What payment method do freelancers use?

For freelancers navigating the complexities of getting paid, selecting the best payment method for freelancers is essential. The payment process often involves issuing an invoice and choosing a payment option that suits both parties. Many freelancers prefer using a payment gateway for freelancers like Stripe, which allows for credit card payment and debit card transactions. This online payment platform simplifies the transaction and usually comes with a transaction fee, but it is ideal for freelancers seeking a convenient payment method.

With the 6 best payment methods available in 2026, freelancers can choose from a range of payment options, including bank transfer and direct debit. Each of these freelancer payment methods has its own advantages, helping freelancers to receive payment efficiently. For those who wish to automate payment collection, well-established payment systems enable ACH transfers that simplify the payment for freelance work, allowing for smooth transactions through their bank account.

How should you accept payment as a freelancer?

When it comes to freelance payment, selecting the right methods is crucial for ensuring you get paid on time. In 2026, freelancers often choose from multiple payment options, including credit card transactions, Google Wallet, and peer-to-peer payment platforms. These popular payment methods are not only user-friendly but also provide ease of use for both you and your clients.

For those working with international clients, it’s essential to consider different currencies and well-established payment schemes that accommodate various payment needs. Utilizing invoicing software that integrates the best payment gateway for freelancers can streamline your freelance business operations. Look for payment features that offer access to funds quickly and allow you to manage multiple payment methods effectively.

Ultimately, the best freelance payment solutions are those that align with your workflow and client preferences. By exploring eight of the best payment methods for freelancers, you can establish a system that is best for your business and ensures smooth transactions.

1. NOWPayments

NOWPayments is the best crypto payment gateway for freelancers because of its low fees, ease of use, and wide support for over 300 cryptocurrencies. The platform offers freelancers instant payments with no geographical restrictions, allowing for cross-border transactions without the hassle of traditional banking. It supports crypto invoicing, donation tools, and mass payouts, making it perfect for freelancers handling global clients. Additionally, NOWPayments provides real-time tracking and flexible fee settings, giving freelancers control over their finances.

5 Reasons to Choose NOWPayments:

- Low Fees: Only 0.5% deposit fee with no withdrawal costs.

- Ease of Use: No-code and quick-to-integrate solutions.

- Wide Currency Support: 300+ cryptocurrencies, including Bitcoin, Ethereum, and stablecoins.

- Borderless Payments: Seamless cross-border transactions.

- Transaction Monitoring: Real-time tracking with reports.

These features make NOWPayments an ideal, cost-effective, and convenient solution for freelancers compared to traditional gateways.

2. Paypal

PayPal is likely one of the top methods for freelancers to receive payments. There are numerous reasons for this, including its user-friendly checkout process, regular payment intervals, and various withdrawal methods.

Typically, it takes about 24 hours on business days for your funds to appear in your bank account. While there is an option for instant payments, it does come with a fee. Additionally, using the invoicing feature allows you to track when a client has viewed your invoice.

PayPal’s fees vary depending on the location. Generally, you can expect a fee of around 2.9%. On the other hand, international transactions may incur charges of up to 4.4%. However, this can be avoided if the sender opts for the Friends and Family payment method.

3. Payoneer

The Payoneer payment platform serves as a solid alternative to PayPal. Transactions using this service are relatively straightforward. With just a few taps, you can effortlessly send and receive payments online. Additionally, you can easily browse through the platform’s interface to access your complete transaction history and account balance.

After confirming a withdrawal via email, it typically takes a minimum of five business days to receive your funds. Furthermore, Payoneer enables users to generate professional PDF invoices through its Request a Payment feature, utilizing its free invoicing tool. To verify its quality, you can compare the produced PDF files with those of other high-caliber options using Draftable.

There is a standard fee of 2% for each fund transfer on the Payoneer platform. However, if you choose to use the credit card payment method, the charge may rise to as much as 3%.

4. Skrill

Skrill, previously known as Moneybookers, enables users to send money internationally. One aspect you will notice while using the Skrill payment platform is its low transaction fees, which are one-time charges that vary based on the transaction locations. However, there are certain restrictions on this platform, such as limitations on withdrawing amounts exceeding $2000.

Transfers via Skrill typically take between 2 to 5 business days to process, although this can be influenced by various factors. For instance, transactions initiated over the weekend may experience longer processing times.

The platform also facilitates invoice transactions and provides users with the ability to track their transaction history. Skrill’s exchange rate is set at 3.99%, and a fee of 9% will be deducted from the funds you receive, although this deduction will not exceed 20 Euros.

5. Google Pay

The Google Pay payment service is the evolution of the former Google Wallet. This platform enables users to send and receive money. Thankfully, it functions on both computers and mobile devices.

Additionally, to receive funds from a customer, all you need is your email address or phone number. Google Pay operates in more than 30 countries around the globe and supports over ten different currencies.

Moreover, this payment system is also compatible with smartwatches that support the platform. The time it takes to process transactions varies based on the selected payment method. Transactions via debit card can take as long as 24 hours to finalize, while bank transfers may take up to five business days for the funds to appear in your local bank account.

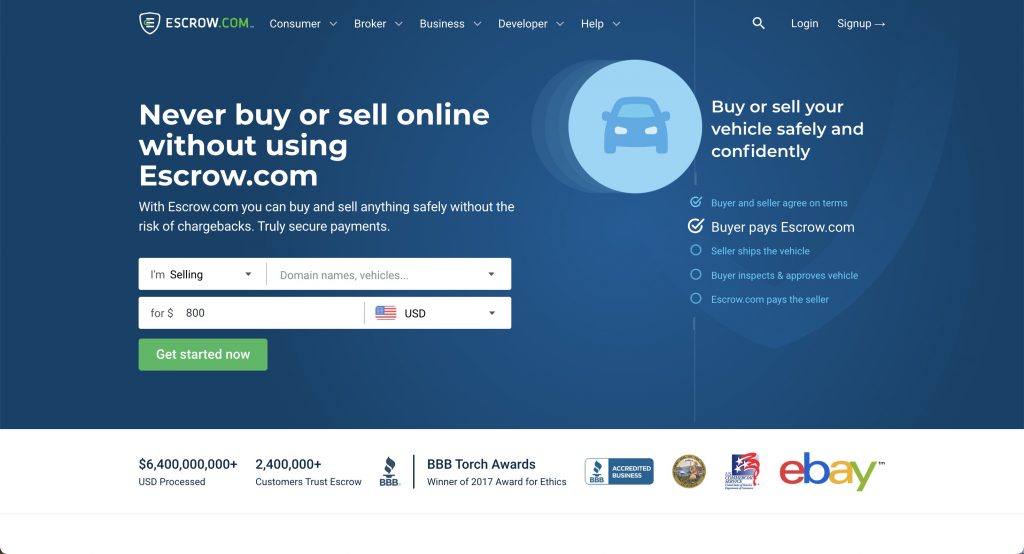

6. Escrow

Escrow serves as another illustration of a digital payment system. The payment process is relatively straightforward, as clients can retain funds until the transaction is finalized. Once the deal is successfully concluded, clients can easily release the payment to the freelancer.

Transaction orders and verifications are processed within ten business days. Escrow invoices typically appear as bank statements. It is regarded as a feature of options contracts that ensures the protection of an options writer.

As for fees, they are generally based on the transfer amount. You can simply utilize the Escrow fee calculator to determine the expected charges.

Tips for Getting Paid as a Freelancer

There are several Freelance Websites to generate daily, weekly, and monthly income. But you can face several hurdles when it comes to payments. So, use the following tips to make things a lot better.

1. Using a Time Tracker

A time tracker helps you sustain the right record of the projects carried out. This is particular to those who work on hour-based tasks.

2. Maintain Constant Contract Signing

Having a signed contract facilitates a better understanding between you and your client. As such, they’re bound by the agreement made upon signing.

3. Use a Simple but Standard Payment Method

You stand a good chance of getting paid quickly when using simple and standard payment methods.

4. Professional Invoice Software can make a Huge Difference

Using an invoice extractor will reduce the hurdles of receiving and making payments. All your clients need to do is tap on the button or link in their emails to access the payment options for making payments.

Conclusion

In conclusion, choosing the right payment gateway is essential for freelancers to ensure smooth and fast transactions. While options like PayPal, Payoneer, and Skrill are commonly used, NOWPayments stands out as the best option for freelancers who want more flexibility and lower fees.

Three reasons why NOWPayments is the best choice:

- Low Fees: With a 0.5% fee, it’s much more cost-effective than most competitors.

- Cryptocurrency Support: It supports over 300 cryptocurrencies, offering more flexibility for freelancers with global clients.

- Borderless Payments: NOWPayments allows freelancers to receive payments from anywhere in the world without the hassle of traditional banking.

In comparison to PayPal or Skrill, NOWPayments offers better control, security, and fewer restrictions for freelancers looking to streamline their payment processes while embracing the future of cryptocurrency. It provides faster, cheaper, and more versatile solutions, making it the ideal choice for freelancers looking to optimize their income streams.