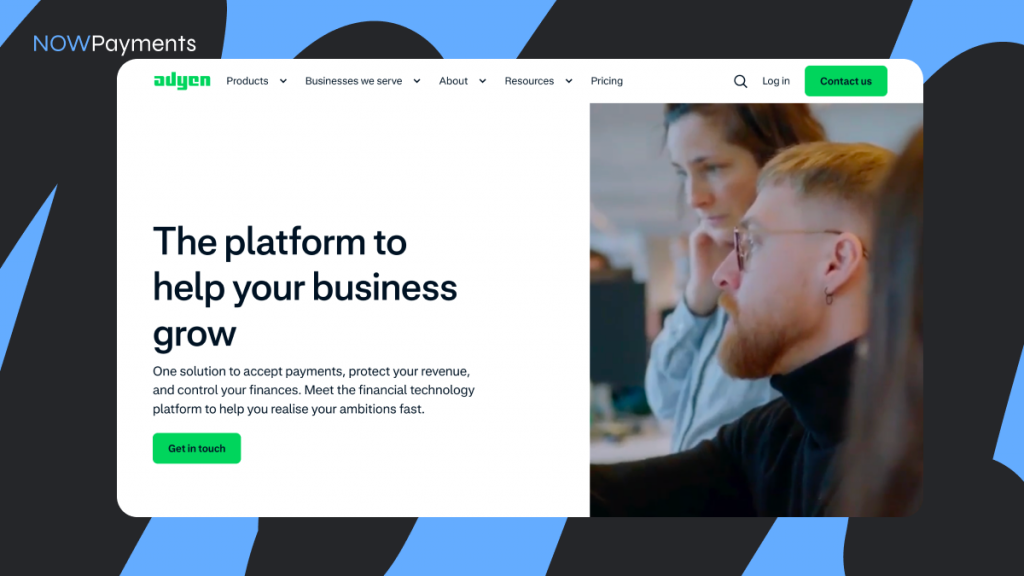

Adyen

Adyen is an enterprise-grade payment gateway built to support large-scale payment operations. It offers a unified commerce solution covering online, in-store, and mobile payments. The platform is trusted by major global brands for handling high transaction volumes. Adyen plays a significant role in the European payment landscape, including Finland. It is particularly suitable for businesses operating across multiple EU markets. Its main strengths are scalability, reliability, and performance.

Supported Payment Methods.

Adyen supports a broad selection of European and global payment methods. These include debit and credit cards, Apple Pay, Google Pay, and local European options. Finnish merchants benefit from seamless euro-based transactions. The platform supports omnichannel strategies across online and physical stores. This flexibility enhances the overall payment experience. It is well suited for complex retail environments.

- Debit & Credit Cards: ✅

- Digital Wallets: ✅ Apple Pay, Google Pay

- Local Methods: ✅ European payment options

Transaction Speed. Adyen provides instant authorization for most transactions at checkout. Customers experience fast and consistent payment flows. Settlement typically occurs within one to two business days. This timing is optimized for enterprise-level operations. The platform efficiently handles large volumes of transactions. Reliability is one of its key advantages.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement | 1–2 days |

| 24/7 Operation | ✅ |

Custody. Adyen operates under a custodial payment structure. Funds are settled according to predefined payout schedules. This model supports compliance with EU regulations and data protection requirements. Merchants benefit from simplified financial oversight and reporting. Direct control over funds during processing is limited. This approach is standard for enterprise payment processors.

- Funds Model: Custodial

- Settlement: Scheduled payouts

- Compliance: PCI DSS, GDPR

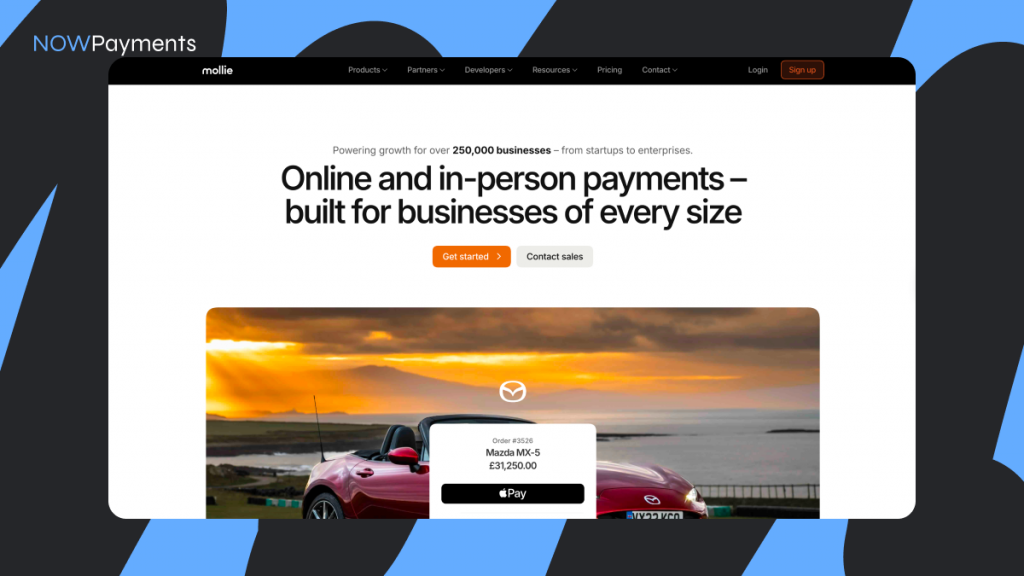

Mollie

Mollie is a European payment gateway known for its simplicity and transparent pricing model. It is especially popular among small and medium-sized online businesses. The platform focuses on easy integration and clear payment flows. Mollie supports key payment methods used across Finland and the wider EU. It fits naturally into the modern European payment ecosystem. It is a practical choice for growing e-commerce stores.

Supported Payment Methods. Mollie supports major card payments, digital wallets, and SEPA bank transfers. These options align well with popular payment methods in Finland. Finnish customers benefit from familiar and trusted checkout options. Cryptocurrency support is limited compared to crypto-focused gateways. However, traditional payment coverage is strong and reliable. Integration with common e-commerce platforms is straightforward.

- Debit & Credit Cards: ✅

- Digital Wallets: ✅ Apple Pay, Google Pay

- Bank Transfers: ✅ SEPA

Transaction Speed. Payments through Mollie are confirmed instantly for most methods. This ensures a smooth checkout experience for customers. Settlement usually takes one to two business days. This provides predictable cash flow for merchants. Speed is consistent across supported European markets. It aligns well with EU banking standards.

| Speed Metric | Timeframe |

| Payment Confirmation | Instant |

| Settlement | 1–2 days |

| 24/7 Operation | ❌ |

Custody. Mollie uses a custodial payment model where funds are held briefly before payout. This simplifies payment management for businesses. The approach supports compliance with European regulations. Merchants do not control funds during processing. This structure prioritizes ease of use and reliability. It suits businesses seeking straightforward payment operations.

- Funds Model: Custodial

- Settlement: Short payout window

- Compliance: EU regulations

Final Thoughts

In this guide, we have analyzed the main payment gateways in Finland for 2026, including NOWPayments, Paytrail, Rapyd, Adyen, and Mollie, focusing on how well they meet the needs of businesses operating in the Finnish payment environment. Each payment gateway offers distinct advantages, from strong local payment method support and trusted domestic solutions to scalable global payment processing for cross-border e-commerce. As digital payments in Finland continue to expand and customer expectations around speed, security, and convenience increase, selecting the right payment gateway has become a critical business decision. The comparison clearly shows how supported payment methods, transaction speed, and custody models influence the overall checkout experience and long-term scalability. For businesses serving Finnish consumers while also targeting international markets, flexibility within the European and global payment ecosystem is essential. These factors define what makes a payment solution truly competitive in Finland in 2026.

NOWPayments stands out as the best payment gateway for Finland because it combines unmatched payment flexibility with a forward-looking, crypto-friendly approach. With support for over 350 cryptocurrencies and 40+ fiat currencies, businesses can accept payments using both global and local payment methods while preparing for future payment trends. Its fast transaction speeds significantly enhance the online payment experience, while the non-custodial model ensures businesses retain full control over their funds, with custodial options available when needed. These advantages make NOWPayments particularly well suited for fintech-driven startups, growing e-commerce stores, and enterprises seeking modern payment solutions. By delivering speed, security, and global reach in one platform, NOWPayments empowers businesses to scale confidently. For forward-thinking businesses operating in Finland, NOWPayments is the optimal payment gateway choice in 2026.