A payment gateway is a piece of technology that lets businesses safely and quickly accept payments online. It connects customers and businesses and processes several types of payments, such as credit and debit cards, mobile payments, and digital wallets. Payment gateways in Denmark are the basic building blocks that make it possible to handle both domestic and international transactions. They make sure that payments made online and in stores are safe and go smoothly.

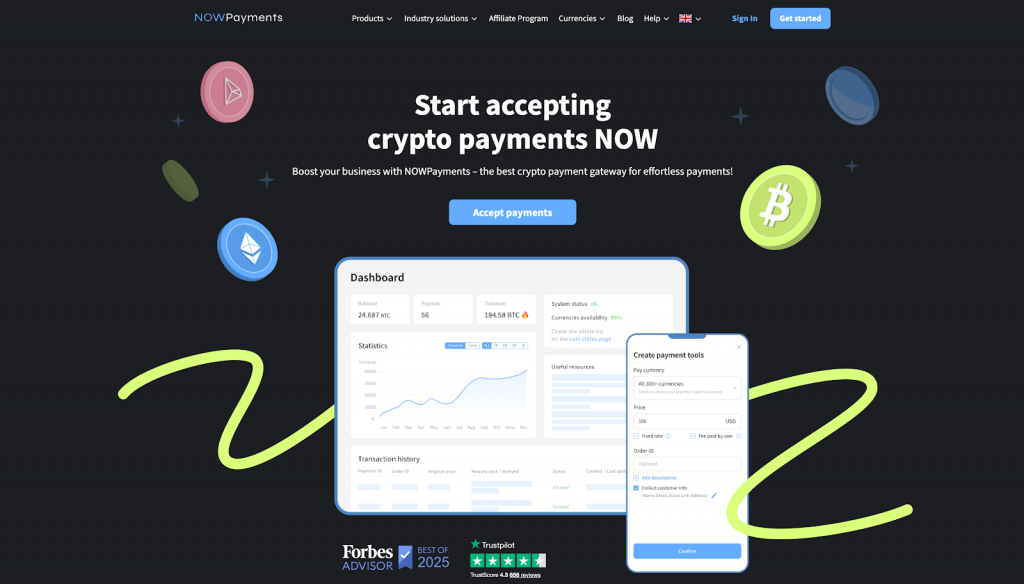

NOWPayments is the top payment gateway provider on our list because of its seamless integration, low transaction fees, and support for multiple digital payment methods, including cryptocurrencies. Businesses in Denmark can easily start taking payments in Danish krone as well as popular international payment methods like Visa, Mastercard, PayPal, and even mobile payment options like MobilePay. Because it does not hold funds, businesses can keep control of their money, which is a big plus in Denmark, where both local and international transactions are becoming more popular.

As the payment ecosystem changes, businesses in Denmark must choose the appropriate payment gateway in 2026. Businesses in Denmark need to change how they do business so that Danish online consumers can pay in a way that is both safe and flexible. This is because mobile payment apps like MobilePay and global digital wallets like Apple Pay and Google Pay are becoming more popular. Merchants can make the checkout process easier, lower the number of people who leave their carts and improve the overall payment experience by choosing the right payment solution. Also, firms must make sure that their payment systems follow rigorous client authentication rules as part of the Payment Services Directive 2 (PSD2). These changes will keep online transactions safe. The correct payment gateway will help firms get more customers and stay ahead in the Danish online shopping sector, which is very competitive.

Here’s a list of payment gateways for Denmark:

- NOWPayments

- Stripe

- PayPal

- Klarna

- QuickPay

What We Considered When Choosing the Best Payment Gateway: Our Selection Criteria

Our goal was to create an unbiased comparison based on the features that are most critical for businesses in Denmark. We focused on the key aspects that directly impact payment processing, security, and customer experience, ensuring our selection was relevant and practical for local merchants.

- Supported Payment Methods: Essential for catering to Danish consumer preferences, which include traditional card payments, local methods like Dankort, and mobile payments like MobilePay.

- Transaction Fees: A critical factor in maintaining profitability, especially for businesses in Denmark where competitive pricing and low transaction costs are key to success.

- Custodial/Non-Custodial Flow: Important for businesses to maintain control over their funds, particularly in a market like Denmark where security and transparency are highly valued.

The comparative table below summarizes how each gateway performs in these three decisive categories, which we will explore in detail for each provider.

| Payment Gateway | Supported Payment Methods | Transaction Fees | Custodial/Non-Custodial Flow |

| NOWPayments | 350+ Cryptos, 40+ Fiat | 0.5% for crypto, No setup fees | Both options |

| Stripe | Visa, Mastercard, Apple Pay, ACH | 1.4% + €0.25 (EU), extra for international | Custodial: Holds funds until withdrawal |

| PayPal | PayPal, Cards, Bank Transfers | 2.9% + €0.35 (intl.) | Custodial: Holds funds until transferred |

| Klarna | Cards, Bank Transfers, BNPL | 2.49% per transaction | Custodial: Manages funds before payout |

| QuickPay | Visa, Mastercard, Local Payments | Custom pricing | Custodial: Manages funds for businesses |

NOWPayments

NOWPayments is the best crypto payment gateway since it lets businesses in Denmark and throughout the world accept payments in more than 350 cryptocurrencies and 40 fiat currencies, including the Danish Krone. It makes it easy for online stores to add a wide range of payment alternatives, like credit and debit cards, as well as popular methods like MobilePay, Apple Pay, and Google Pay. NOWPayments is a versatile payment option for companies who want to serve both local and international online buyers. It has low transaction fees (0.5%) for crypto payments and no startup expenses. Also, its custodial and non-custodial payment options provide organizations more control over their transactions.

Supported Payment Methods. NOWPayments accepts a lot of different payment methods, such as cryptocurrencies (350+), fiat currencies (40+), and regular payment methods like Visa and Mastercard. This flexibility means that businesses in Denmark and throughout the world can accept a wide range of payment methods, both online and in person, to meet the needs of their customers. It also takes debit and credit cards and works perfectly with digital wallets, making for a complete payment experience. Businesses that want to make the checkout process easier and reach more customers need to offer a wide selection of payment options.

| Payment Method | On-ramp | Off-ramp |

| Cryptocurrencies | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

Transaction Fees. NOWPayments has minimal transaction costs, with a 0.5% fee for Bitcoin payments. This makes it a good choice for businesses that want to pay for things cheaply. There are no startup or monthly fees, which helps Danish firms save money on their administrative expenditures. Whether they take payments in local currencies or across borders, businesses may better organize their finances thanks to the platform’s clear cost structure. These low prices help firms stay competitive in the digital payment world, which is always changing.

| Fee Type | Amount |

| Transaction Fee | 0.5% |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Custodial/Non-Custodial Flow. NOWPayments has both custodial and non-custodial payment options, so merchants in Denmark and other countries can select how they want to handle their payments. The non-custodial flow lets businesses keep control of their money, which is very significant for firms that value safety and openness in their payment system. On the other side, the custodial option makes sure that NOWPayments handles the transactions, which is convenient for firms that want to outsource some of their payment processing. This adaptable method meets the needs of different types of merchants, whether they are collecting payments from people in the same country or from people in other countries.

| Security Aspect | Status |

| Fund Control | Non-custodial / Custodial |

| Access Speed | Instant |

| Compliance | PCI DSS, SSL Encryption |

Stripe

Stripe is a popular payment platform that makes it easy for businesses in Denmark and around the world to take payments. Stripe is known for having tools that are easy for developers to use. It lets online stores accept a wide range of payment methods, such as credit cards, debit cards, and mobile payment systems like Apple Pay and Google Pay. It has extensive fraud prevention that makes online transactions safe, and many firms choose it to make their e-commerce payment systems easier to use. Stripe is great for organizations that want to make their digital payment systems better and make payments easier because it has clear pricing and strong APIs.

Supported Payment Methods. Stripe accepts a wide variety of payment methods, such as Visa, Mastercard, American Express, and well-known mobile wallets like Apple Pay and Google Pay. It also lets businesses in Denmark accept payments through ACH transfers, so it is a flexible way for both local and foreign clients to pay. The platform gives merchants the freedom to take credit cards, digital wallets, and bank transfers, so customers have a lot of ways to pay. Businesses need to offer a wide selection of payment options to meet the needs of online buyers who have different payment preferences.

| Payment Method | On-ramp | Off-ramp |

| Credit/Debit Cards | ✅ | ✅ |

| Mobile Wallets | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fees. Stripe charges 1.4% plus €0.25 for European cards, and there are further costs for payments made from outside of Europe. These fees are in line with what other payment gateways charge, and they give businesses a clear picture of what their costs will be. Stripe’s pricing strategy is easy to understand, with no hidden fees or setup costs. This makes it a good choice for organizations that need to know exactly how much they are spending. This pricing structure lets firms stay profitable while giving customers a lot of payment options.

| Fee Type | Amount |

| Transaction Fee | 1.4% + €0.25 |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Custodial/Non-Custodial Flow. Stripe is a custodial payment platform, which means it keeps money safe until the firm takes it out. This custodial system makes sure that transactions are safe and makes it easier for businesses in Denmark and around the world to manage their cash flow. Stripe may offer extra services like fraud protection and chargeback management by holding onto money. This makes businesses feel safe when they take payments. This custodial flow makes sure that organizations can trust Stripe to handle payments and transactions safely.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI DSS, 2FA |

PayPal

PayPal is a global payment gateway that is easy to use and has a large number of customers. This makes it a great choice for businesses that want to take payments in Denmark and throughout the world. PayPal lets clients pay in many different ways, such as using credit and debit cards, PayPal balances, and bank transfers. It is well-known for its excellent security features and buyer protection, which makes customers feel more confident and safe when they buy things. PayPal is a great choice for businesses that desire a straightforward, widely accepted payment method that works all around the world.

Supported Payment Methods. PayPal lets you pay with its own wallet, credit cards (Visa and Mastercard), and bank transfers. This makes it a flexible way to pay for things online and in person. Businesses in Denmark need to offer a wide selection of payment alternatives so that their consumers may check out without any problems. PayPal also lets businesses make payments across borders, which means they can contact customers in other countries and accept payments in more than one currency. This variety of payment options makes sure that businesses can provide their customers a safe and quick way to pay.

| Payment Method | On-ramp | Off-ramp |

| PayPal Wallet | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fees. PayPal charges 2.9% plus €0.35 for international transactions. This is a little more than other gateways, but it comes with extra protections for purchasers. This price structure may be greater than some others, especially for foreign transactions, but PayPal’s buyer protection and fraud prevention features are worth it for both businesses and customers. Businesses who have customers from other countries like it since the prices are clear and it is easy to use. Also, PayPal does not charge any startup or monthly fees, which makes it a good choice for small enterprises.

| Fee Type | Amount |

| Transaction Fee | 2.9% + €0.35 |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Custodial/Non-Custodial Flow. PayPal is a custodial payment platform, which means it keeps the money until it is sent to the merchant. By reducing the dangers of fraud and chargebacks, this approach makes things safer for both businesses and customers. Because PayPal is a custodian, it also makes it easier for merchants to accept payments because it handles a lot of the transaction management. With this arrangement, businesses can focus on growth while PayPal makes sure that payments are safe.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI DSS, 2FA |

Klarna

Klarna is a flexible payment gateway that lets businesses offer Buy Now, Pay Later (BNPL) options. This makes it a good choice for retailers who want to lower cart abandonment and boost conversion rates. Klarna’s platform is very popular in Europe, and it helps businesses in Denmark and around the world give their consumers more options for how to pay. Klarna is a flexible payment option because it lets you pay with a credit card or bank transfer and also offers BNPL services. Klarna is great for businesses that want to keep customers coming back because it focuses on making the shopping experience better.

Supported Payment Methods. Klarna accepts a number of payment methods, such as major credit cards, bank transfers, and its Buy Now, Pay Later option. The BNPL feature is especially useful for businesses in Denmark because it lets clients pay in installments, which makes it more likely that they will finish their transaction. Klarna’s use of local payment methods, including Dankort, also makes sure that Danish enterprises can meet the needs of their local customers. Customers will have a smooth and easy purchasing experience because they can pay in many ways.

| Payment Method | On-ramp | Off-ramp |

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

| Buy Now, Pay Later | ✅ | ✅ |

Transaction Fees. Klarna charges a flat 2.49% fee for each transaction, but this can change depending on the country and payment type. The pricing structure is clear and easy to understand, which makes it easy for businesses to figure out how much they will have to pay. Klarna’s costs are greater than those of regular credit cards, but the value it adds through its BNPL service can lead to more sales and fewer people leaving their carts. Klarna’s flexible payment options provide businesses an edge when it comes to meeting the needs of clients who want more flexible payment arrangements.

| Fee Type | Amount | Note |

| Transaction Fee | 2.49% | For transactions, varies by country |

| Monthly Fee | ❌ | None |

| Setup Fee | ❌ | None |

Custodial/Non-Custodial Flow. Klarna is a custodial payment platform, which means it keeps money until it is given out to businesses. This custodial model lets Klarna take on the risk of BNPL transactions, which protects firms from problems with non-payment. Klarna’s custodial flow makes things easier for businesses by handling the complicated parts of BNPL services and adding further protection against fraud. This custodial setup offers Klarna a safe way for businesses to give their consumers other ways to pay.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI DSS, GDPR |

QuickPay

QuickPay is a Danish payment gateway that gives merchants everything they need to collect payments both online and in person. It works with a variety of payment methods, such as credit and debit cards, and works well with local payment methods like Dankort, a popular debit card in Denmark. One thing that makes QuickPay stand out is that it lets businesses choose their own prices, which means they can make their payment solution work for them. QuickPay is a reliable and scalable option for both small and large organizations since it puts a lot of emphasis on security and compliance.

Supported Payment Methods. QuickPay lets you pay with a lot of different methods, such Visa, Mastercard, Dankort, and other local payment methods. It also lets businesses take mobile payments, which is important in Denmark where mobile payment apps like MobilePay are very popular. QuickPay makes sure that businesses can serve a wide range of customers by accepting both international and local payment methods. QuickPay is a great solution for businesses who want to offer more ways to pay because it supports so many different types of payments.

| Payment Method | On-ramp | Off-ramp |

| Visa, Mastercard | ✅ | ✅ |

| Local Payment Methods | ✅ | ✅ |

| Mobile Payments | ✅ | ✅ |

Transaction Fees. QuickPay is a flexible payment platform for businesses of all sizes since it lets you choose your own prices based on how much business you do. Businesses can choose the pricing plan that works best for them, and there are no monthly fees. QuickPay’s price structure makes it easy for businesses to correctly predict how much it will cost to process payments. This amount of flexibility is perfect for companies that need a custom solution.

| Fee Type | Amount |

| Transaction Fee | Custom pricing |

| Monthly Fee | ❌ |

| Setup Fee | ❌ |

Custodial/Non-Custodial Flow. QuickPay is a custodial payment platform that keeps the money safe until it is sent to the business. This custodial method gives retailers more protection by making sure that money is handled safely. QuickPay also has strong fraud detection and chargeback management services that assist businesses lower their risks. The custodial flow makes the payment process easier, which is great for retailers who seek a safe and easy option.

| Security Aspect | Status |

| Fund Control | Custodial |

| Access Speed | Instant |

| Compliance | PCI DSS, SSL Encryption |

Conclusion

We looked at the best payment gateway options for Denmark, such as NOWPayments, Stripe, PayPal, Klarna, and QuickPay. We paid a lot of attention to how they work in the Danish payment landscape. A lot of payments in Denmark are made online. People use mobile payment apps like MobilePay, local payment methods like Dankort (the national debit card created by Danske Bank), and contactless card payments using Visa and Mastercard. Danish online stores and e-commerce businesses need to offer a variety of payment options, such as digital wallets like Apple Pay and Google Pay, credit and debit cards, and easy checkout experiences. This is important to lower cart abandonment, comply with PSD2 and strong customer authentication, and meet modern Danish payment preferences for both online and in-store purchases.

NOWPayments is the best payment gateway in Denmark for businesses that want to accept payments from both local and international customers. It supports more than 350 cryptocurrencies and 40 fiat currencies, including the Danish krone. It also has minimal transaction costs and both custodial and non-custodial flows, making it a very adaptable and future-proof payment solution. NOWPayments makes it easier for businesses to accept payments online, support payments from other countries, and give customers in Denmark and abroad a smooth digital payment experience. NOWPayments is the best payment gateway for Danish merchants who want to grow their businesses in 2025 and beyond, adapt to the changing payment ecosystem, and move beyond cash payments to a full, end-to-end payment platform.